Post content & earn content mining yield

placeholder

CryptoAnu

#Bitcoin rejected again at the 50 MA.\nBulls still can’t reclaim it.\nUntil that flips → rallies are suspect.\n\nEyes on NY session. 👀

BTC-1,5%

- Reward

- like

- Comment

- Repost

- Share

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/3905?ref=VVNDAQHEUQ&ref_type=132

- Reward

- like

- Comment

- Repost

- Share

#TariffTensionsHitCryptoMarket #TariffTensionsHitCryptoMarket

Global trade wars aren’t just headlines—they’re now bleeding directly into crypto markets, and if you’re still thinking Bitcoin or altcoins move in isolation, you’re already behind. Tariffs are no longer “traditional market noise.” They are catalysts for volatility, liquidity crunches, and rapid sentiment swings that can wipe out unprepared traders in hours.

The reality:

• Investor psychology is shifting fast. Every new tariff announcement triggers a spike in uncertainty. Investors who chased late-2025 rallies are suddenly questioni

Global trade wars aren’t just headlines—they’re now bleeding directly into crypto markets, and if you’re still thinking Bitcoin or altcoins move in isolation, you’re already behind. Tariffs are no longer “traditional market noise.” They are catalysts for volatility, liquidity crunches, and rapid sentiment swings that can wipe out unprepared traders in hours.

The reality:

• Investor psychology is shifting fast. Every new tariff announcement triggers a spike in uncertainty. Investors who chased late-2025 rallies are suddenly questioni

- Reward

- 2

- 1

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊fkriver

river似母

Created By@JustDoIt,Brothers.

Listing Progress

0.00%

MC:

$0.1

Create My Token

$ETH \n12-hour chart\n\nSame pattern as Bitcoin. \n\nThe upward-trending range scenario is slowly getting confirmed. \n\nIf we got a close above 3100$, then $ETH will definitely be in a range. \n\nThe next days will decide whether or not this "range" setup gets confirmed. \n\nIn addition to that, we also have a weekly order block area between 2800-2900$ that has been holding so far.

- Reward

- like

- Comment

- Repost

- Share

NEW: 🟠 Strive to raise $150M through a public offering of its Variable Rate Series A #Perpetual Preferred Stock to pay down Semler Scientific’s debt and support their #Bitcoin acquisition strategy. #crypto\n\n$BTC

- Reward

- 1

- Comment

- Repost

- Share

After the US stocks, Bitcoin continues to fall, dropping to around 8.91 near 2947. We have about 1000/70 room to move between 9.01 million and around 3018. Another perfect day! #欧美关税风波冲击市场

BTC-1,5%

- Reward

- like

- Comment

- Repost

- Share

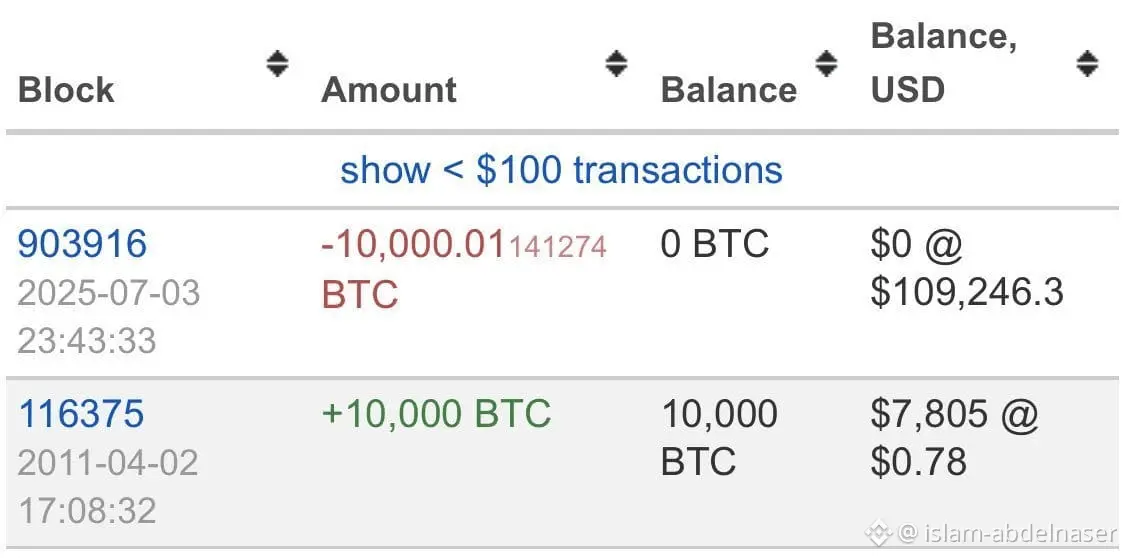

Imagine the nerves needed to hold 10,000 Bitcoin from 2011 to 2025 🤯

Bought at $0.78 per unit = $7,805 total

Sold at $109,246 per unit = $1.09 billion

And transferred everything with a single click without experience 💀

14 years of patience.

View OriginalBought at $0.78 per unit = $7,805 total

Sold at $109,246 per unit = $1.09 billion

And transferred everything with a single click without experience 💀

14 years of patience.

- Reward

- like

- Comment

- Repost

- Share

Today is Usagi's birthday, but it doesn't make wishes or blow out candles. It chooses to keep running in the loudest places in the market. Birthdays for Usagi are not about commemorating the past, but a reminder: emotions, speed, and consensus are the true fuels of memes. The vigor of the Year of the Horse makes it inherently restless, and Usagi's madness makes every wild run seem justified. No roadmap as a gift, no promises as cake, only memes, laughter, and faith created by the community continuing to ferment. Today is not about celebrating a character, but about celebrating this ongoing mem

View Original

[The user has shared his/her trading data. Go to the App to view more.]

MC:$3.87KHolders:2

0.00%

- Reward

- like

- Comment

- Repost

- Share

hihihihihihohihihihihihihihihihihhijhihhhhhihhiiujhghhhhghjhhhhhuiihhhjjjhghjjjvhhjjjhhbbjkjjjjjjhihi btc #JoinGateTradFitoWinGoldPack

BTC-1,5%

- Reward

- like

- Comment

- Repost

- Share

2.1 million!

Holding the position longer increased the profit by 30,000 USD, awesome!!

View OriginalHolding the position longer increased the profit by 30,000 USD, awesome!!

- Reward

- like

- Comment

- Repost

- Share

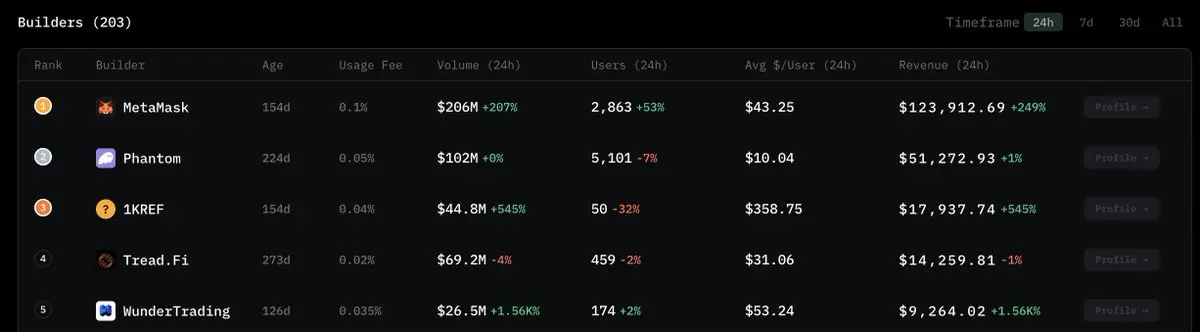

MetaMask printing on those Builder Code Fees\n\nOnly on\n\nHyperliquid

- Reward

- like

- Comment

- Repost

- Share

孔子

孔子

Created By@PiggyFromTheOcean

Listing Progress

100.00%

MC:

$25.99K

Create My Token

$NQ nice impulsive reclaim of support and D1 12/21/50ema but what is it going to take to breakout above the PMH and the previous deviation and back into price discovery? \n\nNo doubt PD will be aggressive if this is able to gain acceptance above that level.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- 3

- Repost

- Share

CurrencyFuller :

:

Just go for it💪View More

Seeing the four characters “Yanzan Angel,” a warm current wells up in my heart. This charitable foundation initiated and established by Mr. Li Yapeng and Ms. Wang Faye has been like a guiding light for many years, bringing smiles and new life to tens of thousands of children with cleft lip and palate. No matter how the outside world changes—storms and winds—“Yanzan Angel” has always been there, silently fulfilling its original vow—this pure and lasting kindness is worth each of us wholeheartedly supporting and protecting.

Talking about Li Yapeng, his life trajectory can be regarded as a roller

View OriginalTalking about Li Yapeng, his life trajectory can be regarded as a roller

- Reward

- 2

- 5

- Repost

- Share

Discovery :

:

Thank you for the helpful information 🙏🏻🥰View More

Bengbu is settled, made me laugh.

View Original- Reward

- like

- Comment

- Repost

- Share

#WarshLeadsFedChairRace

who is kevin warsh and why is he surging?

kevin warsh served on the federal reserve board from 2006 to 2011 and played a key role during the 2008 financial crisis. today he's a visiting fellow at stanford's hoover institution and frequently criticizes current fed policy. his main views include:

- advocating more aggressive rate hikes during high-inflation periods (classic hawkish stance)

- pushing for faster and more decisive balance-sheet runoff (quantitative tightening)

- favoring stricter bank regulation rather than lighter touch

- historically skeptical towar

who is kevin warsh and why is he surging?

kevin warsh served on the federal reserve board from 2006 to 2011 and played a key role during the 2008 financial crisis. today he's a visiting fellow at stanford's hoover institution and frequently criticizes current fed policy. his main views include:

- advocating more aggressive rate hikes during high-inflation periods (classic hawkish stance)

- pushing for faster and more decisive balance-sheet runoff (quantitative tightening)

- favoring stricter bank regulation rather than lighter touch

- historically skeptical towar

- Reward

- 5

- 7

- Repost

- Share

Discovery :

:

1000x VIbes 🤑View More

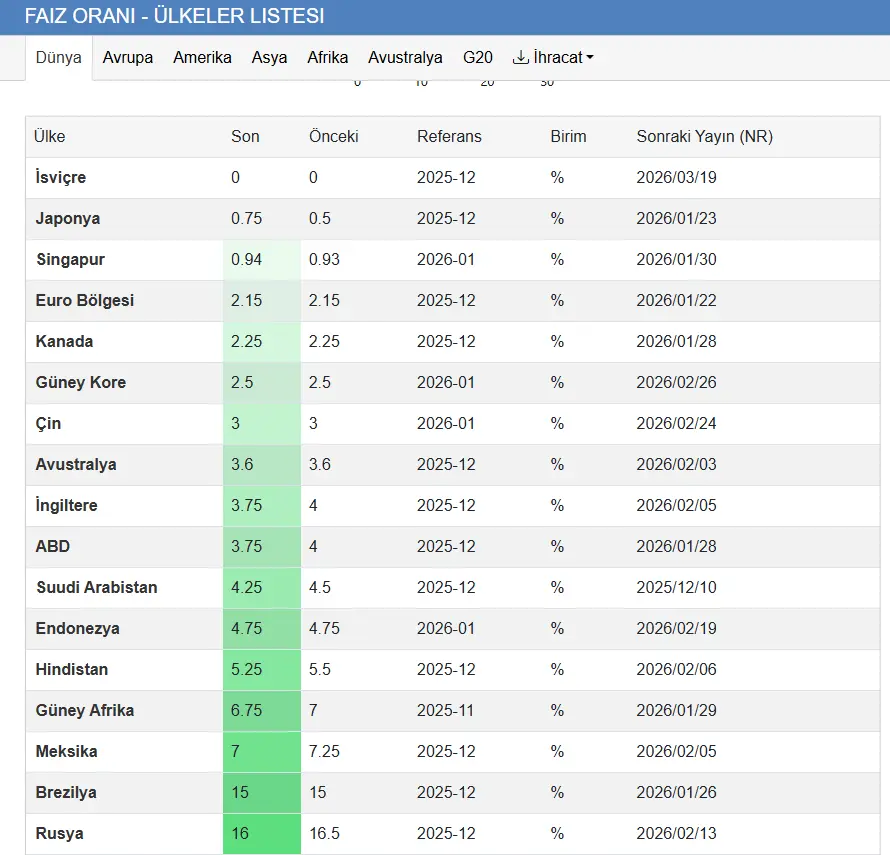

#Boj #Faiz #Bitcoin #BTC

Japan's interest rates are going to rise, fine, let them. What do they say about risky assets being so volatile, this way or that, and carry trades causing problems? After Switzerland, Japan still has the lowest interest rate!

In Switzerland, they don't lend to just anyone. So, were those who took out loans and engaged in carry trades buying my crypto? Were they entering the stock market?

Stop constantly spreading negativity and pessimism. Don't just translate and share what a few foreign, highly-followed herbalists are writing. 🤦♂️

Japan's interest rates are going to rise, fine, let them. What do they say about risky assets being so volatile, this way or that, and carry trades causing problems? After Switzerland, Japan still has the lowest interest rate!

In Switzerland, they don't lend to just anyone. So, were those who took out loans and engaged in carry trades buying my crypto? Were they entering the stock market?

Stop constantly spreading negativity and pessimism. Don't just translate and share what a few foreign, highly-followed herbalists are writing. 🤦♂️

BTC-1,5%

- Reward

- like

- Comment

- Repost

- Share

#嫣然生态 contributes to charity, with daily transaction fees announced daily in the community! Welcome everyone to supervise together!

View Original

[The user has shared his/her trading data. Go to the App to view more.]

MC:$14.98KHolders:19

40.71%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More55.96K Popularity

36.28K Popularity

20.97K Popularity

65.85K Popularity

346.93K Popularity

News

View MoreElon Musk is about to speak at the World Economic Forum

1 m

DDC Enterprise 新增持 200 枚 BTC,总持仓增至 1583 枚

1 m

Bitwise launches anti-currency depreciation ETF BPRO, investing in assets such as gold, Bitcoin, and silver

3 m

US November PCE data remains stable; the Federal Reserve is expected to keep interest rates unchanged next week

7 m

Bitmine increased its ETH holdings by $103.7 million in the past 24 hours

7 m

Pin