🖌️___First, the conclusion:

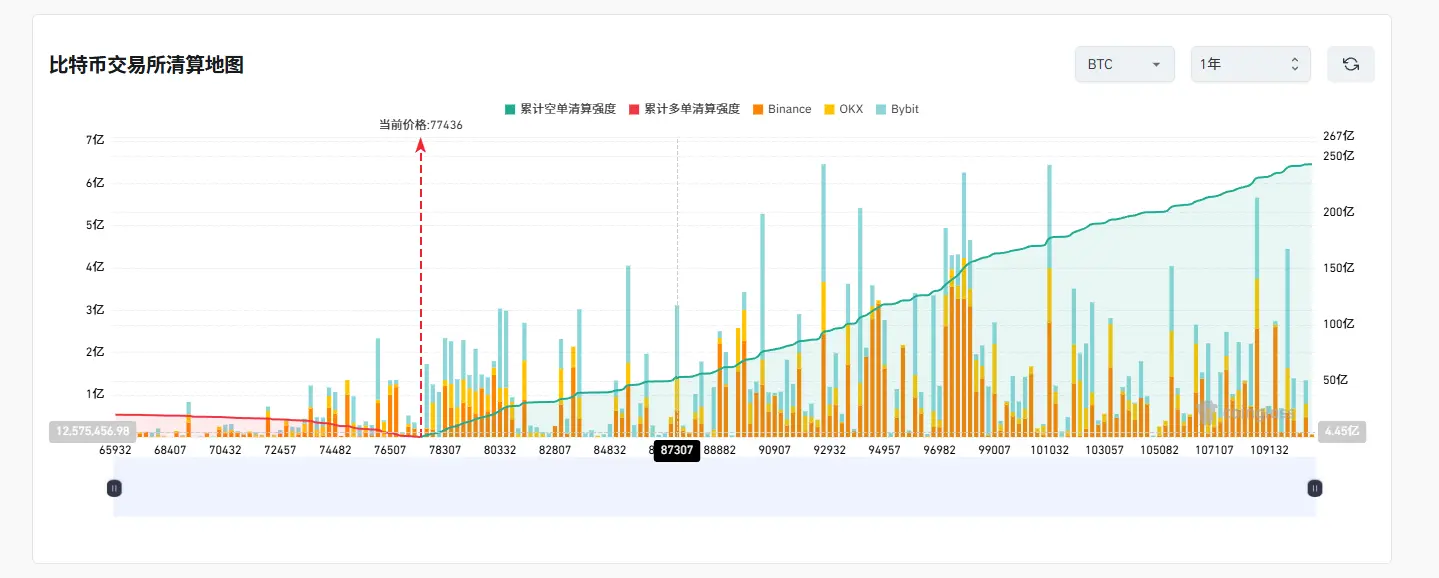

75,000 is not the bottom, but the threshold for entering a deep bear market.

Once effectively broken below, the market should no longer focus on "rebound correction," but switch to monthly-level defense, paying attention to the range 65,000 → 58,000.

The reason is simple: the adjustment level has changed.

From February to April last year, it was a weekly adjustment, but this current round has upgraded to a monthly adjustment.

Larger scale means longer time and deeper space, so 74,000–75,000 no longer meet the conditions for a trend bottom, at most just a correction or emotional rebound point.

Monthly support structure (from weak to strong):

70,800: Major wave 0.5, only a short-term rebound, not a mid-term value

64,800 (key): Monthly EMA52, the start of the main upward wave, may have a rebound but not a reversal

57,700: Major wave 0.618, strong structural support, falling here will start a discussion on whether the cycle has ended

Summary in one sentence:

75,000 is a threshold, not the bottom;

The truly mid-term worthy area is below 65,000.

75,000 is not the bottom, but the threshold for entering a deep bear market.

Once effectively broken below, the market should no longer focus on "rebound correction," but switch to monthly-level defense, paying attention to the range 65,000 → 58,000.

The reason is simple: the adjustment level has changed.

From February to April last year, it was a weekly adjustment, but this current round has upgraded to a monthly adjustment.

Larger scale means longer time and deeper space, so 74,000–75,000 no longer meet the conditions for a trend bottom, at most just a correction or emotional rebound point.

Monthly support structure (from weak to strong):

70,800: Major wave 0.5, only a short-term rebound, not a mid-term value

64,800 (key): Monthly EMA52, the start of the main upward wave, may have a rebound but not a reversal

57,700: Major wave 0.618, strong structural support, falling here will start a discussion on whether the cycle has ended

Summary in one sentence:

75,000 is a threshold, not the bottom;

The truly mid-term worthy area is below 65,000.