Satoshitalks

No content yet

Satoshitalks

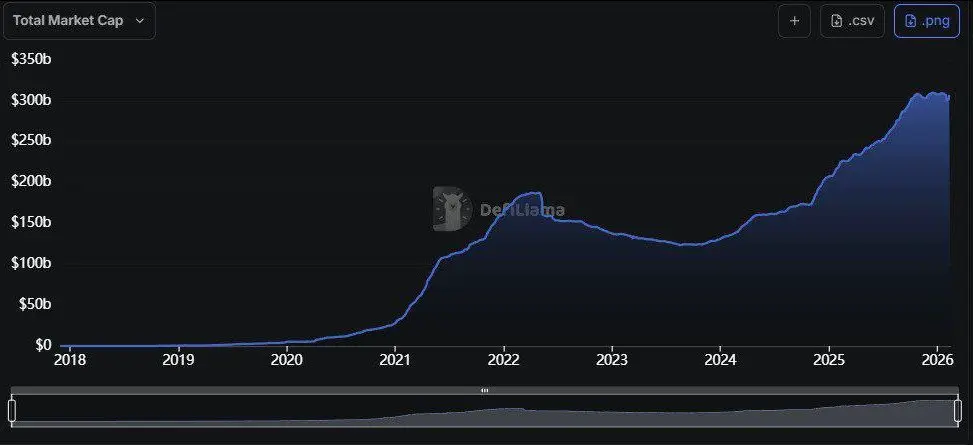

🚨 JUST IN: Stablecoin market cap added $5.5B in the past 7 days.

What this could signal:

1. Fresh capital entering crypto

2. Dry powder building

3. Volatility ahead

Liquidity moves first. Price follows.

What this could signal:

1. Fresh capital entering crypto

2. Dry powder building

3. Volatility ahead

Liquidity moves first. Price follows.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

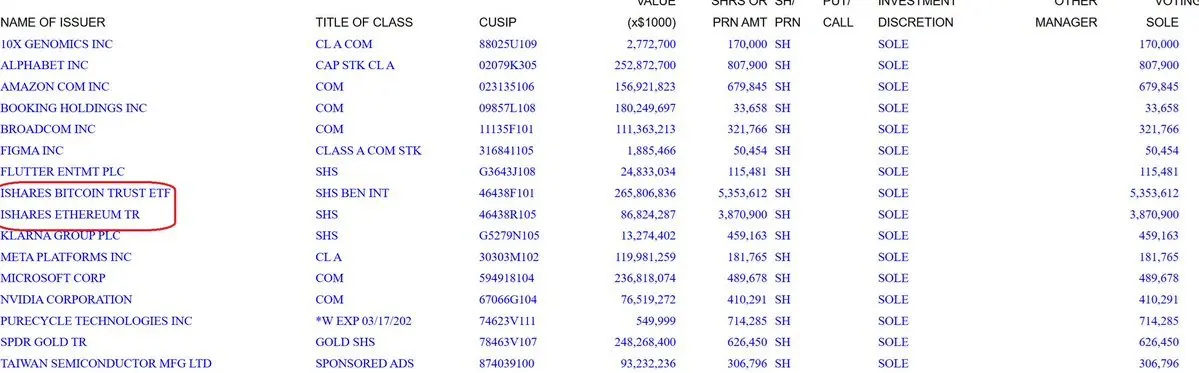

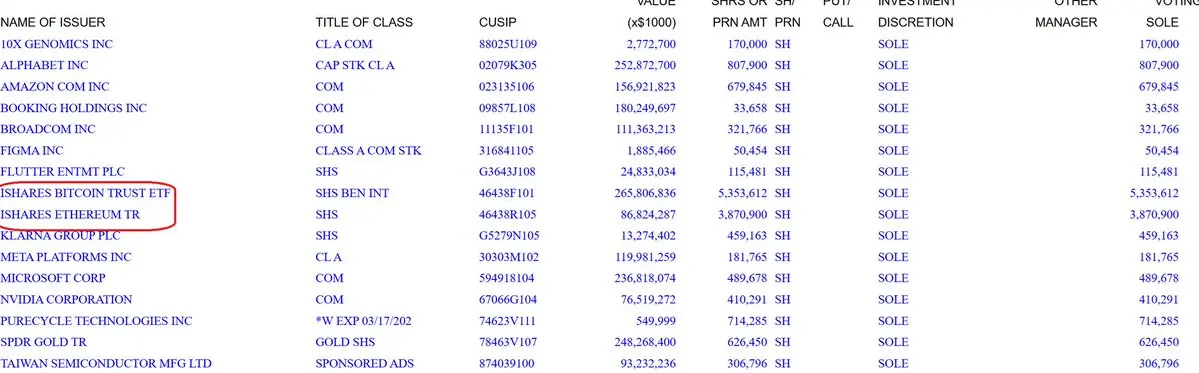

🚨 JUST IN: Harvard trims Bitcoin, adds Ethereum.

Harvard Management Company cut its #Bitcoin ETF exposure by over 20% in Q4 and initiated its first position in an #Ether ETF.

End-of-quarter exposure (~$352.6M total):

• $265.8M in Bitcoin #ETFs

• $86.8M in #BlackRock’s spot Ether ETF

Rotation… or diversification?

Harvard Management Company cut its #Bitcoin ETF exposure by over 20% in Q4 and initiated its first position in an #Ether ETF.

End-of-quarter exposure (~$352.6M total):

• $265.8M in Bitcoin #ETFs

• $86.8M in #BlackRock’s spot Ether ETF

Rotation… or diversification?

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

👇

🚨 JUST IN: Harvard trims Bitcoin, adds Ethereum.

Harvard Management Company cut its #Bitcoin ETF exposure by over 20% in Q4 and initiated its first position in an #Ether ETF.

End-of-quarter exposure (~$352.6M total):

• $265.8M in Bitcoin #ETFs

• $86.8M in #BlackRock’s spot Ether ETF

Rotation… or diversification?

🚨 JUST IN: Harvard trims Bitcoin, adds Ethereum.

Harvard Management Company cut its #Bitcoin ETF exposure by over 20% in Q4 and initiated its first position in an #Ether ETF.

End-of-quarter exposure (~$352.6M total):

• $265.8M in Bitcoin #ETFs

• $86.8M in #BlackRock’s spot Ether ETF

Rotation… or diversification?

- Reward

- like

- Comment

- Repost

- Share

Happy Monday.

Markets opened… and crypto is red.

Liquidity sweep or deeper pullback?

This week should be interesting.

Markets opened… and crypto is red.

Liquidity sweep or deeper pullback?

This week should be interesting.

- Reward

- like

- Comment

- Repost

- Share

💰 FUN FACT: 🇺🇸 The U.S. government is accepting donations to help reduce its $38T national debt.

Yes — you can literally send money to the Treasury.

At $38 trillion, every dollar counts… right?

Yes — you can literally send money to the Treasury.

At $38 trillion, every dollar counts… right?

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

🚨 JUST IN: X is set to launch “Smart Cashtags” in the coming weeks.

Users will reportedly be able to trade stocks and crypto directly from the timeline.

Social media → Trading terminal.

The lines keep blurring.

Big move for fintech.

Users will reportedly be able to trade stocks and crypto directly from the timeline.

Social media → Trading terminal.

The lines keep blurring.

Big move for fintech.

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- 2

- Comment

- Repost

- Share

Bitcoin Price on Valentine’s Day

2011: $1

2012: $5

2013: $20

2014: $600

2015: $300

2016: $450

2017: $1,200

2018: $10,000

2019: $3,631

2020: $10,000

2021: $45,000

2022: $42,500

2023: $22,000

2024: $75,000

2025: $95,000

2026: $70,000

2011: $1

2012: $5

2013: $20

2014: $600

2015: $300

2016: $450

2017: $1,200

2018: $10,000

2019: $3,631

2020: $10,000

2021: $45,000

2022: $42,500

2023: $22,000

2024: $75,000

2025: $95,000

2026: $70,000

BTC0,07%

- Reward

- 2

- 1

- Repost

- Share

CryptoNews_every_day :

:

Interesting statistics, but we're waiting for the reset.- Reward

- 1

- Comment

- Repost

- Share

🚨 JUST IN: U.S. CPI comes in +2.4% YoY (vs. +2.5% expected).

Core CPI: +2.5% YoY (in line).

Takeaways:

Headline inflation slightly cooler

Core remains sticky

Fed path still data-dependent

Core CPI: +2.5% YoY (in line).

Takeaways:

Headline inflation slightly cooler

Core remains sticky

Fed path still data-dependent

- Reward

- like

- Comment

- Repost

- Share

🚨 Ledger co-founder incident (Jan 2025):

• David Balland and his partner abducted from their home

• Attackers demanded €10M

• Police rescued them after two days

A disturbing reminder of the personal security risks tied to crypto wealth.

• David Balland and his partner abducted from their home

• Attackers demanded €10M

• Police rescued them after two days

A disturbing reminder of the personal security risks tied to crypto wealth.

- Reward

- like

- Comment

- Repost

- Share