#AltcoinDivergence

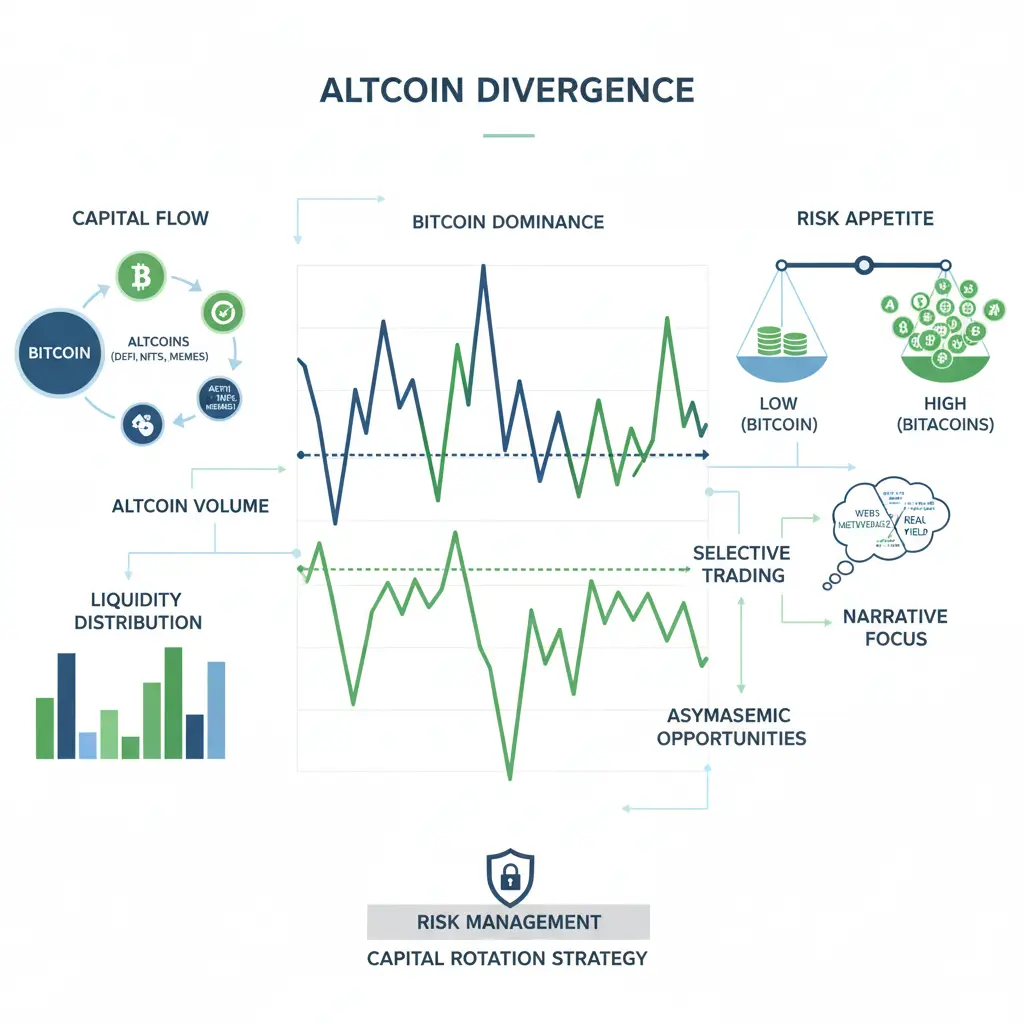

In the crypto market, prices don’t always move as one unified force. While Bitcoin often leads overall market direction, there are many periods when altcoins behave very differently—either underperforming or dramatically outperforming BTC. This behavior is known as Altcoin Divergence, and it plays a crucial role in understanding market cycles, capital rotation, liquidity flow, and risk dynamics. Recognizing altcoin divergence helps traders and investors identify where money is moving, which sectors are gaining attention, and when market conditions are shifting beneath the surface.

Altcoin Divergence: A Complete Market-Level Breakdown

Altcoin Divergence is not just a short-term trading signal—it’s a structural market behavior that reflects how capital, risk appetite, narratives, and liquidity interact inside the crypto ecosystem. When understood properly, it explains why some coins explode 50–300% while others barely move, even though Bitcoin dominates headlines.

This phenomenon becomes especially important during late BTC rallies, mid-cycle pauses, and pre–altcoin season phases.

1. Price Action Divergence (Core Concept)

At its core, altcoin divergence occurs when altcoin price performance deviates from Bitcoin’s trend.

Common price-based divergence scenarios:

BTC +5% | Altcoins −5% to −15%

→ Capital concentrating into Bitcoin (risk-off behavior)

BTC flat (±1%) | Altcoins +10% to +60%

→ Early-stage altcoin rotation

BTC −5% | Strong altcoins +15% to +40%

→ Narrative-driven divergence (rare but powerful)

BTC +20% | Altcoins +0–5%

→ BTC dominance expansion phase

Price divergence is measured relative, not absolute. A +3% altcoin move during a −4% BTC session is strong divergence.

2. Percentage Performance Spread (BTC vs Altcoins)

Professional traders track performance spread, not raw gains.

Example over 14 days:

Bitcoin: +18%

ETH: +6%

Mid-cap altcoins: −8%

Low-cap narratives: +40% to +120%

This tells us:

Large capital stayed in BTC

Selective speculation moved into niche sectors

Broad altcoin market remained suppressed

That spread is divergence.

The wider the spread, the more fragmented the market becomes.

3. Bitcoin Dominance (BTC.D) Dynamics

Bitcoin Dominance is the backbone indicator of altcoin divergence.

Key dominance zones:

BTC.D rising (↑):

Altcoins underperform

Liquidity exits smaller caps

BTC seen as capital anchor

BTC.D flat:

Selective altcoin divergence

Sector-based pumps (AI, RWA, memes)

BTC.D falling (↓):

Broad altcoin participation

Beginning of altcoin season

Higher volatility across pairs

Even a 1–2% shift in BTC.D can trigger double-digit altcoin moves due to thinner liquidity.

4. Liquidity Structure & Market Depth

Liquidity is where divergence becomes dangerous—or profitable.

Bitcoin:

Deep order books

Tight spreads

Can absorb large sell/buy orders

Altcoins:

Thin books

Wide spreads

Prone to slippage

During divergence:

BTC may move 2–3% smoothly

Altcoins may spike 20–50% in minutes

But can retrace just as fast

Low liquidity exaggerates divergence—both up and down.

5. Volume Analysis (Smart Money Clues)

Volume tells you who is driving divergence.

Healthy divergence volume:

Gradual volume increase

Higher lows in volume

Price holds gains

Dangerous divergence volume:

Sudden volume spike

One or two candles dominate

Price fades quickly

Common pattern:

BTC volume declines → capital pauses

Altcoin volume rises → speculative rotation

If BTC volume suddenly returns → altcoin reversal risk increases

Volume divergence often precedes price divergence.

6. Capital Rotation Mechanics

Altcoin divergence is powered by rotation, not new money.

Typical flow:

Stablecoins → Bitcoin

Bitcoin profits → ETH

ETH profits → Large-cap alts

Large-cap alts → Mid & low caps

Cycle resets back to BTC

If rotation stalls at step 1 or 2, altcoins diverge negatively.

If rotation reaches steps 3–4, divergence favors altcoins.

7. Narrative-Based Divergence

Not all altcoins diverge together.

Examples:

AI tokens pumping while DeFi stagnates

Memecoins flying while Layer-2s bleed

RWA projects outperforming everything else

This creates internal altcoin divergence, where:

80% of altcoins are red

10% are flat

10% are up triple digits

Narrative > fundamentals in short-term divergence.

8. Correlation Breakdown

Normally:

Altcoins correlate 0.7–0.9 with BTC

During divergence:

Correlation drops to 0.2–0.4

Some pairs go fully independent

Low correlation =

Higher opportunity

Higher risk

Faster reversals

Correlation returning upward often ends divergence.

9. Volatility Expansion

Altcoin divergence almost always increases volatility:

Daily ranges expand from 5% → 15–30%

Wicks become larger

Stop hunts become frequent

Outperformance comes at the cost of emotional pressure and execution risk.

10. Risk Factors During Altcoin Divergence

Fake breakouts

Low-liquidity traps

Overextended percentage moves

Rapid sentiment flips

Dependency on BTC stability

Altcoins often:

Rise faster than BTC

Fall harder than BTC

Divergence amplifies both outcomes.

11. Strategic Takeaway

Altcoin divergence is not a signal to buy everything.

It’s a signal to:

Be selective

Track dominance and volume

Respect liquidity

Manage position size

The best opportunities appear when:

BTC stabilizes

Dominance stops rising

Altcoin volume quietly builds

Final Thought

Altcoin divergence is the market telling you capital is choosing favorites.

Not every coin will run. Not every pump will last.

Those who understand price percentage spreads, liquidity depth, volume behavior, and rotation timing survive—and outperform—those chasing noise.

In crypto, divergence isn’t chaos.

It’s information.

In the crypto market, prices don’t always move as one unified force. While Bitcoin often leads overall market direction, there are many periods when altcoins behave very differently—either underperforming or dramatically outperforming BTC. This behavior is known as Altcoin Divergence, and it plays a crucial role in understanding market cycles, capital rotation, liquidity flow, and risk dynamics. Recognizing altcoin divergence helps traders and investors identify where money is moving, which sectors are gaining attention, and when market conditions are shifting beneath the surface.

Altcoin Divergence: A Complete Market-Level Breakdown

Altcoin Divergence is not just a short-term trading signal—it’s a structural market behavior that reflects how capital, risk appetite, narratives, and liquidity interact inside the crypto ecosystem. When understood properly, it explains why some coins explode 50–300% while others barely move, even though Bitcoin dominates headlines.

This phenomenon becomes especially important during late BTC rallies, mid-cycle pauses, and pre–altcoin season phases.

1. Price Action Divergence (Core Concept)

At its core, altcoin divergence occurs when altcoin price performance deviates from Bitcoin’s trend.

Common price-based divergence scenarios:

BTC +5% | Altcoins −5% to −15%

→ Capital concentrating into Bitcoin (risk-off behavior)

BTC flat (±1%) | Altcoins +10% to +60%

→ Early-stage altcoin rotation

BTC −5% | Strong altcoins +15% to +40%

→ Narrative-driven divergence (rare but powerful)

BTC +20% | Altcoins +0–5%

→ BTC dominance expansion phase

Price divergence is measured relative, not absolute. A +3% altcoin move during a −4% BTC session is strong divergence.

2. Percentage Performance Spread (BTC vs Altcoins)

Professional traders track performance spread, not raw gains.

Example over 14 days:

Bitcoin: +18%

ETH: +6%

Mid-cap altcoins: −8%

Low-cap narratives: +40% to +120%

This tells us:

Large capital stayed in BTC

Selective speculation moved into niche sectors

Broad altcoin market remained suppressed

That spread is divergence.

The wider the spread, the more fragmented the market becomes.

3. Bitcoin Dominance (BTC.D) Dynamics

Bitcoin Dominance is the backbone indicator of altcoin divergence.

Key dominance zones:

BTC.D rising (↑):

Altcoins underperform

Liquidity exits smaller caps

BTC seen as capital anchor

BTC.D flat:

Selective altcoin divergence

Sector-based pumps (AI, RWA, memes)

BTC.D falling (↓):

Broad altcoin participation

Beginning of altcoin season

Higher volatility across pairs

Even a 1–2% shift in BTC.D can trigger double-digit altcoin moves due to thinner liquidity.

4. Liquidity Structure & Market Depth

Liquidity is where divergence becomes dangerous—or profitable.

Bitcoin:

Deep order books

Tight spreads

Can absorb large sell/buy orders

Altcoins:

Thin books

Wide spreads

Prone to slippage

During divergence:

BTC may move 2–3% smoothly

Altcoins may spike 20–50% in minutes

But can retrace just as fast

Low liquidity exaggerates divergence—both up and down.

5. Volume Analysis (Smart Money Clues)

Volume tells you who is driving divergence.

Healthy divergence volume:

Gradual volume increase

Higher lows in volume

Price holds gains

Dangerous divergence volume:

Sudden volume spike

One or two candles dominate

Price fades quickly

Common pattern:

BTC volume declines → capital pauses

Altcoin volume rises → speculative rotation

If BTC volume suddenly returns → altcoin reversal risk increases

Volume divergence often precedes price divergence.

6. Capital Rotation Mechanics

Altcoin divergence is powered by rotation, not new money.

Typical flow:

Stablecoins → Bitcoin

Bitcoin profits → ETH

ETH profits → Large-cap alts

Large-cap alts → Mid & low caps

Cycle resets back to BTC

If rotation stalls at step 1 or 2, altcoins diverge negatively.

If rotation reaches steps 3–4, divergence favors altcoins.

7. Narrative-Based Divergence

Not all altcoins diverge together.

Examples:

AI tokens pumping while DeFi stagnates

Memecoins flying while Layer-2s bleed

RWA projects outperforming everything else

This creates internal altcoin divergence, where:

80% of altcoins are red

10% are flat

10% are up triple digits

Narrative > fundamentals in short-term divergence.

8. Correlation Breakdown

Normally:

Altcoins correlate 0.7–0.9 with BTC

During divergence:

Correlation drops to 0.2–0.4

Some pairs go fully independent

Low correlation =

Higher opportunity

Higher risk

Faster reversals

Correlation returning upward often ends divergence.

9. Volatility Expansion

Altcoin divergence almost always increases volatility:

Daily ranges expand from 5% → 15–30%

Wicks become larger

Stop hunts become frequent

Outperformance comes at the cost of emotional pressure and execution risk.

10. Risk Factors During Altcoin Divergence

Fake breakouts

Low-liquidity traps

Overextended percentage moves

Rapid sentiment flips

Dependency on BTC stability

Altcoins often:

Rise faster than BTC

Fall harder than BTC

Divergence amplifies both outcomes.

11. Strategic Takeaway

Altcoin divergence is not a signal to buy everything.

It’s a signal to:

Be selective

Track dominance and volume

Respect liquidity

Manage position size

The best opportunities appear when:

BTC stabilizes

Dominance stops rising

Altcoin volume quietly builds

Final Thought

Altcoin divergence is the market telling you capital is choosing favorites.

Not every coin will run. Not every pump will last.

Those who understand price percentage spreads, liquidity depth, volume behavior, and rotation timing survive—and outperform—those chasing noise.

In crypto, divergence isn’t chaos.

It’s information.