TunaKAYA

No content yet

TunaKAYA

What will happen to Borsa Istanbul next week?

The index hit a record high of 14,320 and investor confidence is high; a 7-day increase of 4.1%.

The 14,000 support level is strong; if it stays above, new highs towards 15,000 are possible.

The Central Bank of Turkey's inflation report and the banking sector are supporting the rally.

The outlook for Borsa Istanbul next week remains bullish.

#BIST100 #Bist100 #Borsa #Borsaİstanbul #Hisse #XBANK

View OriginalThe index hit a record high of 14,320 and investor confidence is high; a 7-day increase of 4.1%.

The 14,000 support level is strong; if it stays above, new highs towards 15,000 are possible.

The Central Bank of Turkey's inflation report and the banking sector are supporting the rally.

The outlook for Borsa Istanbul next week remains bullish.

#BIST100 #Bist100 #Borsa #Borsaİstanbul #Hisse #XBANK

- Reward

- like

- Comment

- Repost

- Share

What will happen to SPX500 next week?

If the 6,770 support holds, there could be a rebound to 7,000; if it breaks, a correction to 6,500-6,737.

Focus on AI and big tech gains (Alphabet, Meta, etc.). The US markets are (S&P 500 focused). I expect the upcoming week to see a sideways to slightly upward trend, but volatility may increase with earnings reports.

If the index surpasses the 7,000 resistance, it could rise to 7,500 by the end of the year.

#SPX #SPX500 #Hisse #US #Investment

View OriginalIf the 6,770 support holds, there could be a rebound to 7,000; if it breaks, a correction to 6,500-6,737.

Focus on AI and big tech gains (Alphabet, Meta, etc.). The US markets are (S&P 500 focused). I expect the upcoming week to see a sideways to slightly upward trend, but volatility may increase with earnings reports.

If the index surpasses the 7,000 resistance, it could rise to 7,500 by the end of the year.

#SPX #SPX500 #Hisse #US #Investment

- Reward

- like

- Comment

- Repost

- Share

What will happen to Bitcoin next week?

Positive comments from the US Treasury Secretary on crypto and macroeconomic data will be influential. I expect potential volatility with an upward trend in Bitcoin next week.

Prices have recovered from $60,000 to approach the $66,000-$71,000 range; although ETF flows have slowed, institutional support remains strong.

Short-term: The $71,000 resistance is critical. Support at $65,000.

If it stays above $65,000, a test of $72,000-$74,000 is possible; if it falls below, a pullback to $60,000.

#Bitcoin $BTC #Crypto

Positive comments from the US Treasury Secretary on crypto and macroeconomic data will be influential. I expect potential volatility with an upward trend in Bitcoin next week.

Prices have recovered from $60,000 to approach the $66,000-$71,000 range; although ETF flows have slowed, institutional support remains strong.

Short-term: The $71,000 resistance is critical. Support at $65,000.

If it stays above $65,000, a test of $72,000-$74,000 is possible; if it falls below, a pullback to $60,000.

#Bitcoin $BTC #Crypto

BTC-1,73%

- Reward

- like

- Comment

- Repost

- Share

What will Silver do next week?

I expect the overall trend to be neutral with a downward tendency. Falling peaks and troughs are not appealing to me.

Prices have been confined between $77 and $81 after a 3% decline, and if they stay below $79.42, downside pressure will increase. The short-term forecast shows a decline to $70.96, but the supply deficit remains supportive in the long term...

If the $75 support holds, a recovery is likely; if broken, a move down to $70 is probable. Gold correlation and industrial demand will continue to be the main supports.

#Gümüş #Silver #XAGUSD

View OriginalI expect the overall trend to be neutral with a downward tendency. Falling peaks and troughs are not appealing to me.

Prices have been confined between $77 and $81 after a 3% decline, and if they stay below $79.42, downside pressure will increase. The short-term forecast shows a decline to $70.96, but the supply deficit remains supportive in the long term...

If the $75 support holds, a recovery is likely; if broken, a move down to $70 is probable. Gold correlation and industrial demand will continue to be the main supports.

#Gümüş #Silver #XAGUSD

- Reward

- like

- Comment

- Repost

- Share

What will happen to gold next week?

If it stays above 5,000 in the short term, a rise toward 5,100-5,150 is expected; if it falls below, a correction to 4,950 is anticipated.

Geopolitical tensions and inflation data are the main factors.

Next week, from February 16-22, 2026, I expect volatility in gold prices, but the overall trend appears to be upward.

Recently, prices have maintained the psychological support of $5,000, and if CPI data and interest rate cut expectations increase, upward momentum could accelerate.

Predictions suggest prices could rise to $5,250, but there is a short

If it stays above 5,000 in the short term, a rise toward 5,100-5,150 is expected; if it falls below, a correction to 4,950 is anticipated.

Geopolitical tensions and inflation data are the main factors.

Next week, from February 16-22, 2026, I expect volatility in gold prices, but the overall trend appears to be upward.

Recently, prices have maintained the psychological support of $5,000, and if CPI data and interest rate cut expectations increase, upward momentum could accelerate.

Predictions suggest prices could rise to $5,250, but there is a short

View Original

- Reward

- like

- Comment

- Repost

- Share

This week's most important economic events for the markets from February 16-20, 2026:

Monday, February 16, 2026

Turkey: Budget Balance for January → High-impact local data. If the budget deficit comes in lower than expectations, it could be positive for the TL; if higher, it may exert negative pressure.

Eurozone: Industrial Production → Moderate-high impact. Weak data increases ECB rate cut expectations → EUR may weaken.

Overall, the start of the week is calm, but liquidity could be low due to Presidents' Day (US markets closed).

Tuesday, February 17, 2026

UK: Unemployment Rate, Average Earnin

View OriginalMonday, February 16, 2026

Turkey: Budget Balance for January → High-impact local data. If the budget deficit comes in lower than expectations, it could be positive for the TL; if higher, it may exert negative pressure.

Eurozone: Industrial Production → Moderate-high impact. Weak data increases ECB rate cut expectations → EUR may weaken.

Overall, the start of the week is calm, but liquidity could be low due to Presidents' Day (US markets closed).

Tuesday, February 17, 2026

UK: Unemployment Rate, Average Earnin

- Reward

- like

- Comment

- Repost

- Share

Breaking News

US Inflation Data Released

US inflation data for the (January 2026 CPI) period has been announced and came in below expectations – a positive development for the markets.

Brief summary of the figures:

Annual headline CPI → 2.4% (Expectations: 2.5%, previous: 2.7%) → Lowest level since May 2025.

Monthly change → +0.2% (Expectations: around 0.3%).

Core CPI (yearly) → 2.5% (close to expectations, slight decrease from previous 2.6%).

Inflation signals a soft landing toward the Fed’s 2% target.

Short-term market impact (general expectation):

Stocks (especially Nasdaq/tech) → ↑ Positiv

View OriginalUS Inflation Data Released

US inflation data for the (January 2026 CPI) period has been announced and came in below expectations – a positive development for the markets.

Brief summary of the figures:

Annual headline CPI → 2.4% (Expectations: 2.5%, previous: 2.7%) → Lowest level since May 2025.

Monthly change → +0.2% (Expectations: around 0.3%).

Core CPI (yearly) → 2.5% (close to expectations, slight decrease from previous 2.6%).

Inflation signals a soft landing toward the Fed’s 2% target.

Short-term market impact (general expectation):

Stocks (especially Nasdaq/tech) → ↑ Positiv

- Reward

- like

- Comment

- Repost

- Share

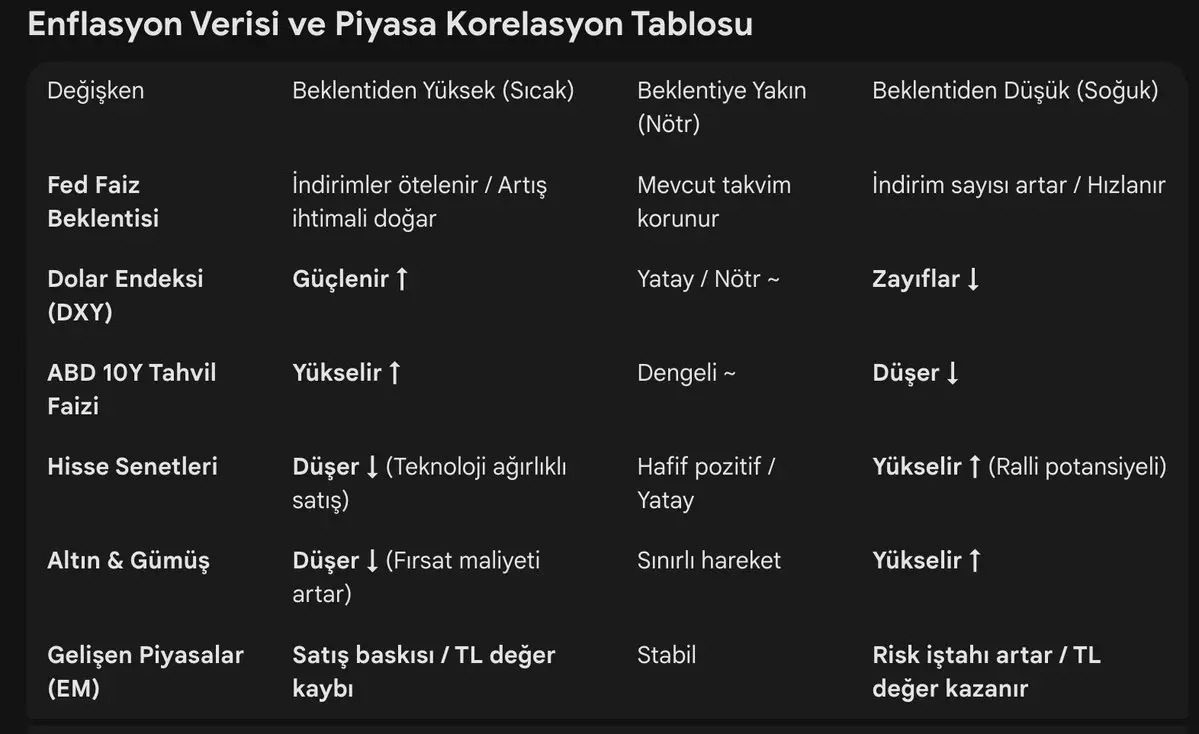

⚠Today at 4:30 PM, how will the US inflation data announced impact the markets?

US inflation data (especially CPI) is one of the data points that creates the highest volatility in global financial markets. Its effect occurs through this basic mechanism:

Expectation: 2.5%

Why Does It React So Strongly?

1. The Fed's 2% inflation target remains the reference point. At the beginning of 2026, inflation is around 2.5–2.7% → still above the target.

2. Every 0.1–0.2 percentage point deviation can change the Fed's expected total interest rate cuts in 2026 by 25–50 basis points.

3. High inflation → borr

View OriginalUS inflation data (especially CPI) is one of the data points that creates the highest volatility in global financial markets. Its effect occurs through this basic mechanism:

Expectation: 2.5%

Why Does It React So Strongly?

1. The Fed's 2% inflation target remains the reference point. At the beginning of 2026, inflation is around 2.5–2.7% → still above the target.

2. Every 0.1–0.2 percentage point deviation can change the Fed's expected total interest rate cuts in 2026 by 25–50 basis points.

3. High inflation → borr

- Reward

- like

- Comment

- Repost

- Share

It is not true that Russia is completely switching to the US dollar — this is an exaggeration.

According to the latest developments in February 2026, based on Bloomberg’s February 12 report:

• A leaked document from within the Kremlin suggests a possible agreement with the Trump administration, including a proposal to partially return to a dollar-based payment system within the scope of Ukraine peace talks.

• The idea of reusing the dollar in energy trade (oil/LNG) and international transactions is on the table.

• Goal: Lift sanctions, attract US companies to Russia, and gain economic

View OriginalAccording to the latest developments in February 2026, based on Bloomberg’s February 12 report:

• A leaked document from within the Kremlin suggests a possible agreement with the Trump administration, including a proposal to partially return to a dollar-based payment system within the scope of Ukraine peace talks.

• The idea of reusing the dollar in energy trade (oil/LNG) and international transactions is on the table.

• Goal: Lift sanctions, attract US companies to Russia, and gain economic

- Reward

- like

- Comment

- Repost

- Share

The three main reasons for the sharp decline in the markets:

• Fed and Interest Rate Expectations:

The very strong non-farm payroll data in the US triggered fears that "the Fed will delay interest rate cuts." This strengthened the dollar index while hitting risky assets like (stocks and cryptocurrencies).

• Cryptocurrency Liquidation Wave:

Bitcoin losing the critical $70,000 support led to the liquidation of billions of dollars in leveraged trades. This situation deepened selling pressure with a snowball effect.

• Geopolitics and Inflation:

Tensions in the Middle East pushing oil prices higher

• Fed and Interest Rate Expectations:

The very strong non-farm payroll data in the US triggered fears that "the Fed will delay interest rate cuts." This strengthened the dollar index while hitting risky assets like (stocks and cryptocurrencies).

• Cryptocurrency Liquidation Wave:

Bitcoin losing the critical $70,000 support led to the liquidation of billions of dollars in leveraged trades. This situation deepened selling pressure with a snowball effect.

• Geopolitics and Inflation:

Tensions in the Middle East pushing oil prices higher

BTC-1,73%

- Reward

- like

- 1

- Repost

- Share

GateUser-05cf0d15 :

:

Happy New Year 🧨Good morning...

The BIST started the day higher, the dollar is stable, gold has slightly declined. Iran-U.S. tensions are pushing oil to $70. Bitcoin is stuck around 67k in crypto.

The general market overview today is as follows levels approximately:

• USD/TRY: Around 43.65 TRY with sideways movement, small fluctuations within the 0.02-0.03% range.

• EUR/TRY: Slight upward trend around 51.95-52.00 TRY.

• BIST 100: Started the day with a slight increase, currently around 13,800-13,850 in the positive zone of 0.1-0.6%.

• Gold per Gram: Between 7,090-7,110 TRY, with gold spot price around 5,050-5

The BIST started the day higher, the dollar is stable, gold has slightly declined. Iran-U.S. tensions are pushing oil to $70. Bitcoin is stuck around 67k in crypto.

The general market overview today is as follows levels approximately:

• USD/TRY: Around 43.65 TRY with sideways movement, small fluctuations within the 0.02-0.03% range.

• EUR/TRY: Slight upward trend around 51.95-52.00 TRY.

• BIST 100: Started the day with a slight increase, currently around 13,800-13,850 in the positive zone of 0.1-0.6%.

• Gold per Gram: Between 7,090-7,110 TRY, with gold spot price around 5,050-5

BTC-1,73%

- Reward

- like

- Comment

- Repost

- Share

📉 Why is gold falling?

On the ounce side, US data has diminished hopes of a rate cut → testing the 7,100 support level in gram TL. The dollar exchange rate is steady, and the stock market is making a slight recovery effort. Do you think this is a correction or an opportunity? #GramAltın #DolarTL

View OriginalOn the ounce side, US data has diminished hopes of a rate cut → testing the 7,100 support level in gram TL. The dollar exchange rate is steady, and the stock market is making a slight recovery effort. Do you think this is a correction or an opportunity? #GramAltın #DolarTL

- Reward

- like

- Comment

- Repost

- Share

Breaking News

The US employment data has been released, adding 130,000 new jobs. The expectation was around 65-75 thousand. The unemployment rate also dropped to 4.3%. This was a positive surprise, significantly above the December forecast of 50,000 new jobs.

The overall market impact can be summarized as follows:

- US stocks → Positive reaction, futures turned green, S&P/Dow slightly upward, generally negative overall.

- Dollar → Strengthening, USD index rising.

- Bond yields → Slight increase, recovery in 10-year yields.

- Gold → Under pressure, gold that was rising earlier is re

View OriginalThe US employment data has been released, adding 130,000 new jobs. The expectation was around 65-75 thousand. The unemployment rate also dropped to 4.3%. This was a positive surprise, significantly above the December forecast of 50,000 new jobs.

The overall market impact can be summarized as follows:

- US stocks → Positive reaction, futures turned green, S&P/Dow slightly upward, generally negative overall.

- Dollar → Strengthening, USD index rising.

- Bond yields → Slight increase, recovery in 10-year yields.

- Gold → Under pressure, gold that was rising earlier is re

- Reward

- like

- Comment

- Repost

- Share

🇺🇸 Eyes on U.S. Non-Farm Payrolls data!

The postponed January data will be released today at 16:30 TSİ.

Expectations: +70K.

📉 Weak data: Increases expectations of a rate cut from the Fed, supports #Altın, #gold, #platinum.

📈 Strong data: Pushes the dollar index (DXY) higher, creates volatility and selling in U.S. stocks #Nasdaq ve #SPX500, negatively affecting gold, silver, and platinum.

View OriginalThe postponed January data will be released today at 16:30 TSİ.

Expectations: +70K.

📉 Weak data: Increases expectations of a rate cut from the Fed, supports #Altın, #gold, #platinum.

📈 Strong data: Pushes the dollar index (DXY) higher, creates volatility and selling in U.S. stocks #Nasdaq ve #SPX500, negatively affecting gold, silver, and platinum.

- Reward

- like

- Comment

- Repost

- Share

Why is Bitcoin falling?

The answer is simple: liquidity crisis and macro fears. As the Fed chairperson changes, the market is avoiding risk.

The cryptocurrency market has generally entered a bearish trend. In this regard, market participants see every rise as a selling opportunity.

Stay tuned.

#BTC #Cryptocurrency

The answer is simple: liquidity crisis and macro fears. As the Fed chairperson changes, the market is avoiding risk.

The cryptocurrency market has generally entered a bearish trend. In this regard, market participants see every rise as a selling opportunity.

Stay tuned.

#BTC #Cryptocurrency

BTC-1,73%

- Reward

- like

- 1

- Repost

- Share

GateUser-1379e90d :

:

Did not mention the deeper underlying factorsWhy are Gold, Silver, and Platinum rising? 🧐

1- US retail sales data came in weak (Recession fears).

2- Bond yields and the Dollar index are weakening.

3- Geopolitical tensions continue.

A good day for those holding in their basket of precious metals. 💰✨ #Gold #Silver #Platinum #Gold #Gümüş #Platinum

View Original1- US retail sales data came in weak (Recession fears).

2- Bond yields and the Dollar index are weakening.

3- Geopolitical tensions continue.

A good day for those holding in their basket of precious metals. 💰✨ #Gold #Silver #Platinum #Gold #Gümüş #Platinum

- Reward

- like

- Comment

- Repost

- Share

Bitcoin is gaining momentum around the $70,000 mark. Long-term predictions in the $170,000 - $266,000 range from institutional players like (JPMorgan) are exciting, but currently the market is in a full liquidity battle. We are at a 'test' turning point where patience will be rewarded and short-term traders will be eliminated. 🚀

#Bitcoin #BTC #Crypto

#Bitcoin #BTC #Crypto

BTC-1,73%

- Reward

- like

- Comment

- Repost

- Share

Palladium futures and ETFs are available in #Quanfury platformunda listelendi. Ayrıca diğer kıymetli metaller # gold #gümüş # platinum. They can be bought and sold with zero transaction costs.

#palladium #ETF #XPDUSD

#palladium #ETF #XPDUSD

View Original

- Reward

- like

- Comment

- Repost

- Share

After the sharp 2.3% increase in Borsa Istanbul yesterday, there is an attempt to stabilize around 13,850 today. While global appetite remains strong, led by technology stocks, domestic industrial production and external US retail sales data could increase volatility. Continuing cautious optimism. 📈 #BIST100 #Stock Exchange

View Original- Reward

- like

- Comment

- Repost

- Share

Today, we are observing a nearly 3% pullback in silver; the ratio is once again trying to shift back in favor of gold. While BNP Paribas's target of $6,000 for gold sounds ambitious, geopolitical risks and central bank purchases keep this fire alive. Short-term corrections do not disrupt the long-term trend. ⚖️

#Altın #Silver #Silver

View Original#Altın #Silver #Silver

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More152.16K Popularity

28.68K Popularity

25.81K Popularity

71.37K Popularity

12.19K Popularity

Pin