MingDragonX

No content yet

MingDragonX

#NewFeatureUpdate | Built for the Next Phase of Web3

This new feature marks a major step forward in making Web3 faster, safer, and more user-centric, removing friction that has long slowed real adoption.

Designed with scalability and simplicity in mind, the feature enables seamless interaction across decentralized applications without compromising security or transparency.

At its core, it introduces smarter automation and trust-minimized execution, allowing users and AI agents to operate efficiently on-chain with reduced reliance on intermediaries.

The upgrade also enhances performance under h

This new feature marks a major step forward in making Web3 faster, safer, and more user-centric, removing friction that has long slowed real adoption.

Designed with scalability and simplicity in mind, the feature enables seamless interaction across decentralized applications without compromising security or transparency.

At its core, it introduces smarter automation and trust-minimized execution, allowing users and AI agents to operate efficiently on-chain with reduced reliance on intermediaries.

The upgrade also enhances performance under h

- Reward

- 1

- Comment

- Repost

- Share

Are you a futures trader with skills to share? Gate Square is officially recruiting Star Copy Trading Leaders — with real rewards, real exposure, and real traffic support.

💰 $5,000 Monthly Reward Pool

📈 Massive visibility across Gate ecosystem

🔥 How to Join

1️⃣ Apply as a Copy Trader

👉 https://www.gate.com/copytrading/lead-trader-registration/futures

2️⃣ Join the Event

👉 https://www.gate.com/questionnaire/7355

3️⃣ Join Gate Square & keep posting original, high-quality trading content

🎁 Rewards Breakdown

✅ First Post Bonus: $10 fee rebate coupon

✅ Bi-weekly Content Pool: Share $500 USDT e

💰 $5,000 Monthly Reward Pool

📈 Massive visibility across Gate ecosystem

🔥 How to Join

1️⃣ Apply as a Copy Trader

👉 https://www.gate.com/copytrading/lead-trader-registration/futures

2️⃣ Join the Event

👉 https://www.gate.com/questionnaire/7355

3️⃣ Join Gate Square & keep posting original, high-quality trading content

🎁 Rewards Breakdown

✅ First Post Bonus: $10 fee rebate coupon

✅ Bi-weekly Content Pool: Share $500 USDT e

- Reward

- 3

- 3

- Repost

- Share

CryptoSelf :

:

Happy New Year! 🤑View More

#TokenizedSilverTrend TokenizedSilverTrend | Silver Enters the Digital Age 🥈

The silver market in 2026 is undergoing a structural transformation that redefines its role within global finance. Once viewed primarily as a physical commodity and a secondary hedge to gold, silver is rapidly evolving into a digitally native asset. Through tokenization, silver is shedding the traditional frictions of storage, transportation, and settlement, becoming fractional, liquid, and globally accessible. What was once heavy, slow, and costly has been reengineered for modern portfolios, marking a decisive shift

The silver market in 2026 is undergoing a structural transformation that redefines its role within global finance. Once viewed primarily as a physical commodity and a secondary hedge to gold, silver is rapidly evolving into a digitally native asset. Through tokenization, silver is shedding the traditional frictions of storage, transportation, and settlement, becoming fractional, liquid, and globally accessible. What was once heavy, slow, and costly has been reengineered for modern portfolios, marking a decisive shift

- Reward

- 7

- 7

- Repost

- Share

CryptoSelf :

:

2026 GOGOGO 👊View More

#GrowthPointsDrawRound16 GrowthPointsDrawRound16 | Growth Value New Year Lottery Vol.16: How Discipline Turns Into Rewards

The 16th edition of the Growth Value New Year Lottery is not a typical seasonal giveaway but a deliberately structured incentive system designed to reward consistency, engagement, and strategic participation within the Gate ecosystem. Unlike traditional lotteries driven purely by chance, this event aligns probability with effort, giving disciplined and active users a measurable advantage over passive participants.

At its core, the lottery transforms everyday platform activ

The 16th edition of the Growth Value New Year Lottery is not a typical seasonal giveaway but a deliberately structured incentive system designed to reward consistency, engagement, and strategic participation within the Gate ecosystem. Unlike traditional lotteries driven purely by chance, this event aligns probability with effort, giving disciplined and active users a measurable advantage over passive participants.

At its core, the lottery transforms everyday platform activ

- Reward

- 6

- 4

- Repost

- Share

Yunna :

:

buy to earnView More

#CryptoRegulationNewProgress CryptoRegulationNewProgress | Global Markets Respond to an Evolving Policy Framework

Global crypto regulation is entering a more decisive and actionable phase, with tangible progress emerging from the United States, the United Kingdom, and other major jurisdictions. These developments are no longer theoretical policy discussions; they are actively shaping investor behavior, institutional participation, and compliance standards across markets. Notably, this regulatory evolution is unfolding while major digital assets remain resilient, signaling that markets are incr

Global crypto regulation is entering a more decisive and actionable phase, with tangible progress emerging from the United States, the United Kingdom, and other major jurisdictions. These developments are no longer theoretical policy discussions; they are actively shaping investor behavior, institutional participation, and compliance standards across markets. Notably, this regulatory evolution is unfolding while major digital assets remain resilient, signaling that markets are incr

- Reward

- 7

- 4

- Repost

- Share

MrFlower_ :

:

2026 GOGOGO 👊View More

#FedKeepsRatesUnchanged FedKeepsRatesUnchanged 🔥 MACRO PAUSE, BIG DECISION: DEFENSE OR ROTATION? 🧠📊

With the Federal Reserve keeping interest rates unchanged and markets fully accepting a “higher for longer” reality, the real question is no longer about the next Fed move, but about how smart money repositions across crypto and traditional assets. Liquidity has not disappeared, but it has become selective. Growth is slowing without breaking, inflation is cooling without collapsing, and markets are signaling rotation opportunities rather than a clean risk-on or risk-off regime. This is a tran

With the Federal Reserve keeping interest rates unchanged and markets fully accepting a “higher for longer” reality, the real question is no longer about the next Fed move, but about how smart money repositions across crypto and traditional assets. Liquidity has not disappeared, but it has become selective. Growth is slowing without breaking, inflation is cooling without collapsing, and markets are signaling rotation opportunities rather than a clean risk-on or risk-off regime. This is a tran

BTC1,45%

- Reward

- 6

- 3

- Repost

- Share

MrFlower_ :

:

2026 GOGOGO 👊View More

#BitcoinFallsBehindGold BitcoinFallsBehindGold | Why “Digital Gold” Is Losing Ground to Traditional Trust

For years, Bitcoin was positioned as the modern challenger to gold, promoted as “digital gold” capable of matching or even replacing the traditional store of value. However, the opening months of 2026 are telling a different story. While spot gold has surged beyond $5,200 per ounce amid rising geopolitical tension and macroeconomic uncertainty, Bitcoin remains range-bound between $86,000 and $89,000. This divergence highlights a critical reality: in periods of stress, markets continue to f

For years, Bitcoin was positioned as the modern challenger to gold, promoted as “digital gold” capable of matching or even replacing the traditional store of value. However, the opening months of 2026 are telling a different story. While spot gold has surged beyond $5,200 per ounce amid rising geopolitical tension and macroeconomic uncertainty, Bitcoin remains range-bound between $86,000 and $89,000. This divergence highlights a critical reality: in periods of stress, markets continue to f

BTC1,45%

- Reward

- 5

- 3

- Repost

- Share

MrFlower_ :

:

2026 GOGOGO 👊View More

#SEConTokenizedSecurities SEConTokenizedSecurities | Navigating SEC Oversight and Evolving Market Dynamics

The market for tokenized securities is entering a critical phase of development, with the U.S. Securities and Exchange Commission firmly positioned at the center of regulatory direction and market behavior. Tokenized securities, defined as digital representations of traditional financial instruments such as equities, bonds, or investment funds, are unequivocally subject to existing U.S. securities laws. Whether issued natively on-chain or digitally mirrored, these assets must comply with

The market for tokenized securities is entering a critical phase of development, with the U.S. Securities and Exchange Commission firmly positioned at the center of regulatory direction and market behavior. Tokenized securities, defined as digital representations of traditional financial instruments such as equities, bonds, or investment funds, are unequivocally subject to existing U.S. securities laws. Whether issued natively on-chain or digitally mirrored, these assets must comply with

- Reward

- 6

- 4

- Repost

- Share

MrFlower_ :

:

2026 GOGOGO 👊View More

#VanEckLaunchesAVAXSpotETF VanEckLaunchesAVAXSpotETF | VanEck Introduces the First U.S. Spot Avalanche (AVAX) ETF — Market Impact & Strategic Analysis

VanEck has officially launched the first U.S.-based spot Avalanche ETF (ticker: VAVX), now trading on Nasdaq, marking a significant milestone for Avalanche and the broader altcoin market. This product offers regulated, direct exposure to AVAX, including potential staking rewards, without requiring investors to manage wallets, private keys, or crypto exchanges. The launch positions Avalanche alongside Bitcoin and Ethereum in the growing class of

VanEck has officially launched the first U.S.-based spot Avalanche ETF (ticker: VAVX), now trading on Nasdaq, marking a significant milestone for Avalanche and the broader altcoin market. This product offers regulated, direct exposure to AVAX, including potential staking rewards, without requiring investors to manage wallets, private keys, or crypto exchanges. The launch positions Avalanche alongside Bitcoin and Ethereum in the growing class of

- Reward

- 6

- 4

- Repost

- Share

MrFlower_ :

:

2026 GOGOGO 👊View More

#CryptoMarketWatch Crypto Market Feature: Fear on the Surface, Structure Beneath

The global crypto market is currently operating under a cloud of extreme caution, with the Crypto Fear & Greed Index sitting near 20, signaling deep investor anxiety. This is not a panic-driven collapse, but a controlled risk-off environment where participants are deliberately slowing down, reassessing exposure, and prioritizing capital protection over short-term gains. Such phases often feel uncomfortable, yet historically they have laid the groundwork for the next major market transition.

Gold’s surge above $5,0

The global crypto market is currently operating under a cloud of extreme caution, with the Crypto Fear & Greed Index sitting near 20, signaling deep investor anxiety. This is not a panic-driven collapse, but a controlled risk-off environment where participants are deliberately slowing down, reassessing exposure, and prioritizing capital protection over short-term gains. Such phases often feel uncomfortable, yet historically they have laid the groundwork for the next major market transition.

Gold’s surge above $5,0

- Reward

- 5

- 3

- Repost

- Share

MrFlower_ :

:

2026 GOGOGO 👊View More

#CryptoMarketWatch CryptoMarketWatch Fear Dominates, But Opportunity Emerges Global crypto markets are signaling heightened caution as the Crypto Fear & Greed Index plunges to 20, firmly placing sentiment in the “fear” zone. Investors are exhibiting deep risk aversion, reflecting a broader macro backdrop of geopolitical uncertainty, regulatory evolution, and capital rotation toward safety. Volatility remains elevated, and traders are carefully weighing their next moves, balancing opportunity against the growing risks of overextension.

Gold Reclaims Its Spotlight Amid the uncertainty, gold has

Gold Reclaims Its Spotlight Amid the uncertainty, gold has

- Reward

- 6

- 5

- Repost

- Share

Peacefulheart :

:

Happy New Year! 🤑View More

#GoldBreaks$5,500 GoldBreaks$5,500 A new historic peak in gold prices: Today, January 29, 2026, gold (XAU) has smashed records again, trading near $5,570 per ounce and briefly approaching $5,600 on heavy safe‑haven flows. This surge reflects a global rush into precious metals amid intensifying geopolitical tensions and a weakening US Dollar. The safe‑haven narrative remains dominant as investors price in uncertainty across multiple fronts.

Demand hits all-time highs: Total global gold demand in 2025 topped 5,000 metric tons, the highest on record, driven mainly by investment demand — especiall

Demand hits all-time highs: Total global gold demand in 2025 topped 5,000 metric tons, the highest on record, driven mainly by investment demand — especiall

- Reward

- 4

- 3

- Repost

- Share

Yunna :

:

happy new yearView More

#FedKeepsRatesUnchanged FedKeepsRatesUnchanged The Federal Reserve has chosen to keep interest rates unchanged, signaling caution rather than a shift in policy. While some investors may have hoped for an immediate easing, the Fed’s decision reflects a careful watch on inflation trends, labor market data, and overall economic stability. This pause does not equate to a rate cut — it simply means the Fed is assessing conditions before committing to its next move.

For markets, this creates a mixed environment. On one hand, relief comes from the absence of additional tightening, which can prevent s

For markets, this creates a mixed environment. On one hand, relief comes from the absence of additional tightening, which can prevent s

- Reward

- 4

- 2

- Repost

- Share

Yunna :

:

2026 gogoView More

#SEConTokenizedSecurities SEConTokenizedSecurities 📌 Tokenized Securities, SEC Oversight, and Market Dynamics

The world of tokenized securities is evolving rapidly, with the U.S. Securities and Exchange Commission (SEC) playing a central role in shaping both regulation and market behavior. Tokenized securities are digital representations of traditional financial instruments such as stocks, bonds, or funds. Regardless of whether they exist natively on-chain or as digital representations, these assets are treated under existing securities laws. The SEC has made it clear that all legal obligatio

The world of tokenized securities is evolving rapidly, with the U.S. Securities and Exchange Commission (SEC) playing a central role in shaping both regulation and market behavior. Tokenized securities are digital representations of traditional financial instruments such as stocks, bonds, or funds. Regardless of whether they exist natively on-chain or as digital representations, these assets are treated under existing securities laws. The SEC has made it clear that all legal obligatio

- Reward

- 4

- 2

- Repost

- Share

DragonFlyOfficial :

:

2026 GOGOGO 👊View More

#WLDSurges40% WLDSurges40% WLD token experienced a massive 40% jump following the announcement of a strategic partnership with AI smart glass manufacturer Rokid. This collaboration positions WLD at the forefront of AI and AR technology, particularly in powering next-generation neural-controlled AR glasses, a sector expected to see rapid adoption over the coming years. The news has clearly captured market attention, reflecting excitement about the potential of AI-integrated wearables.

The current trading price of WLD is approximately $0.49, marking a strong upward movement in a short span. Howe

The current trading price of WLD is approximately $0.49, marking a strong upward movement in a short span. Howe

WLD3,39%

- Reward

- 4

- 2

- Repost

- Share

Yunna :

:

2026 gogoView More

#TokenizedSilverTrend TokenizedSilverTrend As of 29 January 2026, the tokenized silver market is experiencing remarkable momentum, signaling a major evolution in how investors access precious metals. Tokenized silver, which represents real-world silver holdings on blockchain platforms, is bridging the gap between traditional commodities and digital finance. This innovation provides liquidity, transparency, and 24/7 market accessibility, allowing investors to interact with silver in ways previously impossible.

What Is Tokenized Silver? Tokenized silver consists of digital tokens backed by physi

What Is Tokenized Silver? Tokenized silver consists of digital tokens backed by physi

- Reward

- 5

- 3

- Repost

- Share

DragonFlyOfficial :

:

2026 GOGOGO 👊View More

#GoldBreaks$5,500 GoldBreaks$5,500 Future Market Outlook & Strategic Shift ✨

Gold holding firmly above the $5,500 zone is not just a price achievement — it represents a deeper transformation in global financial thinking. Markets are slowly transitioning from growth-focused strategies toward protection-focused allocation. Investors are no longer reacting only to daily headlines; instead, they are preparing for a prolonged phase of uncertainty where preserving wealth becomes more important than chasing aggressive returns. This shift gives gold a structural advantage that may continue shaping pri

Gold holding firmly above the $5,500 zone is not just a price achievement — it represents a deeper transformation in global financial thinking. Markets are slowly transitioning from growth-focused strategies toward protection-focused allocation. Investors are no longer reacting only to daily headlines; instead, they are preparing for a prolonged phase of uncertainty where preserving wealth becomes more important than chasing aggressive returns. This shift gives gold a structural advantage that may continue shaping pri

- Reward

- 4

- 3

- Repost

- Share

Yunna :

:

buy to earnView More

#GateLiveMiningProgramPublicBeta GateLiveMiningProgramPublicBeta — The Future of Interactive Crypto Ecosystems 🚀

The launch of the GateLive Mining Program Public Beta marks a powerful shift in how value is created within the crypto space. This is no longer an environment where profit depends solely on price movement or timing the market. Instead, the future is being shaped around participation, education, and real-time engagement. GateLive introduces a model where knowledge itself becomes a digital asset, transforming everyday interaction into measurable opportunity for both creators and view

The launch of the GateLive Mining Program Public Beta marks a powerful shift in how value is created within the crypto space. This is no longer an environment where profit depends solely on price movement or timing the market. Instead, the future is being shaped around participation, education, and real-time engagement. GateLive introduces a model where knowledge itself becomes a digital asset, transforming everyday interaction into measurable opportunity for both creators and view

- Reward

- 6

- 3

- Repost

- Share

DragonFlyOfficial :

:

2026 GOGOGO 👊View More

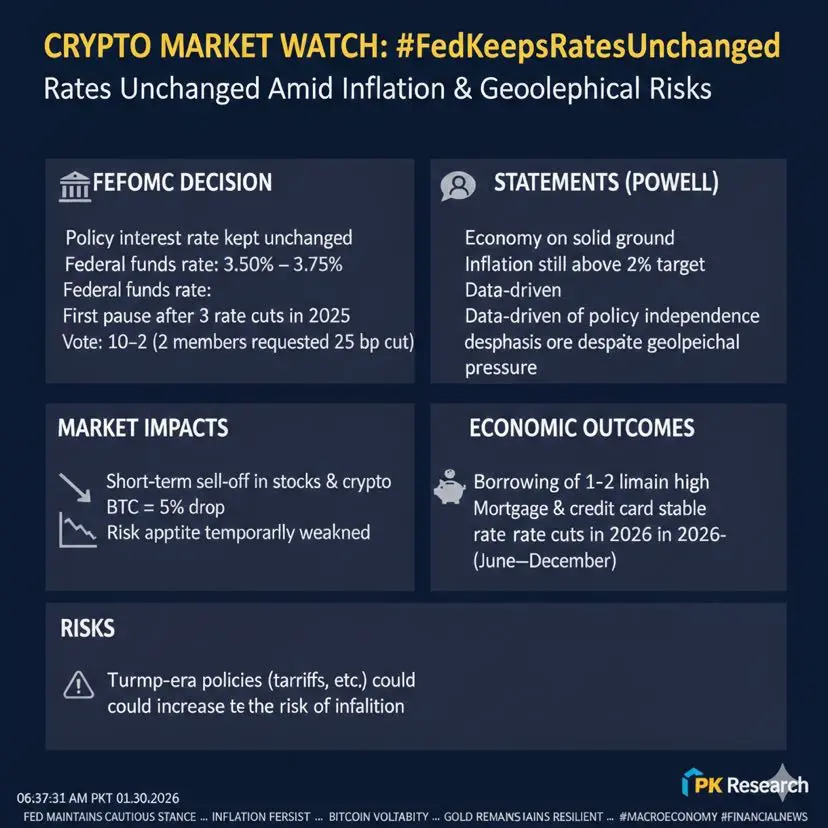

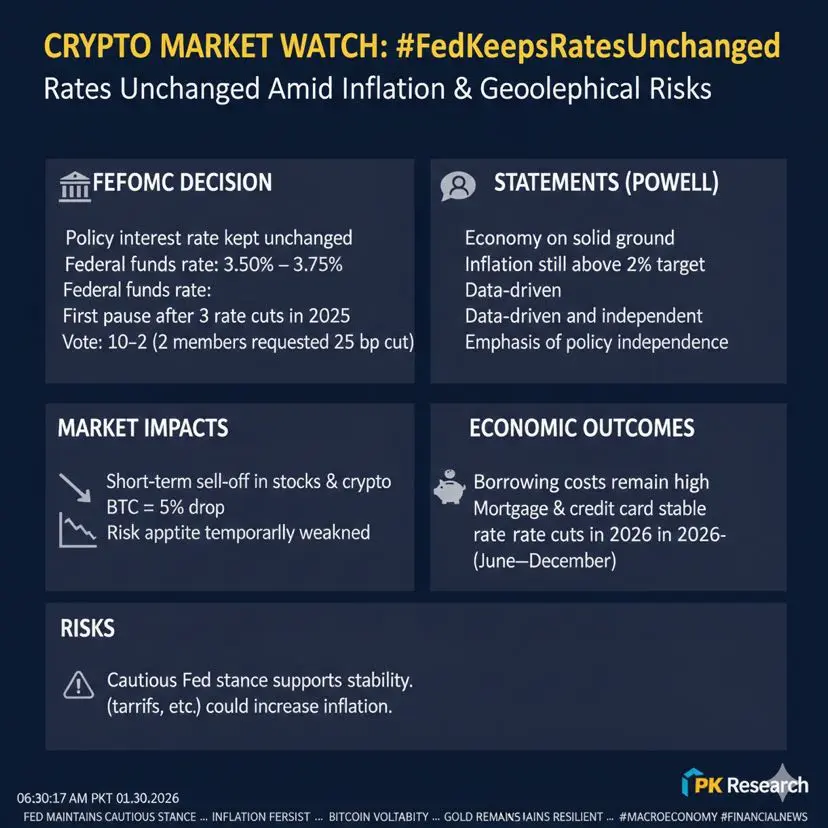

#FedKeepsRatesUnchanged #FedKeepsRatesUnchanged 🏦 Fed FOMC Decision

Policy interest rate kept unchanged

Federal funds rate: 3.50% – 3.75%

First pause after 3 rate cuts in 2025

Vote: 10–2 (Miran and Waller requested a 25 bp cut)

👤 Statements (Powell)

Economy on solid ground

Inflation still above the 2% target

Fed data-driven and independent

Emphasis on policy independence despite political pressure

📉 Market Impacts

Short-term sell-off in stocks and crypto

BTC ≈ 5% drop

Risk appetite temporarily weakened

💳 Economic Outcomes

Borrowing costs remain high

Mortgage and credit card interest rates

Policy interest rate kept unchanged

Federal funds rate: 3.50% – 3.75%

First pause after 3 rate cuts in 2025

Vote: 10–2 (Miran and Waller requested a 25 bp cut)

👤 Statements (Powell)

Economy on solid ground

Inflation still above the 2% target

Fed data-driven and independent

Emphasis on policy independence despite political pressure

📉 Market Impacts

Short-term sell-off in stocks and crypto

BTC ≈ 5% drop

Risk appetite temporarily weakened

💳 Economic Outcomes

Borrowing costs remain high

Mortgage and credit card interest rates

BTC1,45%

- Reward

- 5

- 2

- Repost

- Share

Yunna :

:

buy to earnView More

#SEConTokenizedSecurities The evolution of tokenized securities is entering a defining phase where technology is no longer the main challenge — structure, trust, and governance are. As traditional finance and blockchain-based systems intersect, markets are beginning to understand that tokenization is not about avoiding regulation, but about upgrading how regulated assets move, settle, and interact in a digital economy. This marks a shift from experimentation toward institutional-grade adoption.

In the coming period, the SEC’s role is expected to become more directional rather than reactionary.

In the coming period, the SEC’s role is expected to become more directional rather than reactionary.

- Reward

- 3

- 2

- Repost

- Share

Yunna :

:

buy to earnView More