Post content & earn content mining yield

placeholder

Psalm

⚠️⚠️ JUST IN: The gold market has expanded by $740 billion in market value within the last 18 hours.

- Reward

- like

- Comment

- Repost

- Share

Wise signals rapid growth in volumes and customers - #cryptocurrency #bitcoin #altcoins

BTC-3,78%

- Reward

- like

- Comment

- Repost

- Share

BTCX

BTCX

Created By@Gate.io

Subscription Progress

0.00%

MC:

$0

Create My Token

NFTs are so back!

McDonald’s just changed their banner to a Doodles banner🔥

McDonald’s just changed their banner to a Doodles banner🔥

- Reward

- 1

- Comment

- Repost

- Share

"Wall Street never changes, the pockets change, the suckers change, the stocks change, but Wall Street never changes because human nature never changes."

• Jesse Lauriston Livermore

• Jesse Lauriston Livermore

- Reward

- like

- Comment

- Repost

- Share

JUST IN: Treasury Secretary Scott Bessent reaffirms President Trump's push for US #crypto leadership and strategic #bitcoin reserve. #CryptoScam

$BTC

$BTC

- Reward

- like

- Comment

- Repost

- Share

My Gate 2025 Year-End Summary is here! See how I performed this year.

Click the link to view your exclusive #2025GateYearEndSummary and claim a 20 USDT Position Voucher. https://www.gate.com/competition/your-year-in-review-2025?ref=VLEVUAGNAA&ref_type=126

Click the link to view your exclusive #2025GateYearEndSummary and claim a 20 USDT Position Voucher. https://www.gate.com/competition/your-year-in-review-2025?ref=VLEVUAGNAA&ref_type=126

- Reward

- like

- Comment

- Repost

- Share

Gold prices, after a massive 63% surge in 2025, continued their momentum in the first weeks of 2026, reaching a new record high of over $4,750 per ounce. Behind this rally are central bank gold purchases, particularly concentrated in Asia, a surge in individual demand in China and India, geopolitical tensions (such as Iran-focused protests in the Middle East and signals of US intervention), Fed interest rate cuts, a weakening US dollar, and global economic uncertainties – all triggering investors' search for safe havens and highlighting gold as a new asset class. Analysts predict that if these

- Reward

- 8

- 15

- Repost

- Share

Kai_Zen :

:

HODL Tight 💪View More

🗽 CFTC Chairman says, "Congress is now on the cusp of enacting the Digital Asset Market Clarity Act."

"We will ensure that these markets flourish at home with tailored regulatory frameworks." #regulation

#crypto

"We will ensure that these markets flourish at home with tailored regulatory frameworks." #regulation

#crypto

- Reward

- like

- Comment

- Repost

- Share

$DUSK continues to show relative strength despite recent volatility, recovering cleanly from the 0.205 demand zone and pushing back toward 0.226. This recovery suggests buyers remain active and the broader bullish structure is still intact. Immediate support is now located at 0.218–0.215, which should act as demand on pullbacks. As long as price holds above this zone, continuation remains favored. Resistance is positioned at 0.235–0.240, followed by a major supply zone near 0.250. A clean breakout and hold above 0.240 would open the next upside target at 0.275. Loss of 0.215 would signal a dee

DUSK6,52%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Powell attends Jerome Cook Supreme Court hearing, with policy direction likely to impact market confidence

- Reward

- like

- Comment

- Repost

- Share

DBtc

大吉大利

Created By@AsHasBeen

Listing Progress

0.05%

MC:

$3.38K

Create My Token

#15 on Dex

Push $XAir to #1 trending on DEX

Push $XAir to #1 trending on DEX

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Cryptocurrency Today: Bitcoin, Ethereum, and XRP continue their price correction amid risk-off sentiment due to escalating geopolitical tensions.

Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) prices continued to decline on Tuesday as risk appetite waned amid rising geopolitical tensions over Greenland.

U.S. President Donald Trump posted on his Truth Social account on Tuesday that he spoke with NATO Secretary General (NATO) about Greenland. Trump explained that Greenland is "vital to national and global security," and confirmed plans to hold multi-party discussions at the upcoming World Econo

View OriginalBitcoin (BTC), Ethereum (ETH), and Ripple (XRP) prices continued to decline on Tuesday as risk appetite waned amid rising geopolitical tensions over Greenland.

U.S. President Donald Trump posted on his Truth Social account on Tuesday that he spoke with NATO Secretary General (NATO) about Greenland. Trump explained that Greenland is "vital to national and global security," and confirmed plans to hold multi-party discussions at the upcoming World Econo

- Reward

- 1

- 1

- Repost

- Share

Before00zero :

:

Bitcoin price continues its correction, falling below $91,000 on Tuesday amid escalating geopolitical tensions over Greenland.Spin to Win has been upgraded with a brand-new dual prize pool system, offering progressive rewards for new users and shared benefits for existing users. New users can complete growth tasks to unlock more spins and share a $70,000 USDT cash prize pool, while existing users can spin for cash airdrops ranging from 1 to 888 USDT. https://www.gate.com/campaigns/3884?ref=U1BABw0N&ref_type=132

- Reward

- like

- Comment

- Repost

- Share

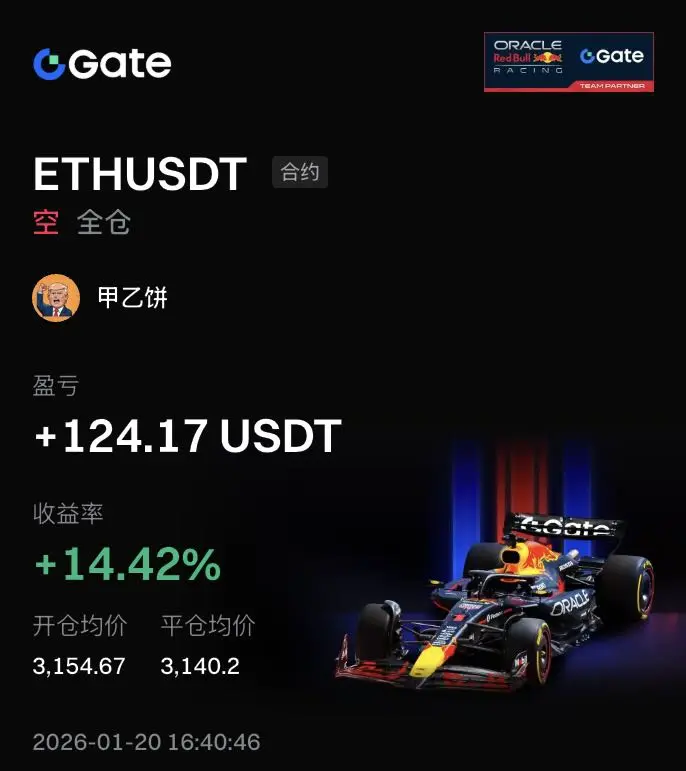

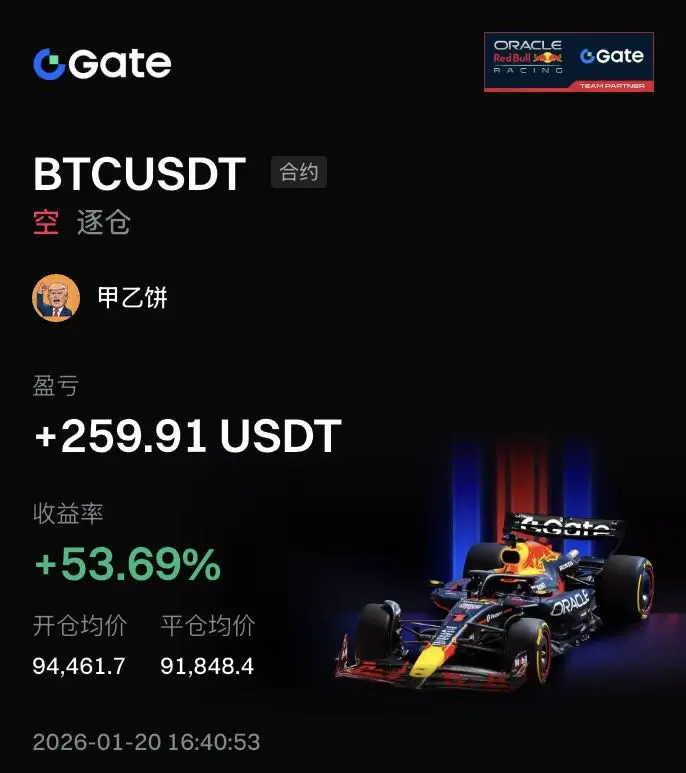

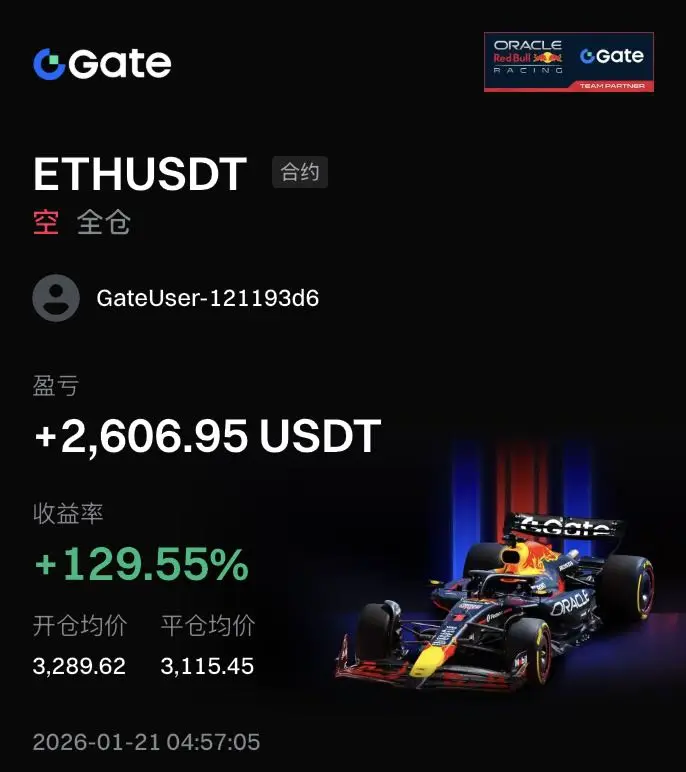

Walked against the wind,

Position has been exited.

View OriginalPosition has been exited.

- Reward

- 3

- 2

- Repost

- Share

GateUser-09e11b15 :

:

How to subscribeView More

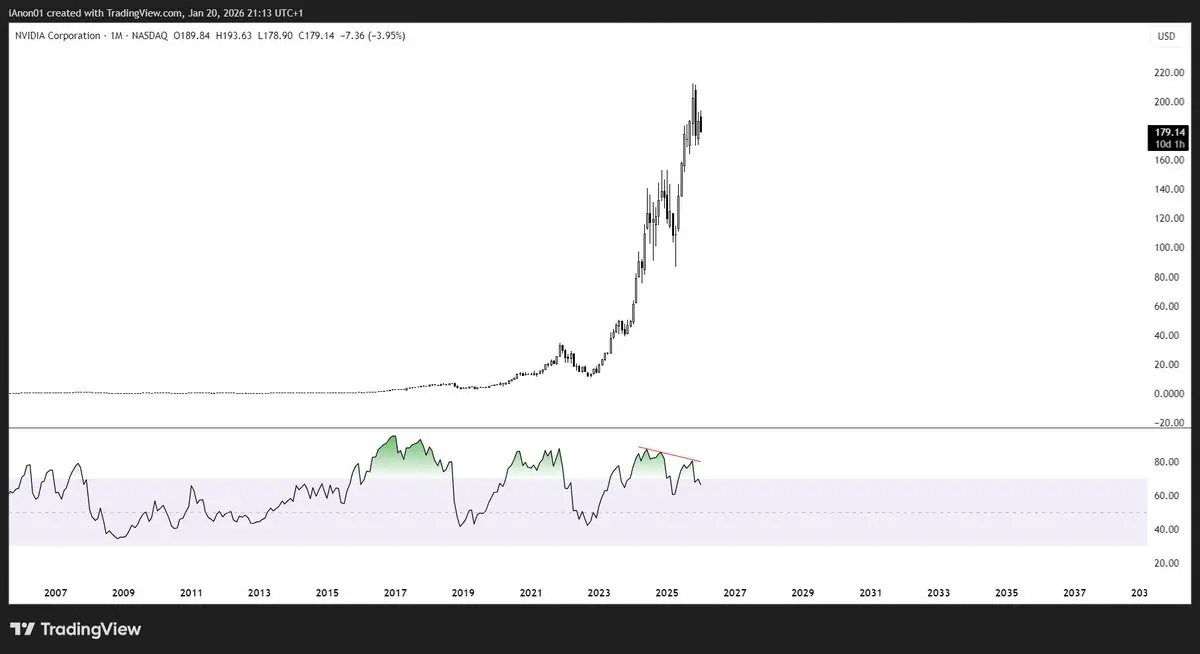

$NVDA | Toppish, $141.

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More12.41K Popularity

39.97K Popularity

52.69K Popularity

14.24K Popularity

10.08K Popularity

News

View MoreThe three major US stock indices plummeted, Nvidia fell over 4%

1 h

The US Dollar Index fell 0.41%, closing at 98.642

1 h

Data: 1,928,900 TON transferred from wallet_v4r2, worth approximately $2,951,200.

1 h

Data: 492.18 BTC transferred from anonymous addresses, worth approximately $44.03 million

1 h

Data: In the past 24 hours, the entire network has been liquidated for a total of $709 million, with long positions liquidated for $649 million and short positions liquidated for $60.451 million.

2 h

Pin