# EUPlansCentralBankStablecoin

6.07M

Good_Girl

Gate Square: Crypto and Traditional Finance Unite in a Historic Leap

At Gate Square, the convergence of crypto and traditional finance is taking a bold leap. Today, as U.S. stock markets and crypto surged, investor confidence soared once again. In parallel, Gate Square took a historic step, launching a regulated, stability-focused stablecoin initiative aimed at both Europe and global markets. Gate Square stands at the forefront of this transformative financial shift.

#gatesquare #Stablecoin

At Gate Square, the convergence of crypto and traditional finance is taking a bold leap. Today, as U.S. stock markets and crypto surged, investor confidence soared once again. In parallel, Gate Square took a historic step, launching a regulated, stability-focused stablecoin initiative aimed at both Europe and global markets. Gate Square stands at the forefront of this transformative financial shift.

#gatesquare #Stablecoin

- Reward

- like

- Comment

- Repost

- Share

Gate Square: Crypto and Traditional Finance Unite in a Historic Leap

At Gate Square, the convergence of crypto and traditional finance is taking a bold leap. Today, as U.S. stock markets and crypto surged, investor confidence soared once again. In parallel, Gate Square took a historic step, launching a regulated, stability-focused stablecoin initiative aimed at both Europe and global markets. Gate Square stands at the forefront of this transformative financial shift.

#gatesquare #Stablecoin

At Gate Square, the convergence of crypto and traditional finance is taking a bold leap. Today, as U.S. stock markets and crypto surged, investor confidence soared once again. In parallel, Gate Square took a historic step, launching a regulated, stability-focused stablecoin initiative aimed at both Europe and global markets. Gate Square stands at the forefront of this transformative financial shift.

#gatesquare #Stablecoin

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 3

- 7

- Repost

- Share

AylaShinex :

:

2026 GOGOGO 👊View More

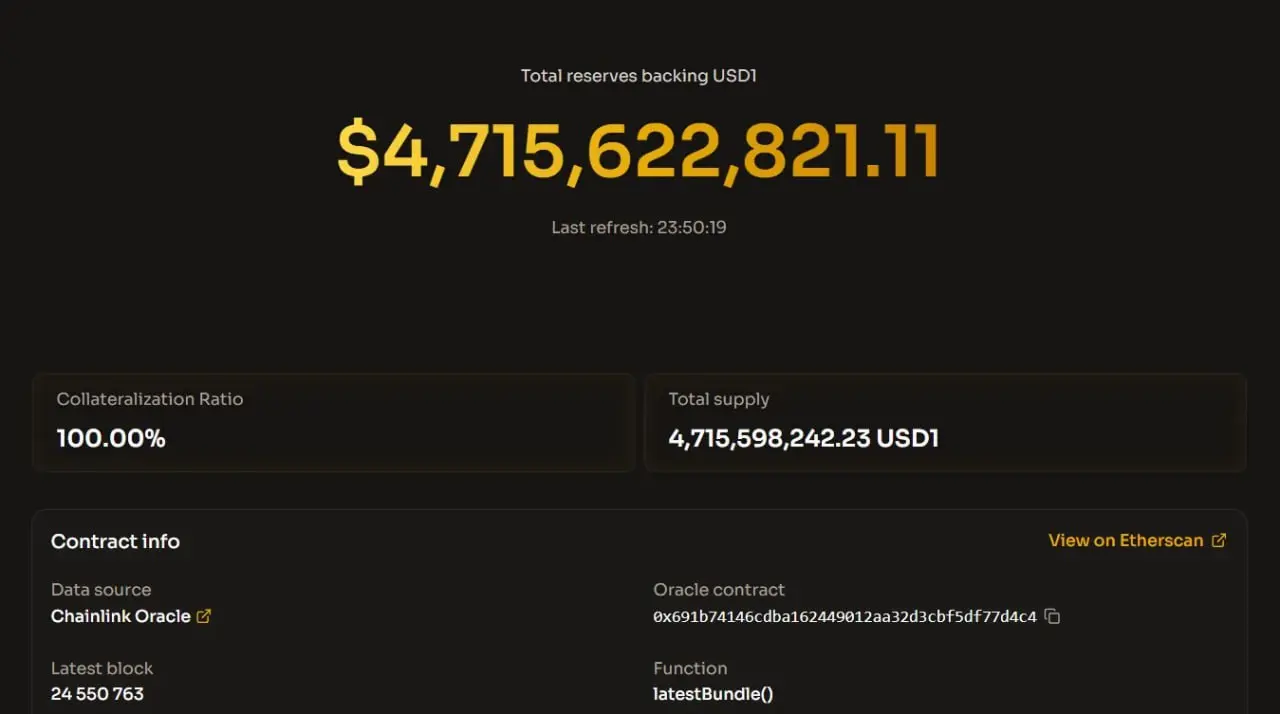

World Liberty Financial Launches Real-Time Reserve Verification for USD1 Stablecoin #stablecoin $WLFI

WLFI-4,76%

- Reward

- 1

- Comment

- Repost

- Share

💰 Tether’s market capitalization has declined for a second consecutive month, falling 0.8% in February to $183.61 billion. This marks its first two-month contraction since the 2022 Terra collapse. $USDC has recovered to about $75 billion from its January low but remains largely flat year to date, reflecting broader stagnation among #major stablecoins. #stablecoin

#crypto

#crypto

USDC0,01%

- Reward

- 1

- Comment

- Repost

- Share

#RussiaStudiesNationalStablecoin

Russia is actively exploring the concept of a national stablecoin, signaling another major step in the global race toward digital financial sovereignty. As geopolitical tensions and sanctions reshape cross-border finance, the move reflects Moscow’s strategic effort to reduce reliance on traditional payment rails and strengthen control over digital settlements.

A Russian national stablecoin could potentially be pegged to the ruble or backed by commodities, aiming to facilitate faster domestic payments, streamline international trade with partner nations, and enh

Russia is actively exploring the concept of a national stablecoin, signaling another major step in the global race toward digital financial sovereignty. As geopolitical tensions and sanctions reshape cross-border finance, the move reflects Moscow’s strategic effort to reduce reliance on traditional payment rails and strengthen control over digital settlements.

A Russian national stablecoin could potentially be pegged to the ruble or backed by commodities, aiming to facilitate faster domestic payments, streamline international trade with partner nations, and enh

- Reward

- 10

- 9

- Repost

- Share

Luna_Star :

:

Superb! This is exactly the kind of content I love to see.View More

🌏🇷🇺 #RussiaStudiesNationalStablecoin – Exploring a State-Backed Digital Currency

The Bank of Russia has officially begun studying the potential issuance of a national stablecoin, signaling a strategic step toward integrating digital assets into the country’s financial system. 🏦💡

🔹 Key Highlights:

• Evaluating the need, design, and risks of a state-backed stablecoin

• Could improve payment efficiency and cross-border transactions

• Part of a global trend where central banks explore digital currencies (CBDCs)

• Aims to balance innovation with financial stability and regulatory compliance

�

The Bank of Russia has officially begun studying the potential issuance of a national stablecoin, signaling a strategic step toward integrating digital assets into the country’s financial system. 🏦💡

🔹 Key Highlights:

• Evaluating the need, design, and risks of a state-backed stablecoin

• Could improve payment efficiency and cross-border transactions

• Part of a global trend where central banks explore digital currencies (CBDCs)

• Aims to balance innovation with financial stability and regulatory compliance

�

- Reward

- 3

- Comment

- Repost

- Share

🚀 #RussiaStudiesNationalStablecoin

Russia is exploring the creation of a national stablecoin, signaling a potential shift in how digital currencies could integrate with its financial system. 🇷🇺💰

Key points:

The government is researching a digital ruble to complement traditional banking.

Aims include faster transactions, reduced reliance on foreign currencies, and enhanced control over monetary policy.

Could impact both domestic and international crypto markets if implemented.

💡 As the world moves toward digital currencies, Russia’s national stablecoin could reshape the crypto landscape an

Russia is exploring the creation of a national stablecoin, signaling a potential shift in how digital currencies could integrate with its financial system. 🇷🇺💰

Key points:

The government is researching a digital ruble to complement traditional banking.

Aims include faster transactions, reduced reliance on foreign currencies, and enhanced control over monetary policy.

Could impact both domestic and international crypto markets if implemented.

💡 As the world moves toward digital currencies, Russia’s national stablecoin could reshape the crypto landscape an

- Reward

- 8

- 14

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

Good luck and prosperity 🧧View More

🇷🇺 Russia Exploring a National Stablecoin!

Russia is reportedly studying the launch of its own national stablecoin, aiming to modernize its financial system, enhance digital payments, and reduce reliance on traditional banking infrastructure. This move could reshape the way digital currencies are adopted and regulated in the country.

💡 Key Points:

Potential use for domestic transactions and cross-border trade

Could coexist with the digital ruble initiative

Reflects growing global interest in state-backed digital currencies

#Russia #DigitalCurrency #Stablecoin #Fintech #Blockchain

Russia is reportedly studying the launch of its own national stablecoin, aiming to modernize its financial system, enhance digital payments, and reduce reliance on traditional banking infrastructure. This move could reshape the way digital currencies are adopted and regulated in the country.

💡 Key Points:

Potential use for domestic transactions and cross-border trade

Could coexist with the digital ruble initiative

Reflects growing global interest in state-backed digital currencies

#Russia #DigitalCurrency #Stablecoin #Fintech #Blockchain

- Reward

- 3

- Comment

- Repost

- Share

#

🚀 Russia Explores Launch of a National Stablecoin 🇷🇺

In a bold move signaling Russia's deepening interest in digital currencies, the Russian government and financial authorities are actively studying the potential of launching a national stablecoin. This initiative aims to strengthen the country’s financial infrastructure while keeping pace with the global shift toward digital assets.

Stablecoins are digital currencies pegged to traditional assets like the US dollar, euro, or gold, providing the stability of conventional currencies with the benefits of blockchain technology. For Russia, a

🚀 Russia Explores Launch of a National Stablecoin 🇷🇺

In a bold move signaling Russia's deepening interest in digital currencies, the Russian government and financial authorities are actively studying the potential of launching a national stablecoin. This initiative aims to strengthen the country’s financial infrastructure while keeping pace with the global shift toward digital assets.

Stablecoins are digital currencies pegged to traditional assets like the US dollar, euro, or gold, providing the stability of conventional currencies with the benefits of blockchain technology. For Russia, a

- Reward

- 10

- 19

- Repost

- Share

Crypto_Buzz_with_Alex :

:

Wishing you abundant wealth and great success in the Year of the Horse 🐴✨View More

#RussiaStudiesNationalStablecoin #RussiaStudiesNationalStablecoin 🇷🇺💰

Big move in the global crypto space — Russia is reportedly studying the launch of a national stablecoin. 👀

As sanctions, cross-border payment restrictions, and global financial fragmentation continue, countries are exploring digital alternatives to traditional settlement systems.

If implemented, this could reshape regional trade dynamics.

Here’s what it could mean:

🔹 Sanctions Workaround?

A state-backed stablecoin could enable faster cross-border transactions outside traditional Western-controlled financial rails.

🔹 Di

Big move in the global crypto space — Russia is reportedly studying the launch of a national stablecoin. 👀

As sanctions, cross-border payment restrictions, and global financial fragmentation continue, countries are exploring digital alternatives to traditional settlement systems.

If implemented, this could reshape regional trade dynamics.

Here’s what it could mean:

🔹 Sanctions Workaround?

A state-backed stablecoin could enable faster cross-border transactions outside traditional Western-controlled financial rails.

🔹 Di

BTC-1,48%

- Reward

- 2

- 3

- Repost

- Share

ShainingMoon :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

838.69K Popularity

308.36K Popularity

150.09K Popularity

405.71K Popularity

36.75K Popularity

185.85K Popularity

239.5K Popularity

190.53K Popularity

271.93K Popularity

1.18M Popularity

6.07M Popularity

56.05K Popularity

5.37M Popularity

392.34K Popularity

59.38K Popularity

News

View MoreData: 10 million MOVE tokens transferred out from Movement Network, worth approximately $2.21 million

21 m

The Federal Reserve has a 97.4% probability of maintaining interest rates unchanged in March.

34 m

Trump claims the "Genius Act" is under threat from banks, emphasizing the protection of the crypto industry

40 m

Traditional Finance Drop Alert: TSLA Falls Over 2%

43 m

Kashkari: If inflation cools down, there may be one or two rate cuts later this year

1 h

Pin