Xamanap

No content yet

xamanap

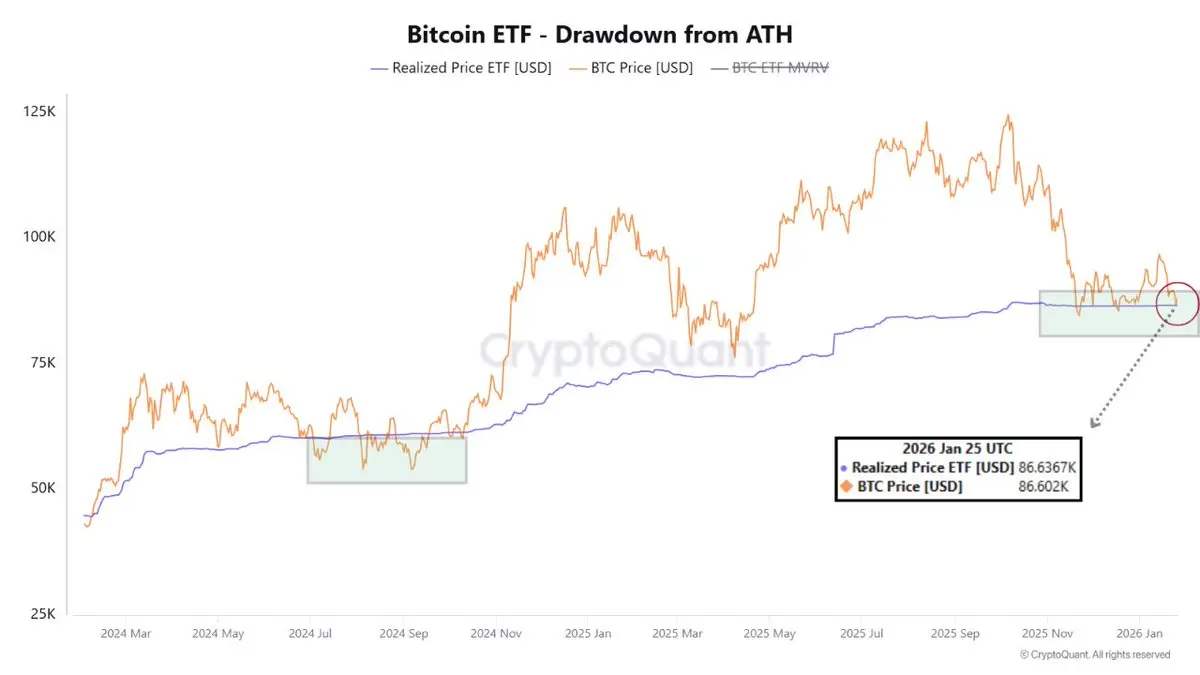

how my crypto bags looking rn.

- Reward

- like

- Comment

- Repost

- Share

my $COPPER being sent finally.

- Reward

- like

- Comment

- Repost

- Share

gm☕️training to hodl crypto

- Reward

- like

- Comment

- Repost

- Share

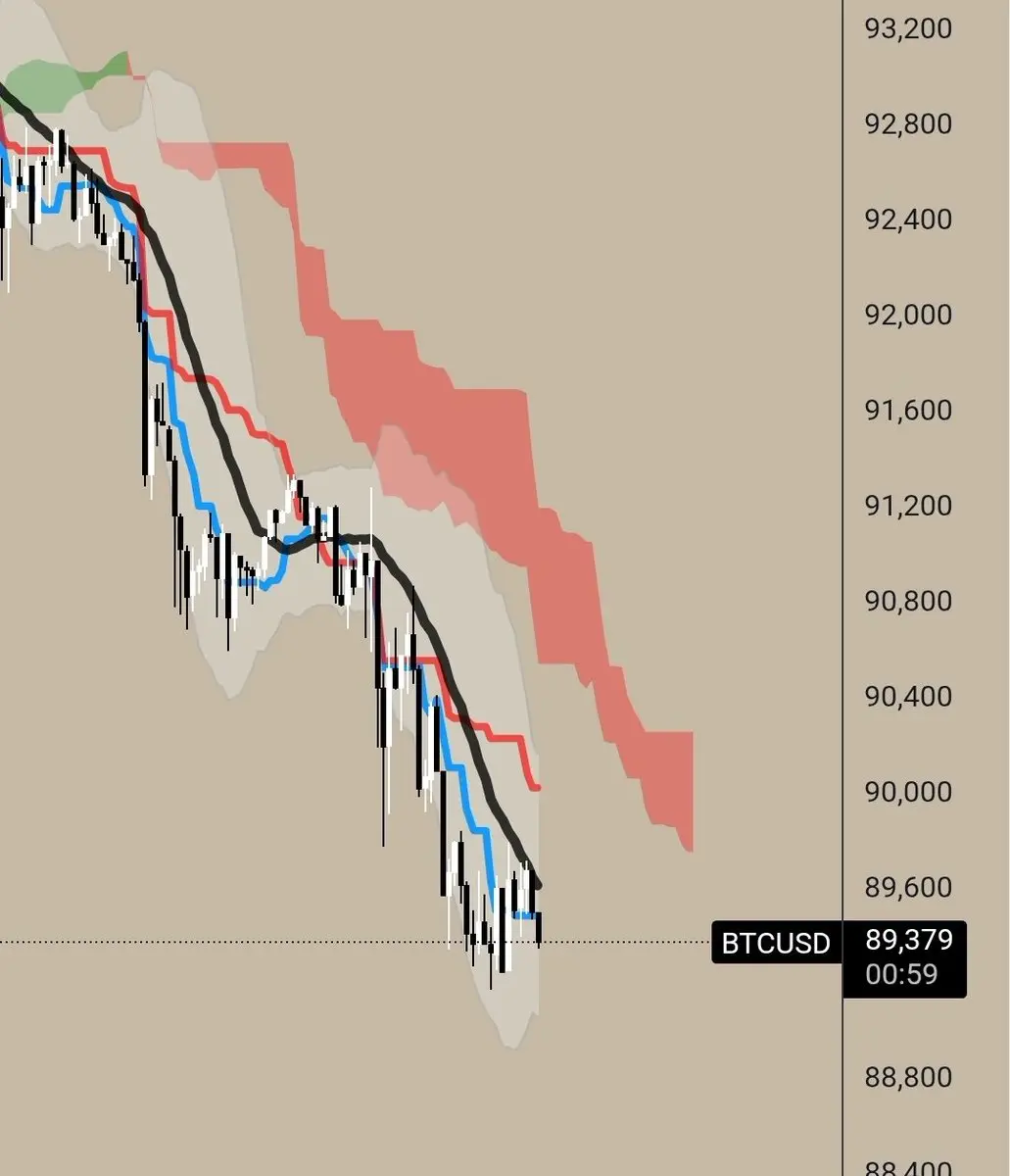

take most of the day off, check charts…

- Reward

- like

- Comment

- Repost

- Share

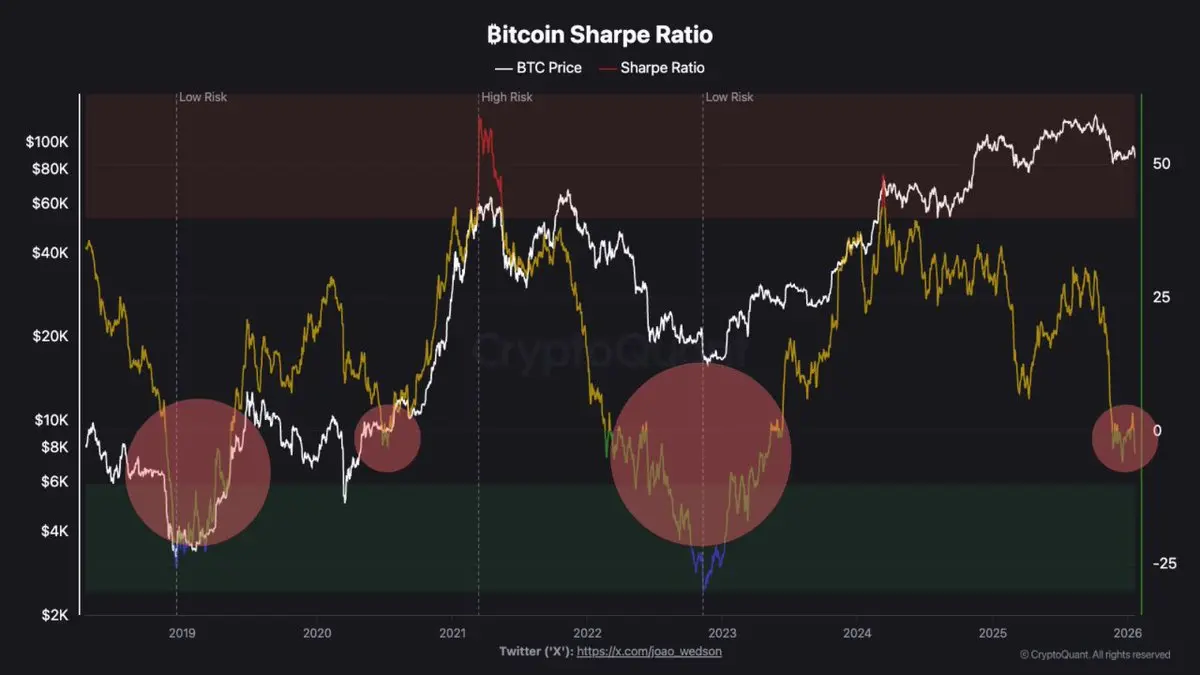

Bitcoin sharpe just nuked back below zero. this zone only shows up in full drawdowns phases. not a bottom call, just context.risk-adjusted returns are washed, vol did the damage, RR is resetting. this is where chop, boredom, and max doubt live before the next real move.

BTC-6,08%

- Reward

- like

- Comment

- Repost

- Share

gm☕️ im tired boss 😮💨

- Reward

- like

- Comment

- Repost

- Share

whale exchange inflows have dried up fast. after the November panic, large holders stopped sending size to .

selling pressure from whales has materially eased, with flows down roughly 3x.

this looks more like waiting and absorbing, not active distribution.

selling pressure from whales has materially eased, with flows down roughly 3x.

this looks more like waiting and absorbing, not active distribution.

- Reward

- like

- Comment

- Repost

- Share

VIX gap up🤔

- Reward

- like

- Comment

- Repost

- Share

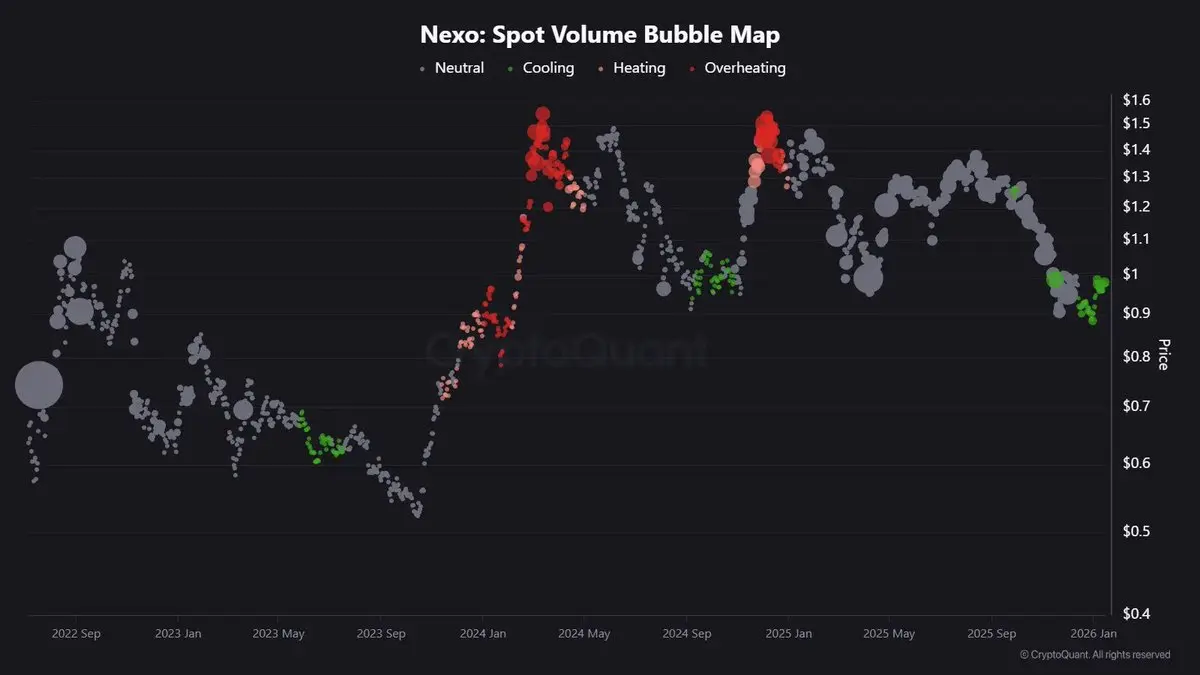

spot volume has cooled off and the froth is gone. smart money accumulating is quietly.

- Reward

- like

- Comment

- Repost

- Share