UBCLUB2133

No content yet

UBCLUB2133

The great way is simple~

View Original

- Reward

- like

- Comment

- Repost

- Share

Others may run the red light, but you stick to your crosswalk... This is just my way of thinking, not any operational advice. Everyone who understands knows, I won't say more~

View Original

- Reward

- 1

- 1

- Repost

- Share

HeavenSlayerSupporter :

:

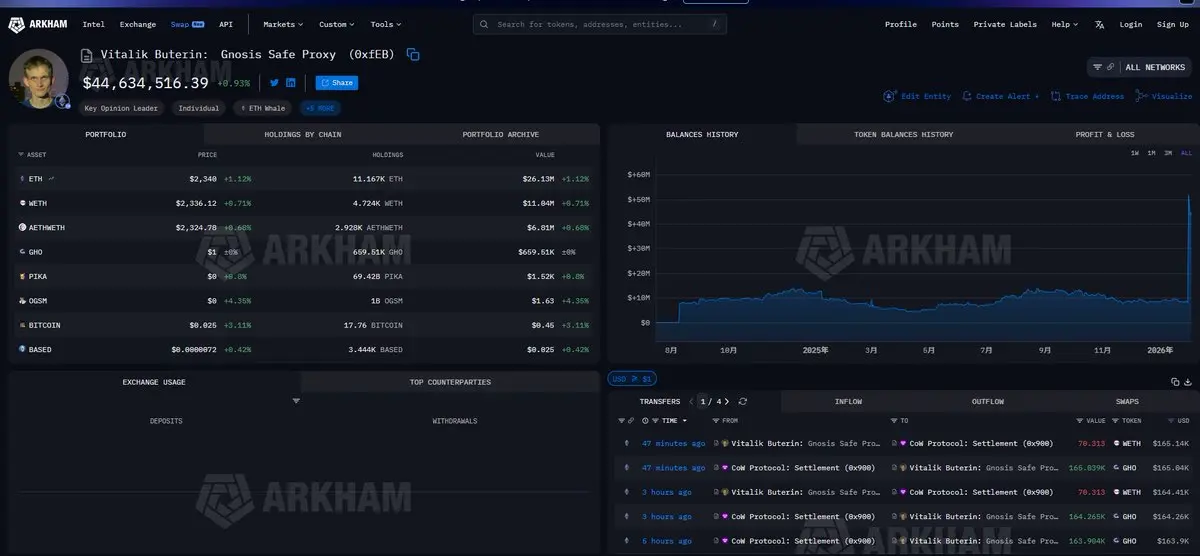

2026 Go Go Go 👊Data shows that Vitalik sold 493.1 ETH today through CoW Swap, exchanging for approximately 1.16 million USDT. More importantly, his ETH authorization limit in this contract is as high as 5,000 ETH, leaving open the possibility of further sales in the future. The occurrence of founder-level selling behavior at this point undoubtedly adds significant psychological pressure to the "bullish camp" such as Tom Lee and Li Hua Yi, and may also disrupt the short-term rebound momentum of ETH.

ETH-7,58%

- Reward

- 1

- Comment

- Repost

- Share

The hardest part during times of a lot of market noise is sticking to your own trading system. Whether it's MACD divergence, Fibonacci, or any other indicator—if you use any indicator well, it will be useful. The fear is having too many indicators, which can be overwhelming and confusing. Just three indicators resonating together are enough.

View Original- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Until mid-next year, just stick to defensive strategies. If it hasn't fallen through, hasn't fallen through, hasn't fallen through, and no matter how many dips occur, the support level isn't broken, then it's not a true breakdown. It takes at least two or more retests to confirm~

View Original- Reward

- like

- Comment

- Repost

- Share

The current Federal Reserve balance sheet has reached several trillion dollars, making it very large. Market interpretations suggest that related statements have reinforced expectations of future liquidity tightening, putting short-term pressure on risk assets, with Bitcoin, gold, and silver experiencing synchronized pullbacks.

BTC-6,81%

- Reward

- like

- Comment

- Repost

- Share

Many people have suffered huge losses in this wave; I hope none of them are you.

View Original- Reward

- like

- Comment

- Repost

- Share

Cryptocurrency Market Observation—February 2nd

1. Market Trend 📉BTC experienced a significant pullback, with altcoins generally under pressure and market risk appetite declining. In overseas markets, US stocks retreated, the US dollar staged a temporary rebound, and precious metals weakened simultaneously. 🔍

2. Market Hotspots

1️⃣ Base Chain AI Theme Active Recently, Base Chain-related AI meme trading has been lively. Historically, market preferences vary at different stages, and currently, AI is being followed across multiple chains. Future attention should be paid to changes in hot s

View Original1. Market Trend 📉BTC experienced a significant pullback, with altcoins generally under pressure and market risk appetite declining. In overseas markets, US stocks retreated, the US dollar staged a temporary rebound, and precious metals weakened simultaneously. 🔍

2. Market Hotspots

1️⃣ Base Chain AI Theme Active Recently, Base Chain-related AI meme trading has been lively. Historically, market preferences vary at different stages, and currently, AI is being followed across multiple chains. Future attention should be paid to changes in hot s

- Reward

- 1

- Comment

- Repost

- Share

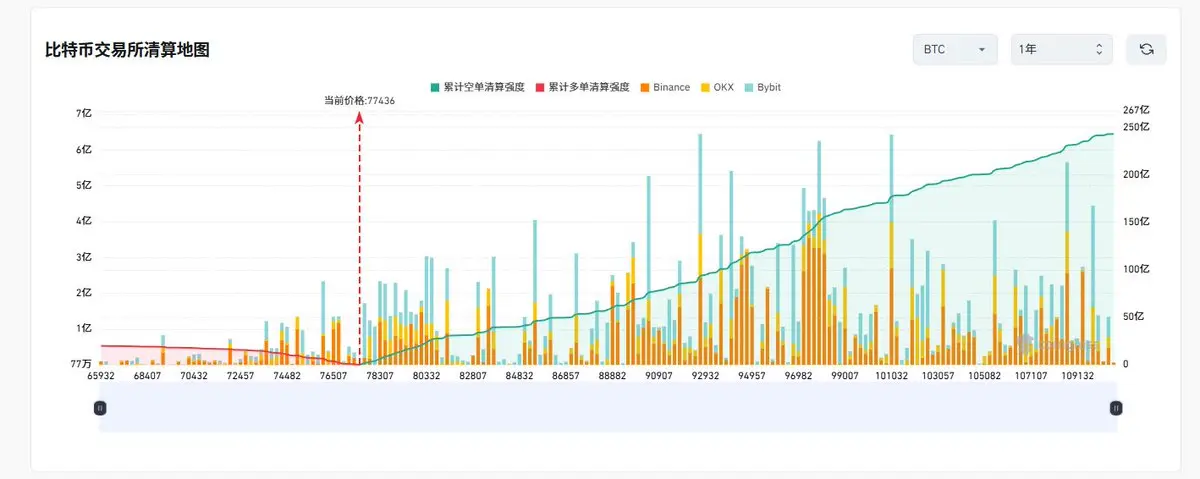

If there are no systemic black swan events, Bitcoin's annual liquidation data drops to 65,000, with liquidations of 2 billion. If it rises to 100,000, liquidations reach 17 billion. Truly tempting~ If you were the market maker, how would you play it?

BTC-6,81%

- Reward

- like

- 1

- Repost

- Share

Mr.WarGod :

:

No matter what you say, whether you buy more or less, you will still get rich; ultimately, data is just data.It's said that filling the gap is a mystical art. Guess when this gap around 76,500-21,200 will be filled~

View Original

- Reward

- like

- Comment

- Repost

- Share

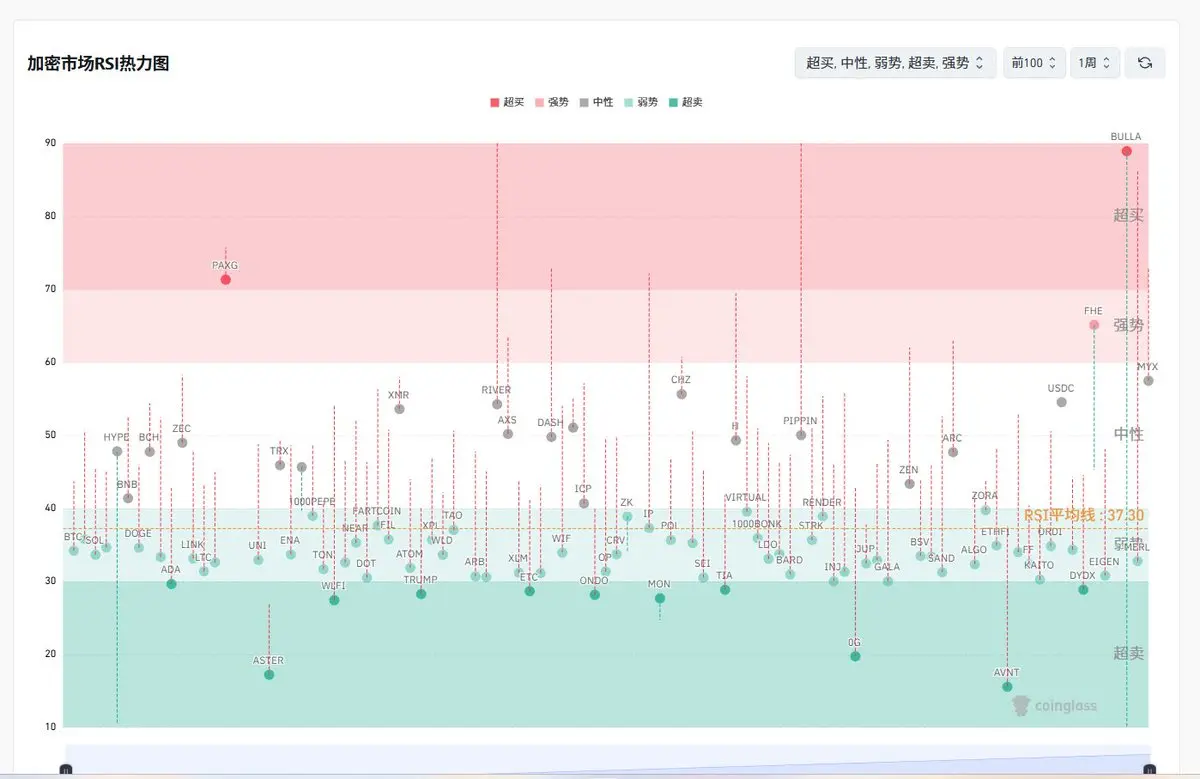

From the weekly RSI heatmap, the top 100 cryptocurrencies are still trending downward, and the decline is intensifying. Currently, the overall market hasn't reached the level of "severely oversold," only considered somewhat weak, but based on the weekly chart, it's not far from being truly oversold.

View Original

- Reward

- 1

- 3

- Repost

- Share

RiwajStudio :

:

1000x VIbes 🤑View More

To summarize: 75,000 is not the bottom, but rather the threshold for entering a deep bear market. Once effectively broken below, the market should no longer focus on "rebound correction," but switch to monthly-level defense, paying attention to the range of 65,000 → 58,000. The reason is simple: the adjustment level has changed. From February to April last year, it was a weekly adjustment, but this current cycle has upgraded to a monthly adjustment. The larger the adjustment level, the longer the time and the deeper the space, so 74,000–75,000 no longer meet the conditions for a trend bottom,

View Original

- Reward

- 1

- 1

- Repost

- Share

Gate.io518 :

:

😀😀😀😀😀😀😀😀😀😀😀😀😀😀😀😀😀😀😀😀First thing in the morning, everyone is eager to buy the dip, especially some of the bigger KOLs. I knew then that this is not the bottom~

View Original

- Reward

- like

- Comment

- Repost

- Share

Did you contribute to the over 200 million liquidation last night?

View Original

- Reward

- like

- Comment

- Repost

- Share

As a crypto player, whether you win or lose, you must always have the courage to place a trade!

View Original

- Reward

- like

- Comment

- Repost

- Share

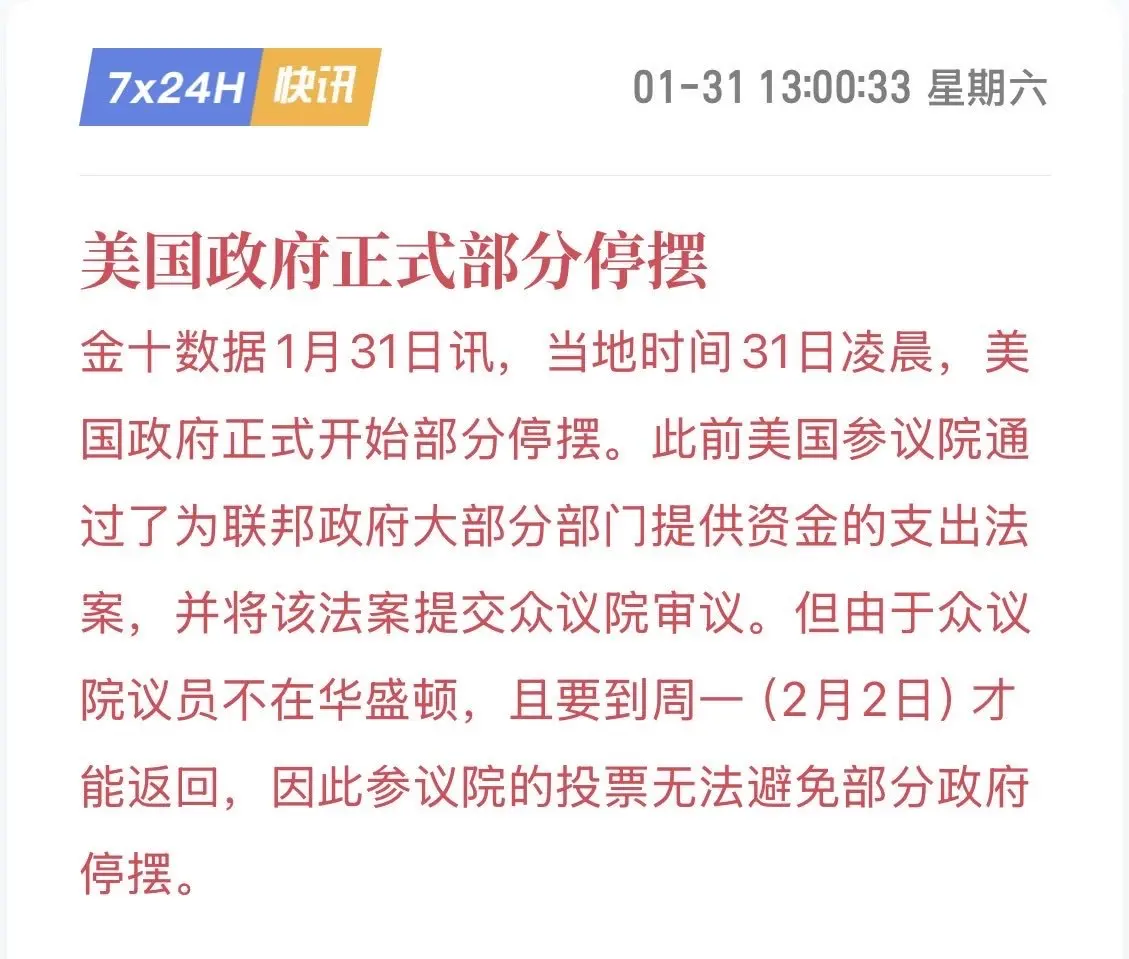

Latest News: The US government has once again shut down, turning from a safe haven dividend to institutional exploitation. Could this shutdown lead to completely different outcomes than in 2025? In the investment world, the most dangerous thought is—"This time is the same." In October 2025, the US government shutdown lasted 43 days, and Bitcoin surged against the trend to $110,000, establishing its status as a "digital safe haven asset." But at the dawn of 2026, all macroeconomic logic has quietly shifted.

1. The underlying logic of monetary policy has changed: from "water warming" to "freezi

1. The underlying logic of monetary policy has changed: from "water warming" to "freezi

BTC-6,81%

- Reward

- 1

- Comment

- Repost

- Share

The four stages of a bear market and our current position

Most bear markets: the early to mid-term is characterized by "gradual decline + repeated torment," while the later stage often involves "emotion-driven accelerated decline (panic waterfall)," but not in a straight line, rather "rapid sell-off → technical rebound → further decline." There are also rare cases where the decline continues silently until no one is talking, but that is an extreme liquidity exhaustion phase.

🧠

Bear markets are usually divided into 4 stages:

① Early Bear: Trend breakdown phase

Characteristics: High levels wea

View OriginalMost bear markets: the early to mid-term is characterized by "gradual decline + repeated torment," while the later stage often involves "emotion-driven accelerated decline (panic waterfall)," but not in a straight line, rather "rapid sell-off → technical rebound → further decline." There are also rare cases where the decline continues silently until no one is talking, but that is an extreme liquidity exhaustion phase.

🧠

Bear markets are usually divided into 4 stages:

① Early Bear: Trend breakdown phase

Characteristics: High levels wea

- Reward

- like

- Comment

- Repost

- Share

How to do a reduction in information flow, so that your trading mindset doesn't get confused? The best approach is to only focus on trading cycles that are consistent with yours when browsing Twitter. The indicators should also be the same, and the trading targets you follow daily should be consistent. Don't easily get involved in new coins you're not familiar with. Also, try not to pay attention to those who are constantly spreading gossip or posting all kinds of provocative images just to gain traffic. Trading requires a flow of focus. If you are fully immersed in the trading field, you don'

View Original

- Reward

- like

- Comment

- Repost

- Share

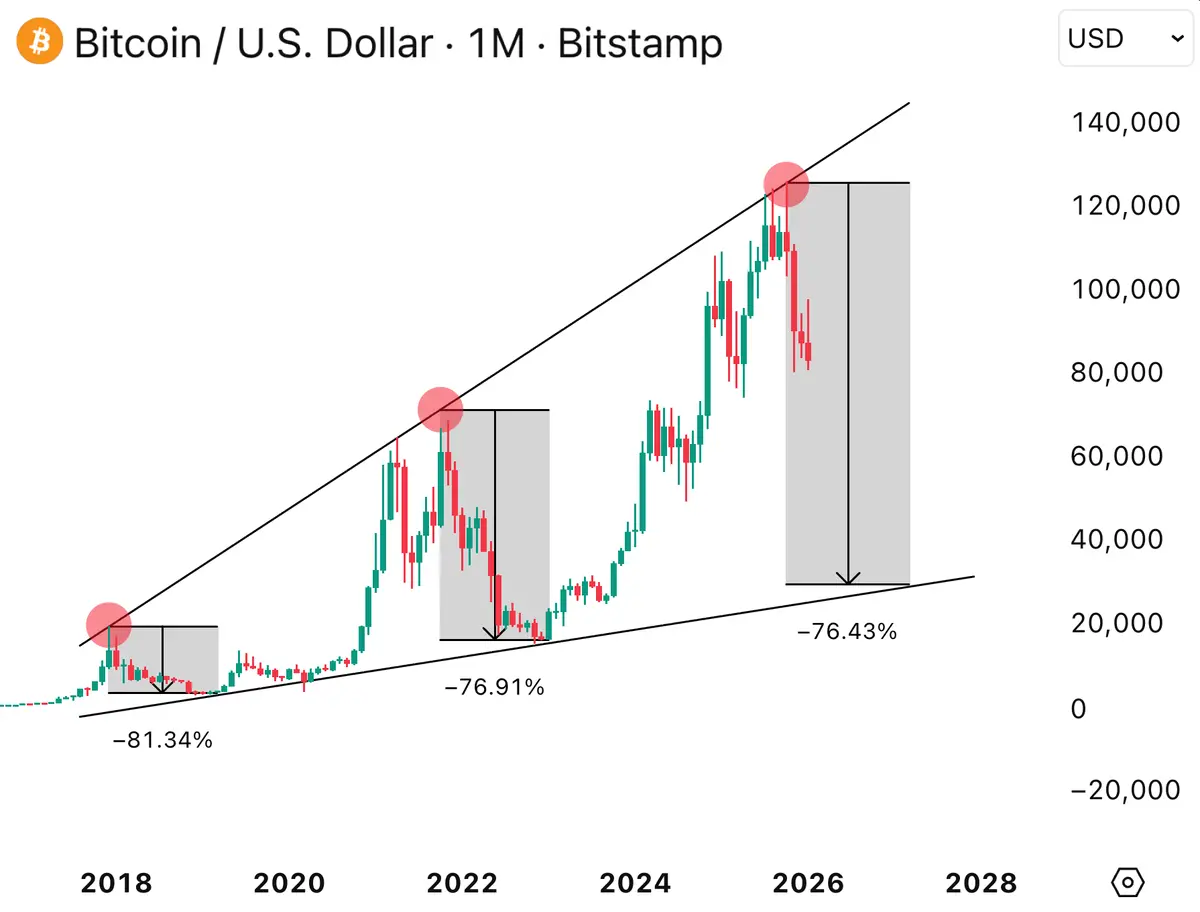

If the trend must be completed, guess what will happen next?

View Original

- Reward

- like

- Comment

- Repost

- Share