BitLiuBei

No content yet

BitLiuBei

SOL

Sol confirmed the bottom with a second test yesterday, and the daily chart shows a lower shadow line starting to rebound, seeking upward resistance. Currently, the four-hour chart shows a top doji indicating weakened buying pressure, suggesting that an upward peak is in sight!

It is recommended to short the current position at 127 directly, reserve for additional shorting at 130, and watch for a break below the targets of 123-121-117 down to 111.

$SOL #十二月行情展望

Sol confirmed the bottom with a second test yesterday, and the daily chart shows a lower shadow line starting to rebound, seeking upward resistance. Currently, the four-hour chart shows a top doji indicating weakened buying pressure, suggesting that an upward peak is in sight!

It is recommended to short the current position at 127 directly, reserve for additional shorting at 130, and watch for a break below the targets of 123-121-117 down to 111.

$SOL #十二月行情展望

SOL9.92%

- Reward

- like

- Comment

- Repost

- Share

BNB

Currently in an hourly-level rebound, due to the weakening of the daily line and the decrease in bullish volume, the rebound will not reach too high, mainly focusing on shorting.

It is recommended to open a short position at 833 for the first warehouse, add to the short position at 845 for the second warehouse, and aim for targets at 817-801-790. If it breaks down, look for 732.

$BNB #十二月降息预测

Currently in an hourly-level rebound, due to the weakening of the daily line and the decrease in bullish volume, the rebound will not reach too high, mainly focusing on shorting.

It is recommended to open a short position at 833 for the first warehouse, add to the short position at 845 for the second warehouse, and aim for targets at 817-801-790. If it breaks down, look for 732.

$BNB #十二月降息预测

BNB6.11%

- Reward

- like

- Comment

- Repost

- Share

December 2 BTC/ETH strategy analysis:

Bending down and bowing, the rebound is only to soar higher!

The market finally saw a relatively strong rebound in the early morning. Don’t think that the market has reversed; the overall decline has been too large, and it’s unrealistic to expect an effective rebound to fix the market structure. Yesterday, I emphasized that before the rebound at 8830, the big coin had reached the take profit level after the US market at the 2850 line for both Kong and Auntie. Pay close attention to Trump's speech at 3:00 AM today!

BTC

In the early session, the daily li

View OriginalBending down and bowing, the rebound is only to soar higher!

The market finally saw a relatively strong rebound in the early morning. Don’t think that the market has reversed; the overall decline has been too large, and it’s unrealistic to expect an effective rebound to fix the market structure. Yesterday, I emphasized that before the rebound at 8830, the big coin had reached the take profit level after the US market at the 2850 line for both Kong and Auntie. Pay close attention to Trump's speech at 3:00 AM today!

BTC

In the early session, the daily li

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Is this rhythm correct?

The Asian market plummets, the European market fluctuates, waiting for the US stocks to rally?

It's said that a sharp drop is always followed by a rebound. The strength of the rebound during the day session is so significant that there is absolutely no reason to bottom fish. The rebound at the opening of the U.S. stock market also provides an opportunity for the bears to get in!

The rebound strength of Bitcoin has also been overestimated. It didn't reach the highest point at a stable position before rebounding to 8690. Before the US market opened, it even hit a

View OriginalThe Asian market plummets, the European market fluctuates, waiting for the US stocks to rally?

It's said that a sharp drop is always followed by a rebound. The strength of the rebound during the day session is so significant that there is absolutely no reason to bottom fish. The rebound at the opening of the U.S. stock market also provides an opportunity for the bears to get in!

The rebound strength of Bitcoin has also been overestimated. It didn't reach the highest point at a stable position before rebounding to 8690. Before the US market opened, it even hit a

- Reward

- 1

- Comment

- Repost

- Share

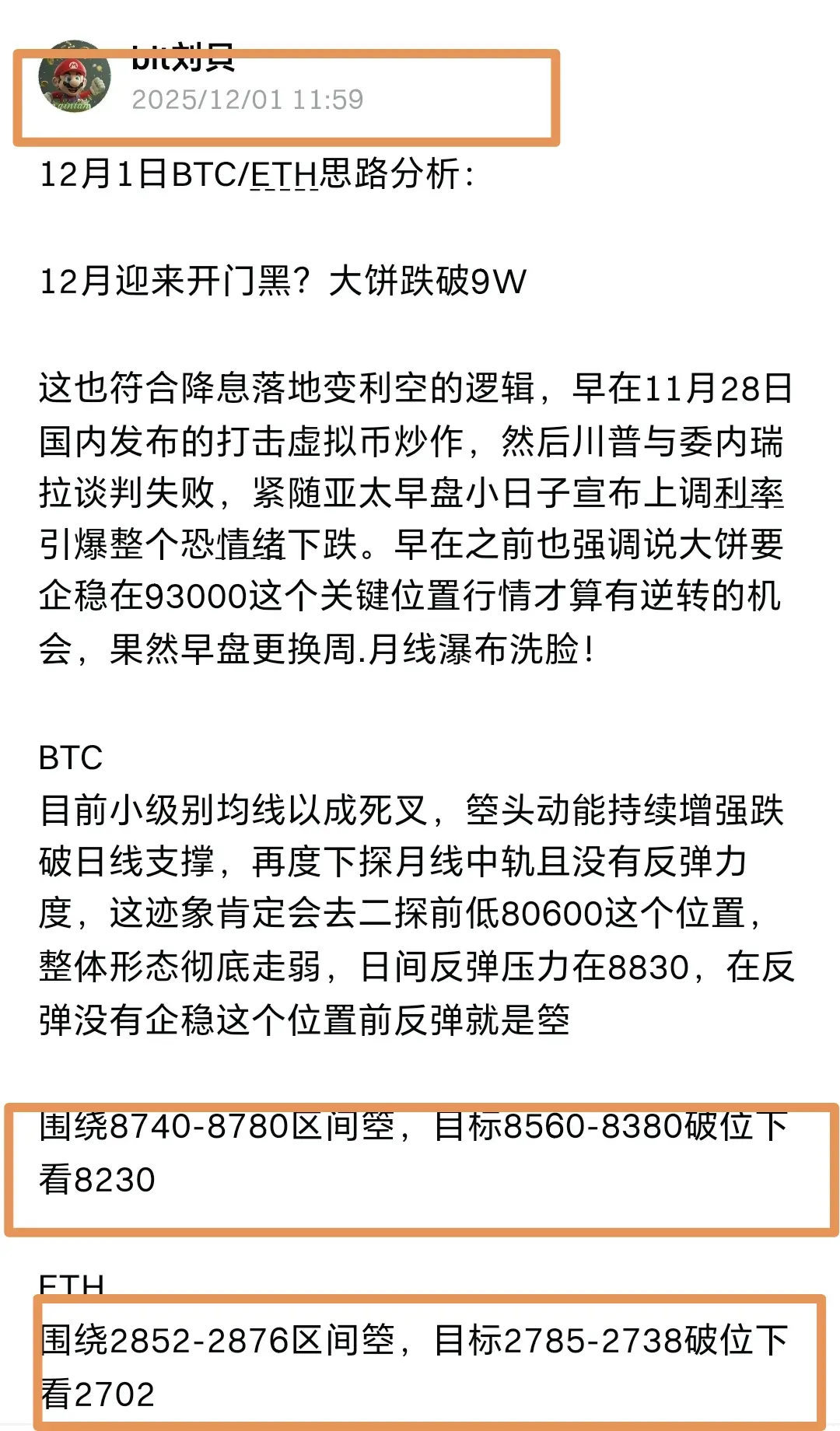

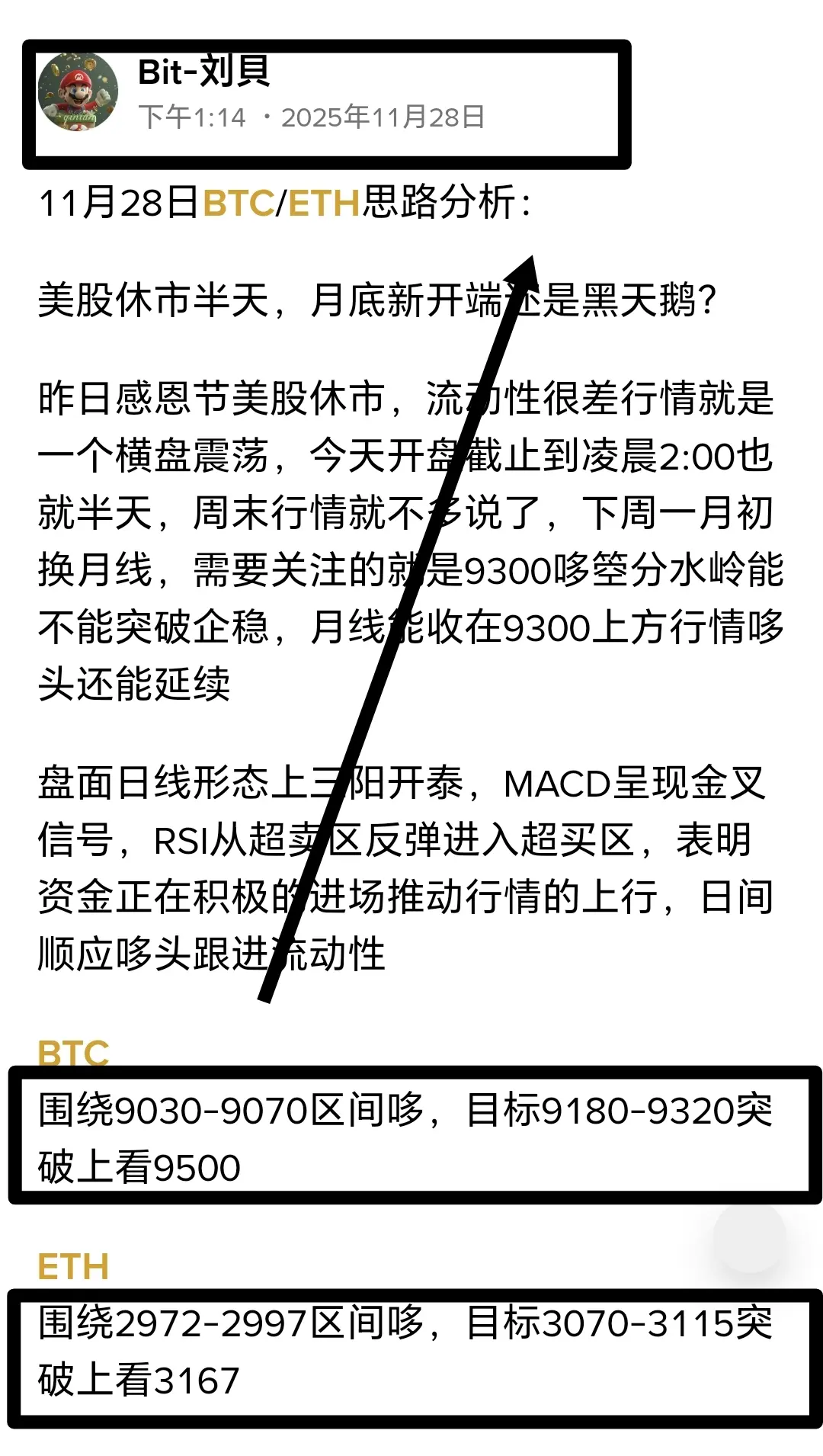

December 1 BTC/ETH analysis:

Is December welcoming a black opening? The big cake has fallen below 90,000.

This also aligns with the logic that a rate cut becoming a bearish signal. On November 28, domestic measures to curb virtual currency speculation were announced, followed by Trump’s failed negotiations with Venezuela. Shortly after, the Asia-Pacific early market announced an interest rate hike, triggering a wave of panic selling. Previously, it was emphasized that BTC needed to stabilize at the crucial position of 93000 for there to be a chance of reversal, and indeed, the early market exp

View OriginalIs December welcoming a black opening? The big cake has fallen below 90,000.

This also aligns with the logic that a rate cut becoming a bearish signal. On November 28, domestic measures to curb virtual currency speculation were announced, followed by Trump’s failed negotiations with Venezuela. Shortly after, the Asia-Pacific early market announced an interest rate hike, triggering a wave of panic selling. Previously, it was emphasized that BTC needed to stabilize at the crucial position of 93000 for there to be a chance of reversal, and indeed, the early market exp

- Reward

- like

- Comment

- Repost

- Share

Ether has something going on, it directly broke a new high!

This is the guiding needle for the rise, the beacon!

Did you capture the positions for BTC/ETH during the midday thinking? The first target resistance levels for the rebounds have all been reached, with Bitcoin at 1000 points and Ether at 80 points of space. Before the US market opens, the trend is still in a consolidation range. For short-term trading, take profits where you can. If you want to adjust your positions, just ensure you cover your costs!

$BTC $ETH #十二月降息预测

View OriginalThis is the guiding needle for the rise, the beacon!

Did you capture the positions for BTC/ETH during the midday thinking? The first target resistance levels for the rebounds have all been reached, with Bitcoin at 1000 points and Ether at 80 points of space. Before the US market opens, the trend is still in a consolidation range. For short-term trading, take profits where you can. If you want to adjust your positions, just ensure you cover your costs!

$BTC $ETH #十二月降息预测

- Reward

- like

- Comment

- Repost

- Share

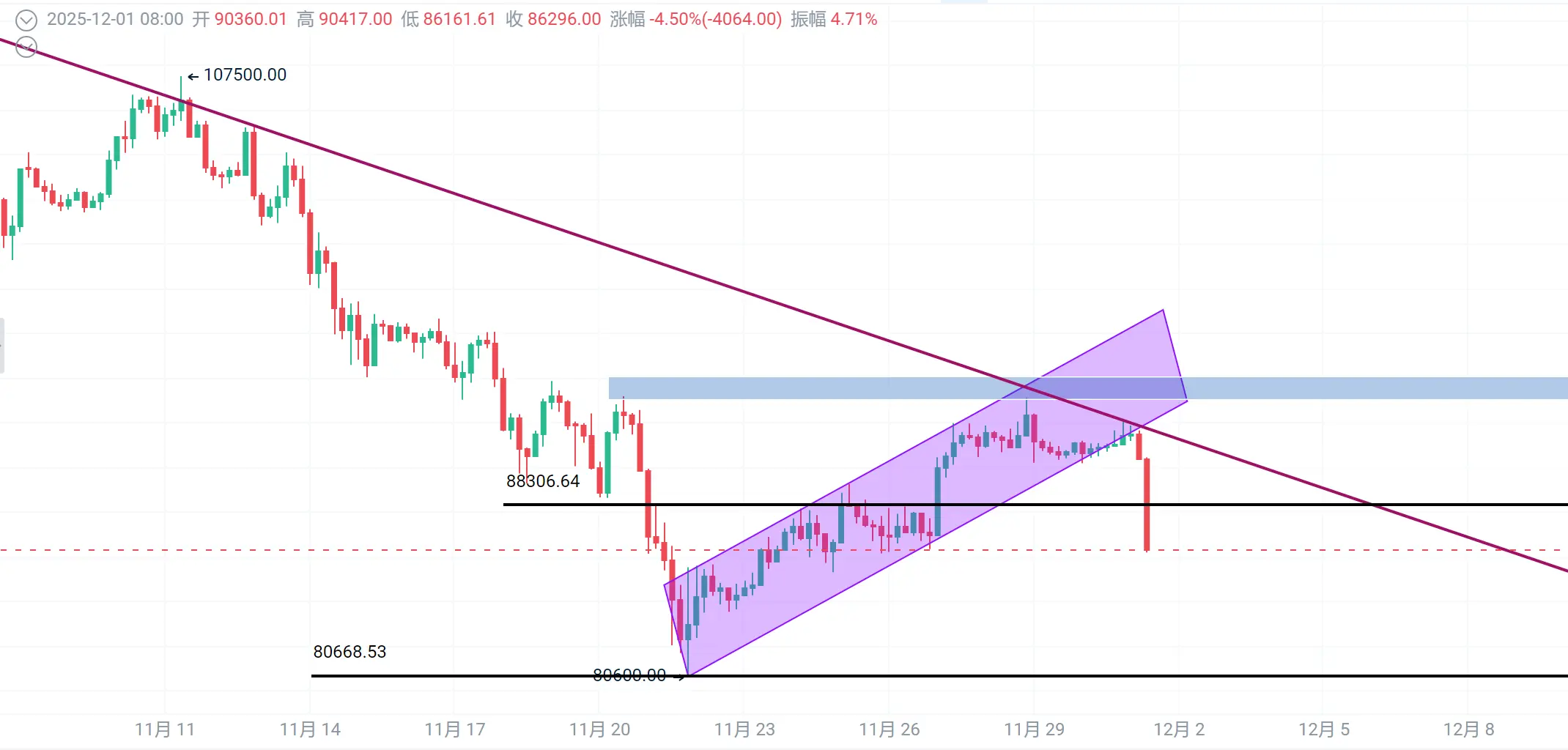

November 28 BTC/ETH Analysis:

The US stock market is closed for half a day; will the new beginning at the end of the month be a black swan?

Yesterday was Thanksgiving and the US stock market was closed, resulting in poor liquidity and a sideways market. As of 2:00 AM today, the market has only been open for half a day, and I won't say much about the weekend market. Next Monday marks the beginning of the new month, and we need to pay attention to whether the 9300 level can break and stabilize. If the monthly line can close above 9300, the market can continue to rise.

On the daily chart, the

View OriginalThe US stock market is closed for half a day; will the new beginning at the end of the month be a black swan?

Yesterday was Thanksgiving and the US stock market was closed, resulting in poor liquidity and a sideways market. As of 2:00 AM today, the market has only been open for half a day, and I won't say much about the weekend market. Next Monday marks the beginning of the new month, and we need to pay attention to whether the 9300 level can break and stabilize. If the monthly line can close above 9300, the market can continue to rise.

On the daily chart, the

- Reward

- like

- Comment

- Repost

- Share

Bull and bear are both cyclical; understanding leads to profits and losses!

All day long, there are people who say "bull" when it rises a bit and "bear" when it falls a bit. The statement itself is not wrong; it's just a matter of short and long cycles. As the ancients said: "Adjusting to the length and following the changes, ultimately reaching the end!" The end of a bull will eventually "prosper and then decline," falling into a bear market. This is the economic cycle, the inevitable result of human nature's game and the flow of capital!

Today, on Thanksgiving, U.S. stocks are closed

View OriginalAll day long, there are people who say "bull" when it rises a bit and "bear" when it falls a bit. The statement itself is not wrong; it's just a matter of short and long cycles. As the ancients said: "Adjusting to the length and following the changes, ultimately reaching the end!" The end of a bull will eventually "prosper and then decline," falling into a bear market. This is the economic cycle, the inevitable result of human nature's game and the flow of capital!

Today, on Thanksgiving, U.S. stocks are closed

- Reward

- like

- Comment

- Repost

- Share

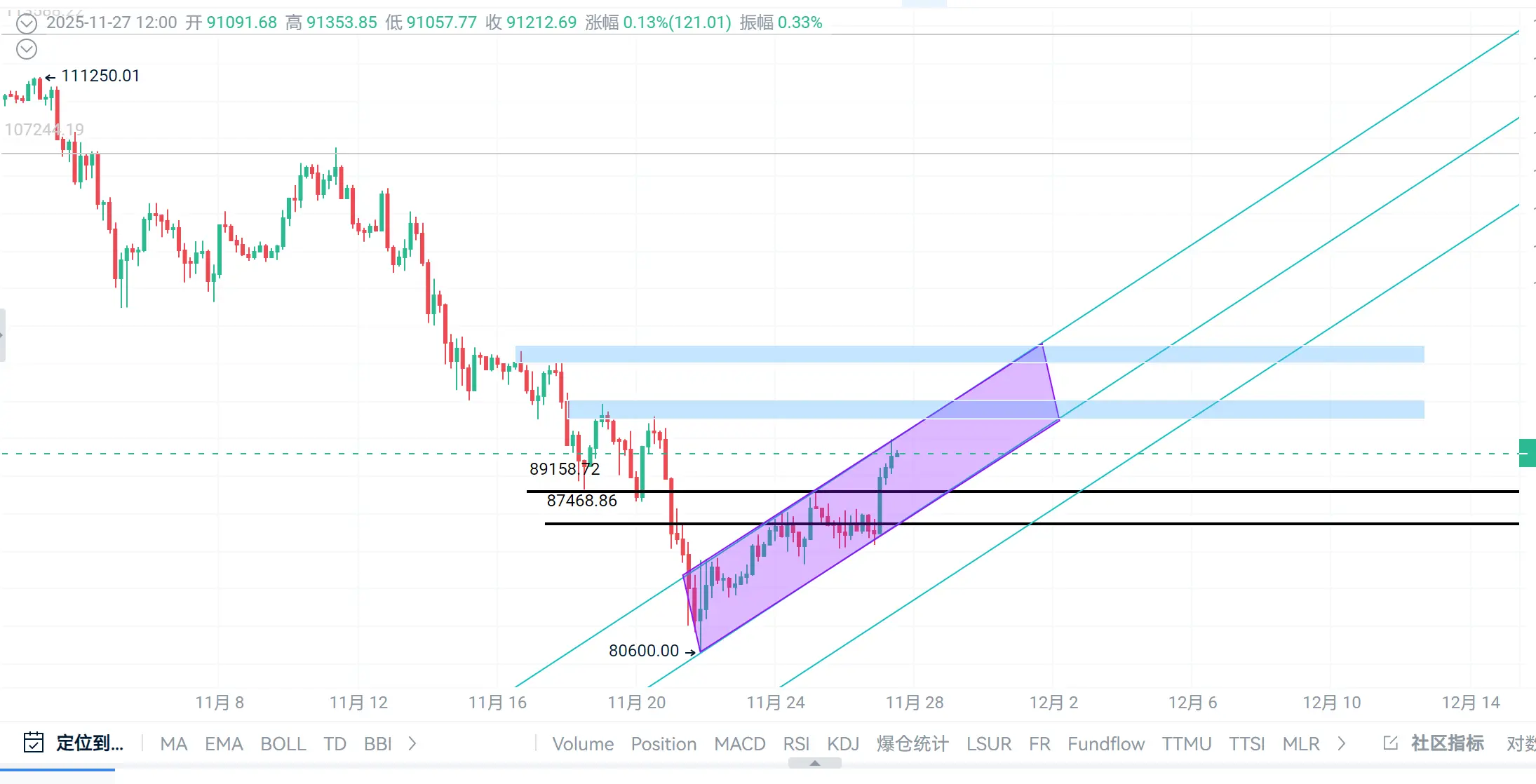

November 27 BTC/ETH Analysis:

Will the rebound continue?

Last night's unemployment benefits data was released, hitting a new low since April, which also raised the Federal Reserve's interest rate cut expectation to 82.9%. After the morning call between China and the US, the US extended the tariff exemption period for China until November 10, 2026. Meanwhile, the market continues to warm up, with BTC around 8600 and ETH near 2900. Isn't this a precise landing after a takeoff?

BTC

The current K-line shows three consecutive bullish candles on the four-hour chart, coexisting with the m

View OriginalWill the rebound continue?

Last night's unemployment benefits data was released, hitting a new low since April, which also raised the Federal Reserve's interest rate cut expectation to 82.9%. After the morning call between China and the US, the US extended the tariff exemption period for China until November 10, 2026. Meanwhile, the market continues to warm up, with BTC around 8600 and ETH near 2900. Isn't this a precise landing after a takeoff?

BTC

The current K-line shows three consecutive bullish candles on the four-hour chart, coexisting with the m

- Reward

- like

- Comment

- Repost

- Share

A bullish belt hold, pumped from the horizon to the hairline!

After several days of sideways movement, it finally broke out of the consolidation range!

The evening unemployment data is positive, and the US stocks opened high with the bulls attacking with their slogan! Before the US market closes, it also reached a new high for realization!

In fact, about 80% to 90% of market conditions can be classified as sideways markets, where the bulls and bears pull back and forth, revealing trends. The midday strategy is to enter long positions at the lowest point. Bitcoin has already moved 3800 points,

View OriginalAfter several days of sideways movement, it finally broke out of the consolidation range!

The evening unemployment data is positive, and the US stocks opened high with the bulls attacking with their slogan! Before the US market closes, it also reached a new high for realization!

In fact, about 80% to 90% of market conditions can be classified as sideways markets, where the bulls and bears pull back and forth, revealing trends. The midday strategy is to enter long positions at the lowest point. Bitcoin has already moved 3800 points,

- Reward

- like

- Comment

- Repost

- Share

November 26 BTC/ETH analysis:

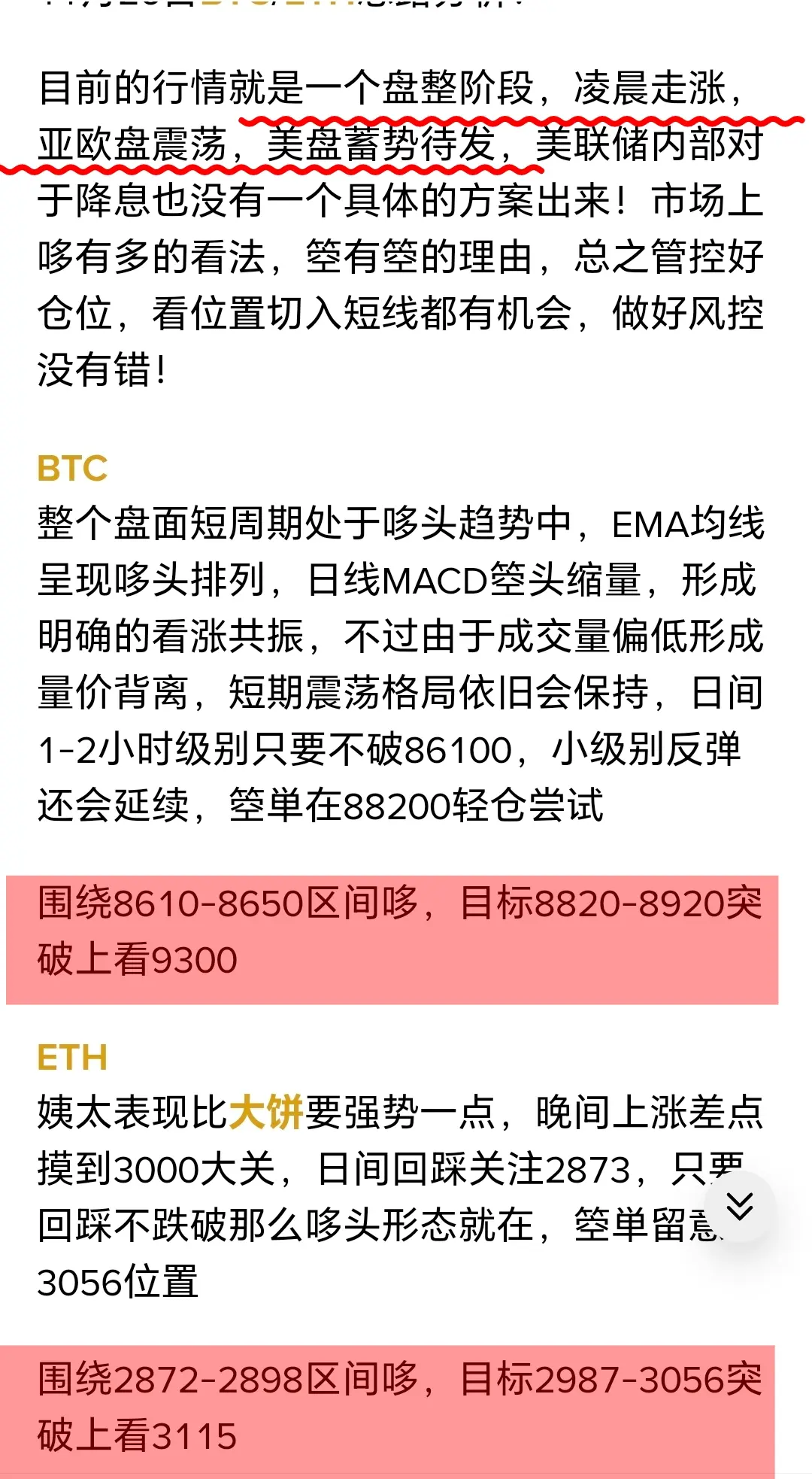

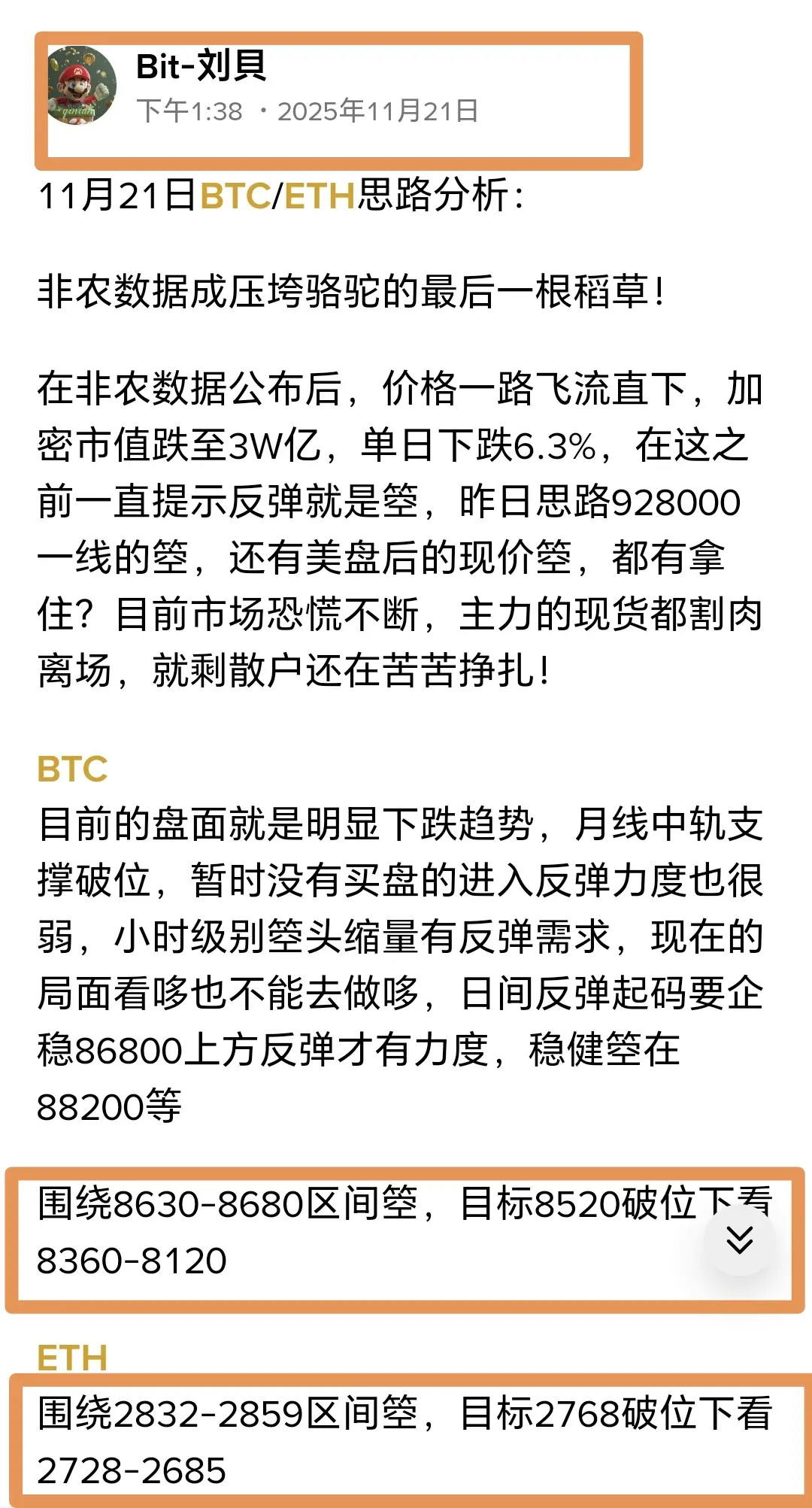

The current market is in a consolidation phase, rising in the early morning, fluctuating in the Asian and European sessions, and building momentum in the US market. There is no specific plan from the Federal Reserve regarding interest rate cuts! There are various opinions in the market, each with its own reasons. In short, manage your positions well, and there are opportunities for short-term entries depending on the price levels. It’s important to have good risk control!

BTC

The entire market is in a short-term trend of consolidation, with the EMA moving averages

View OriginalThe current market is in a consolidation phase, rising in the early morning, fluctuating in the Asian and European sessions, and building momentum in the US market. There is no specific plan from the Federal Reserve regarding interest rate cuts! There are various opinions in the market, each with its own reasons. In short, manage your positions well, and there are opportunities for short-term entries depending on the price levels. It’s important to have good risk control!

BTC

The entire market is in a short-term trend of consolidation, with the EMA moving averages

- Reward

- like

- Comment

- Repost

- Share

November 25 BTC/ETH Analysis:

The weather is getting colder, and people are starting to catch colds relatively late. The market has already moved more than halfway. The daytime trading is basically in a consolidation phase, and the price levels cannot be too high. Yesterday, I asked everyone to wait at 88900 for a small-level rebound, which has now arrived. The available small contracts currently have a space of 1500 points. The market is now in a phase of corrective consolidation, and there are again expectations of interest rate cuts being promoted. Both short-term low and high contracts hav

View OriginalThe weather is getting colder, and people are starting to catch colds relatively late. The market has already moved more than halfway. The daytime trading is basically in a consolidation phase, and the price levels cannot be too high. Yesterday, I asked everyone to wait at 88900 for a small-level rebound, which has now arrived. The available small contracts currently have a space of 1500 points. The market is now in a phase of corrective consolidation, and there are again expectations of interest rate cuts being promoted. Both short-term low and high contracts hav

- Reward

- like

- Comment

- Repost

- Share

Don't mistake a rebound for a reversal.

The weekly chart shows four consecutive bearish candles. The price of Bitcoin has plummeted 📉 from 116,000 to 80,000 over the course of a month, and the larger trend has completely weakened. Over the weekend, the market saw a significant rebound of 7,000 points, which gives the bottom-fishing bulls some hope. However, based on on-chain statistics, the market's fear has led to a lack of substantial buying volume. During the day, the market fluctuated back and forth between bullish and bearish, and it is unlikely to enter a particularly strong one

View OriginalThe weekly chart shows four consecutive bearish candles. The price of Bitcoin has plummeted 📉 from 116,000 to 80,000 over the course of a month, and the larger trend has completely weakened. Over the weekend, the market saw a significant rebound of 7,000 points, which gives the bottom-fishing bulls some hope. However, based on on-chain statistics, the market's fear has led to a lack of substantial buying volume. During the day, the market fluctuated back and forth between bullish and bearish, and it is unlikely to enter a particularly strong one

- Reward

- like

- Comment

- Repost

- Share

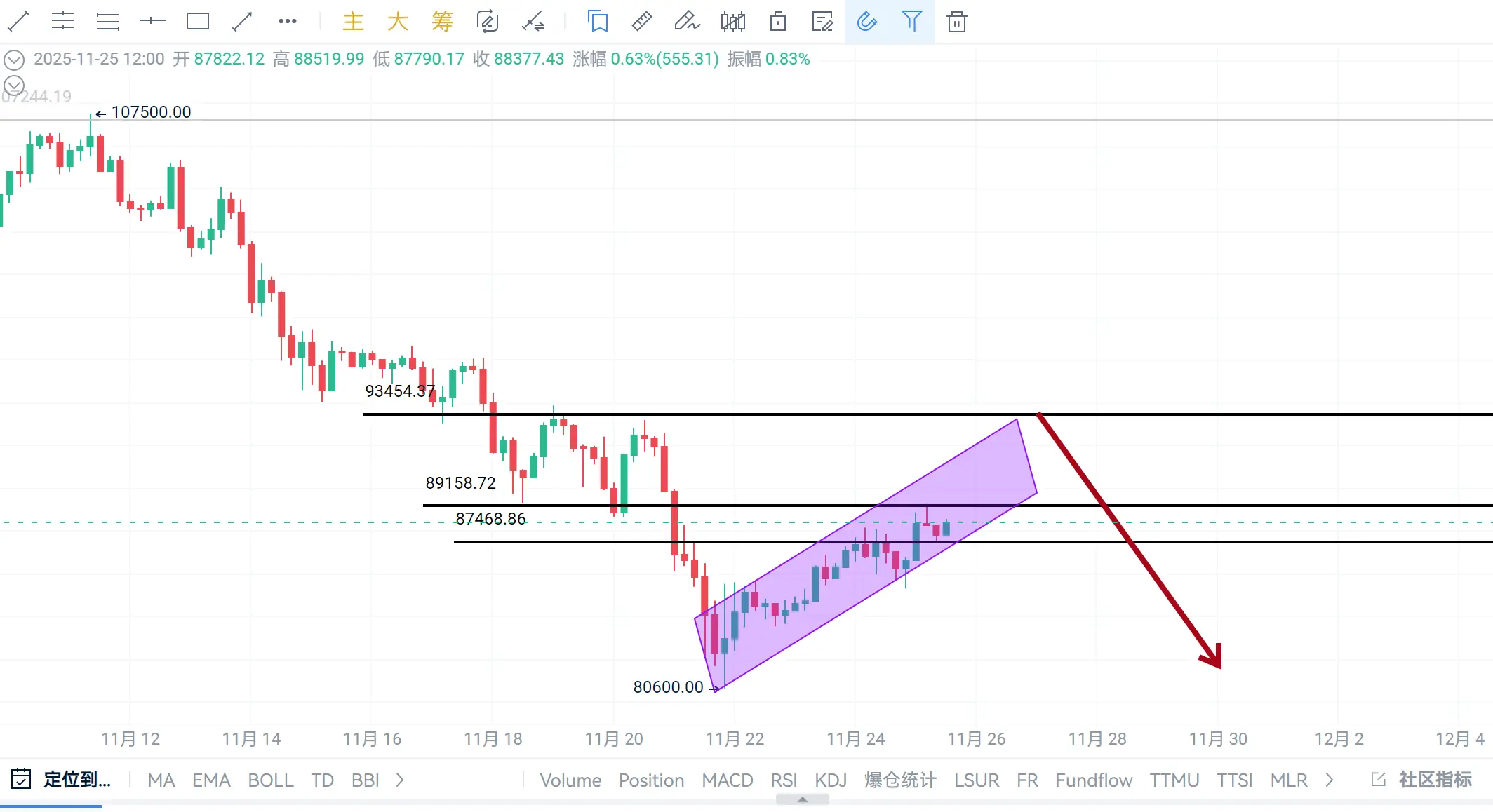

November 24 BTC/ETH analysis:

The Federal Reserve collectively turns dovish, and the market rebounds by 7000 points!

The US stock market is closed on weekends, and there hasn't been a particularly large inflow of funds. BTC instead rebounded sharply by 7000 points. At last Thursday's Federal Reserve meeting, some members had a dovish attitude, and the probability of interest rate cuts has increased. However, this does not mean that the market is warming up. Overall, there is a significant turnover rate due to panic selling around 80000 and institutions taking the opportunity to pick up

View OriginalThe Federal Reserve collectively turns dovish, and the market rebounds by 7000 points!

The US stock market is closed on weekends, and there hasn't been a particularly large inflow of funds. BTC instead rebounded sharply by 7000 points. At last Thursday's Federal Reserve meeting, some members had a dovish attitude, and the probability of interest rate cuts has increased. However, this does not mean that the market is warming up. Overall, there is a significant turnover rate due to panic selling around 80000 and institutions taking the opportunity to pick up

- Reward

- like

- Comment

- Repost

- Share

Long Wick Candle🚨响起

How many people will receive emails again?

In one hour, 950 million was liquidated, and traders should not hold a fixed mindset; blindly trying to catch the bottom is unwise. Everyone thinks the current position is very low and dares not short. Relying on subjective judgment to determine the market's top and bottom will always lead to a counterattack from the market!

This market directly rebounding is a short. In the afternoon strategy, enter the Bitcoin short at around 86300, Ethereum at 2832, targeting three lines to be achieved. Long Wick Candle at a low level, not

View OriginalHow many people will receive emails again?

In one hour, 950 million was liquidated, and traders should not hold a fixed mindset; blindly trying to catch the bottom is unwise. Everyone thinks the current position is very low and dares not short. Relying on subjective judgment to determine the market's top and bottom will always lead to a counterattack from the market!

This market directly rebounding is a short. In the afternoon strategy, enter the Bitcoin short at around 86300, Ethereum at 2832, targeting three lines to be achieved. Long Wick Candle at a low level, not

- Reward

- like

- Comment

- Repost

- Share

The market makers are all rug pulling.

The expectation of interest rate cuts is gone, yet a considerable portion of the market is still shouting about bottom-fishing. Are they buying with their mouths?

$840 million in long liquidations in 24H. If the market makers don't liquidate the long positions above, how can it rebound? A short-term rebound is a short, and for long positions, it is estimated that the main position has been entered. The second position for adding to the position is looking at 75000. In this situation, even the yellow-haired traders' calls may not stop the decline!

View OriginalThe expectation of interest rate cuts is gone, yet a considerable portion of the market is still shouting about bottom-fishing. Are they buying with their mouths?

$840 million in long liquidations in 24H. If the market makers don't liquidate the long positions above, how can it rebound? A short-term rebound is a short, and for long positions, it is estimated that the main position has been entered. The second position for adding to the position is looking at 75000. In this situation, even the yellow-haired traders' calls may not stop the decline!

- Reward

- like

- Comment

- Repost

- Share

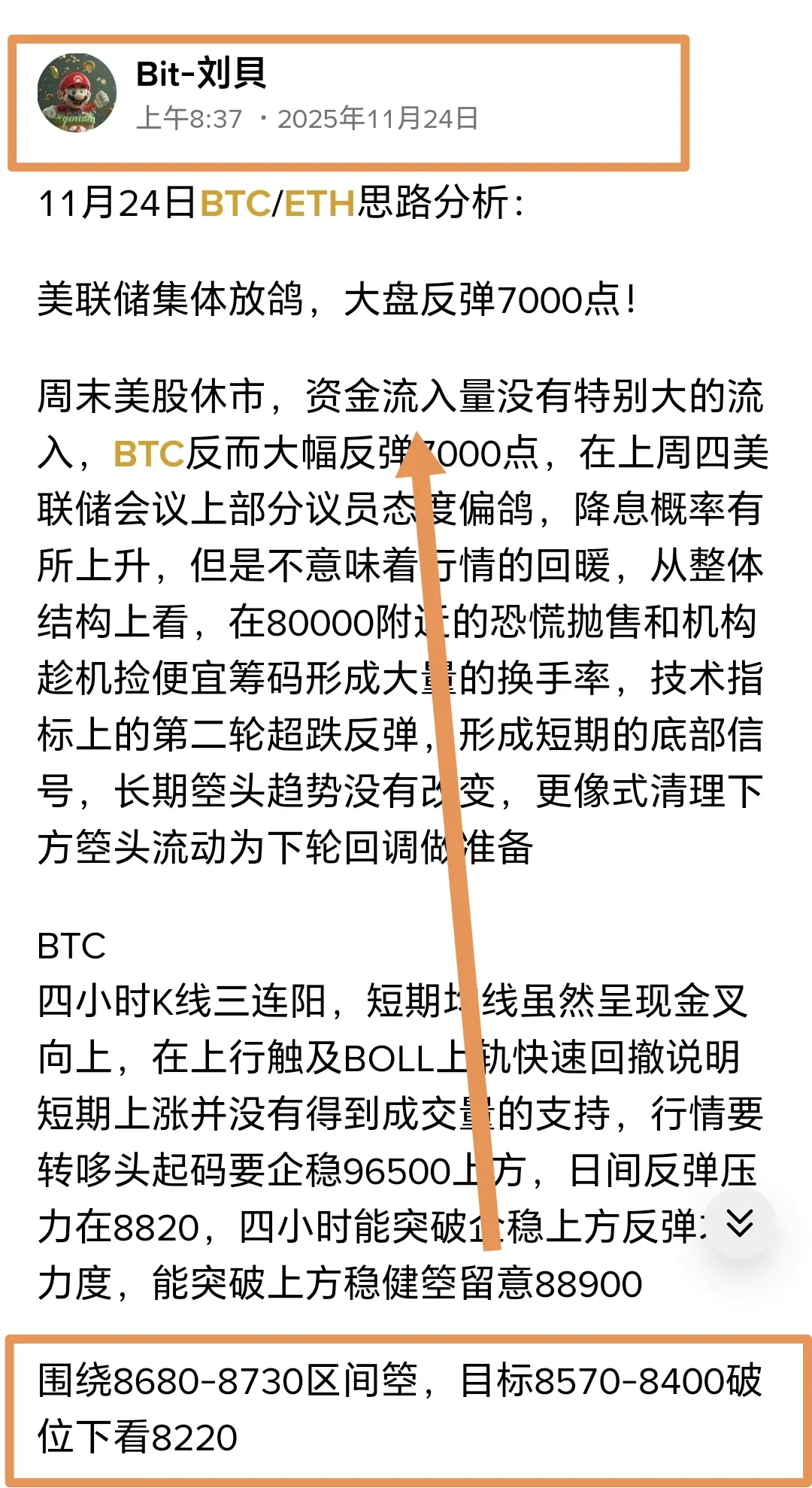

November 21 BTC/ETH Strategy Analysis:

The non-farm data is the last straw that broke the camel's back!

After the non-farm data was released, the price plummeted, and the crypto market value dropped to 3 trillion, with a daily decline of 6.3%. Before this, there was a hint of a rebound which was a trap. Yesterday's strategy was to trap at the 928,000 line, and there were also traps at the current price after the US market opened. Did anyone hold on? Currently, market panic continues, and the main players have cut losses and exited the market, leaving only retail investors struggling!

B

View OriginalThe non-farm data is the last straw that broke the camel's back!

After the non-farm data was released, the price plummeted, and the crypto market value dropped to 3 trillion, with a daily decline of 6.3%. Before this, there was a hint of a rebound which was a trap. Yesterday's strategy was to trap at the 928,000 line, and there were also traps at the current price after the US market opened. Did anyone hold on? Currently, market panic continues, and the main players have cut losses and exited the market, leaving only retail investors struggling!

B

- Reward

- 1

- Comment

- Repost

- Share

9:30 PM US Non-farm Payrolls (NFP) released

Everyone is concerned whether the market can break out of this phase of volatility and decline. Some predict BTC will rise to 150,000, while others believe it will drop to 50,000. Each has their own reasons and suggestions. Indeed, there are opportunities, but no one can control the market trends. One can only gamble for the greatest benefit with small risks within a reasonable range. What you say casually may be taken seriously by others who are investing real money!

Last night I said this market broke new lows, which is just an early divergence in

View OriginalEveryone is concerned whether the market can break out of this phase of volatility and decline. Some predict BTC will rise to 150,000, while others believe it will drop to 50,000. Each has their own reasons and suggestions. Indeed, there are opportunities, but no one can control the market trends. One can only gamble for the greatest benefit with small risks within a reasonable range. What you say casually may be taken seriously by others who are investing real money!

Last night I said this market broke new lows, which is just an early divergence in

- Reward

- like

- Comment

- Repost

- Share

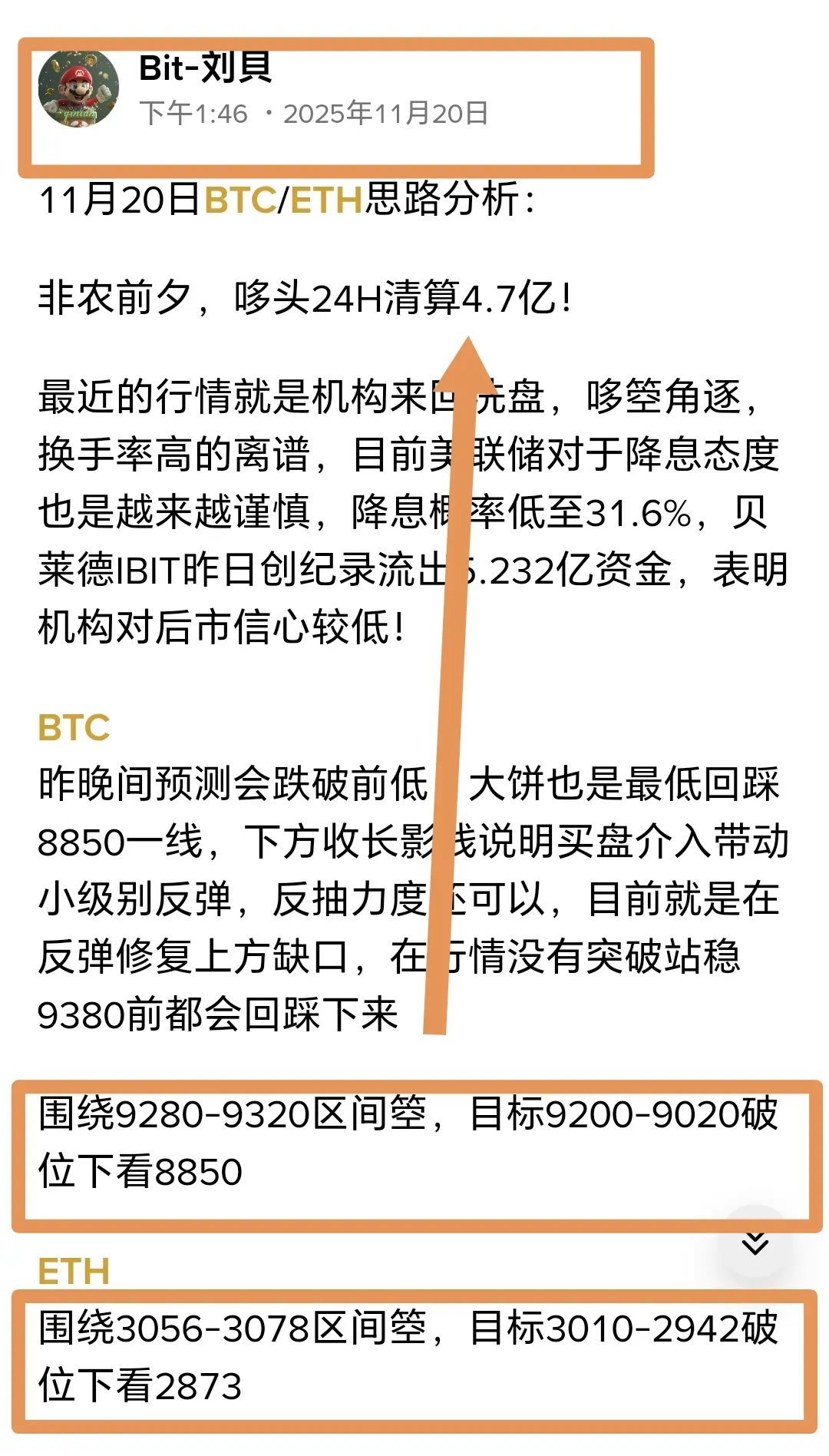

November 20 BTC/ETH Strategy Analysis:

On the eve of the non-farm payrolls, Doto cleared 470 million in 24 hours!

The recent market trend shows institutions frequently washing positions, with intense competition and an absurdly high turnover rate. Currently, the Federal Reserve's attitude towards interest rate cuts is becoming increasingly cautious, with the probability of a rate cut dropping to 31.6%. BlackRock's IBIT saw a record outflow of 523.2 million in funds yesterday, indicating that institutions have low confidence in the future market!

BTC

Last night it was predicted that it

View OriginalOn the eve of the non-farm payrolls, Doto cleared 470 million in 24 hours!

The recent market trend shows institutions frequently washing positions, with intense competition and an absurdly high turnover rate. Currently, the Federal Reserve's attitude towards interest rate cuts is becoming increasingly cautious, with the probability of a rate cut dropping to 31.6%. BlackRock's IBIT saw a record outflow of 523.2 million in funds yesterday, indicating that institutions have low confidence in the future market!

BTC

Last night it was predicted that it

- Reward

- like

- Comment

- Repost

- Share