# BitcoinSix-DayRally

48.02K

BTC has climbed for six straight days, nearing $94,000, supported by strong ETF inflows and rising spot volume. Do you see this as a real bull-market move or a short squeeze? Buy now or wait for a pullback?

StylishKuri

#BitcoinSix-DayRally Consolidation or Ignition? Reading the Next Phase of BTC Momentum

As of early January 2026, Bitcoin is locked in a high-pressure equilibrium. Price action over the last six days reflects more than short-term speculation — it represents a recalibration phase after the turbulent close of 2025. The market is currently balancing institutional accumulation, technical exhaustion, and psychological resistance clustered around the $94,000–$95,000 region. This zone has become the defining battleground for Bitcoin’s next directional move.

What makes this rally structurally different

As of early January 2026, Bitcoin is locked in a high-pressure equilibrium. Price action over the last six days reflects more than short-term speculation — it represents a recalibration phase after the turbulent close of 2025. The market is currently balancing institutional accumulation, technical exhaustion, and psychological resistance clustered around the $94,000–$95,000 region. This zone has become the defining battleground for Bitcoin’s next directional move.

What makes this rally structurally different

BTC2,89%

- Reward

- 4

- 2

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#BitcoinSix-DayRally #BitcoinSixDayRally 🚀 #SmartPositioning

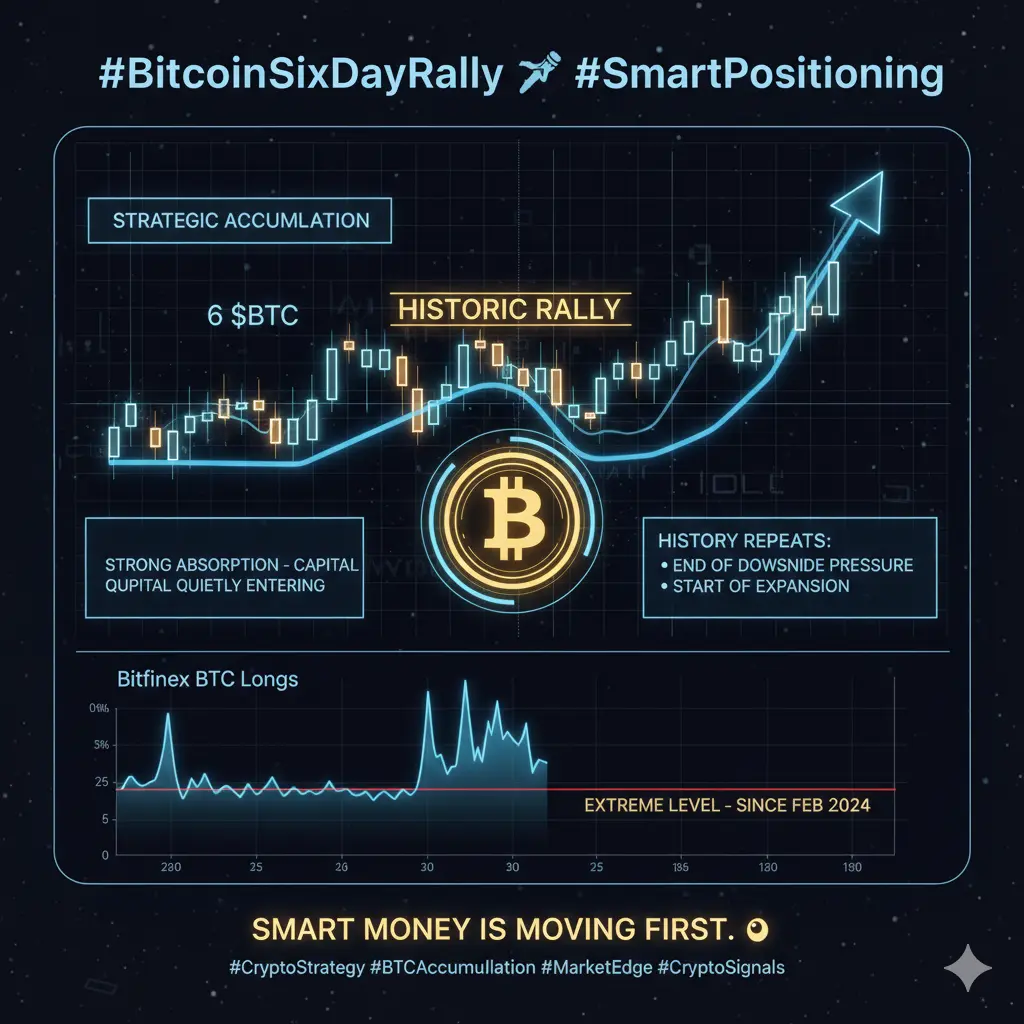

Something historic is unfolding in Bitcoin markets. $BTC longs on Bitfinex have just reached levels we haven’t seen since February 2024 — an extreme so rare it commands attention.

But let’s be clear: this isn’t FOMO. This is strategic accumulation — smart positioning by those who understand that when sentiment is weak and prices are heavy, opportunity is quietly building.

Here’s what history tells us: every prior time this extreme was reached, it marked:

The end of downside pressure – sellers exhausted, buyers absorbing.

Strong abs

Something historic is unfolding in Bitcoin markets. $BTC longs on Bitfinex have just reached levels we haven’t seen since February 2024 — an extreme so rare it commands attention.

But let’s be clear: this isn’t FOMO. This is strategic accumulation — smart positioning by those who understand that when sentiment is weak and prices are heavy, opportunity is quietly building.

Here’s what history tells us: every prior time this extreme was reached, it marked:

The end of downside pressure – sellers exhausted, buyers absorbing.

Strong abs

- Reward

- 1

- Comment

- Repost

- Share

#BitcoinSix-DayRally

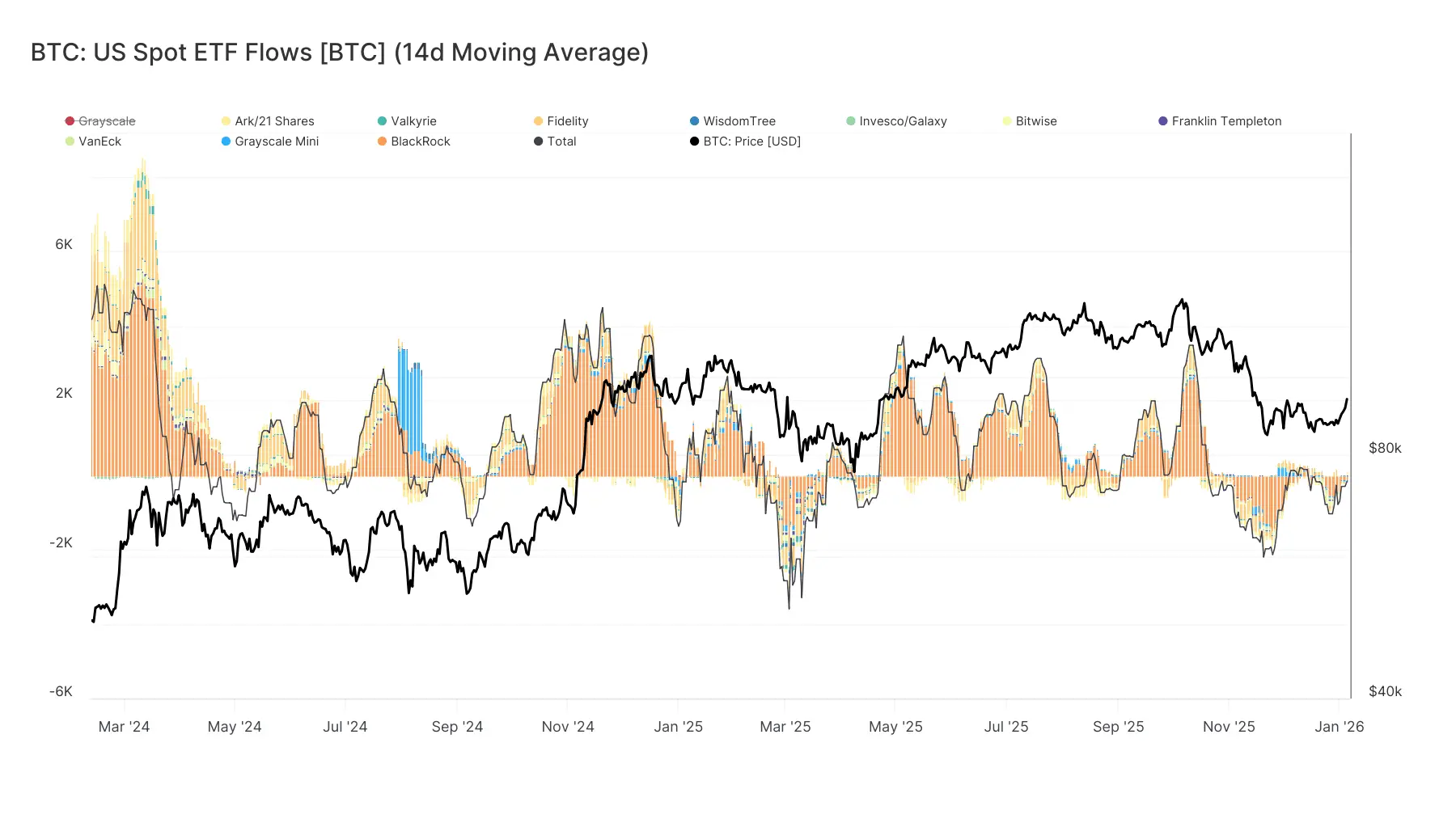

In the first week of January 2026, the cryptocurrency markets are rising from the ashes thanks to the "January Effect" and institutional cash flow. Bitcoin, which started its journey on January 1st, has been showing green candles for 6 consecutive days, bringing the #BitcoinSixDayRally hashtag to the world's trending topics.

The $94,000 Barrier and ETF Power

Bitcoin made a rapid entry into 2026 from the $87,400 levels, surpassing the $94,000 mark in six days. This rise is not just a technical correction, but the result of a deep liquidity wave.

ETF Wind: Spot Bitcoin ETFs

In the first week of January 2026, the cryptocurrency markets are rising from the ashes thanks to the "January Effect" and institutional cash flow. Bitcoin, which started its journey on January 1st, has been showing green candles for 6 consecutive days, bringing the #BitcoinSixDayRally hashtag to the world's trending topics.

The $94,000 Barrier and ETF Power

Bitcoin made a rapid entry into 2026 from the $87,400 levels, surpassing the $94,000 mark in six days. This rise is not just a technical correction, but the result of a deep liquidity wave.

ETF Wind: Spot Bitcoin ETFs

- Reward

- 6

- 4

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

#BitcoinSix-DayRally

In the first week of January 2026, the cryptocurrency markets are rising from the ashes thanks to the "January Effect" and institutional cash flow. Bitcoin, which started its journey on January 1st, has been showing green candles for 6 consecutive days, bringing the #BitcoinSixDayRally hashtag to the world's trending topics.

The $94,000 Barrier and ETF Power

Bitcoin made a rapid entry into 2026 from the $87,400 levels, surpassing the $94,000 mark in six days. This rise is not just a technical correction, but the result of a deep liquidity wave.

ETF Wind: Spot Bitcoin ETFs

In the first week of January 2026, the cryptocurrency markets are rising from the ashes thanks to the "January Effect" and institutional cash flow. Bitcoin, which started its journey on January 1st, has been showing green candles for 6 consecutive days, bringing the #BitcoinSixDayRally hashtag to the world's trending topics.

The $94,000 Barrier and ETF Power

Bitcoin made a rapid entry into 2026 from the $87,400 levels, surpassing the $94,000 mark in six days. This rise is not just a technical correction, but the result of a deep liquidity wave.

ETF Wind: Spot Bitcoin ETFs

- Reward

- 15

- 20

- Repost

- Share

PrincessOfBitcoin :

:

Buy To Earn 💎View More

#BitcoinSix-DayRally Smart Positioning Is Happening $BTC

Bitcoin longs on Bitfinex just hit a historic extreme, the highest since Feb 2024. $ZKP

This isn’t FOMO. This is what accumulation looks like when sentiment is weak and price is heavy. $BREV

Every prior occurrence marked:

• The end of downside

• Strong absorption

• The start of expansion

The crowd freezes here. The data is already moving.👀

Bitcoin longs on Bitfinex just hit a historic extreme, the highest since Feb 2024. $ZKP

This isn’t FOMO. This is what accumulation looks like when sentiment is weak and price is heavy. $BREV

Every prior occurrence marked:

• The end of downside

• Strong absorption

• The start of expansion

The crowd freezes here. The data is already moving.👀

- Reward

- 1

- Comment

- Repost

- Share

#BitcoinSix-DayRally

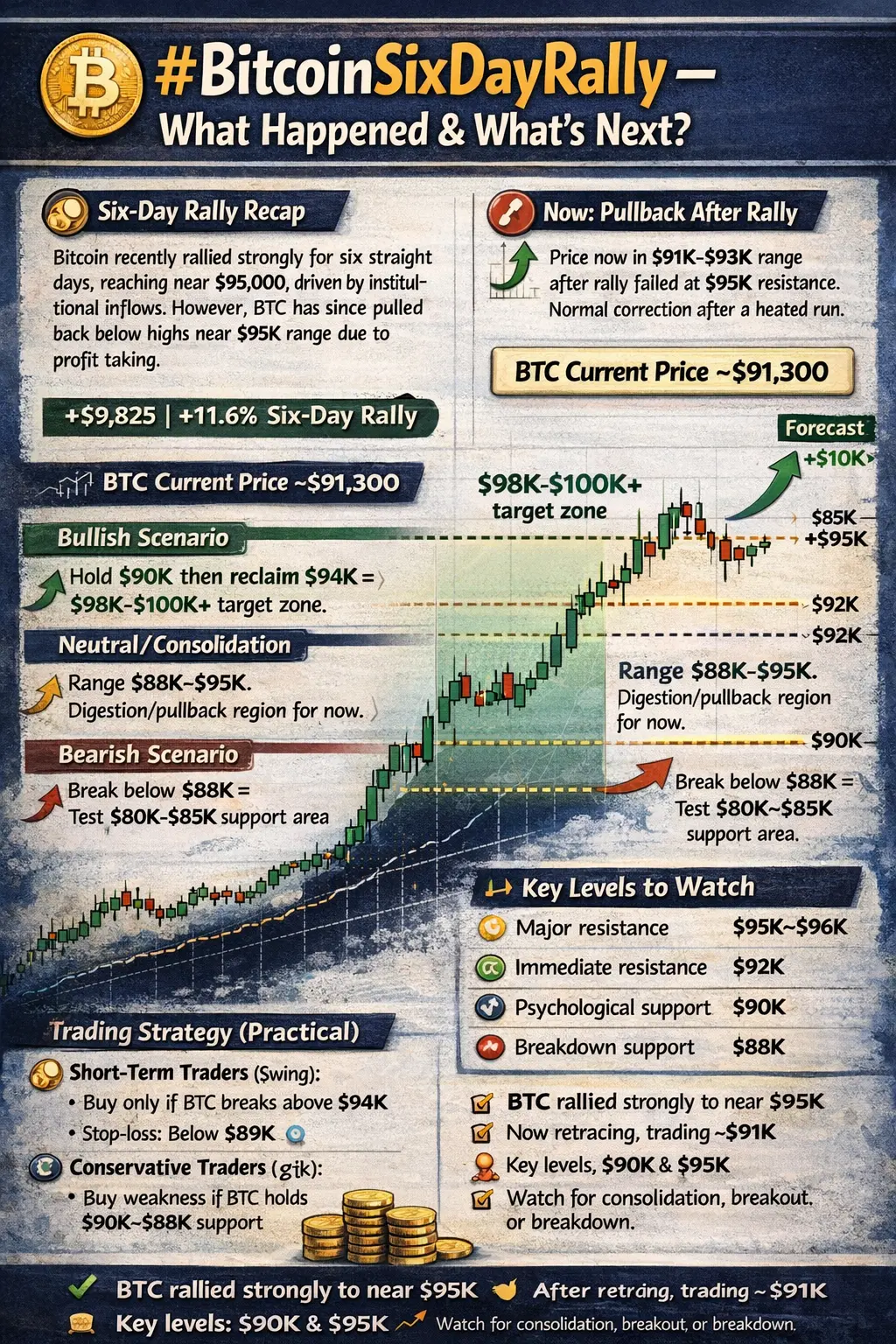

Bitcoin's Six-Day Rally: A Genuine Bull Market Move or Just a Short Squeeze?

January 7, 2026 – Bitcoin (BTC) has posted impressive gains in the opening week of 2026, climbing for six consecutive days from around $87,000–$88,000 at the start of the year to a high near $94,700 before pulling back slightly. As of today, BTC is trading around $92,500–$93,000, supported by robust spot Bitcoin ETF inflows and increasing on-chain volume. The rally has sparked debate: Is this the start of a sustained bull market, or primarily a short squeeze fueled by liquidations? Should investo

Bitcoin's Six-Day Rally: A Genuine Bull Market Move or Just a Short Squeeze?

January 7, 2026 – Bitcoin (BTC) has posted impressive gains in the opening week of 2026, climbing for six consecutive days from around $87,000–$88,000 at the start of the year to a high near $94,700 before pulling back slightly. As of today, BTC is trading around $92,500–$93,000, supported by robust spot Bitcoin ETF inflows and increasing on-chain volume. The rally has sparked debate: Is this the start of a sustained bull market, or primarily a short squeeze fueled by liquidations? Should investo

BTC2,89%

- Reward

- 128

- 77

- Repost

- Share

Bab谋_Ali :

:

Happy New Year! 🤑View More

#BitcoinSix-DayRally

Bitcoin's Six-Day Rally Excites Markets. Bitcoin has shown remarkable performance in the first week of 2026, rising for six consecutive days. The leading cryptocurrency has gained approximately 11-12% since the beginning of the year, surpassing the $94,000 level.

This rally is supported by institutional ETF inflows, New Year's optimism, and geopolitical developments. Analysts note that the "January effect" has come into play, and positions are increasing in options markets for targets above $100,000.

Market experts emphasize that the $90,000 support level is critical for

Bitcoin's Six-Day Rally Excites Markets. Bitcoin has shown remarkable performance in the first week of 2026, rising for six consecutive days. The leading cryptocurrency has gained approximately 11-12% since the beginning of the year, surpassing the $94,000 level.

This rally is supported by institutional ETF inflows, New Year's optimism, and geopolitical developments. Analysts note that the "January effect" has come into play, and positions are increasing in options markets for targets above $100,000.

Market experts emphasize that the $90,000 support level is critical for

BTC2,89%

- Reward

- 44

- 32

- Repost

- Share

CryptoAlice :

:

Happy New Year! 🤑View More

#BitcoinSix-DayRally

Consolidation or Ignition? Interpreting Bitcoin’s Next Decisive Phase

As January 2026 unfolds, Bitcoin finds itself in a tightly compressed equilibrium a phase I have learned to respect deeply over multiple market cycles. After a volatile and emotionally charged close to 2025, the last six days of price action are not random noise or simple momentum chasing. They reflect a deliberate recalibration process, where capital, conviction, and caution are all competing near the same price levels. The $94,000–$95,000 zone has emerged as the focal point of this tension, acting as

Consolidation or Ignition? Interpreting Bitcoin’s Next Decisive Phase

As January 2026 unfolds, Bitcoin finds itself in a tightly compressed equilibrium a phase I have learned to respect deeply over multiple market cycles. After a volatile and emotionally charged close to 2025, the last six days of price action are not random noise or simple momentum chasing. They reflect a deliberate recalibration process, where capital, conviction, and caution are all competing near the same price levels. The $94,000–$95,000 zone has emerged as the focal point of this tension, acting as

BTC2,89%

- Reward

- 6

- 4

- Repost

- Share

Crypto_Buzz_with_Alex :

:

🙌 “Solid analysis, thanks for sharing this!”View More

#BitcoinSix-DayRally

#BitcoinSixDayRally — What Happened & What’s Next?

📈 Six-Day Rally Recap

Bitcoin recently rallied strongly for about six consecutive trading sessions, climbing from lower levels up toward the $94,000–$95,000 zone. This upward move was driven by renewed institutional demand, ETF inflows, and improved market sentiment heading into 2026.

During this stretch:

• BTC rose each day for nearly six sessions — a sign of sustained bullish momentum.

• Price tested recently strong resistance near $95,000, the highest level seen since late 2025.

• This was partially supported by te

#BitcoinSixDayRally — What Happened & What’s Next?

📈 Six-Day Rally Recap

Bitcoin recently rallied strongly for about six consecutive trading sessions, climbing from lower levels up toward the $94,000–$95,000 zone. This upward move was driven by renewed institutional demand, ETF inflows, and improved market sentiment heading into 2026.

During this stretch:

• BTC rose each day for nearly six sessions — a sign of sustained bullish momentum.

• Price tested recently strong resistance near $95,000, the highest level seen since late 2025.

• This was partially supported by te

BTC2,89%

- Reward

- 31

- 20

- Repost

- Share

BeautifulDay :

:

Buy To Earn 💎View More

#BitcoinSix-DayRally

In the first week of January 2026, the cryptocurrency markets are rising from the ashes thanks to the "January Effect" and institutional cash flow. Bitcoin, which started its journey on January 1st, has been showing green candles for 6 consecutive days, bringing the #BitcoinSixDayRally hashtag to the world's trending topics.

The $94,000 Barrier and ETF Power

Bitcoin made a rapid entry into 2026 from the $87,400 levels, surpassing the $94,000 mark in six days. This rise is not just a technical correction, but the result of a deep liquidity wave.

ETF Wind: Spot Bitcoin ETFs

In the first week of January 2026, the cryptocurrency markets are rising from the ashes thanks to the "January Effect" and institutional cash flow. Bitcoin, which started its journey on January 1st, has been showing green candles for 6 consecutive days, bringing the #BitcoinSixDayRally hashtag to the world's trending topics.

The $94,000 Barrier and ETF Power

Bitcoin made a rapid entry into 2026 from the $87,400 levels, surpassing the $94,000 mark in six days. This rise is not just a technical correction, but the result of a deep liquidity wave.

ETF Wind: Spot Bitcoin ETFs

- Reward

- 115

- 150

- Repost

- Share

User_any :

:

Buy To Earn 💎View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

162.45K Popularity

133.34K Popularity

40.01K Popularity

59.39K Popularity

415.65K Popularity

333.31K Popularity

711 Popularity

94 Popularity

118 Popularity

2.86K Popularity

5.99K Popularity

4.01K Popularity

4.88K Popularity

30.17K Popularity

31.3K Popularity

News

View MoreCryptocurrency ATM Regulation Upgrades: Bitcoin Depot Mandates Identity Verification for Each Transaction, US Anti-Fraud and KYC Compliance Tighten Across the Board

3 m

On-chain data: Nearly 300 XAUt tokens were large withdrawals from Gate's hot wallet, valued at approximately 1.537 million USD.

4 m

Spot silver is currently quoted at $89.51 per ounce, up more than 4.45% intraday.

6 m

Clude increased by 55.98% after launching Alpha, current price is 0.0013019401428674 USDT

13 m

A trader has bet on NVIDIA's earnings report, already opening a position of approximately 147,000 shares of NVDA on Hyperliquid.

18 m

Pin