#GateJanTransparencyReport Gate.io January 2026 Transparency Report: 125% Reserves and Explosive TradFi Growth

Gate.io, one of the world’s leading digital asset exchanges, has set a new benchmark for transparency and reliability with its January 2026 Transparency Report. In a market still grappling with volatility and regulatory scrutiny, the report showcases the platform’s financial strength, operational maturity, and strategic expansion into traditional finance (TradFi) assets, reinforcing user confidence in its long-term vision.

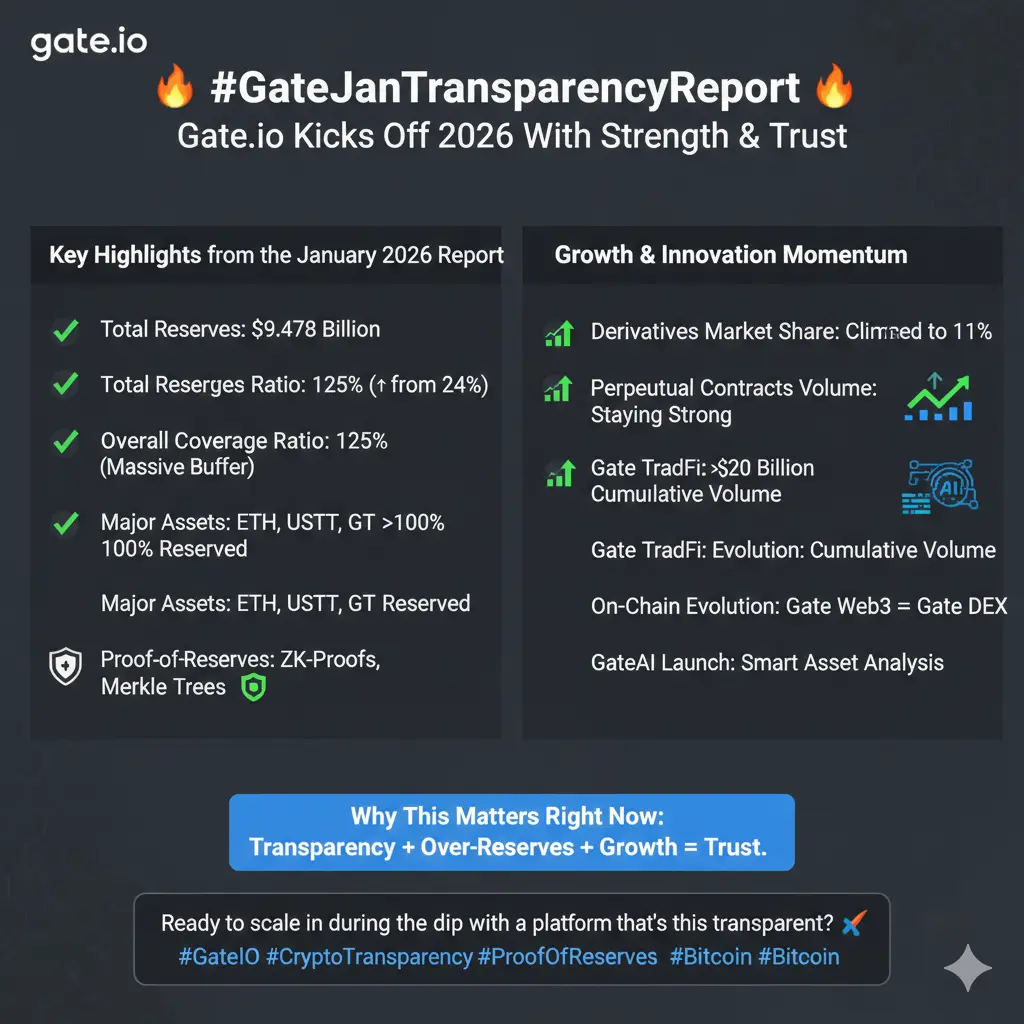

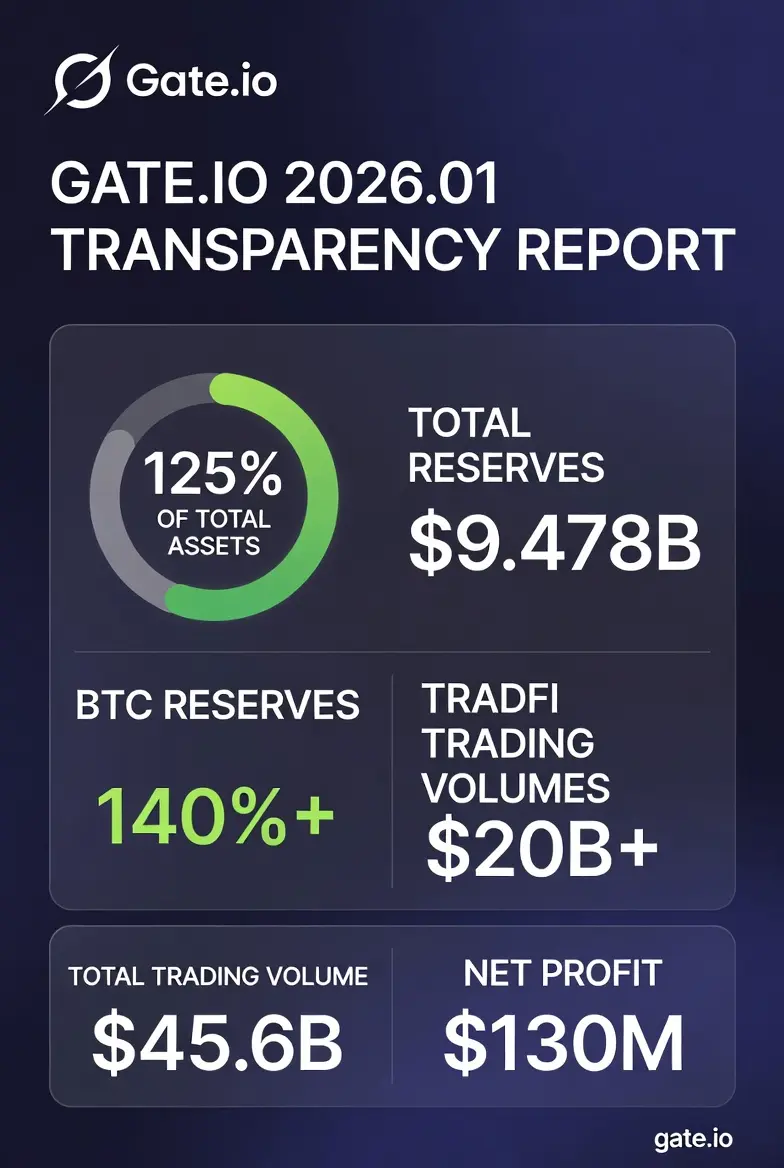

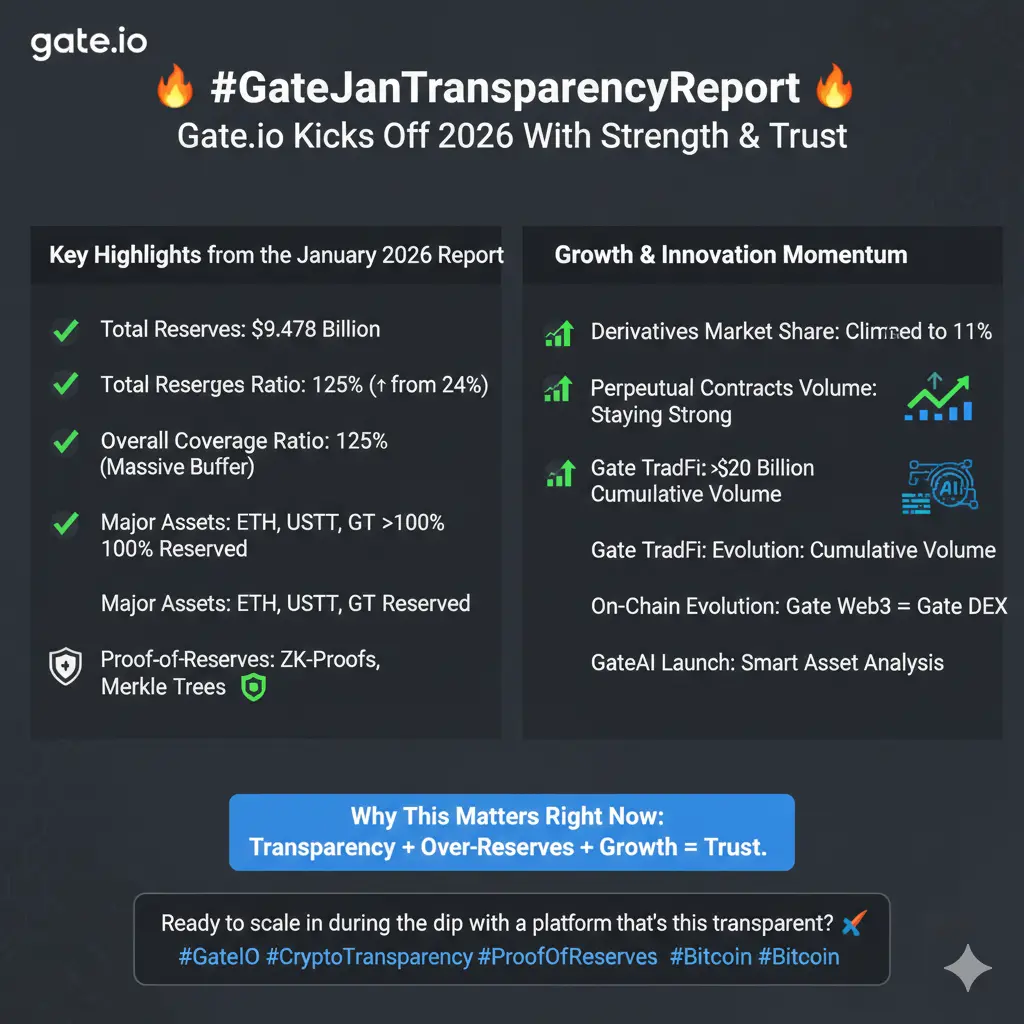

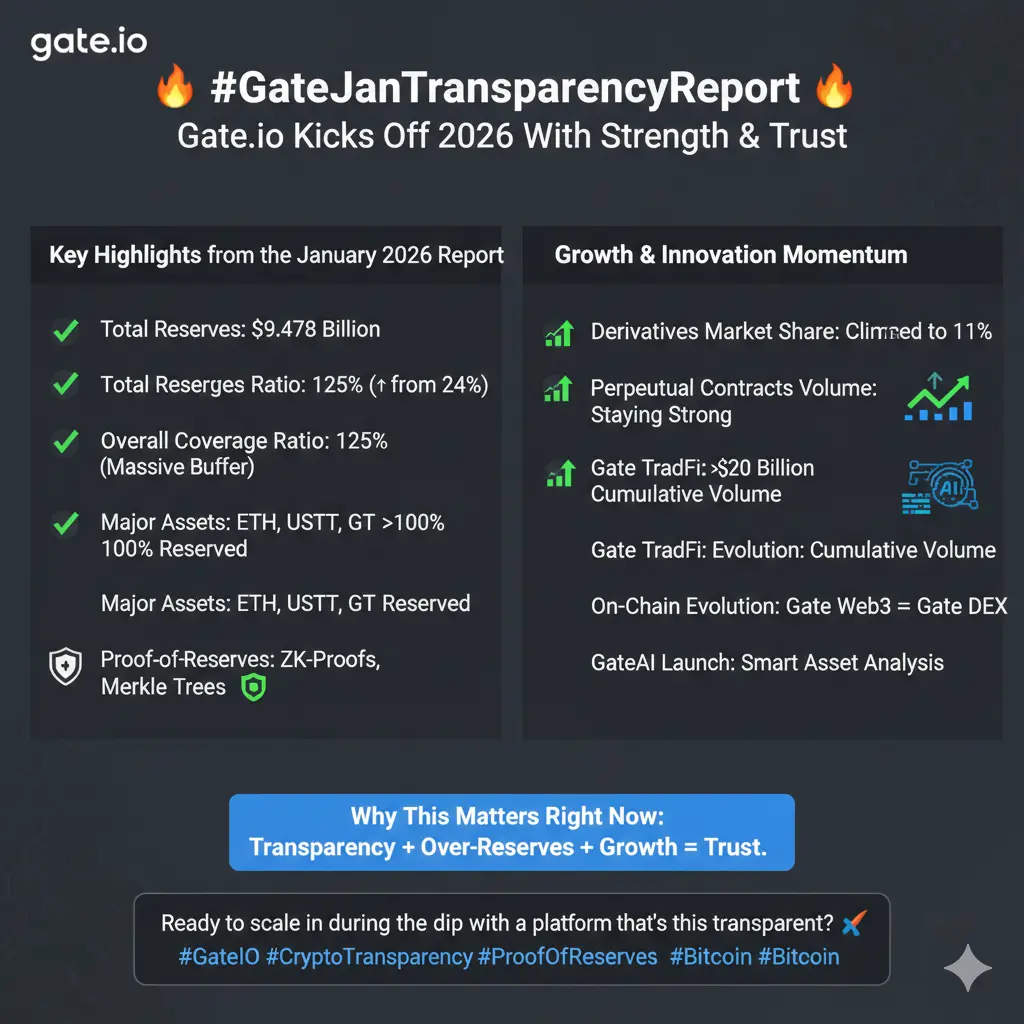

One of the most impressive metrics from the report is Gate.io’s reserve coverage ratio, which has surged to 125%. With total reserves of $9.478 billion, the platform comfortably exceeds the 100% benchmark typically considered necessary to fully back user assets. Such a buffer is particularly significant in a market prone to rapid sell-offs and liquidity crunches, highlighting Gate.io’s commitment to safeguarding user funds beyond the industry norm.

Breaking it down by asset, Bitcoin (BTC) reserves surpass 140%, while Ethereum (ETH), Tether (USDT), and GateToken (GT) maintain ratios above 100%. This over-collateralization reflects a proactive risk management approach. Even in periods of high market turbulence, Gate.io ensures that user assets remain secure, fostering trust in both retail and institutional clients.

Derivatives trading remains a core strength. Gate.io’s market share in this sector has climbed to 11%, underscoring its growing prominence among centralized exchanges (CEXs). Perpetual contract volumes have remained robust, stabilizing around $1.93 trillion in Q4 2025 after previous quarterly peaks of $2.42 trillion in Q3. This sustained performance illustrates the platform’s appeal to traders seeking advanced leveraged strategies.

A notable highlight is Gate.io’s push into TradFi integration. By enabling multi-asset trading across metals, forex, indices, commodities, and selected equities, the platform has achieved cumulative volumes exceeding $20 billion. Users can now trade crypto and traditional markets within a single account, using USDT as margin. This unified experience not only simplifies access but also positions Gate.io as a bridge between crypto ecosystems and conventional financial markets.

The report also underscores continued innovation in on-chain derivatives and asset management. By expanding yield-generating products, cross-market trading tools, and portfolio diversification options, Gate.io is evolving from a purely crypto-focused exchange into a full-spectrum digital asset hub. Such enhancements attract both short-term traders and long-term investors seeking more sophisticated strategies.

From a strategic perspective, the combination of strong reserves, derivatives growth, and TradFi integration demonstrates Gate.io’s resilience. While competitors have faced liquidity challenges or regulatory hurdles, Gate.io’s proactive disclosure and capital robustness provide reassurance that the platform is prepared for future market shocks.

Transparency is another key takeaway. By publishing detailed reports, Gate.io not only meets compliance expectations but also sets a high standard for accountability in the crypto industry. For users, this level of disclosure reduces uncertainty and fosters trust, which is crucial as cryptocurrencies continue to integrate with mainstream finance.

Looking forward, Gate.io’s January 2026 report signals confidence in long-term growth. The platform is not just reacting to market trends; it is actively shaping the intersection of crypto and TradFi. With continued innovation, robust capital backing, and strategic product expansion, Gate.io is well-positioned to attract new users and strengthen its foothold among institutional players.

In conclusion, the January 2026 Transparency Report illustrates Gate.io as a mature, forward-thinking exchange. Its strong reserves, leading derivatives performance, and successful TradFi integration highlight a platform that prioritizes security, innovation, and user trust. For the broader crypto ecosystem, Gate.io’s example underscores the importance of transparency, financial resilience, and strategic vision—key factors that will likely influence adoption trends and market confidence throughout 2026 and beyond.

Gate.io, one of the world’s leading digital asset exchanges, has set a new benchmark for transparency and reliability with its January 2026 Transparency Report. In a market still grappling with volatility and regulatory scrutiny, the report showcases the platform’s financial strength, operational maturity, and strategic expansion into traditional finance (TradFi) assets, reinforcing user confidence in its long-term vision.

One of the most impressive metrics from the report is Gate.io’s reserve coverage ratio, which has surged to 125%. With total reserves of $9.478 billion, the platform comfortably exceeds the 100% benchmark typically considered necessary to fully back user assets. Such a buffer is particularly significant in a market prone to rapid sell-offs and liquidity crunches, highlighting Gate.io’s commitment to safeguarding user funds beyond the industry norm.

Breaking it down by asset, Bitcoin (BTC) reserves surpass 140%, while Ethereum (ETH), Tether (USDT), and GateToken (GT) maintain ratios above 100%. This over-collateralization reflects a proactive risk management approach. Even in periods of high market turbulence, Gate.io ensures that user assets remain secure, fostering trust in both retail and institutional clients.

Derivatives trading remains a core strength. Gate.io’s market share in this sector has climbed to 11%, underscoring its growing prominence among centralized exchanges (CEXs). Perpetual contract volumes have remained robust, stabilizing around $1.93 trillion in Q4 2025 after previous quarterly peaks of $2.42 trillion in Q3. This sustained performance illustrates the platform’s appeal to traders seeking advanced leveraged strategies.

A notable highlight is Gate.io’s push into TradFi integration. By enabling multi-asset trading across metals, forex, indices, commodities, and selected equities, the platform has achieved cumulative volumes exceeding $20 billion. Users can now trade crypto and traditional markets within a single account, using USDT as margin. This unified experience not only simplifies access but also positions Gate.io as a bridge between crypto ecosystems and conventional financial markets.

The report also underscores continued innovation in on-chain derivatives and asset management. By expanding yield-generating products, cross-market trading tools, and portfolio diversification options, Gate.io is evolving from a purely crypto-focused exchange into a full-spectrum digital asset hub. Such enhancements attract both short-term traders and long-term investors seeking more sophisticated strategies.

From a strategic perspective, the combination of strong reserves, derivatives growth, and TradFi integration demonstrates Gate.io’s resilience. While competitors have faced liquidity challenges or regulatory hurdles, Gate.io’s proactive disclosure and capital robustness provide reassurance that the platform is prepared for future market shocks.

Transparency is another key takeaway. By publishing detailed reports, Gate.io not only meets compliance expectations but also sets a high standard for accountability in the crypto industry. For users, this level of disclosure reduces uncertainty and fosters trust, which is crucial as cryptocurrencies continue to integrate with mainstream finance.

Looking forward, Gate.io’s January 2026 report signals confidence in long-term growth. The platform is not just reacting to market trends; it is actively shaping the intersection of crypto and TradFi. With continued innovation, robust capital backing, and strategic product expansion, Gate.io is well-positioned to attract new users and strengthen its foothold among institutional players.

In conclusion, the January 2026 Transparency Report illustrates Gate.io as a mature, forward-thinking exchange. Its strong reserves, leading derivatives performance, and successful TradFi integration highlight a platform that prioritizes security, innovation, and user trust. For the broader crypto ecosystem, Gate.io’s example underscores the importance of transparency, financial resilience, and strategic vision—key factors that will likely influence adoption trends and market confidence throughout 2026 and beyond.