Post content & earn content mining yield

placeholder

- Reward

- 2

- 3

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

GoldAndSilverHitNewHighs 🏆💰

A Macro, Monetary & Inter-Market Breakdown

Gold and Silver have surged to multi-year highs, signaling a structural shift in global capital allocation. This rally is driven by macro stress, changing monetary expectations, and rising demand for hard assets, not by a single catalyst.

🔹 1. Macro & Monetary Policy

Real Yield Compression: Sticky inflation + slowing growth compress real yields → historically bullish for metals.

Rate Cut Expectations: Slowing economic momentum, tighter credit, rising debt costs → markets price in policy easing, benefiting precious metals

A Macro, Monetary & Inter-Market Breakdown

Gold and Silver have surged to multi-year highs, signaling a structural shift in global capital allocation. This rally is driven by macro stress, changing monetary expectations, and rising demand for hard assets, not by a single catalyst.

🔹 1. Macro & Monetary Policy

Real Yield Compression: Sticky inflation + slowing growth compress real yields → historically bullish for metals.

Rate Cut Expectations: Slowing economic momentum, tighter credit, rising debt costs → markets price in policy easing, benefiting precious metals

BTC-3,19%

- Reward

- like

- 1

- Repost

- Share

GateUser-6aca4c9a :

:

❤️🎉马币

mmmml

Created By@ComeWealth,ComeWealth

Subscription Progress

0.00%

MC:

$0

Create My Token

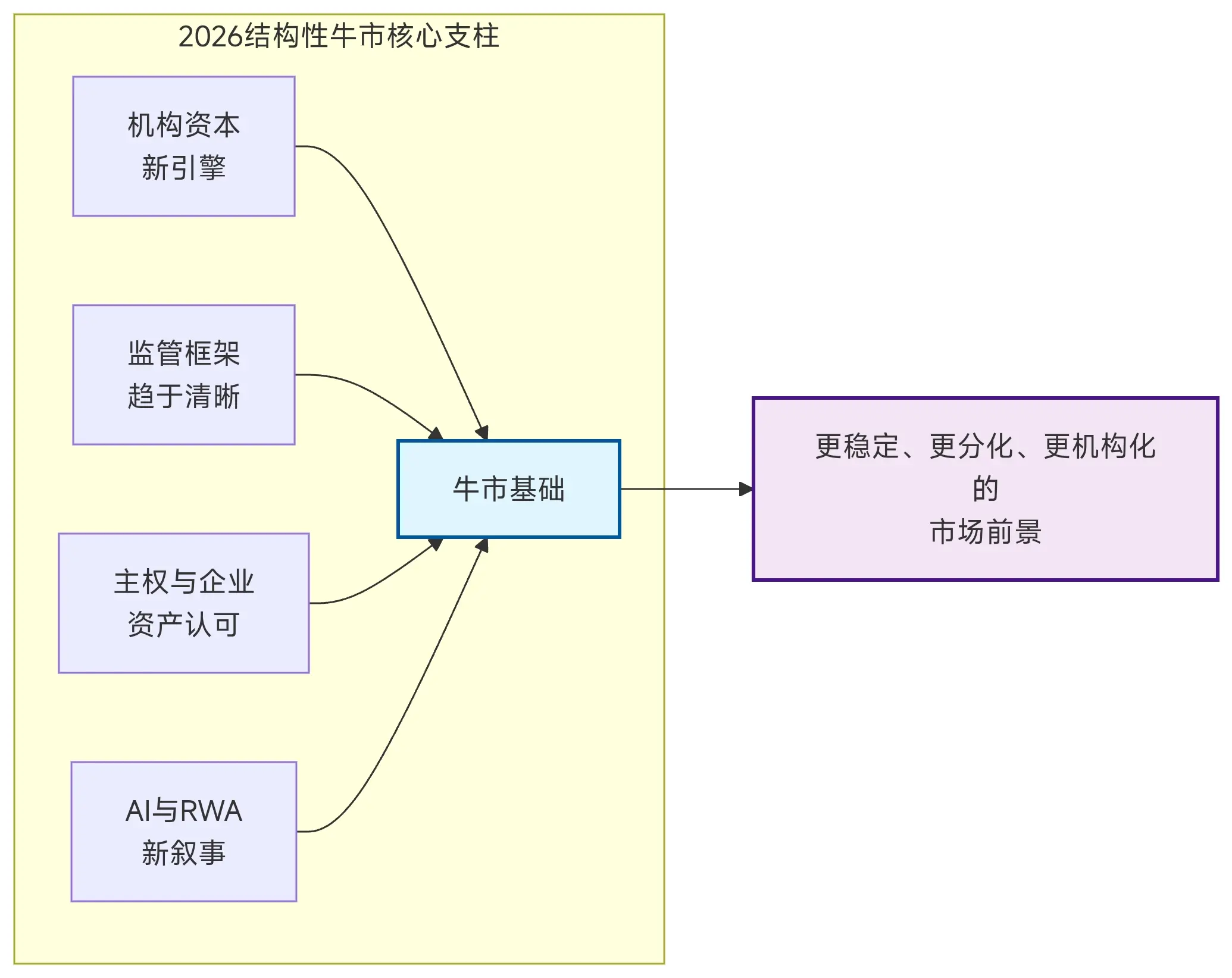

Let's discuss a topic that most retail investors care about: Will there still be a bull market in cryptocurrencies in 2026?

From the dual perspectives of Wall Street and Silicon Valley, the foundation for a structural bull market in the crypto space in 2026 remains solid, but market logic has shifted from retail speculation to institutional-led value revaluation.

The core basis is as follows:

1. Institutional capital becomes the new engine: Traditional financial giants like BlackRock and Fidelity continue to enter through compliant channels such as spot ETFs. According to 21Shares, by 2026, th

View OriginalFrom the dual perspectives of Wall Street and Silicon Valley, the foundation for a structural bull market in the crypto space in 2026 remains solid, but market logic has shifted from retail speculation to institutional-led value revaluation.

The core basis is as follows:

1. Institutional capital becomes the new engine: Traditional financial giants like BlackRock and Fidelity continue to enter through compliant channels such as spot ETFs. According to 21Shares, by 2026, th

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

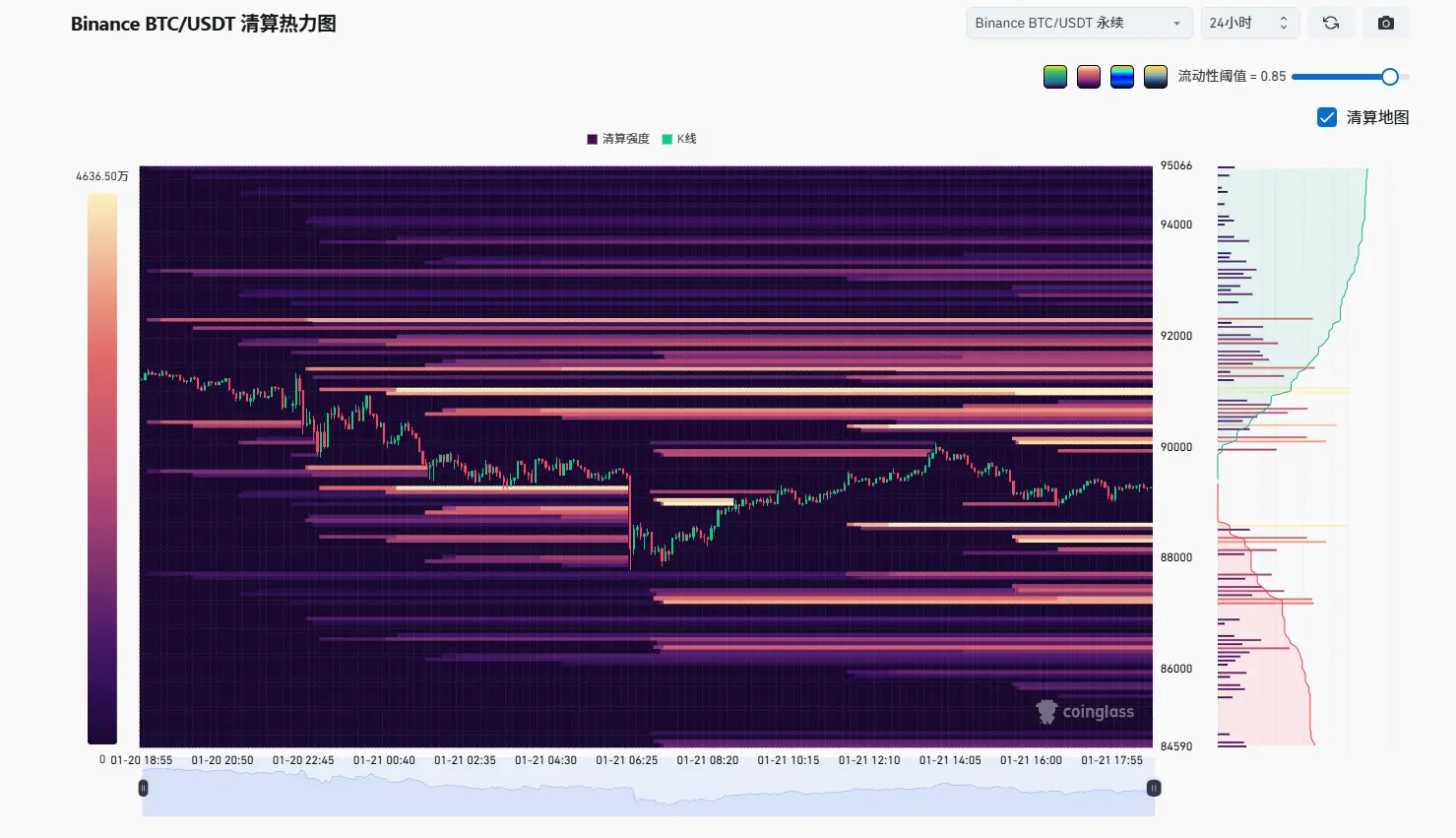

🚨 BREAKING: Bitcoin just flushed hard.\nWhat happened:\n\n~$2,000 drop in minutes\n\n$360M in leveraged longs liquidated\n\nVolatility spike\nLeverage cleanses always come fast.

BTC-3,19%

- Reward

- like

- Comment

- Repost

- Share

📊 BTC Today's Long and Short Liquidation Points

Short Liquidation Points: 90,087|91,053|92,316|93,208–94,100 (Last Short Liquidation Zone)

Long Liquidation Points: 88,601|87,190|86,372|85,629–84,589 (Last Long Liquidation Zone)

Short Liquidation Points: 90,087|91,053|92,316|93,208–94,100 (Last Short Liquidation Zone)

Long Liquidation Points: 88,601|87,190|86,372|85,629–84,589 (Last Long Liquidation Zone)

BTC-3,19%

- Reward

- like

- Comment

- Repost

- Share

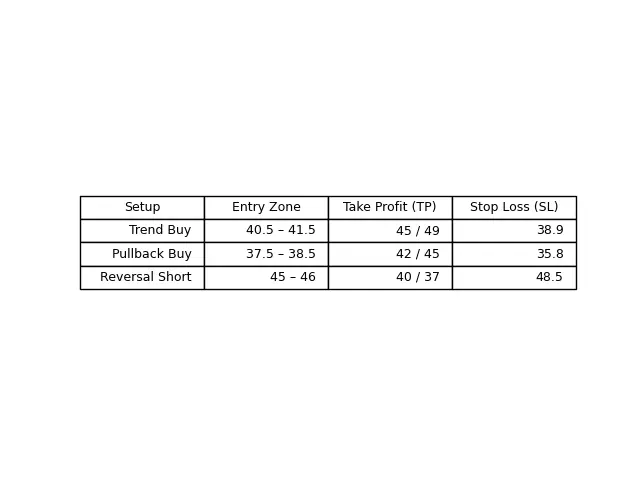

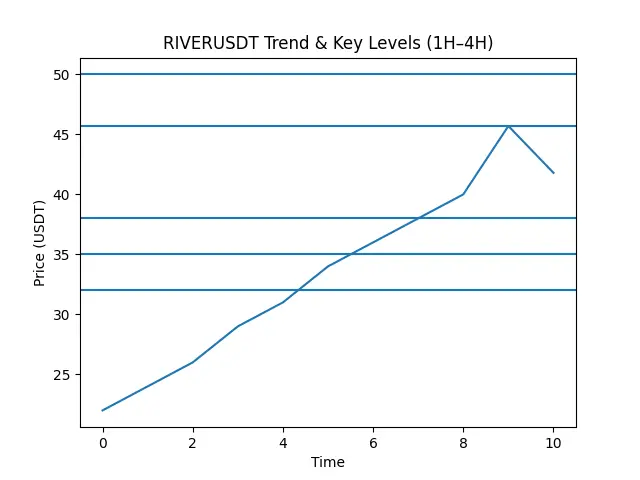

$RIVER RIVER made a strong upside move, followed by a healthy pullback. This doesn’t look like weakness — it looks like profit booking after a fast rally.

On the 1H timeframe, price is still holding above key moving averages, which keeps the short-term trend bullish.

On the 4H view, structure is clearly higher highs & higher lows. As long as price stays above the main demand zone, bulls remain in control.

🔑 Key Zones

Support: 38 → 35 → 32

Resistance: 45.7 → 50

Current price is sitting in a decision zone

🔮 What can happen next?

Holding above support → continuation toward higher levels

Losin

On the 1H timeframe, price is still holding above key moving averages, which keeps the short-term trend bullish.

On the 4H view, structure is clearly higher highs & higher lows. As long as price stays above the main demand zone, bulls remain in control.

🔑 Key Zones

Support: 38 → 35 → 32

Resistance: 45.7 → 50

Current price is sitting in a decision zone

🔮 What can happen next?

Holding above support → continuation toward higher levels

Losin

- Reward

- like

- Comment

- Repost

- Share

Are there any experts predicting the hot trends for the next 5-10 years?

View Original- Reward

- like

- Comment

- Repost

- Share

Bitway, a Bitcoin native Layer 1 protocol, completed a $4.444 million seed funding round led by TRON DAO. It is now valued at $100 million. $BTC #CryptoMarketPullback #TariffTensionsHitCryptoMarket

BTC-3,19%

MC:$3.46KHolders:1

0.00%

- Reward

- like

- Comment

- Repost

- Share

At Davos, Trump pressed his controversial Greenland acquisition plan but faced strong European and NATO pushback, with allies reaffirming sovereignty and Arctic cooperation.\n\n✍️This moment has been recorded on #HistoryDAO.\n\n#Greenland #Davos2026 #NATO #Geopolitics $HAO

- Reward

- like

- Comment

- Repost

- Share

【ETH Structural Insights | Weak Balance Under Moving Average Convergence】

ETH on the 4-hour chart exhibits a typical consolidation pattern of “moving average convergence and price oscillation.” The price is compressed within a narrow range of $2950-3000, with short-term moving averages MA5 (2977), MA10 (2969), and MA20 (2990) highly converged and flat. This formation indicates that, after the previous decline, the market’s bullish and bearish forces have reached a temporary, fragile equilibrium in this area.

Key Technical Logic and Observation Points

1. Structural Positioning: The price contin

ETH on the 4-hour chart exhibits a typical consolidation pattern of “moving average convergence and price oscillation.” The price is compressed within a narrow range of $2950-3000, with short-term moving averages MA5 (2977), MA10 (2969), and MA20 (2990) highly converged and flat. This formation indicates that, after the previous decline, the market’s bullish and bearish forces have reached a temporary, fragile equilibrium in this area.

Key Technical Logic and Observation Points

1. Structural Positioning: The price contin

ETH-6,41%

- Reward

- like

- Comment

- Repost

- Share

#TariffTensionsHitCryptoMarket

Global trade tensions are no longer just headlines for economists they have real, measurable impacts on markets around the world, including cryptocurrencies. The hashtag #TariffTensionsHitCryptoMarket captures exactly this phenomenon: when tariffs rise, international trade slows, supply chains are disrupted, and investors react across all asset classes. While stocks and commodities have long been sensitive to geopolitical and trade risks, cryptocurrencies are emerging as another arena where these macroeconomic forces play out in real-time, often with amplified v

Global trade tensions are no longer just headlines for economists they have real, measurable impacts on markets around the world, including cryptocurrencies. The hashtag #TariffTensionsHitCryptoMarket captures exactly this phenomenon: when tariffs rise, international trade slows, supply chains are disrupted, and investors react across all asset classes. While stocks and commodities have long been sensitive to geopolitical and trade risks, cryptocurrencies are emerging as another arena where these macroeconomic forces play out in real-time, often with amplified v

- Reward

- 1

- Comment

- Repost

- Share

2026马上来财

2026马上来财

Created By@YearOfTheHorseMemeGlobal

Listing Progress

0.00%

MC:

$3.4K

Create My Token

In an hour there will be Trump’s speech that we would watch later on,

Why Greenland keeps coming up and why it matters. 🧵

🔸When Trump mentions Greenland, it’s often dismissed as ego or provocation.

In reality, Greenland sits at the center of Arctic geopolitics.

🔸Greenland matters because of:

- Strategic military positioning

- Rare earth minerals

- Arctic shipping routes

- Climate-driven access to resources

🔸While other nations focus on de-escalation, Trump historically uses pressure first negotiation:

Create tension → gain leverage → force dialogue on his terms.

🔸This approach isn’t about

View OriginalWhy Greenland keeps coming up and why it matters. 🧵

🔸When Trump mentions Greenland, it’s often dismissed as ego or provocation.

In reality, Greenland sits at the center of Arctic geopolitics.

🔸Greenland matters because of:

- Strategic military positioning

- Rare earth minerals

- Arctic shipping routes

- Climate-driven access to resources

🔸While other nations focus on de-escalation, Trump historically uses pressure first negotiation:

Create tension → gain leverage → force dialogue on his terms.

🔸This approach isn’t about

- Reward

- like

- Comment

- Repost

- Share

#TariffTensionsHitCryptoMarket

What’s Happening

Recently, renewed threats around tariffs and escalating trade tensions have shaken markets. That pushed risk assets lower, and Bitcoin dropped after a quick rally. The key question is whether the market is pricing in a real shift in fundamentals or just reacting emotionally.

Short-Term Reaction vs Structural Signal

Right now it feels more like a sentiment-driven pullback than a sustained trend change.

When macro risks spike — especially trade tensions that could slow growth — traders instinctively move to safety. That means selling risk assets,

What’s Happening

Recently, renewed threats around tariffs and escalating trade tensions have shaken markets. That pushed risk assets lower, and Bitcoin dropped after a quick rally. The key question is whether the market is pricing in a real shift in fundamentals or just reacting emotionally.

Short-Term Reaction vs Structural Signal

Right now it feels more like a sentiment-driven pullback than a sustained trend change.

When macro risks spike — especially trade tensions that could slow growth — traders instinctively move to safety. That means selling risk assets,

BTC-3,19%

- Reward

- 2

- 1

- Repost

- Share

GateUser-0749e41e :

:

2002 lets goooCRYPTO ANALYSIS 705!! And secret Strategy!!!

- Reward

- like

- Comment

- Repost

- Share

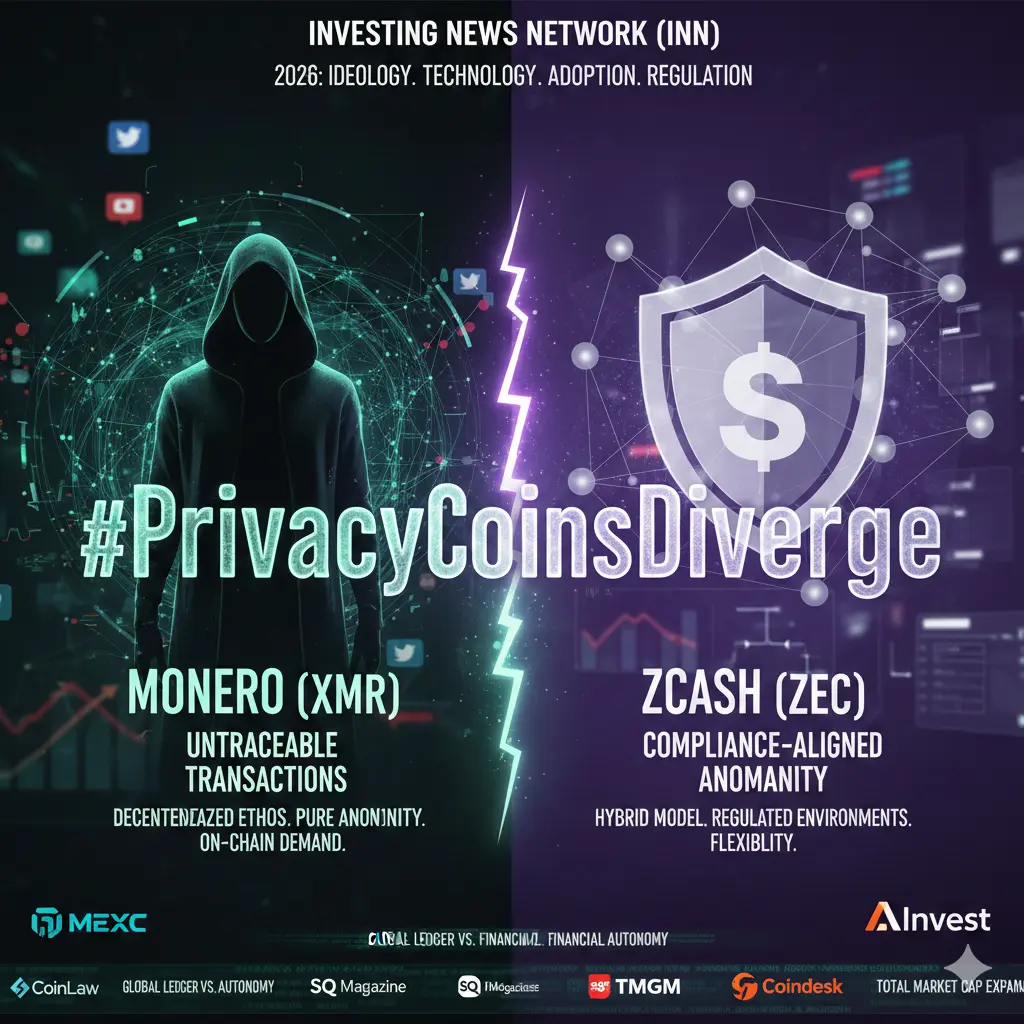

#PrivacyCoinsDiverge

#PrivacyCoinsDiverge

In early 2026, privacy‑focused cryptocurrencies are revealing one of the most intriguing divergences in the entire digital asset landscape. While the broader crypto market continues to ebb and flow with macro volatility and regulatory pressures, the privacy coin sector led by pioneers like Monero (XMR) and Zcash (ZEC) has developed its own distinct narrative. This divergence isn’t just about price action; it’s about ideology, technology, adoption, and regulatory friction pushing users, developers, and institutions to redefine the role of privacy in

#PrivacyCoinsDiverge

In early 2026, privacy‑focused cryptocurrencies are revealing one of the most intriguing divergences in the entire digital asset landscape. While the broader crypto market continues to ebb and flow with macro volatility and regulatory pressures, the privacy coin sector led by pioneers like Monero (XMR) and Zcash (ZEC) has developed its own distinct narrative. This divergence isn’t just about price action; it’s about ideology, technology, adoption, and regulatory friction pushing users, developers, and institutions to redefine the role of privacy in

- Reward

- 1

- 1

- Repost

- Share

Discovery :

:

Happy New Year! 🤑#CryptoMarketPullback Crypto Market Pullback – Reality Check & Opportunity

The cryptocurrency market has recently experienced a notable pullback, sending ripples across the trading community. While it may feel alarming, corrections like this are normal and healthy for a dynamic market. Volatility isn’t a bug—it’s a feature of crypto that tests conviction and clears the way for more sustainable growth.

🔹 What’s Happening?

Bitcoin, Ethereum, and many altcoins have retraced after strong rallies.

Overleveraged positions are being liquidated, shaking out short-term traders.

Technical and macro fac

The cryptocurrency market has recently experienced a notable pullback, sending ripples across the trading community. While it may feel alarming, corrections like this are normal and healthy for a dynamic market. Volatility isn’t a bug—it’s a feature of crypto that tests conviction and clears the way for more sustainable growth.

🔹 What’s Happening?

Bitcoin, Ethereum, and many altcoins have retraced after strong rallies.

Overleveraged positions are being liquidated, shaking out short-term traders.

Technical and macro fac

- Reward

- 1

- Comment

- Repost

- Share

In the challenging crypto space where privacy and compliance are hard to balance, $DUSK provides the optimal solution through hardcore innovation! As a Layer1 public chain compliant with the EU MiCA certification, Dusk leverages PLONK zero-knowledge proof technology to achieve a unique advantage—"privacy enabled by default, compliance traceable on demand"—with the Citadel protocol ensuring anonymous KYC, confidential smart contracts hiding sensitive data, yet allowing seamless regulatory audits. Now, over 196 million euros worth of securities are circulating on its ecosystem, and its deep coo

DUSK9,52%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More29.2K Popularity

10.58K Popularity

2.93K Popularity

51.69K Popularity

341.81K Popularity

Hot Gate Fun

View More- MC:$3.45KHolders:20.35%

- MC:$0.1Holders:10.00%

- MC:$3.38KHolders:10.00%

- MC:$3.45KHolders:20.29%

- MC:$3.42KHolders:20.00%

News

View MoreSuzhou "15th Five-Year Plan" Recommendations: Expanding Digital RMB Innovation Applications Across the Entire City and All Sectors

3 m

JPMorgan CEO Dimon: Federal Reserve independence is crucial

8 m

Vietnam has begun to pilot the formal licensing system for cryptocurrency asset trading platforms.

12 m

Gate launches a 5,000,000 USDT market fluctuation bottom support subsidy plan

17 m

Gate CandyDrop launches the全民空投10.0, sharing 30 ETH

18 m

Pin