# BiggestCryptoOutflowsSince2022

60.94K

AylaShinex

#BiggestCryptoOutflowsSince2022 BiggestCryptoOutflowsSince2022 📉

Mid-February 2026.

This is not just a dip.

This is the largest capital contraction since the 2022 structural collapse.

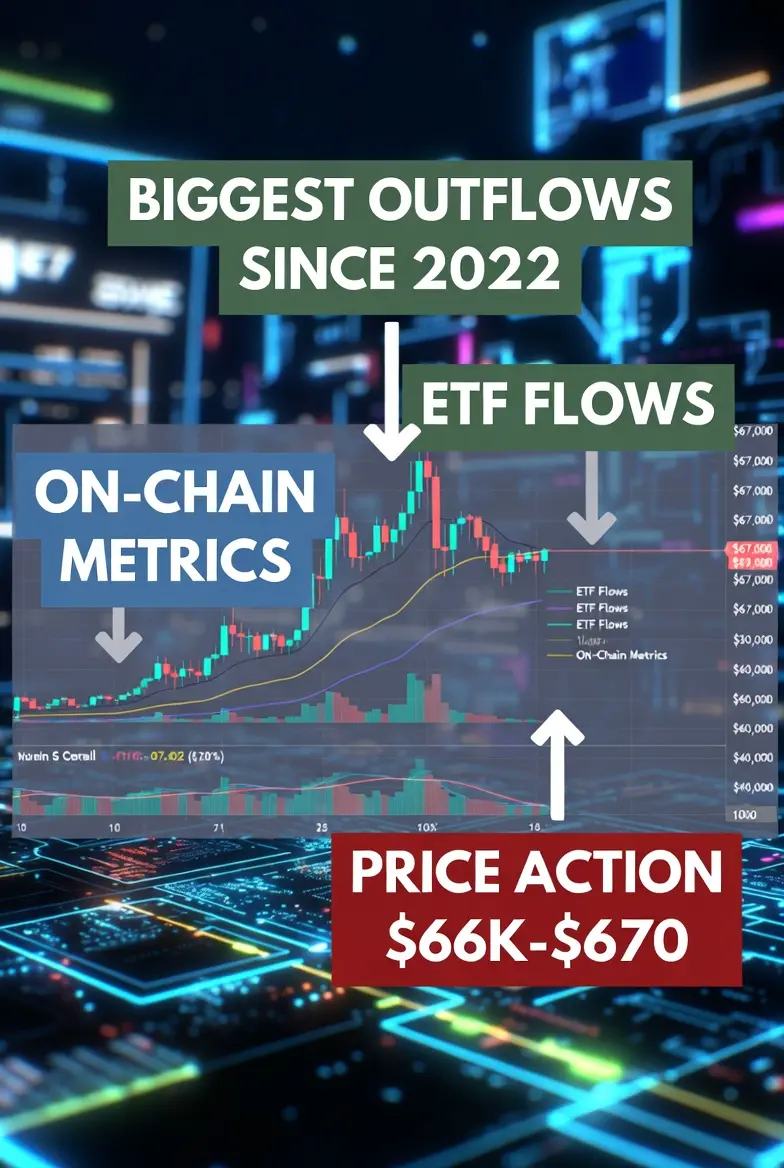

Bitcoin: $66K–$67K 💰

~50% drawdown from $126K highs 📊

Total market cap compressing toward $2.3T–$2.4T

Sentiment: Extreme Fear 😨

But remove emotion.

This isn’t chaos.

It’s capital reallocation. 🔄

1️⃣ Real Signal: Capital Is Leaving

Realized Cap Netflow (BTC + ETH + stables) has flipped deeply negative 📉

Most aggressive 30-day contraction since 2022.

That means real USD value is exiting — not just paper losse

Mid-February 2026.

This is not just a dip.

This is the largest capital contraction since the 2022 structural collapse.

Bitcoin: $66K–$67K 💰

~50% drawdown from $126K highs 📊

Total market cap compressing toward $2.3T–$2.4T

Sentiment: Extreme Fear 😨

But remove emotion.

This isn’t chaos.

It’s capital reallocation. 🔄

1️⃣ Real Signal: Capital Is Leaving

Realized Cap Netflow (BTC + ETH + stables) has flipped deeply negative 📉

Most aggressive 30-day contraction since 2022.

That means real USD value is exiting — not just paper losse

- Reward

- 3

- 3

- Repost

- Share

MoonGirl :

:

LFG 🔥View More

#BiggestCryptoOutflowsSince2022 Biggest Crypto Outflows Since 2022: What’s Really Happening in the Market?

The cryptocurrency market has entered one of its most volatile phases in years, with capital flowing out at a pace not seen since the brutal bear market of 2022. For traders, investors, and long-term believers, this moment feels familiar — a mix of fear, uncertainty, forced selling, and strategic repositioning. Yet beneath the surface panic lies a complex story involving institutional behavior, macroeconomic pressure, ETF dynamics, and changing market structure.

Understanding these massiv

The cryptocurrency market has entered one of its most volatile phases in years, with capital flowing out at a pace not seen since the brutal bear market of 2022. For traders, investors, and long-term believers, this moment feels familiar — a mix of fear, uncertainty, forced selling, and strategic repositioning. Yet beneath the surface panic lies a complex story involving institutional behavior, macroeconomic pressure, ETF dynamics, and changing market structure.

Understanding these massiv

- Reward

- 2

- Comment

- Repost

- Share

#BiggestCryptoOutflowsSince2022

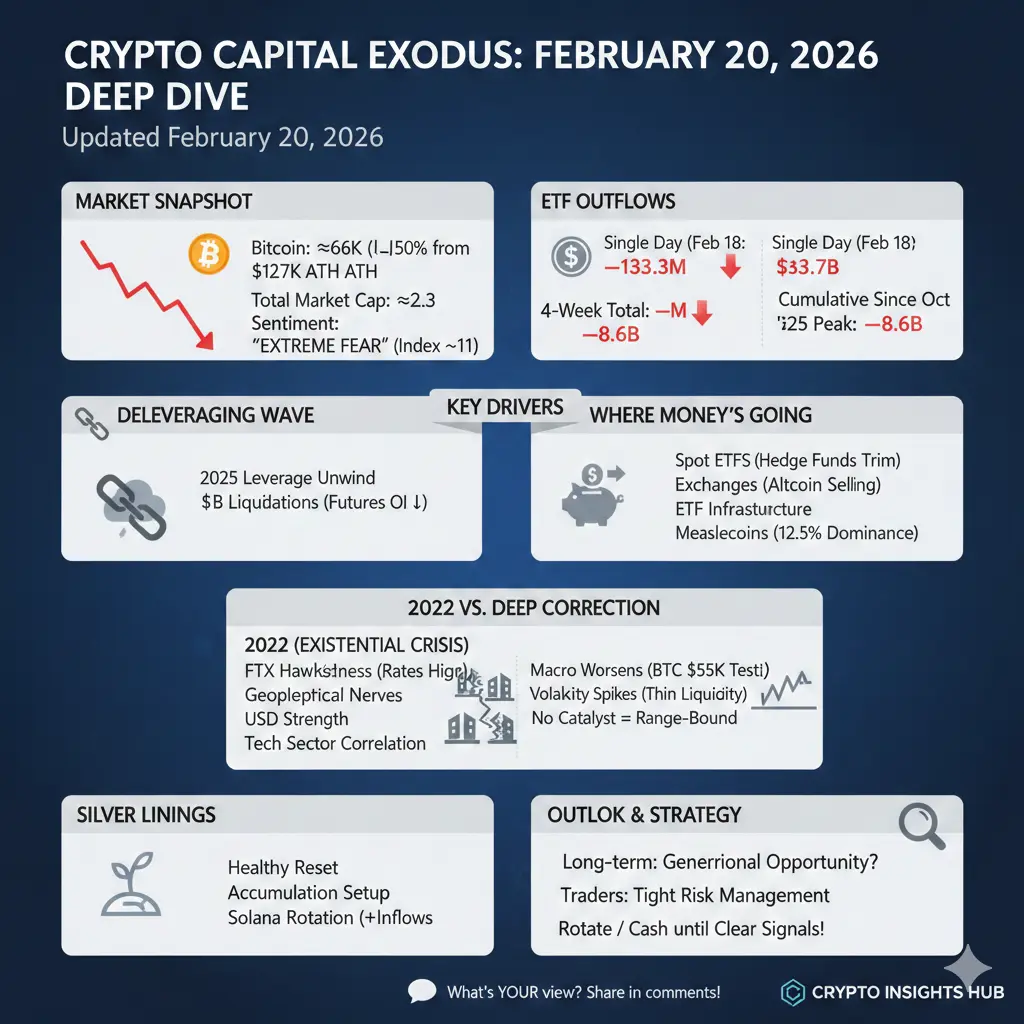

As of mid-February 2026, the cryptocurrency market is experiencing one of its most intense periods of capital departure since the brutal 2022 bear market. Bitcoin hovers around the $66,000–$67,000 zone after a painful ~50% drop from its late-2025 all-time high near $126,000–$127,000. Ethereum and many altcoins are bleeding similarly, with the total crypto market cap dipping toward $2.3–$2.4 trillion amid "extreme fear" levels on sentiment indexes.

This isn't just another routine correction—it's a broad-based exodus of capital from exchanges, funds, ETFs, and le

As of mid-February 2026, the cryptocurrency market is experiencing one of its most intense periods of capital departure since the brutal 2022 bear market. Bitcoin hovers around the $66,000–$67,000 zone after a painful ~50% drop from its late-2025 all-time high near $126,000–$127,000. Ethereum and many altcoins are bleeding similarly, with the total crypto market cap dipping toward $2.3–$2.4 trillion amid "extreme fear" levels on sentiment indexes.

This isn't just another routine correction—it's a broad-based exodus of capital from exchanges, funds, ETFs, and le

- Reward

- 7

- 6

- Repost

- Share

Ryakpanda :

:

Wishing you great wealth in the Year of the Horse 🐴View More

Biggest Crypto Outflows Since 2022 🚨

The crypto market has witnessed some of the largest capital outflows since 2022, signaling a major shift in investor sentiment. Billions have moved out of digital assets as traders react to macroeconomic pressure, regulatory uncertainty, and changing risk appetite.

While short-term confidence may fluctuate, history shows that periods of heavy outflows often reshape the market — filtering weak projects and strengthening long-term fundamentals.

Smart money doesn’t just watch price… it watches flow.

Are we seeing fear — or the setup for the next cycle?

#Bigge

The crypto market has witnessed some of the largest capital outflows since 2022, signaling a major shift in investor sentiment. Billions have moved out of digital assets as traders react to macroeconomic pressure, regulatory uncertainty, and changing risk appetite.

While short-term confidence may fluctuate, history shows that periods of heavy outflows often reshape the market — filtering weak projects and strengthening long-term fundamentals.

Smart money doesn’t just watch price… it watches flow.

Are we seeing fear — or the setup for the next cycle?

#Bigge

BTC0,79%

- Reward

- 3

- 2

- Repost

- Share

FixedBetBtc :

:

Happy New Year 🧨View More

Biggest Crypto Outflows Since 2022 🚨

The crypto market has witnessed some of the largest capital outflows since 2022, signaling a major shift in investor sentiment. Billions have moved out of digital assets as traders react to macroeconomic pressure, regulatory uncertainty, and changing risk appetite.

While short-term confidence may fluctuate, history shows that periods of heavy outflows often reshape the market — filtering weak projects and strengthening long-term fundamentals.

Smart money doesn’t just watch price… it watches flow.

Are we seeing fear — or the setup for the next cycle?

#Bigge

The crypto market has witnessed some of the largest capital outflows since 2022, signaling a major shift in investor sentiment. Billions have moved out of digital assets as traders react to macroeconomic pressure, regulatory uncertainty, and changing risk appetite.

While short-term confidence may fluctuate, history shows that periods of heavy outflows often reshape the market — filtering weak projects and strengthening long-term fundamentals.

Smart money doesn’t just watch price… it watches flow.

Are we seeing fear — or the setup for the next cycle?

#Bigge

BTC0,79%

- Reward

- 2

- 2

- Repost

- Share

Ryakpanda :

:

Wishing you great wealth in the Year of the Horse 🐴View More

#BiggestCryptoOutflowsSince2022

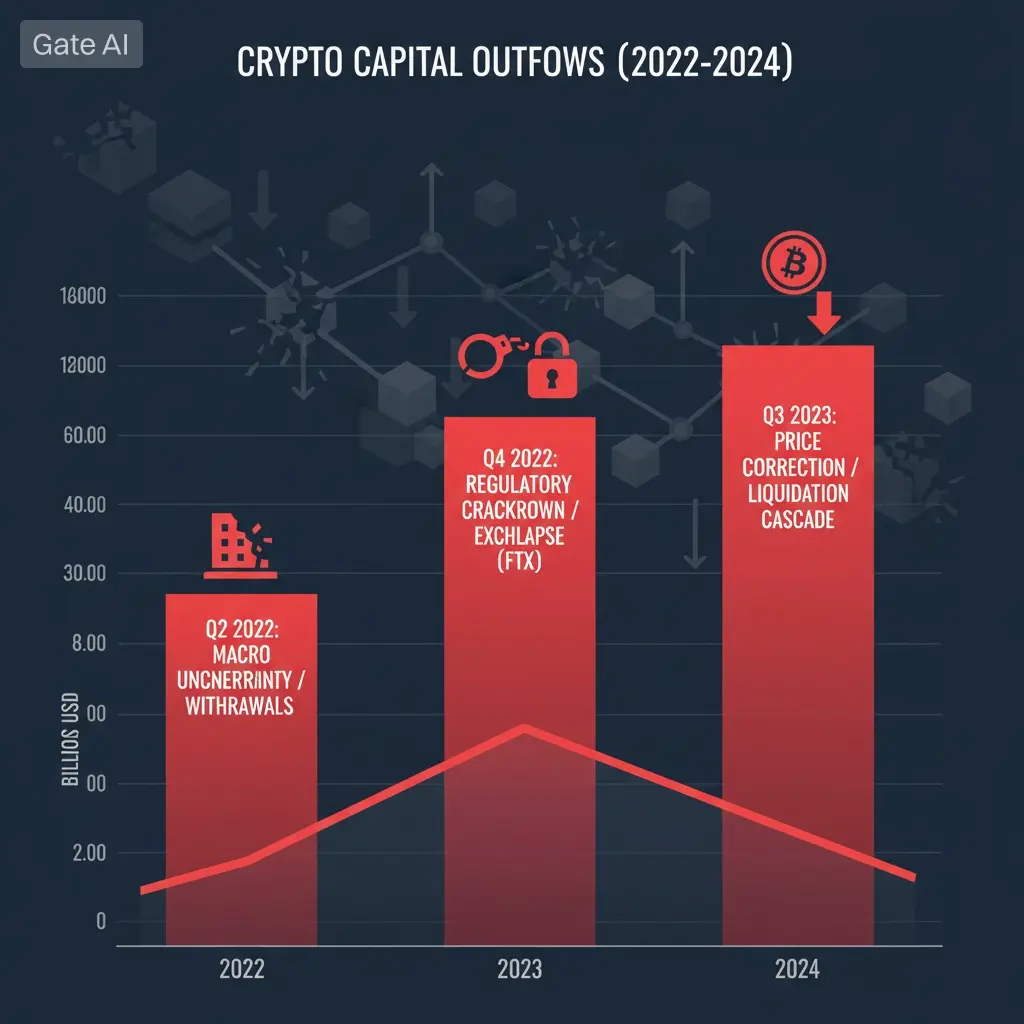

The crypto market has experienced several major capital outflow waves since 2022, marking some of the most significant institutional withdrawals in recent history. These outflows typically occurred during periods of macro uncertainty, regulatory pressure, or sharp price corrections.

1️⃣ 2022 Bear Market Capitulation

During the 2022 crypto winter, massive withdrawals followed major industry collapses and liquidity crises. Billions of dollars exited digital asset funds and exchanges as investor confidence dropped sharply. This period marked one of the largest sus

The crypto market has experienced several major capital outflow waves since 2022, marking some of the most significant institutional withdrawals in recent history. These outflows typically occurred during periods of macro uncertainty, regulatory pressure, or sharp price corrections.

1️⃣ 2022 Bear Market Capitulation

During the 2022 crypto winter, massive withdrawals followed major industry collapses and liquidity crises. Billions of dollars exited digital asset funds and exchanges as investor confidence dropped sharply. This period marked one of the largest sus

- Reward

- 5

- 3

- Repost

- Share

Korean_Girl :

:

To The Moon 🌕View More

#BiggestCryptoOutflowsSince2022 $BTC recovery momentum from support, btc aiming for 70k target.

Plan trade: Long

Entry zone: 66.3k - 67.6k

Take profit:

🎯TP1: 67.7k

🎯TP2: 68.8k

🎯TP3: 70k

Stop loss: 65.2k

$BTC bottomed at 65.5k. On H1, price crossed above EMA50 with rising RSI. A short-term recovery trend is forming as selling pressure weakens at a key support level.

Plan trade: Long

Entry zone: 66.3k - 67.6k

Take profit:

🎯TP1: 67.7k

🎯TP2: 68.8k

🎯TP3: 70k

Stop loss: 65.2k

$BTC bottomed at 65.5k. On H1, price crossed above EMA50 with rising RSI. A short-term recovery trend is forming as selling pressure weakens at a key support level.

BTC0,79%

- Reward

- 4

- 3

- Repost

- Share

Unoshi :

:

Thanks for the AnalysisView More

#BiggestCryptoOutflowsSince2022 #BiggestCryptoOutflowsSince2022

The recent data showing some of the largest crypto outflows since 2022 has caught my attention, and it’s worth reflecting on what this means beyond headlines. When we talk about outflows at this scale, we are not talking about random fluctuation we are witnessing a shift in sentiment, capital rotation, and investor psychology that can shape market structure for months or even years.

Outflows at this level typically indicate that participants are reallocating risk, de‑risking positions, or seeking liquidity elsewhere. Since 2022, t

The recent data showing some of the largest crypto outflows since 2022 has caught my attention, and it’s worth reflecting on what this means beyond headlines. When we talk about outflows at this scale, we are not talking about random fluctuation we are witnessing a shift in sentiment, capital rotation, and investor psychology that can shape market structure for months or even years.

Outflows at this level typically indicate that participants are reallocating risk, de‑risking positions, or seeking liquidity elsewhere. Since 2022, t

- Reward

- 4

- 2

- Repost

- Share

Yunna :

:

To The Moon 🌕View More

#BiggestCryptoOutflowsSince2022 🧧🧧🚀🚀#BiggestCryptoOutflowsSince2022

🚀🚀🚀🚀🔥🔥🎉The recent data showing some of the largest crypto outflows since 2022 has caught my attention, and it’s worth reflecting on what this means beyond headlines. When we talk about outflows at this scale, we are not talking about random fluctuation we are witnessing a shift in sentiment, capital rotation, and investor psychology that can shape market structure for months or even years.

Outflows at this level typically indicate that participants are reallocating risk, de‑risking positions, or seeking liquidity el

🚀🚀🚀🚀🔥🔥🎉The recent data showing some of the largest crypto outflows since 2022 has caught my attention, and it’s worth reflecting on what this means beyond headlines. When we talk about outflows at this scale, we are not talking about random fluctuation we are witnessing a shift in sentiment, capital rotation, and investor psychology that can shape market structure for months or even years.

Outflows at this level typically indicate that participants are reallocating risk, de‑risking positions, or seeking liquidity el

- Reward

- 5

- 3

- Repost

- Share

Ryakpanda :

:

Wishing you great wealth in the Year of the Horse 🐴View More

#BiggestCryptoOutflowsSince2022

The crypto market is witnessing the largest capital outflows since the 2022 bear cycle — and this isn’t just a number headline. It’s a sentiment shift.

Recent data shows heavy withdrawals from Bitcoin and Ethereum investment products, with spot ETFs seeing notable redemptions. Major asset managers like BlackRock have recorded significant movements in products such as the iShares Bitcoin Trust, adding pressure to short-term liquidity.

🔎 Market Breakdown

1️⃣ Institutional Risk-Off Mode

When large funds reduce exposure, it typically signals caution. Institutions

The crypto market is witnessing the largest capital outflows since the 2022 bear cycle — and this isn’t just a number headline. It’s a sentiment shift.

Recent data shows heavy withdrawals from Bitcoin and Ethereum investment products, with spot ETFs seeing notable redemptions. Major asset managers like BlackRock have recorded significant movements in products such as the iShares Bitcoin Trust, adding pressure to short-term liquidity.

🔎 Market Breakdown

1️⃣ Institutional Risk-Off Mode

When large funds reduce exposure, it typically signals caution. Institutions

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

242.79K Popularity

869.07K Popularity

10.63M Popularity

97.28K Popularity

510.76K Popularity

295.32K Popularity

61.77K Popularity

40.06K Popularity

27.54K Popularity

25.44K Popularity

25.74K Popularity

22.41K Popularity

24.91K Popularity

51.68K Popularity

News

View MoreSharplink Ethereum holdings increase to 867,000 coins, valued at approximately $1.68 billion, with institutional investors' share rising to 46%

2 m

Data: Hyperliquid platform whales currently hold positions worth $3.01 billion, with a long-short position ratio of 1.

5 m

Market Report: Top 5 Cryptocurrency Gainers on February 20, 2026, led by Kite

6 m

Metaplanet responds to "dishonest information disclosure": Contrary to the facts, the long-term systematic accumulation of BTC remains unchanged.

6 m

Tether CEO: XAUT, worth 94 tons of gold, has completed on-chain transfer with a total fee of only 0.0016%

9 m

Pin