#BuyTheDipOrWaitNow?

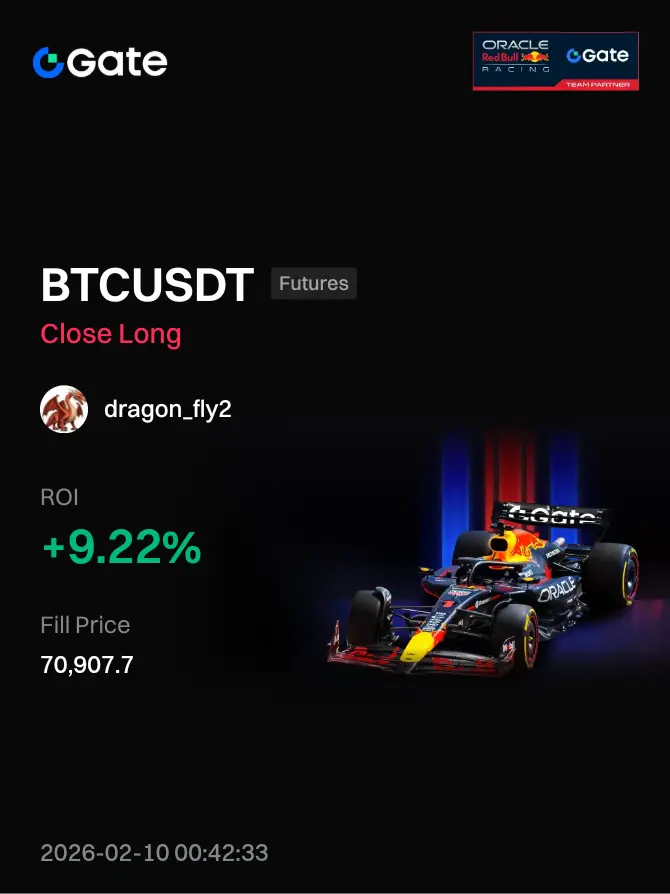

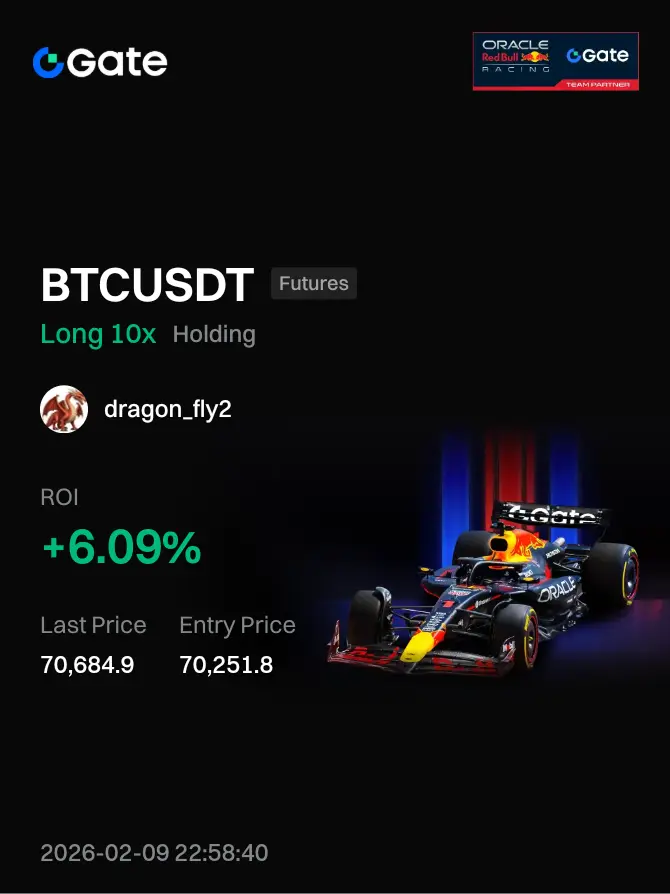

Current Price: Approximately $70,600 – $71,100 USD (slight upward momentum, but still consolidating in the low-to-mid $70k range)

24h Range: Roughly $68,750 – $71,500 (wild swings continue — low tested heavy support, high met resistance)

24h Change: +1.8% to +2.5% (modest recovery from weekend lows, but not yet a full reversal)

7-Day Performance: Down around 10–15% (ongoing pullback from prior levels)

Market Cap: ~$1.41 – $1.42 Trillion

24h Trading Volume: $37–40 Billion+ (elevated from liquidations and fear trading, but not at euphoric bull levels)

Technical Mood: Sideways to short-term mildly bullish bounce within a broader corrective/bearish structure

Crypto Fear & Greed Index: 7–8/100 — Extreme Fear (one of the lowest levels in recent memory — panic selling dominates, retail capitulation vibes strong)

Volume Trend: Rebound on solid but not overwhelming volume — suggests sellers may be tiring, but buyers aren't fully committed yet (watch for volume surge on any breakout)

Deeper Market Analysis

Price Action & Critical Levels:

Bitcoin is clinging to the psychologically massive $70,000 support zone. A hold here keeps hope alive for bulls; a clean break below could accelerate toward $68,000 (recent low), then potentially $65,000 or even $60,000–$62,000 in a deeper correction scenario (Fib retracement levels and past cycle support align here).

Upside: Resistance at $71,500 – $72,000 is key. A decisive close above $72k could trigger short covering and push toward $75,000+ quickly. Failure to break keeps us range-bound or lower.

Technicals in Detail:

RSI (daily/weekly): Deeply oversold (around 30 or lower on multiple frames) — classic reversal territory, with potential bullish divergence forming if price holds lows while RSI ticks up.

MACD: Bearish momentum still present (negative histogram), but showing signs of flattening — short-term weakness easing?

Moving Averages: Price below key EMAs (e.g., 50-day), reinforcing corrective phase. A reclaim above would be bullish confirmation.

Overall verdict: Late-stage correction after the massive 2025 run-up (ATH ~$126k). Healthy shakeout for long-term cycle, but near-term chop or downside risk remains high.

Sentiment & On-Chain Signals:

Extreme Fear at 7–8 is a powerful contrarian indicator. History shows these levels often precede major bottoms (e.g., 2022 lows, previous bear phases). On-chain data hints at whale/institutional accumulation during dips, while retail panic-sells. Media and socials are flooded with bearish headlines — frequently the setup for reversals when fear peaks.

Liquidations & Macro Risks:

Leveraged positions heavily clustered around $70k (support) and $73k (resistance). A break in either direction risks cascading liquidations and 5–10%+ moves in hours. Broader macro (e.g., interest rate uncertainty, equity market wobbles) adds extra pressure — no major catalysts yet to flip the narrative fully bullish.

Cycle Context:

Down ~40–45% from late-2025 ATH. This aligns with typical post-peak corrections in Bitcoin's halving cycles. Fundamentals (scarcity, adoption trends, institutional inflows) remain intact long-term, but short-term sentiment drives the bus.

Buy the Dip... or Wait? Extended Strategy Options

Aggressive Dip Buying (Short-Term / High Risk Tolerance):

Extreme Fear + oversold technicals = textbook contrarian opportunity. Scale in now (e.g., 20–30% position) with strict stops below $69,500–$70k to limit downside. Targets: $73k–$75k on breakout, potentially higher in a squeeze. High reward if reversal starts, but high risk of further pain if macro worsens.

Dollar-Cost Averaging (DCA) – Balanced & Recommended for Most:

Spread entries over days/weeks. Buy a chunk at current fear levels (~$70k–$71k), add more on dips to $68k or lower. This lowers average cost, removes timing pressure, and capitalizes on historical rebounds from Extreme Fear. Patient approach — rewards HODLers over time.

Wait for Clear Confirmation (Conservative / Lower Risk):

Stay sidelined or in stables if you hate uncertainty. Wait for:

Strong close above $72,000 (bullish flip, momentum shift)

Deeper dip to $65k–$68k (superior risk/reward entry)

Avoids FOMO buys at potential local tops and lets the market prove direction first.

For pure long-term holders (HODL mindset): These fear-drenched levels have historically been among the best accumulation windows — buy and forget if you believe in Bitcoin's story.

Important Risk Advisory

Bitcoin is one of the most volatile assets on earth. Corrections can deepen unexpectedly, and Extreme Fear can persist or lead to more downside before any real bottom.

Current Price: Approximately $70,600 – $71,100 USD (slight upward momentum, but still consolidating in the low-to-mid $70k range)

24h Range: Roughly $68,750 – $71,500 (wild swings continue — low tested heavy support, high met resistance)

24h Change: +1.8% to +2.5% (modest recovery from weekend lows, but not yet a full reversal)

7-Day Performance: Down around 10–15% (ongoing pullback from prior levels)

Market Cap: ~$1.41 – $1.42 Trillion

24h Trading Volume: $37–40 Billion+ (elevated from liquidations and fear trading, but not at euphoric bull levels)

Technical Mood: Sideways to short-term mildly bullish bounce within a broader corrective/bearish structure

Crypto Fear & Greed Index: 7–8/100 — Extreme Fear (one of the lowest levels in recent memory — panic selling dominates, retail capitulation vibes strong)

Volume Trend: Rebound on solid but not overwhelming volume — suggests sellers may be tiring, but buyers aren't fully committed yet (watch for volume surge on any breakout)

Deeper Market Analysis

Price Action & Critical Levels:

Bitcoin is clinging to the psychologically massive $70,000 support zone. A hold here keeps hope alive for bulls; a clean break below could accelerate toward $68,000 (recent low), then potentially $65,000 or even $60,000–$62,000 in a deeper correction scenario (Fib retracement levels and past cycle support align here).

Upside: Resistance at $71,500 – $72,000 is key. A decisive close above $72k could trigger short covering and push toward $75,000+ quickly. Failure to break keeps us range-bound or lower.

Technicals in Detail:

RSI (daily/weekly): Deeply oversold (around 30 or lower on multiple frames) — classic reversal territory, with potential bullish divergence forming if price holds lows while RSI ticks up.

MACD: Bearish momentum still present (negative histogram), but showing signs of flattening — short-term weakness easing?

Moving Averages: Price below key EMAs (e.g., 50-day), reinforcing corrective phase. A reclaim above would be bullish confirmation.

Overall verdict: Late-stage correction after the massive 2025 run-up (ATH ~$126k). Healthy shakeout for long-term cycle, but near-term chop or downside risk remains high.

Sentiment & On-Chain Signals:

Extreme Fear at 7–8 is a powerful contrarian indicator. History shows these levels often precede major bottoms (e.g., 2022 lows, previous bear phases). On-chain data hints at whale/institutional accumulation during dips, while retail panic-sells. Media and socials are flooded with bearish headlines — frequently the setup for reversals when fear peaks.

Liquidations & Macro Risks:

Leveraged positions heavily clustered around $70k (support) and $73k (resistance). A break in either direction risks cascading liquidations and 5–10%+ moves in hours. Broader macro (e.g., interest rate uncertainty, equity market wobbles) adds extra pressure — no major catalysts yet to flip the narrative fully bullish.

Cycle Context:

Down ~40–45% from late-2025 ATH. This aligns with typical post-peak corrections in Bitcoin's halving cycles. Fundamentals (scarcity, adoption trends, institutional inflows) remain intact long-term, but short-term sentiment drives the bus.

Buy the Dip... or Wait? Extended Strategy Options

Aggressive Dip Buying (Short-Term / High Risk Tolerance):

Extreme Fear + oversold technicals = textbook contrarian opportunity. Scale in now (e.g., 20–30% position) with strict stops below $69,500–$70k to limit downside. Targets: $73k–$75k on breakout, potentially higher in a squeeze. High reward if reversal starts, but high risk of further pain if macro worsens.

Dollar-Cost Averaging (DCA) – Balanced & Recommended for Most:

Spread entries over days/weeks. Buy a chunk at current fear levels (~$70k–$71k), add more on dips to $68k or lower. This lowers average cost, removes timing pressure, and capitalizes on historical rebounds from Extreme Fear. Patient approach — rewards HODLers over time.

Wait for Clear Confirmation (Conservative / Lower Risk):

Stay sidelined or in stables if you hate uncertainty. Wait for:

Strong close above $72,000 (bullish flip, momentum shift)

Deeper dip to $65k–$68k (superior risk/reward entry)

Avoids FOMO buys at potential local tops and lets the market prove direction first.

For pure long-term holders (HODL mindset): These fear-drenched levels have historically been among the best accumulation windows — buy and forget if you believe in Bitcoin's story.

Important Risk Advisory

Bitcoin is one of the most volatile assets on earth. Corrections can deepen unexpectedly, and Extreme Fear can persist or lead to more downside before any real bottom.