#CryptoSurvivalGuide #BTC

Liquidity Compression Playbook

Executive Weekend View

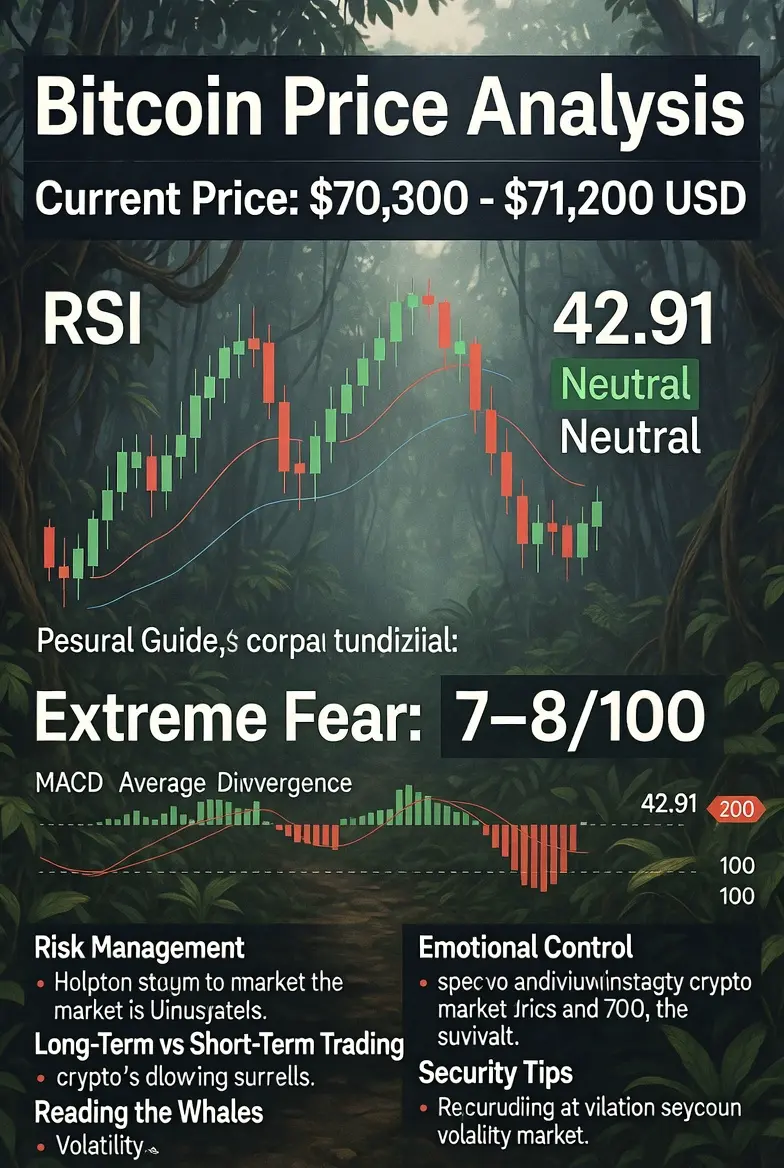

Bitcoin is holding near critical support while volatility remains elevated.

But this is not an isolated crypto event.

Cross-asset pressure across crypto, metals, and equities suggests one thing:

liquidity is tightening, not rotating.

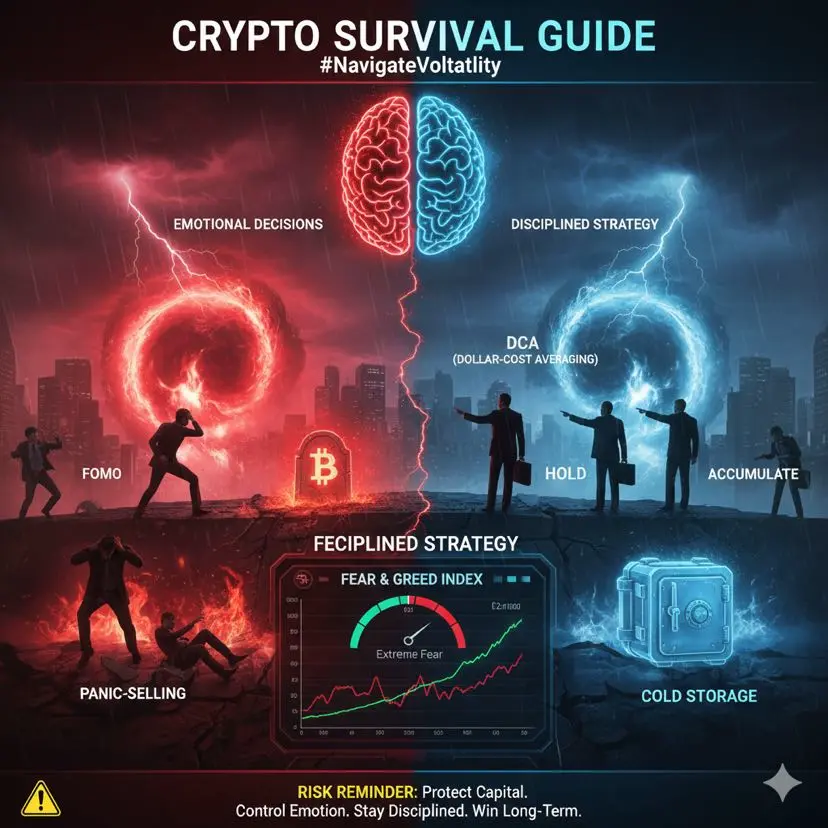

When liquidity contracts, markets stop rewarding aggression —

they reward discipline.

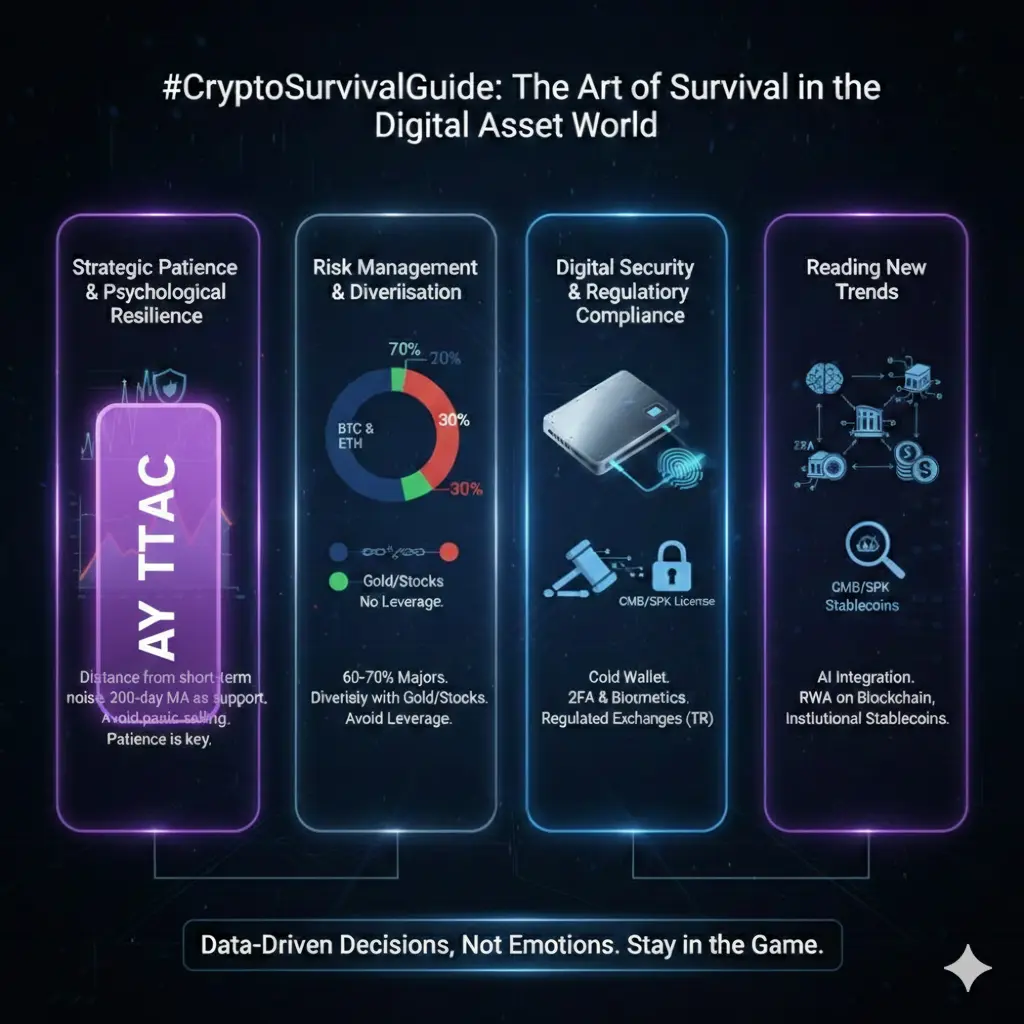

1️⃣ Risk Control: Keep the Portfolio Alive

Primary objective:

Capital preservation with tactical flexibility.

In liquidity-sensitive regimes:

Support zones trigger emotional dip-buying

Resistance zones trap breakout traders

Volatility expands around liquidity clusters

My framework:

✔ Reduced core exposure

✔ Defined stop structure

✔ Liquidity reserve maintained

✔ No leverage escalation in compression

Because in contraction phases, survival compounds faster than overexposure.

2️⃣ Tactical Execution: Reaction Rallies & Controlled Shorts

Volatile consolidation creates repeatable patterns:

🔹 Sharp breakdown → oversold bounce

🔹 Weak bounce → lower high formation

🔹 Liquidity sweep → fast rejection

When support reactions lack follow-through,

shorting failed breakouts into resistance becomes a tactical hedge — not speculation.

Shorts are tools.

Not identity.

They protect capital.

They neutralize drawdowns.

They keep the portfolio adaptive.

Rules remain strict:

✔ Controlled position sizing

✔ Predefined invalidation

✔ No emotional averaging

✔ No revenge trading

The objective is not to “win big.”

The objective is to stay structurally positioned.

3️⃣ Macro Anchor: Why This Structure Matters

When Bitcoin struggles at support while gold and equities also weaken,

it signals liquidity compression, not simple sentiment fear.

Correlation spikes in contraction phases often precede either:

a final liquidity flush — or a violent volatility expansion.

This is not random noise.

This is structural repricing under tightening conditions.

4️⃣ Mindset: Remove Ego From Execution

The real danger is not volatility.

It is escalation.

“I must recover yesterday.”

“This breakout cannot fail.”

“This is definitely the bottom.”

No ego.

No emotional size increase.

No forced conviction.

Execution > prediction.

Structure > opinion.

5️⃣ Weekend Structure Outlook

Two dominant paths:

1️⃣ Support reaction → weak continuation → short opportunity into resistance

2️⃣ Liquidity flush below support → aggressive reclaim → squeeze setup

Both require precision.

Neither rewards impulsiveness.

Strategic Closing

In liquidity compression phases, courage is expensive.

Control is profitable.

Liquidity doesn’t reward confidence. It rewards discipline.

⚠ This content is for educational purposes only and does not constitute financial or investment advice.

Liquidity Compression Playbook

Executive Weekend View

Bitcoin is holding near critical support while volatility remains elevated.

But this is not an isolated crypto event.

Cross-asset pressure across crypto, metals, and equities suggests one thing:

liquidity is tightening, not rotating.

When liquidity contracts, markets stop rewarding aggression —

they reward discipline.

1️⃣ Risk Control: Keep the Portfolio Alive

Primary objective:

Capital preservation with tactical flexibility.

In liquidity-sensitive regimes:

Support zones trigger emotional dip-buying

Resistance zones trap breakout traders

Volatility expands around liquidity clusters

My framework:

✔ Reduced core exposure

✔ Defined stop structure

✔ Liquidity reserve maintained

✔ No leverage escalation in compression

Because in contraction phases, survival compounds faster than overexposure.

2️⃣ Tactical Execution: Reaction Rallies & Controlled Shorts

Volatile consolidation creates repeatable patterns:

🔹 Sharp breakdown → oversold bounce

🔹 Weak bounce → lower high formation

🔹 Liquidity sweep → fast rejection

When support reactions lack follow-through,

shorting failed breakouts into resistance becomes a tactical hedge — not speculation.

Shorts are tools.

Not identity.

They protect capital.

They neutralize drawdowns.

They keep the portfolio adaptive.

Rules remain strict:

✔ Controlled position sizing

✔ Predefined invalidation

✔ No emotional averaging

✔ No revenge trading

The objective is not to “win big.”

The objective is to stay structurally positioned.

3️⃣ Macro Anchor: Why This Structure Matters

When Bitcoin struggles at support while gold and equities also weaken,

it signals liquidity compression, not simple sentiment fear.

Correlation spikes in contraction phases often precede either:

a final liquidity flush — or a violent volatility expansion.

This is not random noise.

This is structural repricing under tightening conditions.

4️⃣ Mindset: Remove Ego From Execution

The real danger is not volatility.

It is escalation.

“I must recover yesterday.”

“This breakout cannot fail.”

“This is definitely the bottom.”

No ego.

No emotional size increase.

No forced conviction.

Execution > prediction.

Structure > opinion.

5️⃣ Weekend Structure Outlook

Two dominant paths:

1️⃣ Support reaction → weak continuation → short opportunity into resistance

2️⃣ Liquidity flush below support → aggressive reclaim → squeeze setup

Both require precision.

Neither rewards impulsiveness.

Strategic Closing

In liquidity compression phases, courage is expensive.

Control is profitable.

Liquidity doesn’t reward confidence. It rewards discipline.

⚠ This content is for educational purposes only and does not constitute financial or investment advice.