#CPIDataAhead

U.S. CPI Cools — Global Markets on Edge as Crypto Surges

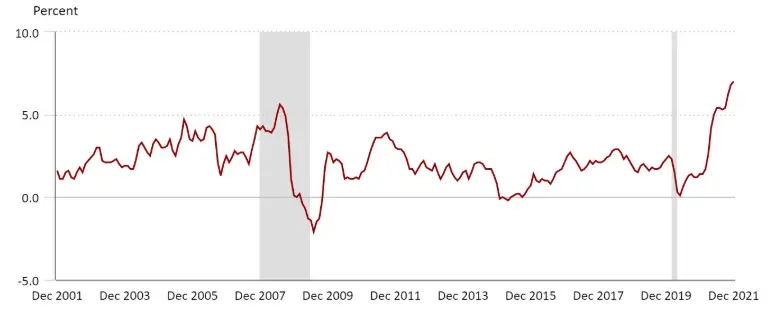

On February 13, 2026, the U.S. Bureau of Labor Statistics released the January CPI report, and the numbers delivered a meaningful macro signal that immediately rippled across global markets — from bonds and equities to Bitcoin and altcoins.

This wasn’t just another inflation print.

This was a liquidity signal.

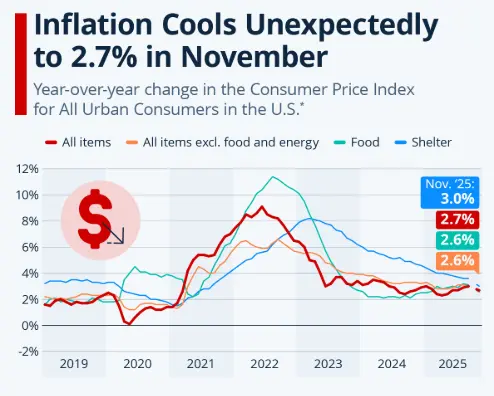

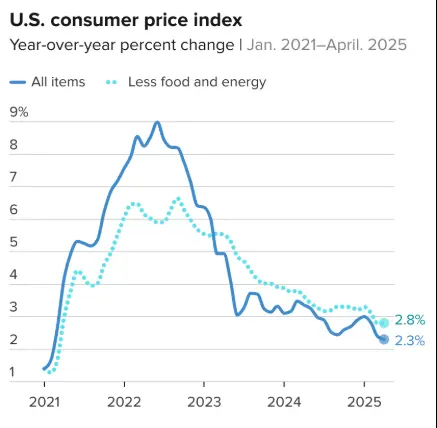

📊 The Inflation Numbers That Moved Markets

Headline CPI (YoY): 2.4%

Below expectations (2.5%) → Clear sign inflation is gradually easing.

Headline CPI (MoM): +0.2%

Lower than forecast (+0.3%) → Momentum cooling.

Core CPI (YoY): 2.5%

In line with expectations → Inflation not gone, but stabilizing.

Core CPI (MoM): +0.3%

Sticky but not accelerating.

Macro Interpretation:

Inflation is not defeated — but it is no longer re-accelerating.

That subtle difference changes liquidity expectations.

🌍 Global Markets Reaction — “Risk-On” Returns (Cautiously)

Markets were positioned defensively going into the print.

The softer-than-expected headline triggered a fast re-pricing of rate expectations.

🇺🇸 U.S. Treasury Yields

• 2-year yield dropped sharply

• Rate cut probability for later 2026 increased

• Bond markets priced in a more dovish path

Lower yields = lower opportunity cost for risk assets.

💵 U.S. Dollar (DXY)

The dollar initially held steady, then softened slightly.

A cooling inflation narrative weakens aggressive rate stance expectations — easing global financial pressure.

Emerging markets and crypto benefit when the dollar loses strength.

📈 U.S. Equities

• Stock futures moved higher

• Growth and tech stocks reacted positively

• Risk appetite returned intraday

Liquidity expectations drive equity multiples — and CPI helped stabilize that outlook.

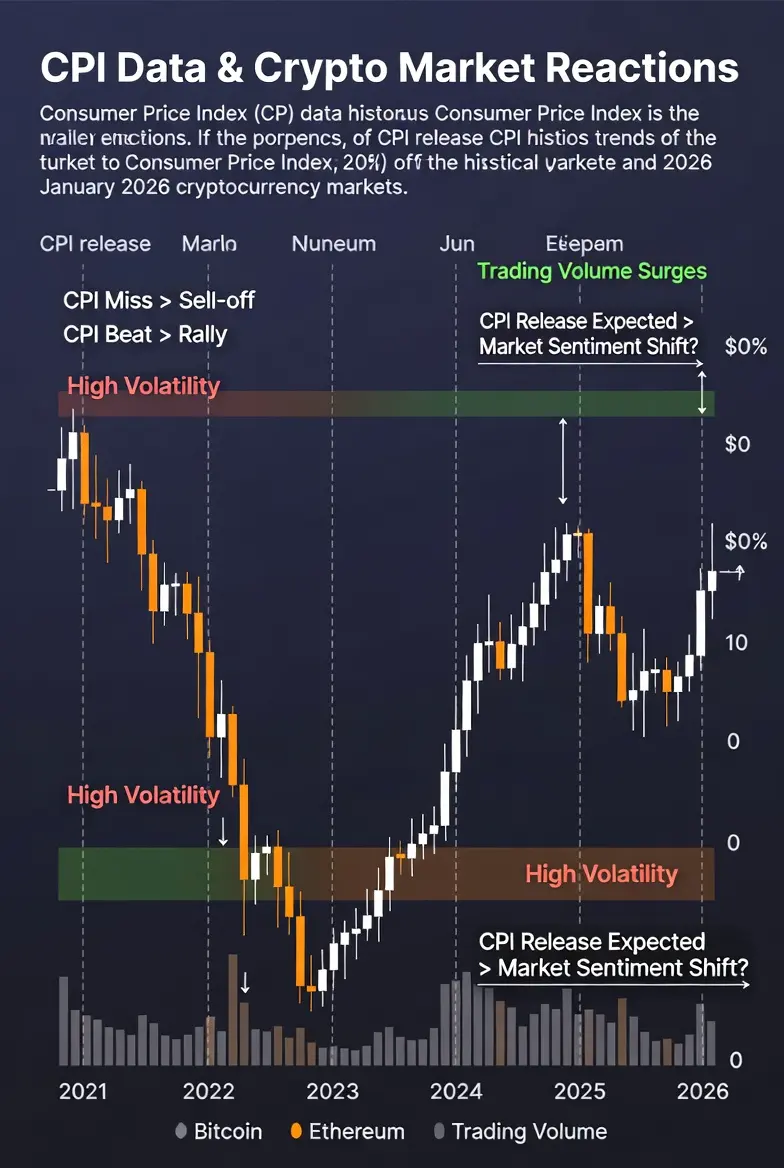

₿ Crypto Market Reaction — Liquidity Awakens

Bitcoin (BTC)

Bitcoin surged above $69,000 immediately after the release.

• Intraday gain: ~4–6%

• Strong spot buying observed

• Derivatives volume spiked

• Short liquidations accelerated upside

The move was not random — it was macro-driven repricing.

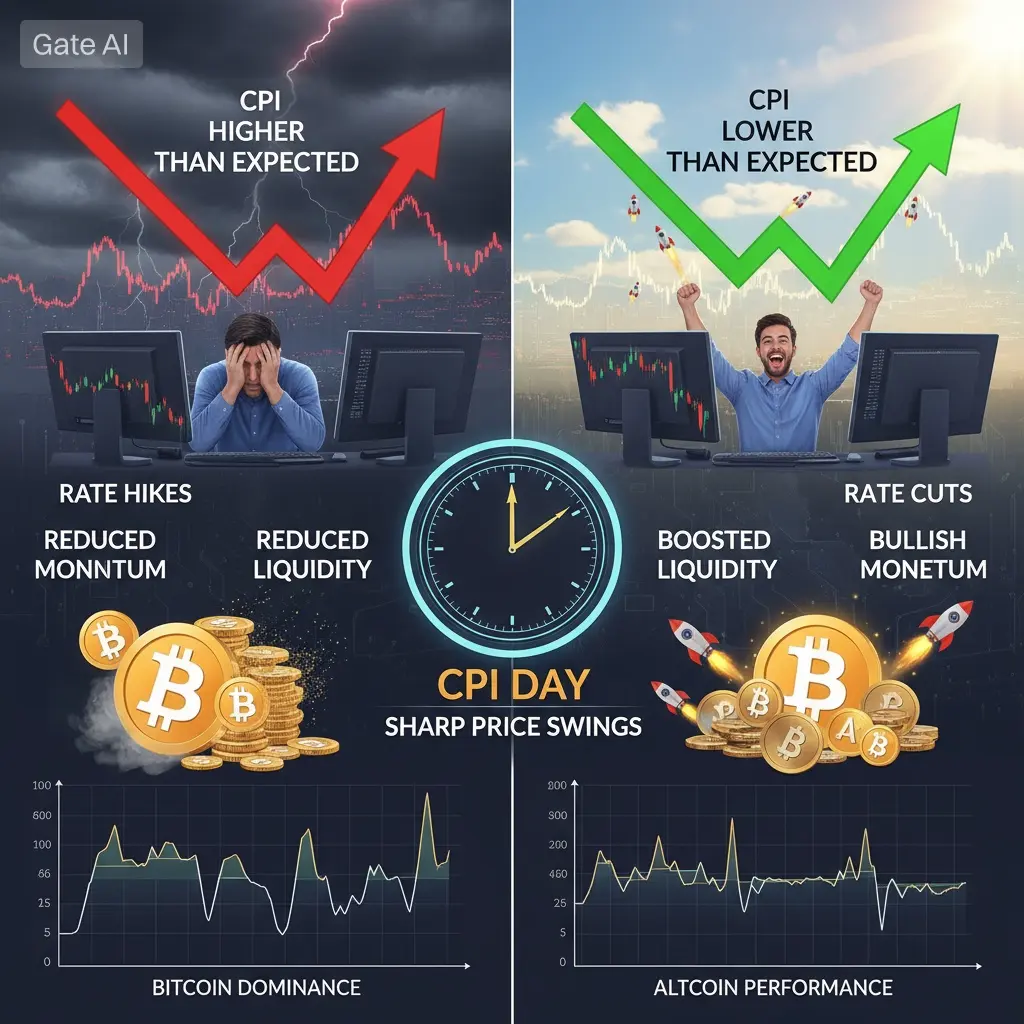

When inflation cools → rate cut probability rises → liquidity expectations improve → crypto responds.

Ethereum & Altcoins

Ethereum climbed approximately 7–8%, outperforming BTC.

• Large-cap alts followed

• Total crypto market cap jumped ~4–5%

• Market cap reclaimed ~$2.4 trillion

Altcoins tend to respond more aggressively when macro pressure eases.

💧 Liquidity & Volume Dynamics

• Trading volume expanded significantly across major exchanges

• Open interest increased, showing fresh positioning

• Stablecoin reserves remain elevated (~$300B+ equivalent), signaling deployable capital

This suggests the rally was supported by participation — not just thin liquidity spikes.

However, higher open interest also increases volatility risk.

🧠 Why This CPI Print Matters Globally

This CPI report impacts more than just U.S. markets.

1️⃣ Lower U.S. inflation reduces pressure on global central banks.

2️⃣ A softer dollar improves capital flow conditions worldwide.

3️⃣ Risk assets globally benefit from easing financial conditions.

4️⃣ Crypto, being liquidity-sensitive, reacts disproportionately.

Global markets were on edge before the release.

Now they’re cautiously optimistic — but not complacent.

⚠️ The Critical Risk Factors

Despite the rally:

• Core inflation remains above the Fed’s 2% target.

• The Federal Reserve has not confirmed imminent rate cuts.

• One CPI print does not define policy direction.

• January data sometimes carries seasonal distortions.

Markets may have reacted positively — but the Fed will look for consistency.

If future data re-accelerates, today’s rally could retrace quickly.

🔎 Short-Term Outlook

If inflation continues trending lower: → Liquidity improves

→ Risk assets extend higher

→ Bitcoin could challenge prior highs

If inflation stalls or rebounds: → Rate cut expectations fade

→ Dollar strengthens

→ Crypto faces renewed pressure

For now, the market narrative has shifted slightly toward optimism — but volatility remains elevated.

📌 Final Takeaway

This CPI release acted as a macro catalyst.

• Inflation cooling

• Yields falling

• Dollar softening

• Equities rising

• Crypto rallying

The global market was on edge — and CPI temporarily eased that tension.

But the bigger question remains:

Is this the beginning of a sustained disinflation trend — or just a temporary pause?

Liquidity will decide.

U.S. CPI Cools — Global Markets on Edge as Crypto Surges

On February 13, 2026, the U.S. Bureau of Labor Statistics released the January CPI report, and the numbers delivered a meaningful macro signal that immediately rippled across global markets — from bonds and equities to Bitcoin and altcoins.

This wasn’t just another inflation print.

This was a liquidity signal.

📊 The Inflation Numbers That Moved Markets

Headline CPI (YoY): 2.4%

Below expectations (2.5%) → Clear sign inflation is gradually easing.

Headline CPI (MoM): +0.2%

Lower than forecast (+0.3%) → Momentum cooling.

Core CPI (YoY): 2.5%

In line with expectations → Inflation not gone, but stabilizing.

Core CPI (MoM): +0.3%

Sticky but not accelerating.

Macro Interpretation:

Inflation is not defeated — but it is no longer re-accelerating.

That subtle difference changes liquidity expectations.

🌍 Global Markets Reaction — “Risk-On” Returns (Cautiously)

Markets were positioned defensively going into the print.

The softer-than-expected headline triggered a fast re-pricing of rate expectations.

🇺🇸 U.S. Treasury Yields

• 2-year yield dropped sharply

• Rate cut probability for later 2026 increased

• Bond markets priced in a more dovish path

Lower yields = lower opportunity cost for risk assets.

💵 U.S. Dollar (DXY)

The dollar initially held steady, then softened slightly.

A cooling inflation narrative weakens aggressive rate stance expectations — easing global financial pressure.

Emerging markets and crypto benefit when the dollar loses strength.

📈 U.S. Equities

• Stock futures moved higher

• Growth and tech stocks reacted positively

• Risk appetite returned intraday

Liquidity expectations drive equity multiples — and CPI helped stabilize that outlook.

₿ Crypto Market Reaction — Liquidity Awakens

Bitcoin (BTC)

Bitcoin surged above $69,000 immediately after the release.

• Intraday gain: ~4–6%

• Strong spot buying observed

• Derivatives volume spiked

• Short liquidations accelerated upside

The move was not random — it was macro-driven repricing.

When inflation cools → rate cut probability rises → liquidity expectations improve → crypto responds.

Ethereum & Altcoins

Ethereum climbed approximately 7–8%, outperforming BTC.

• Large-cap alts followed

• Total crypto market cap jumped ~4–5%

• Market cap reclaimed ~$2.4 trillion

Altcoins tend to respond more aggressively when macro pressure eases.

💧 Liquidity & Volume Dynamics

• Trading volume expanded significantly across major exchanges

• Open interest increased, showing fresh positioning

• Stablecoin reserves remain elevated (~$300B+ equivalent), signaling deployable capital

This suggests the rally was supported by participation — not just thin liquidity spikes.

However, higher open interest also increases volatility risk.

🧠 Why This CPI Print Matters Globally

This CPI report impacts more than just U.S. markets.

1️⃣ Lower U.S. inflation reduces pressure on global central banks.

2️⃣ A softer dollar improves capital flow conditions worldwide.

3️⃣ Risk assets globally benefit from easing financial conditions.

4️⃣ Crypto, being liquidity-sensitive, reacts disproportionately.

Global markets were on edge before the release.

Now they’re cautiously optimistic — but not complacent.

⚠️ The Critical Risk Factors

Despite the rally:

• Core inflation remains above the Fed’s 2% target.

• The Federal Reserve has not confirmed imminent rate cuts.

• One CPI print does not define policy direction.

• January data sometimes carries seasonal distortions.

Markets may have reacted positively — but the Fed will look for consistency.

If future data re-accelerates, today’s rally could retrace quickly.

🔎 Short-Term Outlook

If inflation continues trending lower: → Liquidity improves

→ Risk assets extend higher

→ Bitcoin could challenge prior highs

If inflation stalls or rebounds: → Rate cut expectations fade

→ Dollar strengthens

→ Crypto faces renewed pressure

For now, the market narrative has shifted slightly toward optimism — but volatility remains elevated.

📌 Final Takeaway

This CPI release acted as a macro catalyst.

• Inflation cooling

• Yields falling

• Dollar softening

• Equities rising

• Crypto rallying

The global market was on edge — and CPI temporarily eased that tension.

But the bigger question remains:

Is this the beginning of a sustained disinflation trend — or just a temporary pause?

Liquidity will decide.