# tokenization

537.79K

QueenOfTheDay

#SEConTokenizedSecurities 📢 SEC Clarifies Tokenization & Securities Regulation

The U.S. SEC has confirmed that tokenizing assets does not change securities regulations. While digital representations of real-world assets (RWA) can increase accessibility and efficiency, they remain subject to existing compliance frameworks.

💡 Key Implications:

Regulatory Certainty:

Tokenization alone does not exempt an asset from securities laws.

This clarity helps institutions navigate digital asset adoption with confidence.

Institution-Friendly Environment:

While compliance obligations persist, clearer guide

The U.S. SEC has confirmed that tokenizing assets does not change securities regulations. While digital representations of real-world assets (RWA) can increase accessibility and efficiency, they remain subject to existing compliance frameworks.

💡 Key Implications:

Regulatory Certainty:

Tokenization alone does not exempt an asset from securities laws.

This clarity helps institutions navigate digital asset adoption with confidence.

Institution-Friendly Environment:

While compliance obligations persist, clearer guide

- Reward

- like

- Comment

- Repost

- Share

# TraditionalFinanceAcceleratesTokenization

🏦 TradFi Goes

All-In: The Tokenization Revolution is Here!

The giants of Wall Street are waking up to the power of

blockchain. Industry leaders like State Street, JPMorgan, and Goldman

Sachs are actively adopting distributed ledger technology and

launching digital asset platforms dedicated to asset tokenization. 🔗

This isn't just a trend; it's a transformation. By

digitizing traditional financial products, these institutions aim to: ✨

Enhance circulation efficiency ⚡ Improve system performance

🔄

Drive seamless financial transactions

The bridge

🏦 TradFi Goes

All-In: The Tokenization Revolution is Here!

The giants of Wall Street are waking up to the power of

blockchain. Industry leaders like State Street, JPMorgan, and Goldman

Sachs are actively adopting distributed ledger technology and

launching digital asset platforms dedicated to asset tokenization. 🔗

This isn't just a trend; it's a transformation. By

digitizing traditional financial products, these institutions aim to: ✨

Enhance circulation efficiency ⚡ Improve system performance

🔄

Drive seamless financial transactions

The bridge

DEFI1,01%

- Reward

- like

- Comment

- Repost

- Share

#TokenizedSilverTrend 🪙⚡

Silver is no longer just a metal.

It’s becoming programmable.

The rise of tokenized silver is quietly building momentum — blending real-world assets (RWA) with blockchain infrastructure. Physical value. Digital liquidity.

Why this trend matters 👇

🔗 24/7 tradable exposure to silver

🏦 Lower barriers for global investors

💎 Fractional ownership without storage hassle

⚡ Faster settlement vs traditional markets

As gold dominates headlines, silver is positioning itself as the high-beta alternative — and tokenization is amplifying that narrative.

In 2026, capital isn’t ju

Silver is no longer just a metal.

It’s becoming programmable.

The rise of tokenized silver is quietly building momentum — blending real-world assets (RWA) with blockchain infrastructure. Physical value. Digital liquidity.

Why this trend matters 👇

🔗 24/7 tradable exposure to silver

🏦 Lower barriers for global investors

💎 Fractional ownership without storage hassle

⚡ Faster settlement vs traditional markets

As gold dominates headlines, silver is positioning itself as the high-beta alternative — and tokenization is amplifying that narrative.

In 2026, capital isn’t ju

- Reward

- 6

- 5

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

#TokenizedSilverTrend 🪙⚡

Silver is no longer just a metal.

It’s becoming programmable.

The rise of tokenized silver is quietly building momentum — blending real-world assets (RWA) with blockchain infrastructure. Physical value. Digital liquidity.

Why this trend matters 👇

🔗 24/7 tradable exposure to silver

🏦 Lower barriers for global investors

💎 Fractional ownership without storage hassle

⚡ Faster settlement vs traditional markets

As gold dominates headlines, silver is positioning itself as the high-beta alternative — and tokenization is amplifying that narrative.

In 2026, capital isn’t ju

Silver is no longer just a metal.

It’s becoming programmable.

The rise of tokenized silver is quietly building momentum — blending real-world assets (RWA) with blockchain infrastructure. Physical value. Digital liquidity.

Why this trend matters 👇

🔗 24/7 tradable exposure to silver

🏦 Lower barriers for global investors

💎 Fractional ownership without storage hassle

⚡ Faster settlement vs traditional markets

As gold dominates headlines, silver is positioning itself as the high-beta alternative — and tokenization is amplifying that narrative.

In 2026, capital isn’t ju

MC:$3.18KHolders:8

0.00%

- Reward

- 1

- Comment

- Repost

- Share

#TokenizedSilverTrend 🪙⚡

Silver is no longer just a metal.

It’s becoming programmable.

The rise of tokenized silver is quietly building momentum — blending real-world assets (RWA) with blockchain infrastructure. Physical value. Digital liquidity.

Why this trend matters 👇

🔗 24/7 tradable exposure to silver

🏦 Lower barriers for global investors

💎 Fractional ownership without storage hassle

⚡ Faster settlement vs traditional markets

As gold dominates headlines, silver is positioning itself as the high-beta alternative — and tokenization is amplifying that narrative.

In 2026, capital isn’t ju

Silver is no longer just a metal.

It’s becoming programmable.

The rise of tokenized silver is quietly building momentum — blending real-world assets (RWA) with blockchain infrastructure. Physical value. Digital liquidity.

Why this trend matters 👇

🔗 24/7 tradable exposure to silver

🏦 Lower barriers for global investors

💎 Fractional ownership without storage hassle

⚡ Faster settlement vs traditional markets

As gold dominates headlines, silver is positioning itself as the high-beta alternative — and tokenization is amplifying that narrative.

In 2026, capital isn’t ju

- Reward

- 10

- 16

- Repost

- Share

ybaser :

:

Happy New Year! 🤑View More

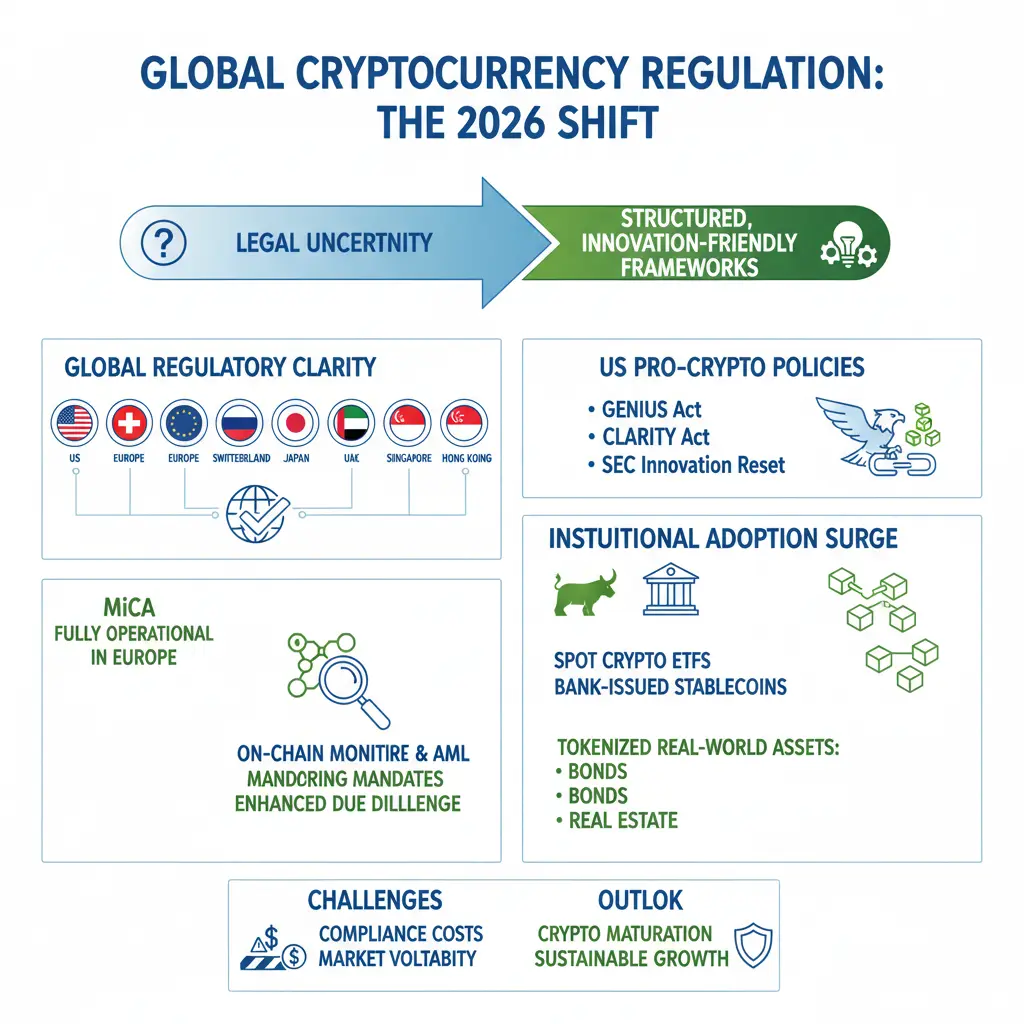

#CryptoRegulationNewProgress 🚀

2026 marks a historic shift for cryptocurrency — from legal uncertainty and enforcement crackdowns to structured, innovation-friendly regulatory frameworks. Crypto is no longer just a speculative frontier; it is now evolving into a regulated financial asset class integrated with banks, ETFs, tokenized real-world assets (RWAs), and national financial systems.

🌍 Global Shift: From Chaos to Clarity

Regulators worldwide are moving from conflicting laws and enforcement-first approaches to:

✅ Implementing finalized laws

✅ Licensing exchanges & stablecoin issuers

✅ En

2026 marks a historic shift for cryptocurrency — from legal uncertainty and enforcement crackdowns to structured, innovation-friendly regulatory frameworks. Crypto is no longer just a speculative frontier; it is now evolving into a regulated financial asset class integrated with banks, ETFs, tokenized real-world assets (RWAs), and national financial systems.

🌍 Global Shift: From Chaos to Clarity

Regulators worldwide are moving from conflicting laws and enforcement-first approaches to:

✅ Implementing finalized laws

✅ Licensing exchanges & stablecoin issuers

✅ En

DEFI1,01%

- Reward

- 8

- 11

- Repost

- Share

NovaCryptoGirl :

:

Ape In 🚀View More

🏛️🔗 #SEConTokenizedSecurities | Regulatory Watch 📊The U.S. SEC is increasing its focus on tokenized securities, highlighting the growing intersection between regulation, traditional finance, and blockchain technology. This development signals a critical phase for how digital assets may be structured, issued, and traded going forward. 👀⚖️🔍 Why This Matters:🧾 Greater regulatory clarity for tokenized assets🏦 Implications for institutions exploring on-chain securities🌐 Potential impact on market confidence and adoption💡 As regulation evolves, understanding compliance and structure becomes

- Reward

- 3

- Comment

- Repost

- Share

#TheWorldEconomicForum 🌍

Davos 2026: Where Global Leaders Shaped the Future 🌐

The WEF 2026 Summit tackled the big issues:

🌱 Climate change

🌍 Geopolitical tensions

💻 Digital transformation

Key takeaway for crypto:

🚀 Stablecoins get a regulatory boost

🏦 Asset tokenization to democratize markets

🇺🇸 Trump reinforces US as the “Crypto Capital of the World”

Result?

More institutional adoption

A safer, more accessible crypto ecosystem

Potential market cap growth across the board

💭 Your take: Is this the year crypto truly goes mainstream?

#Crypto #Davos2026 #Stablecoins #Tokenization

Davos 2026: Where Global Leaders Shaped the Future 🌐

The WEF 2026 Summit tackled the big issues:

🌱 Climate change

🌍 Geopolitical tensions

💻 Digital transformation

Key takeaway for crypto:

🚀 Stablecoins get a regulatory boost

🏦 Asset tokenization to democratize markets

🇺🇸 Trump reinforces US as the “Crypto Capital of the World”

Result?

More institutional adoption

A safer, more accessible crypto ecosystem

Potential market cap growth across the board

💭 Your take: Is this the year crypto truly goes mainstream?

#Crypto #Davos2026 #Stablecoins #Tokenization

TRUMP-0,02%

- Reward

- 2

- Comment

- Repost

- Share

🏦🔗 #DTCCMovesTowardTokenization | Institutional Adoption Watch

The DTCC (Depository Trust & Clearing Corporation) is advancing efforts toward asset tokenization, marking a significant milestone in the convergence of traditional finance and blockchain technology. This move highlights growing institutional confidence in distributed ledger solutions. 📊✨

🔍 Why This Matters:

🧾 Tokenization can improve settlement efficiency and transparency

⚡ Potential for faster clearing and reduced operational risk

🌍 Opens the door for broader institutional participation in digital assets

💡 Developments lik

The DTCC (Depository Trust & Clearing Corporation) is advancing efforts toward asset tokenization, marking a significant milestone in the convergence of traditional finance and blockchain technology. This move highlights growing institutional confidence in distributed ledger solutions. 📊✨

🔍 Why This Matters:

🧾 Tokenization can improve settlement efficiency and transparency

⚡ Potential for faster clearing and reduced operational risk

🌍 Opens the door for broader institutional participation in digital assets

💡 Developments lik

- Reward

- 2

- Comment

- Repost

- Share

Affordable Housing Innovation with ATEG Capital

High rent, limited ownership opportunities, and opaque real estate systems remain major barriers to financial stability. Traditional housing models are slow, capital-intensive, and often leave tenants without a clear path to ownership.

ATEG Capital is changing this narrative.

By leveraging blockchain technology to tokenize housing assets, ATEG introduces a transparent and secure rent-to-own model. Every transaction is immutably recorded on-chain, every process is auditable, and ownership is fully traceable.

This approach goes beyond innovation. I

High rent, limited ownership opportunities, and opaque real estate systems remain major barriers to financial stability. Traditional housing models are slow, capital-intensive, and often leave tenants without a clear path to ownership.

ATEG Capital is changing this narrative.

By leveraging blockchain technology to tokenize housing assets, ATEG introduces a transparent and secure rent-to-own model. Every transaction is immutably recorded on-chain, every process is auditable, and ownership is fully traceable.

This approach goes beyond innovation. I

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

378.48K Popularity

7.09K Popularity

7.06K Popularity

4.2K Popularity

2.81K Popularity

4.81K Popularity

2.48K Popularity

3.24K Popularity

2.17K Popularity

23 Popularity

54.45K Popularity

72.42K Popularity

20.38K Popularity

26.61K Popularity

219.71K Popularity

News

View MoreOpinion: The crypto bear market cycle is expected to reverse by 2026, with Bitcoin potentially bottoming out around $60,000.

4 m

Michael Saylor: Strategy has accumulated a total of 713,502 BTC, with an average purchase price of approximately $76,052.

6 m

Spot gold prices briefly surged past $4,800 per ounce, breaking through the short-term resistance level.

17 m

Analysis: CME Bitcoin futures show a clear price gap, offering a glimmer of hope for the bulls

21 m

Hong Kong Monetary Authority: Plans to issue the first stablecoin issuer licenses in March

30 m

Pin