Ninisweet

No content yet

Ninisweet

When Trump initially issued his coin, it was even trending on Moments...

Now the team has moved 17 million in chips to the exchange themselves.

$TRUMP dropped from a high of $80 to now $3.4, a decline of over 95%. I don't know how many people are still trapped at the high.

Most people's fate is to be an unaware liquidity in someone else's story.

Now the team has moved 17 million in chips to the exchange themselves.

$TRUMP dropped from a high of $80 to now $3.4, a decline of over 95%. I don't know how many people are still trapped at the high.

Most people's fate is to be an unaware liquidity in someone else's story.

TRUMP-3,06%

- Reward

- 1

- 1

- Repost

- Share

HardToLeave,HardToPart :

:

Getting ready for the market trendAnnual loss of $70 million, stock price soars 35%.

This is the market pre-emptively buying into a story that hasn't happened yet.

Circle announced Q4 earnings yesterday: USDC circulation $75.3 billion, up 72% year-over-year; quarterly revenue $770 million, up 77% year-over-year; EBITDA surged 412%, the data indeed looks impressive.

But looking at the full-year data, net loss is $70 million.

The reason is that during IPO, they issued $424 million worth of stock incentives, which wiped out all profits in one go.

The market chose to ignore this and directly pushed the stock price from $

This is the market pre-emptively buying into a story that hasn't happened yet.

Circle announced Q4 earnings yesterday: USDC circulation $75.3 billion, up 72% year-over-year; quarterly revenue $770 million, up 77% year-over-year; EBITDA surged 412%, the data indeed looks impressive.

But looking at the full-year data, net loss is $70 million.

The reason is that during IPO, they issued $424 million worth of stock incentives, which wiped out all profits in one go.

The market chose to ignore this and directly pushed the stock price from $

View Original

- Reward

- 2

- Comment

- Repost

- Share

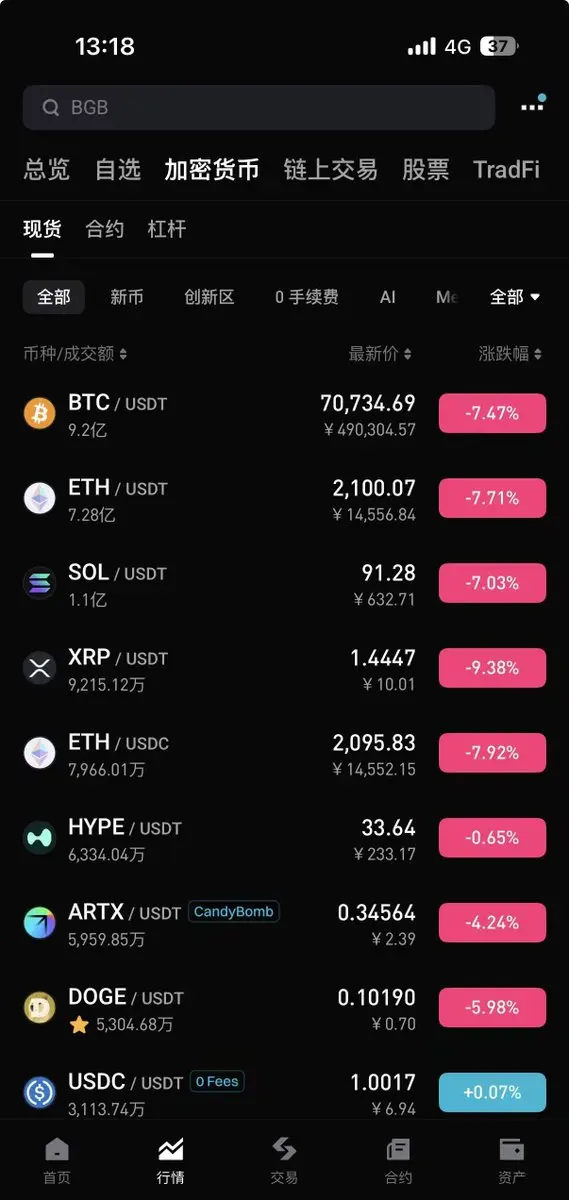

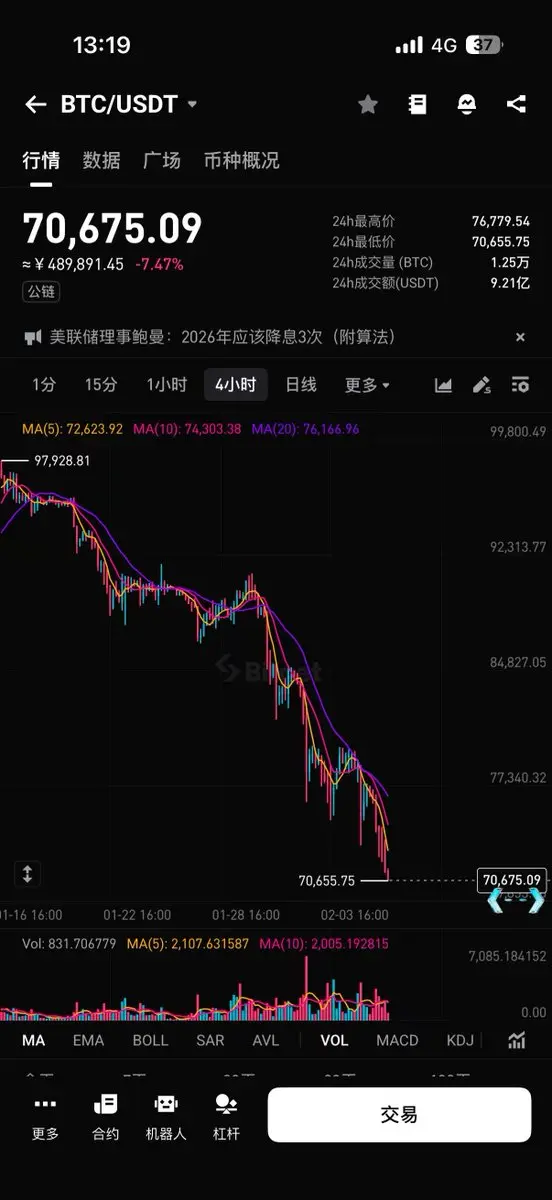

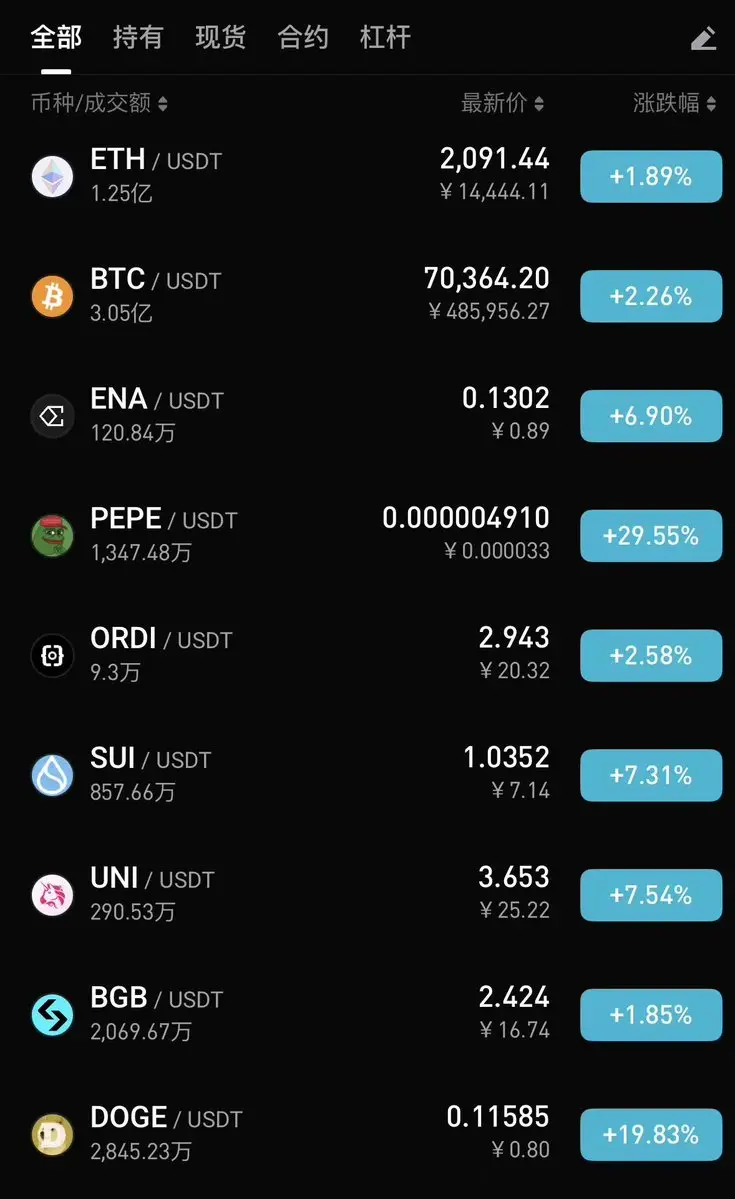

Why are all the altcoins starting to rise to varying degrees today?

View Original

- Reward

- 1

- Comment

- Repost

- Share

Hong Kong, which once completely banned crypto trading, is now rushing to become Asia's Web3 capital. Can you believe it?

Consensus has chosen Hong Kong as its location for two consecutive years, which is no coincidence. The Hong Kong government has issued 11 exchange licenses, hundreds of Web3 companies have set up operations, and a stablecoin license will be issued this quarter. Digital asset regulation legislation is scheduled to be introduced in the Legislative Council this summer.

From "ban everything outright" to "actively legislating to welcome it," Hong Kong has only taken two year

View OriginalConsensus has chosen Hong Kong as its location for two consecutive years, which is no coincidence. The Hong Kong government has issued 11 exchange licenses, hundreds of Web3 companies have set up operations, and a stablecoin license will be issued this quarter. Digital asset regulation legislation is scheduled to be introduced in the Legislative Council this summer.

From "ban everything outright" to "actively legislating to welcome it," Hong Kong has only taken two year

- Reward

- like

- Comment

- Repost

- Share

Seeing that the Federal Reserve is evaluating opening payment account access to non-bank institutions.

It must be said: the biggest threat to banks has always been within the system.

In the future, companies like Circle and PayPal might settle directly with the Fed, no longer needing to pay tolls to banks.

Currently, the awkward situation of stablecoins like USDC and USDT is that they are pegged to the US dollar, but every off-chain settlement has to go through banks, which can cut you off at any time. Last year, several crypto companies had their accounts closed because of this.

If the Fed tr

It must be said: the biggest threat to banks has always been within the system.

In the future, companies like Circle and PayPal might settle directly with the Fed, no longer needing to pay tolls to banks.

Currently, the awkward situation of stablecoins like USDC and USDT is that they are pegged to the US dollar, but every off-chain settlement has to go through banks, which can cut you off at any time. Last year, several crypto companies had their accounts closed because of this.

If the Fed tr

View Original

- Reward

- like

- Comment

- Repost

- Share

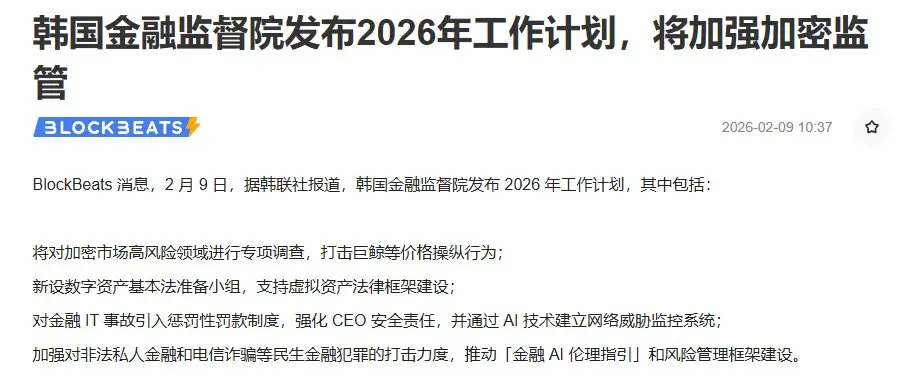

Korean regulators moved when no one was paying attention\nEveryone is watching the actions of the US SEC, but South Korea’s Financial Supervisory Service’s 2026 work plan directly targets the "weaknesses" of crypto.\nThree critical points: CEOs will be held criminally responsible for safety incidents, AI will be used to establish real-time risk control systems, and the promotion of "Financial AI Ethical Guidelines".\nWhile the global debate continues on whether cryptocurrencies should be compliant, South Korea has already started using AI to catch insider trading and leveraging criminal liabil

View Original

- Reward

- 1

- Comment

- Repost

- Share

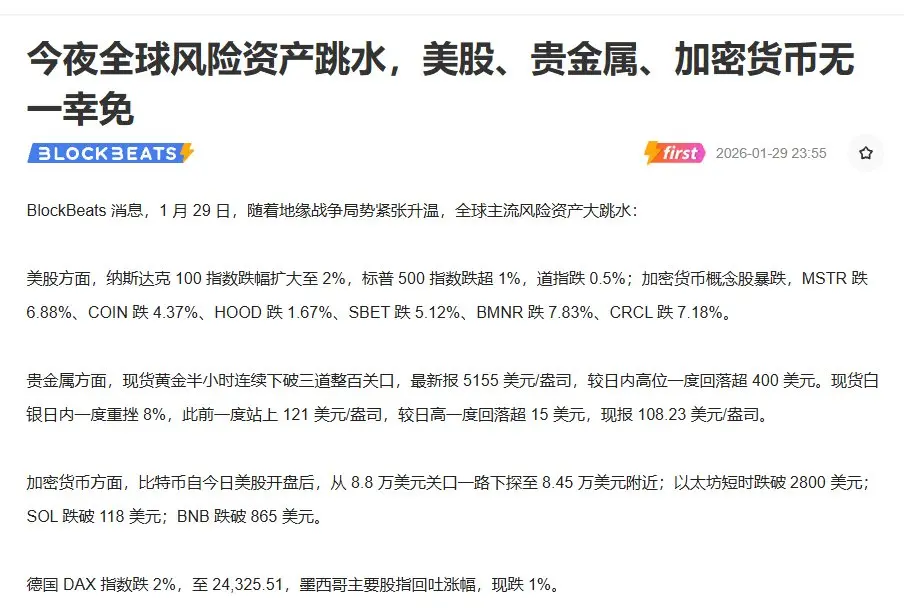

Gold just broke below the $5000 mark, and this might be the most expensive collective exit I have ever seen in my life. Everyone thinks gold is the safest haven, but last night it told us with a $3.5 trillion evaporation: when liquidity contracts, no asset is absolutely safe. This number is equivalent to the GDP of France, or in other words, all the wealth of the top ten global billionaires combined is not enough to fill this one night's deficit. Even the highly volatile $BTC , when combined, only accounts for enough to make it drop twice. When gold begins to experience a sudden plunge, it ind

BTC-0,05%

- Reward

- 1

- Comment

- Repost

- Share

No matter where there is a war, our wallets will suffer as soon as possible and wish for world peace 🙏

View Original

- Reward

- like

- Comment

- Repost

- Share

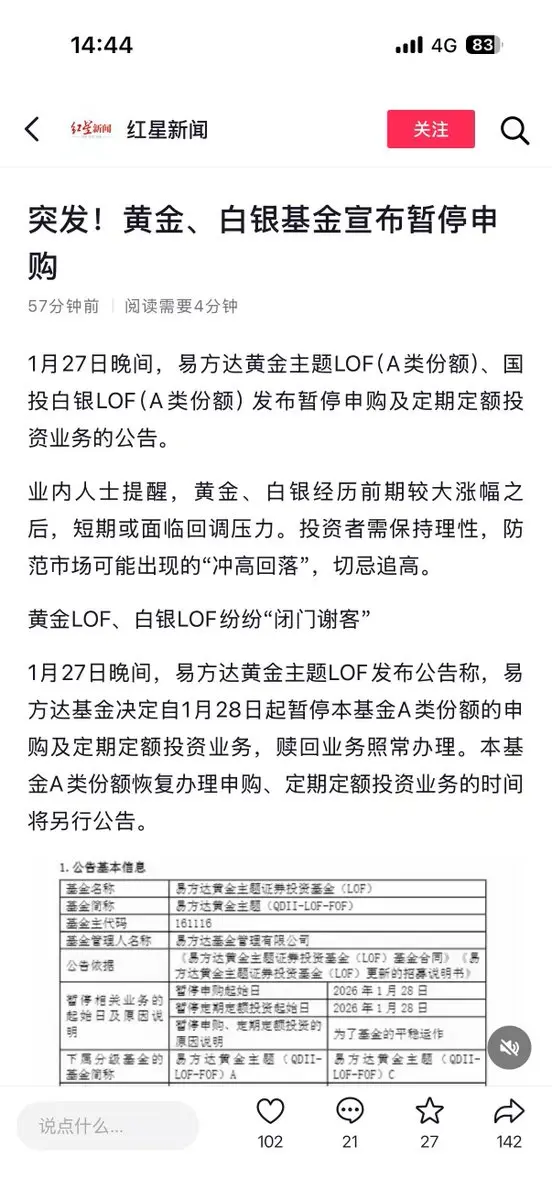

Gold and silver prices have surged so much that the domestic authorities directly "cut the internet line" to prevent purchases. E Fund issued a notice that all gold and silver funds have suspended subscriptions, and no matter how much money you have, you can't buy in. Are they afraid that everyone will rush in and become cannon fodder, or is there a crazier market rally coming? This wave of gold and silver prosperity is simply too crazy 🙂#黄金 # Silver

View Original

- Reward

- like

- 1

- Repost

- Share

ChongChongGeGeWu :

:

Reached the topGold $5000, Silver $106 Witness History, $BTC Last night’s drop was so shocking it made people question life. When the US Navy’s Lincoln aircraft carrier entered the Middle East, safe-haven funds voted with their feet: gold and silver surged wildly, while $BTC started a vertical decline. Where is the promised “digital gold”? Where is the consensus on safe-haven assets? The reality is that in the face of real gunfire and geopolitical crises, old money still only trusts tangible gold, and $BTC seems to have returned to its fundamental nature as a “risk asset.” “Ancient treasures in prosperous

BTC-0,05%

- Reward

- like

- Comment

- Repost

- Share

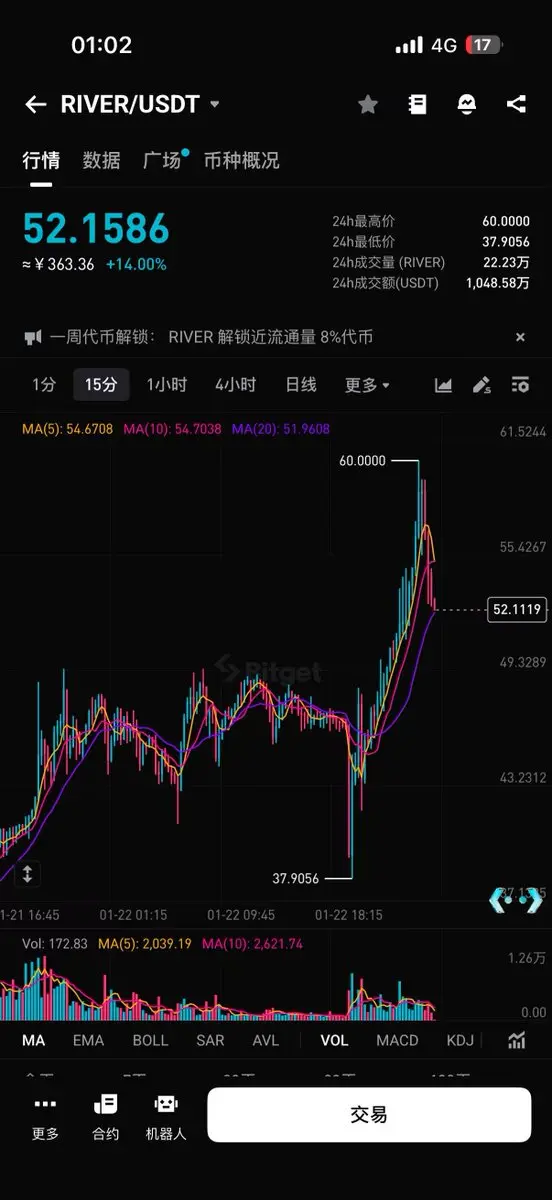

$RIVER Why is it so strong at pulling, it just hit 60 a moment ago\n\nIs there anyone who bought in single digits? Truly free now

View Original

- Reward

- like

- 7

- Repost

- Share

TurnIntoChangshengRoadFrom :

:

Raising spot prices is to widen the basis and absorb contract capital costs. The liquidity of the spot market is insufficient, and large players are controlling the market strongly. Essentially, the market is dominated by contracts. Starting from $40U, the big players have been offloading, and the contracts have been shrinking in volume. In the middle, on the afternoon of the 22nd, a V-shaped move occurred, and retail investors' long positions were absorbed, then pushed up to around $50, and continued to close positions. Now, they are betting on when the big players will finish offloading and start holding short positions to push the price down. Recently, the popular altcoins have been in a downward trend, making shorting uncomfortable. When the price dips slightly, retail investors' long positions get liquidated, causing a rebound.View More

This.\n\nJust about to say I missed today's Golden Dog\n\nHow did it just crash directly\n#bsc #memes

View Original

- Reward

- like

- Comment

- Repost

- Share

Yesterday, the NYSE officially announced that Wall Street is actually going on-chain.

This could be the most important signal in the crypto world in 2026.

The NYSE and its parent company ICE officially announced that they are developing a tokenized securities trading platform, which has already been submitted to the SEC for approval.

This platform offers 24/7 trading + instant settlement, so you can buy NVIDIA in the middle of the night or bottom out on weekends. Traditional US stocks require T+1 to access funds, but on-chain US stocks settle in seconds.

Fragmented trading + stablecoin payment

View OriginalThis could be the most important signal in the crypto world in 2026.

The NYSE and its parent company ICE officially announced that they are developing a tokenized securities trading platform, which has already been submitted to the SEC for approval.

This platform offers 24/7 trading + instant settlement, so you can buy NVIDIA in the middle of the night or bottom out on weekends. Traditional US stocks require T+1 to access funds, but on-chain US stocks settle in seconds.

Fragmented trading + stablecoin payment

- Reward

- like

- Comment

- Repost

- Share

Seeing the SEC delay two more crypto ETF decisions

One is the $PENGU filed by Cboe, and the other is the T. Rowe Price actively managed crypto ETF filed with NYSE.

The SEC's reason is very official, requiring more time to evaluate, extending the decision period by 45 days.

In fact, it just means the SEC hasn't decided how to handle it yet. Previously, spot Bitcoin and Ethereum ETFs were approved, and the market once thought the door to crypto ETFs was open.

But it now appears that the SEC's approval pace remains cautious, especially for this type of actively managed crypto ETF, which involves

View OriginalOne is the $PENGU filed by Cboe, and the other is the T. Rowe Price actively managed crypto ETF filed with NYSE.

The SEC's reason is very official, requiring more time to evaluate, extending the decision period by 45 days.

In fact, it just means the SEC hasn't decided how to handle it yet. Previously, spot Bitcoin and Ethereum ETFs were approved, and the market once thought the door to crypto ETFs was open.

But it now appears that the SEC's approval pace remains cautious, especially for this type of actively managed crypto ETF, which involves

- Reward

- like

- Comment

- Repost

- Share