# TrumpLaunchesStrikesonVenezuela

27.94K

On January 3, explosions and air defense alerts were reported in Caracas after President Trump ordered strikes on military targets in Venezuela. How do you view this escalation? What impact could it have on global markets? Which assets do you favor next—crypto, U.S. stocks, oil, or precious metals? Join the discussion.

StylishKuri

#TrumpLaunchesStrikesonVenezuela #GlobalShockAndMarketReset

From Operation Absolute Resolve to a New Financial Era

The events triggered by Operation Absolute Resolve in early 2026 marked a defining geopolitical shock that rippled far beyond Latin America. What began as a sudden military intervention rapidly evolved into a structural shift across energy markets, global capital flows, and digital assets. Regardless of political positioning, the scale and speed of the response forced investors to reassess long-held assumptions about risk, supply chains, and financial sovereignty.

At the center of

From Operation Absolute Resolve to a New Financial Era

The events triggered by Operation Absolute Resolve in early 2026 marked a defining geopolitical shock that rippled far beyond Latin America. What began as a sudden military intervention rapidly evolved into a structural shift across energy markets, global capital flows, and digital assets. Regardless of political positioning, the scale and speed of the response forced investors to reassess long-held assumptions about risk, supply chains, and financial sovereignty.

At the center of

- Reward

- 5

- 2

- Repost

- Share

YingYue :

:

2026 GOGOGO 👊View More

#TrumpLaunchesStrikesonVenezuela

Operation Absolute Resolve and the Market Shockwave

Early January 2026 introduced a geopolitical rupture few global markets were positioned for. Under the codename Operation Absolute Resolve, the United States initiated a rapid and forceful intervention in Venezuela, instantly reshaping political expectations across Latin America and triggering a chain reaction through energy markets, currencies, and digital assets.

Unlike conventional military escalations that unfold gradually, this operation was defined by speed and coordination. Air operations, intelligence

Operation Absolute Resolve and the Market Shockwave

Early January 2026 introduced a geopolitical rupture few global markets were positioned for. Under the codename Operation Absolute Resolve, the United States initiated a rapid and forceful intervention in Venezuela, instantly reshaping political expectations across Latin America and triggering a chain reaction through energy markets, currencies, and digital assets.

Unlike conventional military escalations that unfold gradually, this operation was defined by speed and coordination. Air operations, intelligence

- Reward

- 8

- 6

- Repost

- Share

Atilss :

:

Jump in 🚀View More

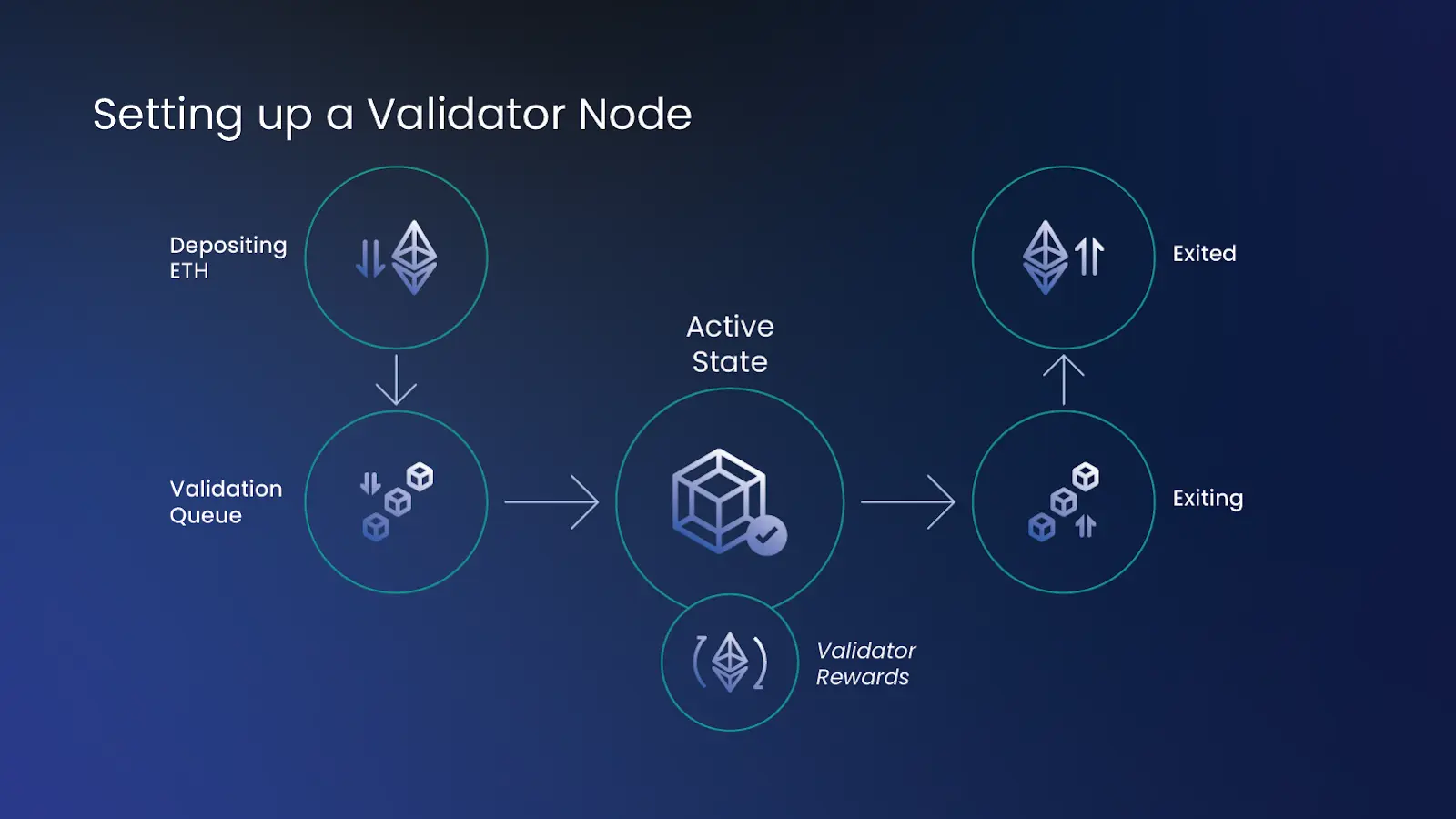

BitMine Immersion’s Massive Ethereum Purchase: How Institutional Interest Is Shaping ETH

One of the major players in the crypto market, BitMine Immersion Technologies (BMNR), made a significant move in the final week of 2025 by purchasing 32,977 Ethereum (ETH). This acquisition increased the company’s total ETH holdings to 4,143,502 ETH, further strengthening its position as the largest corporate Ethereum treasury in the world. Led by Fundstrat co-founder and well-known Wall Street analyst Tom Lee as Chairman, BitMine once again demonstrated strong confidence in the Ethereum ecosystem with thi

One of the major players in the crypto market, BitMine Immersion Technologies (BMNR), made a significant move in the final week of 2025 by purchasing 32,977 Ethereum (ETH). This acquisition increased the company’s total ETH holdings to 4,143,502 ETH, further strengthening its position as the largest corporate Ethereum treasury in the world. Led by Fundstrat co-founder and well-known Wall Street analyst Tom Lee as Chairman, BitMine once again demonstrated strong confidence in the Ethereum ecosystem with thi

- Reward

- 80

- 69

- Repost

- Share

Bab谋_Ali :

:

2026 GOGOGO 👊View More

#TrumpLaunchesStrikesonVenezuela

Operation Absolute Resolve and the Market Shockwave

Early January 2026 introduced a geopolitical rupture few global markets were positioned for. Under the codename Operation Absolute Resolve, the United States initiated a rapid and forceful intervention in Venezuela, instantly reshaping political expectations across Latin America and triggering a chain reaction through energy markets, currencies, and digital assets.

Unlike conventional military escalations that unfold gradually, this operation was defined by speed and coordination. Air operations, intelligence

Operation Absolute Resolve and the Market Shockwave

Early January 2026 introduced a geopolitical rupture few global markets were positioned for. Under the codename Operation Absolute Resolve, the United States initiated a rapid and forceful intervention in Venezuela, instantly reshaping political expectations across Latin America and triggering a chain reaction through energy markets, currencies, and digital assets.

Unlike conventional military escalations that unfold gradually, this operation was defined by speed and coordination. Air operations, intelligence

- Reward

- 7

- 4

- Repost

- Share

Seskas :

:

Hold tight 💪View More

#TrumpLaunchesStrikesOnVenezuela

Operation “Absolute Resolve”: How a Sudden Geopolitical Shock Redefined Energy Markets, Safe-Haven Flows, and Crypto Sentiment

The events of January 3, 2026, marked a turning point in global markets. The U.S. military operation in Venezuela—launched without the usual buildup or diplomatic prelude—instantly reshaped political calculations, investor behavior, and the direction of global capital flows.

But beyond the headlines, what truly matters is how markets interpreted the shock and where money moved next.

Here’s a clear, human-centered breakdown of what happe

Operation “Absolute Resolve”: How a Sudden Geopolitical Shock Redefined Energy Markets, Safe-Haven Flows, and Crypto Sentiment

The events of January 3, 2026, marked a turning point in global markets. The U.S. military operation in Venezuela—launched without the usual buildup or diplomatic prelude—instantly reshaped political calculations, investor behavior, and the direction of global capital flows.

But beyond the headlines, what truly matters is how markets interpreted the shock and where money moved next.

Here’s a clear, human-centered breakdown of what happe

- Reward

- 12

- 17

- Repost

- Share

Crypto_Buzz_with_Alex :

:

🚀 “Next-level energy here — can feel the momentum building!”View More

#TrumpLaunchesStrikesonVenezuela

1. Immediate Market Sentiment

Geopolitical crises like U.S. military strikes in Venezuela typically trigger risk-off behavior in global markets.

Investors often move capital into safe-haven assets such as Bitcoin, gold, or stablecoins. Historically, Bitcoin has shown short-term price spikes during political unrest due to its “digital gold” narrative.

However, extreme uncertainty can also temporarily reduce trading volume, as institutional participants may pause positions until clarity emerges.

2. Liquidity & Volatility

Venezuela has historically had one of the

1. Immediate Market Sentiment

Geopolitical crises like U.S. military strikes in Venezuela typically trigger risk-off behavior in global markets.

Investors often move capital into safe-haven assets such as Bitcoin, gold, or stablecoins. Historically, Bitcoin has shown short-term price spikes during political unrest due to its “digital gold” narrative.

However, extreme uncertainty can also temporarily reduce trading volume, as institutional participants may pause positions until clarity emerges.

2. Liquidity & Volatility

Venezuela has historically had one of the

- Reward

- 8

- 12

- Repost

- Share

EagleEye :

:

Excellent post! Very motivating and inspiringView More

Trump's Venezuela Operation.

✨An Unexpected Intervention

On January 3, 2026, US President Donald Trump announced he had ordered a "large-scale" military operation against Venezuela. This operation led to explosions in Caracas, the capital of Venezuela, struck critical military targets, and most strikingly, captured Venezuelan President Nicolás Maduro and his wife, taking them to the US. Trump described the operation as a victory against "narcoterrorism" and electoral interference, but this move ignited debates about international law. The operation culminated in Trump's statement that the US w

✨An Unexpected Intervention

On January 3, 2026, US President Donald Trump announced he had ordered a "large-scale" military operation against Venezuela. This operation led to explosions in Caracas, the capital of Venezuela, struck critical military targets, and most strikingly, captured Venezuelan President Nicolás Maduro and his wife, taking them to the US. Trump described the operation as a victory against "narcoterrorism" and electoral interference, but this move ignited debates about international law. The operation culminated in Trump's statement that the US w

BTC-1,13%

- Reward

- 40

- 18

- Repost

- Share

CryptoAlice :

:

Happy New Year! 🤑View More

#TrumpLaunchesStrikesonVenezuela

Operation Absolute Resolve and the Market Shockwave

Early January 2026 introduced a geopolitical rupture few global markets were positioned for. Under the codename Operation Absolute Resolve, the United States initiated a rapid and forceful intervention in Venezuela, instantly reshaping political expectations across Latin America and triggering a chain reaction through energy markets, currencies, and digital assets.

Unlike conventional military escalations that unfold gradually, this operation was defined by speed and coordination. Air operations, intelligence

Operation Absolute Resolve and the Market Shockwave

Early January 2026 introduced a geopolitical rupture few global markets were positioned for. Under the codename Operation Absolute Resolve, the United States initiated a rapid and forceful intervention in Venezuela, instantly reshaping political expectations across Latin America and triggering a chain reaction through energy markets, currencies, and digital assets.

Unlike conventional military escalations that unfold gradually, this operation was defined by speed and coordination. Air operations, intelligence

- Reward

- 13

- 9

- Repost

- Share

EagleEye :

:

#GateCrazyWednesday View More

#TrumpLaunchesStrikesOnVenezuela

Operation “Absolute Resolve”: How a Geopolitical Shock Reshaped Global Markets and Redirected Capital Flows

The events of January 3, 2026—marked by the sudden U.S. military operation in Venezuela—sent an immediate wave through global politics and financial markets. What began as a high-stakes geopolitical maneuver quickly transformed into a defining moment for energy markets, traditional safe-haven assets, and notably, the cryptocurrency sector.

Rather than focusing solely on the political drama, investors around the world rushed to understand what this means f

Operation “Absolute Resolve”: How a Geopolitical Shock Reshaped Global Markets and Redirected Capital Flows

The events of January 3, 2026—marked by the sudden U.S. military operation in Venezuela—sent an immediate wave through global politics and financial markets. What began as a high-stakes geopolitical maneuver quickly transformed into a defining moment for energy markets, traditional safe-haven assets, and notably, the cryptocurrency sector.

Rather than focusing solely on the political drama, investors around the world rushed to understand what this means f

- Reward

- 13

- 10

- Repost

- Share

MissCrypto :

:

Happy New Year! 🤑View More

#TrumpLaunchesStrikesonVenezuela Operation Absolute Resolve

On January 3, 2026, the United States launched an unprecedented military campaign against Venezuela under the name Operation Absolute Resolve, marking one of the most aggressive and unexpected geopolitical actions of the Donald Trump era. Coordinated air strikes and special operations over Caracas led to the collapse of the existing power structure and opened a new chapter not only in Latin American politics, but also in the global financial and energy system.

The operation reportedly involved more than 150 aircraft, elite U.S. specia

On January 3, 2026, the United States launched an unprecedented military campaign against Venezuela under the name Operation Absolute Resolve, marking one of the most aggressive and unexpected geopolitical actions of the Donald Trump era. Coordinated air strikes and special operations over Caracas led to the collapse of the existing power structure and opened a new chapter not only in Latin American politics, but also in the global financial and energy system.

The operation reportedly involved more than 150 aircraft, elite U.S. specia

- Reward

- 12

- 6

- Repost

- Share

GateUser-d17881b0 :

:

Happy New Year! 🤑View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

157.46K Popularity

129.35K Popularity

36.21K Popularity

57.29K Popularity

408.39K Popularity

327.76K Popularity

546 Popularity

94 Popularity

98 Popularity

1.76K Popularity

4.28K Popularity

3.2K Popularity

3.07K Popularity

30.17K Popularity

30.12K Popularity

News

View MoreTraditional Finance Alert: TSLA Rises Over 2%

40 m

The three major U.S. stock indices closed higher, with AMD soaring over 8%

1 h

Traditional Finance Alert: PYPL Surges Over 8%

2 h

The US Dollar Index rose to 97.844, and the euro depreciated to 1.1779 USD.

2 h

Barkin: Inflation is expected to decline to 2%, pending clear data confirmation

2 h

Pin