方片九

No content yet

Pin

方片九

This is an experience where I turned the tide against adversity in my life. Three years ago, I was jolted awake in the middle of the night by a red liquidation alert from a certain exchange. In just three hours, my account with over 1 million USDT was wiped out. Staring at the negative balance, I felt as if I was nailed to the cross of reality.

Afterwards, I began to reflect, summarize, and consult all my relatives and friends. With a borrowed 200,000, I started over. In 90 days, using a method with a 78% win rate, I grew my principal to 20 million. The process was extremely tough, but it resu

Afterwards, I began to reflect, summarize, and consult all my relatives and friends. With a borrowed 200,000, I started over. In 90 days, using a method with a 78% win rate, I grew my principal to 20 million. The process was extremely tough, but it resu

BTC1.36%

- Reward

- 13

- 7

- Repost

- Share

方片九 :

:

Experience determines cognition, and I look forward to everyone winning~View More

Let me be real with my fellow crypto friends: when it comes to short-term trading, there’s really no need to get obsessed with all those fancy indicators!

I’ve summed up six practical rules I’ve learned from real trading experience. Memorize and follow them—they’re way more reliable than blindly following the crowd or making random moves.

Rule 1: Wait for new highs during high-level consolidation; watch out for breakdowns during low-level consolidation. Newbies, don’t rush in when you see sideways movement at high prices—the big players are usually building up strength. As long as the key supp

View OriginalI’ve summed up six practical rules I’ve learned from real trading experience. Memorize and follow them—they’re way more reliable than blindly following the crowd or making random moves.

Rule 1: Wait for new highs during high-level consolidation; watch out for breakdowns during low-level consolidation. Newbies, don’t rush in when you see sideways movement at high prices—the big players are usually building up strength. As long as the key supp

- Reward

- 1

- 1

- Repost

- Share

GateUser-7283b17e :

:

hay kkA small step, but also a giant leap.

Today, the US Commodity Futures Trading Commission (CFTC) has allowed the stablecoin USDC to be used as collateral for derivatives trading.

With daily trading volumes in the derivatives market reaching trillions of dollars, after this approval, institutions can directly use USDC to lock in trading positions, reducing transaction costs and increasing efficiency.

This slow yet massive transformation is underway.

In the future, when the NYSE gets involved, stock issuance, trading, and dividend distribution will all be on-chain...

Today, the US Commodity Futures Trading Commission (CFTC) has allowed the stablecoin USDC to be used as collateral for derivatives trading.

With daily trading volumes in the derivatives market reaching trillions of dollars, after this approval, institutions can directly use USDC to lock in trading positions, reducing transaction costs and increasing efficiency.

This slow yet massive transformation is underway.

In the future, when the NYSE gets involved, stock issuance, trading, and dividend distribution will all be on-chain...

USDC-0.02%

- Reward

- 1

- Comment

- Repost

- Share

Mr. Zeng Shiqiang's prediction about 2026 has been widely circulated inside and outside the circle in the past two days. As a Web3 participant in cycles and fluctuations, I read it with some resonance and some inspiration. He is not creating panic, but reminding us how to recognize cycles and prepare in advance.

The core sentence: The year of Bingwu in 2026 is a turning point for "leaving the fire luck" to completely replace the "gentu luck". The fire is the most intense, which means that the old structure and old thinking will accelerate the burning and purification, and the new order will be

View OriginalThe core sentence: The year of Bingwu in 2026 is a turning point for "leaving the fire luck" to completely replace the "gentu luck". The fire is the most intense, which means that the old structure and old thinking will accelerate the burning and purification, and the new order will be

- Reward

- 1

- Comment

- Repost

- Share

At the heart of trading is probability?

The core of trading is not the probability itself, but a decision-making and management system based on probabilistic thinking.

This sentence sounds a bit abstract, let me elaborate from my own perspective.

First, probability is the background, not the answer

The market is essentially an environment full of uncertainty, and there is no way to guarantee that a single transaction will be profitable, even the top performing traders cannot guarantee that they will make money by buying and selling will not sell away, so the objective fact is that the transact

View OriginalThe core of trading is not the probability itself, but a decision-making and management system based on probabilistic thinking.

This sentence sounds a bit abstract, let me elaborate from my own perspective.

First, probability is the background, not the answer

The market is essentially an environment full of uncertainty, and there is no way to guarantee that a single transaction will be profitable, even the top performing traders cannot guarantee that they will make money by buying and selling will not sell away, so the objective fact is that the transact

- Reward

- like

- Comment

- Repost

- Share

If you really want to be in the crypto circle for a long time and do it as a profession - remember these 10 points.

1️⃣ Laying the foundation is more important than making money

Don't worry when you first enter the circle, first understand how to use the exchange, how to cross the chain, and how to run the blockchain.

If the foundation is not solid, the profits belong to others.

2️⃣ All decisions must be independent

There are too many scammers in the currency circle and their opinions are too mixed, and anyone who listens to it may be biased.

In the end, it is you who make the decision, not an

1️⃣ Laying the foundation is more important than making money

Don't worry when you first enter the circle, first understand how to use the exchange, how to cross the chain, and how to run the blockchain.

If the foundation is not solid, the profits belong to others.

2️⃣ All decisions must be independent

There are too many scammers in the currency circle and their opinions are too mixed, and anyone who listens to it may be biased.

In the end, it is you who make the decision, not an

BTC1.36%

- Reward

- 1

- Comment

- Repost

- Share

Seeing that many people reposted this post that I wasted 8 years in Crypto, I was deeply touched but felt too pessimistic, so I added a few objective views:

1) I have also been in the circle for 17 years, which is exactly 8 years, although there are ups and downs in the process, but I think joining the Crypto field is the biggest opportunity in my life, whether it is personal growth, wealth accumulation, resources and connections accumulation, it far exceeds the experience of the past 10 years of the Internet.

This is an absolute fact, and the heart of gratitude for Crypto will always be there

View Original1) I have also been in the circle for 17 years, which is exactly 8 years, although there are ups and downs in the process, but I think joining the Crypto field is the biggest opportunity in my life, whether it is personal growth, wealth accumulation, resources and connections accumulation, it far exceeds the experience of the past 10 years of the Internet.

This is an absolute fact, and the heart of gratitude for Crypto will always be there

- Reward

- like

- Comment

- Repost

- Share

The most important thing to invest in: stay at the table and don't get out of the black swan event

The world is full of uncertainties, like the multiverse, from who you will meet and marry when you go out, to the results of the election, and even the outbreak of the epidemic and world wars. The future direction of different stories is only probabilistic events, not deterministic events.

Good investors will put their chips on a few of the most likely story directions, but still be in awe of tail events, which are black swans.

High debt and high leverage may increase short-term gains, but at the

View OriginalThe world is full of uncertainties, like the multiverse, from who you will meet and marry when you go out, to the results of the election, and even the outbreak of the epidemic and world wars. The future direction of different stories is only probabilistic events, not deterministic events.

Good investors will put their chips on a few of the most likely story directions, but still be in awe of tail events, which are black swans.

High debt and high leverage may increase short-term gains, but at the

- Reward

- like

- Comment

- Repost

- Share

The Blue Zhanfei incident is another reminder to everyone: when you’re out and about, always keep a low profile, stay alert, and be cautious.

If your whereabouts are exposed the whole time, someone will keep an eye on you. No matter how low the probability, if it happens to you, it’s a 100% disaster.

In the crypto world, this risk is even greater.

This October, Roman Novak, a crypto industry figure famous for flaunting his wealth, and his wife Anna, were tortured and killed by kidnappers in Dubai after scamming investors out of about $500 million through fake projects.

In June, a crypto trader

View OriginalIf your whereabouts are exposed the whole time, someone will keep an eye on you. No matter how low the probability, if it happens to you, it’s a 100% disaster.

In the crypto world, this risk is even greater.

This October, Roman Novak, a crypto industry figure famous for flaunting his wealth, and his wife Anna, were tortured and killed by kidnappers in Dubai after scamming investors out of about $500 million through fake projects.

In June, a crypto trader

- Reward

- 1

- Comment

- Repost

- Share

Why CZ predicts that the four-year cycle may be gone, or may turn into a supercycle like the US stock market

Objectively speaking, the Bitcoin market structure has undergone a "historic change"—some irreversible factors are pushing the "four-year halving cycle" toward a longer and larger supercycle structure.

1. Institutional Era = Cycle is "Extended and Amplified"

In the past, the cycle was dominated by:

Retail sentiment

Miner selling pressure

Algorithmic halving supply changes

But now it's completely different:

ETF funds are "continuously flowing in," not cyclical FOMO

ETFs are mechanical bu

Objectively speaking, the Bitcoin market structure has undergone a "historic change"—some irreversible factors are pushing the "four-year halving cycle" toward a longer and larger supercycle structure.

1. Institutional Era = Cycle is "Extended and Amplified"

In the past, the cycle was dominated by:

Retail sentiment

Miner selling pressure

Algorithmic halving supply changes

But now it's completely different:

ETF funds are "continuously flowing in," not cyclical FOMO

ETFs are mechanical bu

BTC1.36%

- Reward

- 1

- Comment

- Repost

- Share

Summarize 20 hard-core underlying cognitive breakthroughs—not chicken soup, but methodologies:

1. The secret of the rich is "preserving achievements," the trap of the poor is "seeking stability."

The rich rarely lose wealth as long as they don't mess around; the poor find it hard to move up if they only seek comfort.

2. The "smart ones" at the edge of the law are more likely to succeed.

Few people who make big money are purely honest. They excel at finding profit in the gray areas between law and ethics.

3. 80% of people around you don't genuinely wish you well.

Human nature is selfish; emotio

View Original1. The secret of the rich is "preserving achievements," the trap of the poor is "seeking stability."

The rich rarely lose wealth as long as they don't mess around; the poor find it hard to move up if they only seek comfort.

2. The "smart ones" at the edge of the law are more likely to succeed.

Few people who make big money are purely honest. They excel at finding profit in the gray areas between law and ethics.

3. 80% of people around you don't genuinely wish you well.

Human nature is selfish; emotio

- Reward

- 1

- Comment

- Repost

- Share

Trading short-term in the crypto market isn’t as mysterious as people think.

The real core of short-term trading is discipline + execution, not prediction + passion.

Here are six ironclad short-term rules I’ve repeatedly validated over the years:

1⃣ Consolidation always leads to a breakout: Patience is your advantage

If the price is moving sideways at the top, don’t chase.

If it’s grinding sideways at the bottom, don’t cut losses.

If the market isn’t showing a direction, then it’s not giving you an opportunity.

The most profitable move at this time—do nothing.

2⃣ Sideways markets are ambush zo

The real core of short-term trading is discipline + execution, not prediction + passion.

Here are six ironclad short-term rules I’ve repeatedly validated over the years:

1⃣ Consolidation always leads to a breakout: Patience is your advantage

If the price is moving sideways at the top, don’t chase.

If it’s grinding sideways at the bottom, don’t cut losses.

If the market isn’t showing a direction, then it’s not giving you an opportunity.

The most profitable move at this time—do nothing.

2⃣ Sideways markets are ambush zo

BTC1.36%

- Reward

- 1

- Comment

- Repost

- Share

The most heartbreaking part of trading isn’t losing money, but staying busy while repeatedly falling into the same trap, never making real progress.

Step 1: Blindly Relying on Luck

You see a direction from a big influencer/blogger/KOL, go all-in, leverage up and gamble. If you make a little profit, you run away quickly. If you lose, you keep holding, hoping to break even when the loss gets big. As soon as you break even, you exit immediately. If you get liquidated, you start doubting life and curse the influencer, blaming them for colluding with projects/exchanges to scam you. This isn’t tradi

View OriginalStep 1: Blindly Relying on Luck

You see a direction from a big influencer/blogger/KOL, go all-in, leverage up and gamble. If you make a little profit, you run away quickly. If you lose, you keep holding, hoping to break even when the loss gets big. As soon as you break even, you exit immediately. If you get liquidated, you start doubting life and curse the influencer, blaming them for colluding with projects/exchanges to scam you. This isn’t tradi

- Reward

- 1

- Comment

- Repost

- Share

Jack Ma is making a full-scale entry into cryptocurrency!

Friends around him are also working on wallets and public chains at Ant Group.

Jack Ma invested $44 million to buy 10,000 Ethereum (ETH).

At the same time, he publicly stated that he will not limit himself to ETH; they plan to include Bitcoin (BTC), Solana (SOL), and other mainstream coins in their strategic reserves.

He has also applied for and obtained a virtual asset trading service license.

Announced a formal entry into virtual asset trading, management, and on-chain financial services.

So, what level of entry is Jack Ma making this

View OriginalFriends around him are also working on wallets and public chains at Ant Group.

Jack Ma invested $44 million to buy 10,000 Ethereum (ETH).

At the same time, he publicly stated that he will not limit himself to ETH; they plan to include Bitcoin (BTC), Solana (SOL), and other mainstream coins in their strategic reserves.

He has also applied for and obtained a virtual asset trading service license.

Announced a formal entry into virtual asset trading, management, and on-chain financial services.

So, what level of entry is Jack Ma making this

- Reward

- 2

- Comment

- Repost

- Share

Consolidate your learning. Today was another day without losses and with diligent study and reflection. Watched a video—pretty good—organized and sharing it here.

This is a video about trading mindset. The creator shares, through personal experience and observation, the counter-intuitive logic for making money in trading. The core points are as follows:

1. Essential Understanding of Trading

• It’s not a myth that some people turn tens of thousands into hundreds of millions, nor is it due to talent or mysterious tricks, but thanks to seemingly simple trading mindsets that can change one’s fate.

View OriginalThis is a video about trading mindset. The creator shares, through personal experience and observation, the counter-intuitive logic for making money in trading. The core points are as follows:

1. Essential Understanding of Trading

• It’s not a myth that some people turn tens of thousands into hundreds of millions, nor is it due to talent or mysterious tricks, but thanks to seemingly simple trading mindsets that can change one’s fate.

- Reward

- 2

- Comment

- Repost

- Share

The truth you'll only understand when you turn 30: wasting time is the biggest liability in life.

You can spend 3 hours scrolling through short videos, but you can't even spare 1 hour to study. Achieving nothing and owning nothing—that's the consequence you'll face at 30.

However, if you stop what you're doing now and make a comeback, it's not too late, even if you're already 30.

Three key truths you must understand:

1. Ordinary people always think, “Wait until I’m ready” before starting. But you—act immediately, correct your course as you go. When Ang Lee was casting the lead actress for "Bro

You can spend 3 hours scrolling through short videos, but you can't even spare 1 hour to study. Achieving nothing and owning nothing—that's the consequence you'll face at 30.

However, if you stop what you're doing now and make a comeback, it's not too late, even if you're already 30.

Three key truths you must understand:

1. Ordinary people always think, “Wait until I’m ready” before starting. But you—act immediately, correct your course as you go. When Ang Lee was casting the lead actress for "Bro

BTC1.36%

- Reward

- 1

- Comment

- Repost

- Share

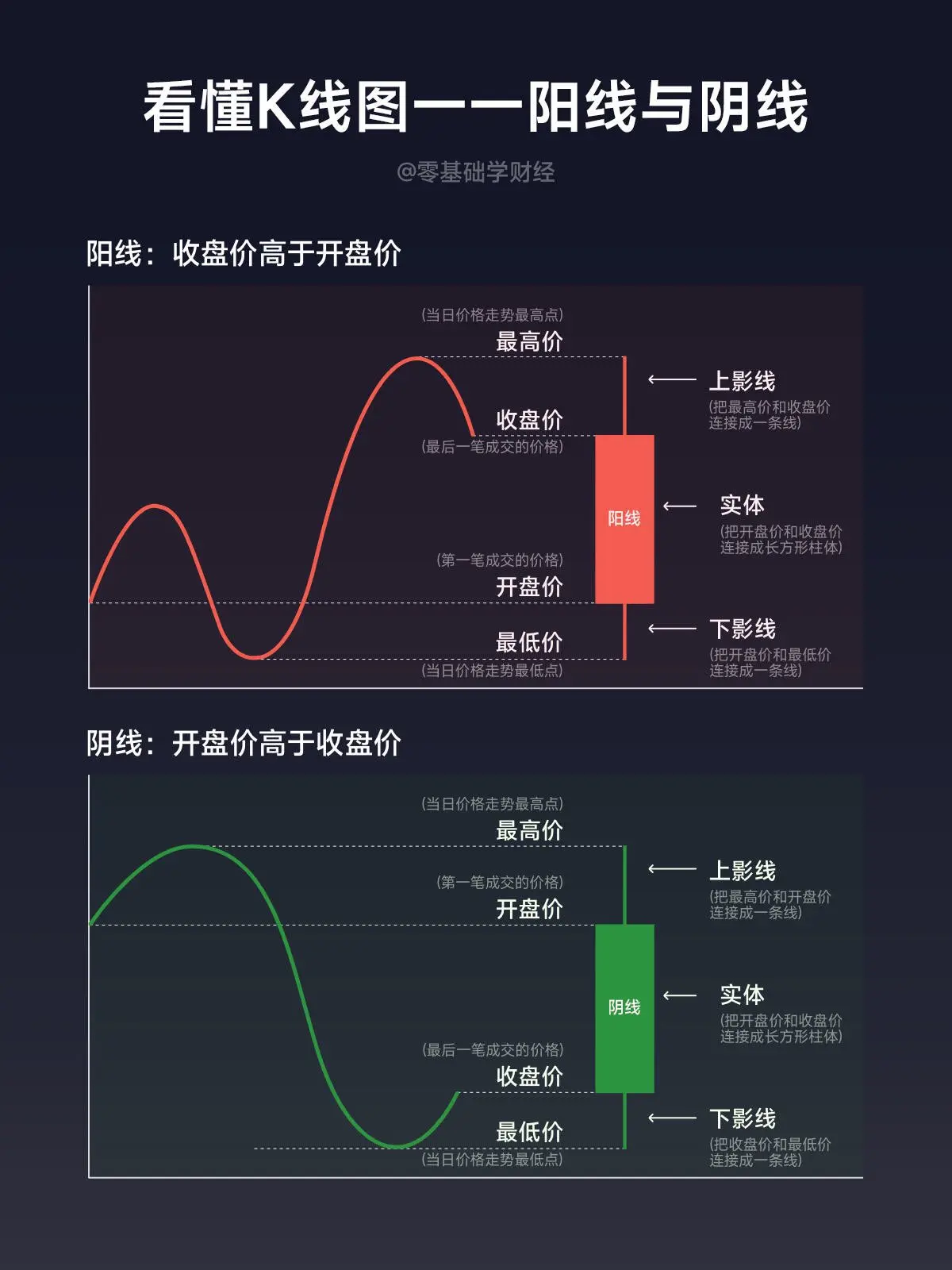

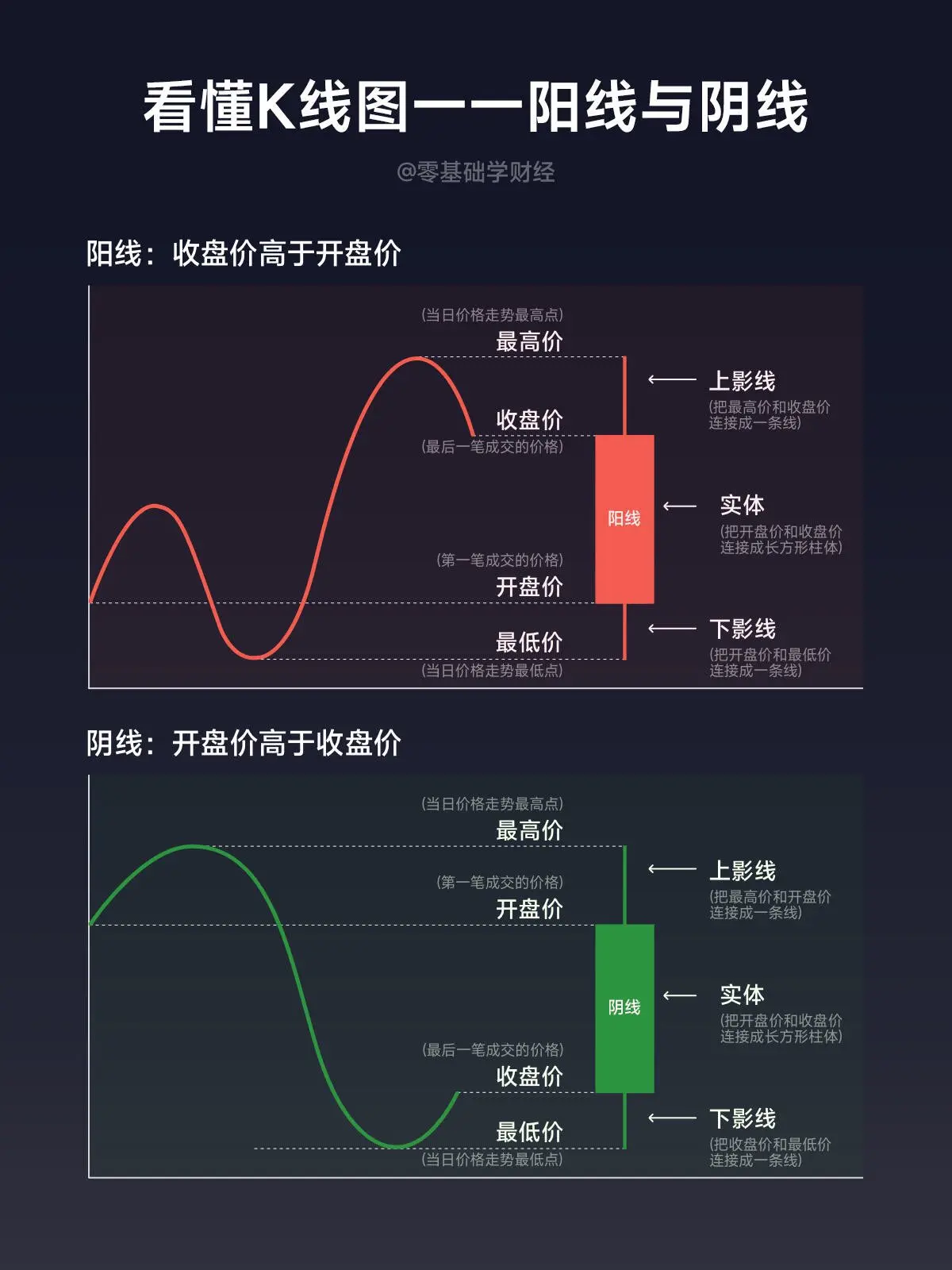

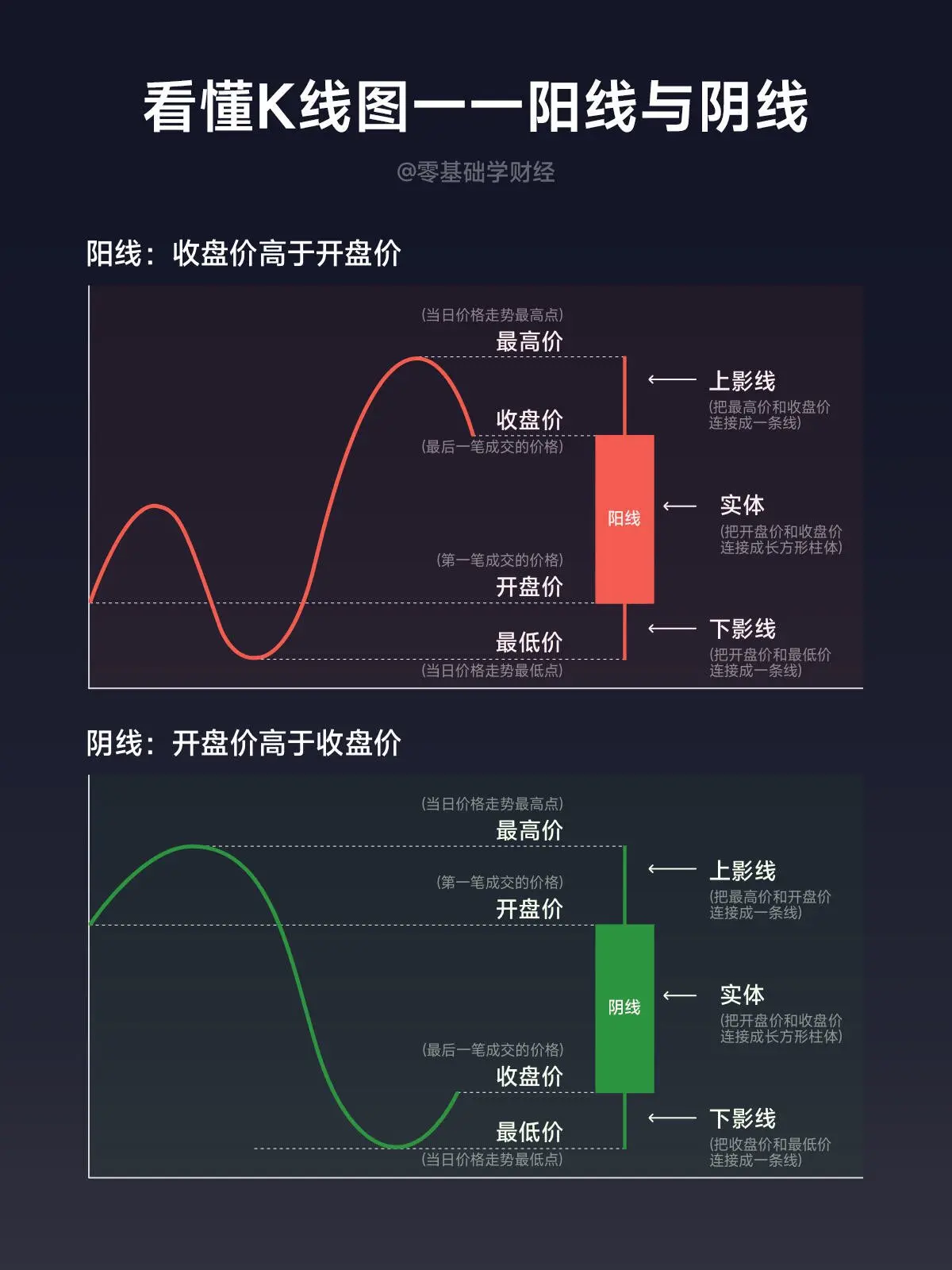

After studying and learning about candlestick charts, you’ll finally understand how to make your first million in the crypto world!

Why should you look at the 4-hour, 1-hour, and 15-minute candlestick charts?

Many people keep making the same mistakes in crypto trading because they only focus on a single timeframe.

Today, I’ll share my commonly used multi-timeframe candlestick trading method, which consists of three simple steps: identify the trend, find the key levels, and time your entry.

1. 4-Hour Candlestick Chart: Determines whether you go long or short

This timeframe is long enough to fil

View OriginalWhy should you look at the 4-hour, 1-hour, and 15-minute candlestick charts?

Many people keep making the same mistakes in crypto trading because they only focus on a single timeframe.

Today, I’ll share my commonly used multi-timeframe candlestick trading method, which consists of three simple steps: identify the trend, find the key levels, and time your entry.

1. 4-Hour Candlestick Chart: Determines whether you go long or short

This timeframe is long enough to fil

- Reward

- 2

- Comment

- Repost

- Share

If you truly want to establish yourself in the crypto space for the long term, treating it as a profession rather than a hobby, then your mindset must be upgraded from day one. Here is the roadmap I’ve summarized as a “veteran, full-cycle player”—no fluff, all substance:

1⃣ Master the basics before thinking about making money

Don’t rush for profits when you first enter the space. If you don’t even understand exchanges, chains, cross-chain bridges, gas, or contract mechanisms, but dream of getting rich quick, you’ll only end up as a number in someone else’s account.

The basics are your weapons.

1⃣ Master the basics before thinking about making money

Don’t rush for profits when you first enter the space. If you don’t even understand exchanges, chains, cross-chain bridges, gas, or contract mechanisms, but dream of getting rich quick, you’ll only end up as a number in someone else’s account.

The basics are your weapons.

BTC1.36%

- Reward

- 3

- 1

- Repost

- Share

方片九 :

:

Hop on board!🚗A bull market isn’t the fastest time for retail investors to make money, but the fastest time to go to zero.

The reason boils down to one sentence:

Money made by luck will eventually be lost by skill.

A bull market amplifies luck into “talent” and packages short-term wins as “ability.” In the end, you’ll use bigger positions, higher leverage, and worse coins to give back everything you made earlier.

Whether the bull market is still here or not, I hope everyone stays clear-headed at all times.

//

Pitfall 1: Frequent rotating.

You see others pumping, so you sell at a loss and chase the next hot

View OriginalThe reason boils down to one sentence:

Money made by luck will eventually be lost by skill.

A bull market amplifies luck into “talent” and packages short-term wins as “ability.” In the end, you’ll use bigger positions, higher leverage, and worse coins to give back everything you made earlier.

Whether the bull market is still here or not, I hope everyone stays clear-headed at all times.

//

Pitfall 1: Frequent rotating.

You see others pumping, so you sell at a loss and chase the next hot

- Reward

- 2

- 1

- Repost

- Share

Alabama1 :

:

excellent thoughts