StacyMuur

No content yet

StacyMuur

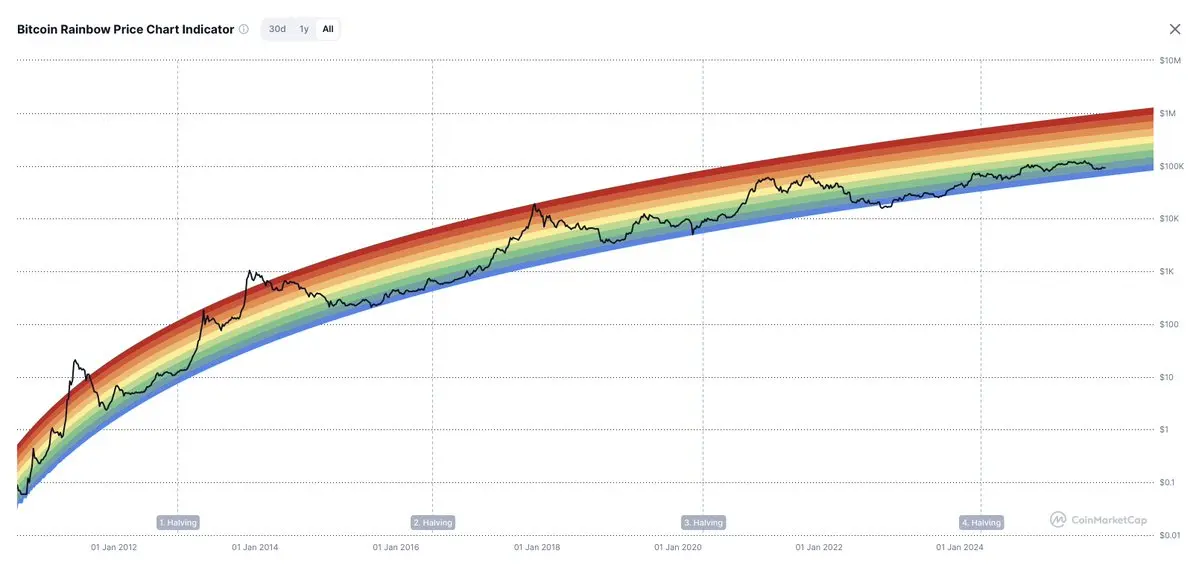

A great illustration of why the halving theory is dead

- Reward

- 1

- Comment

- Repost

- Share

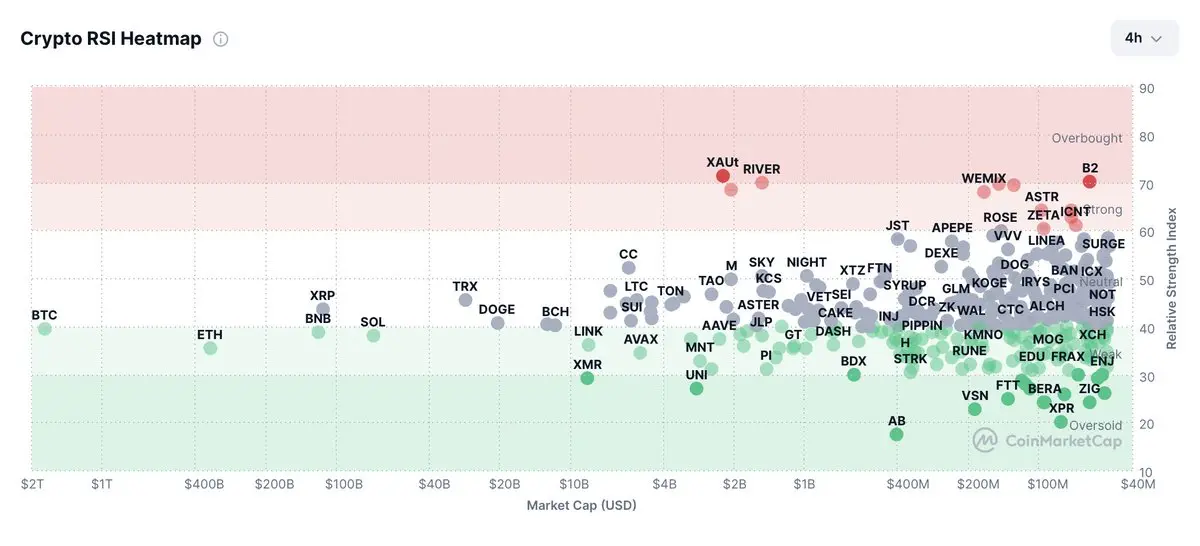

Quick overview of today\'s overbought / oversold map ↓

- Reward

- like

- Comment

- Repost

- Share

What\'s your core grind these days, anon?

- Reward

- like

- Comment

- Repost

- Share

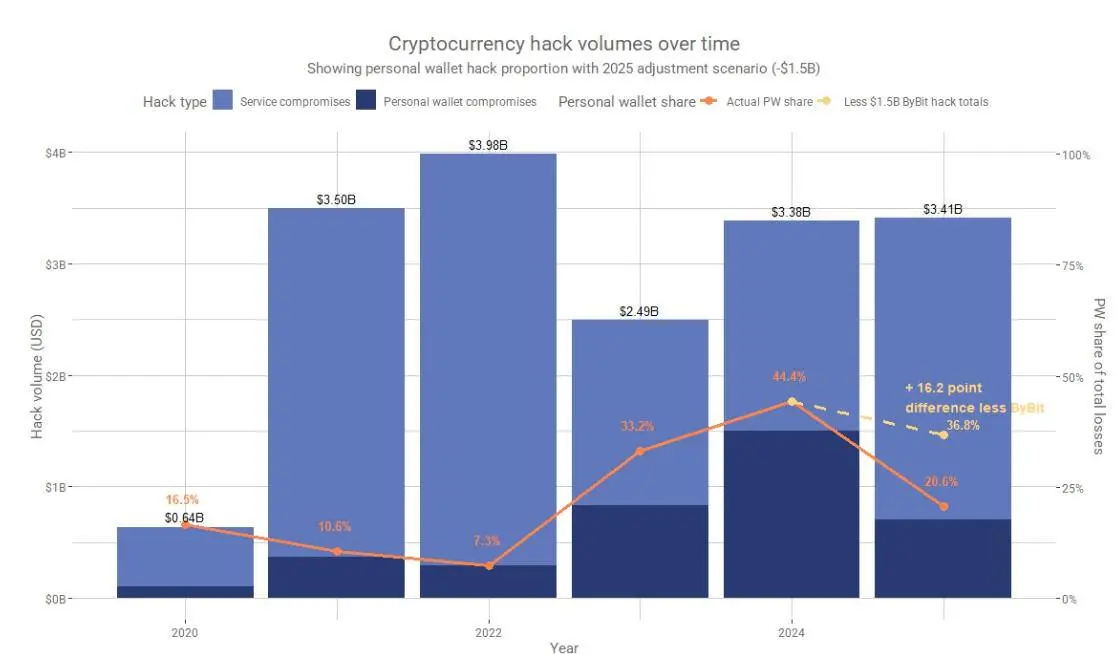

Hacks are still a huge problem.And most protocols never make it back.

- Reward

- like

- Comment

- Repost

- Share

Are you still farming airdrops, anon?

- Reward

- like

- Comment

- Repost

- Share

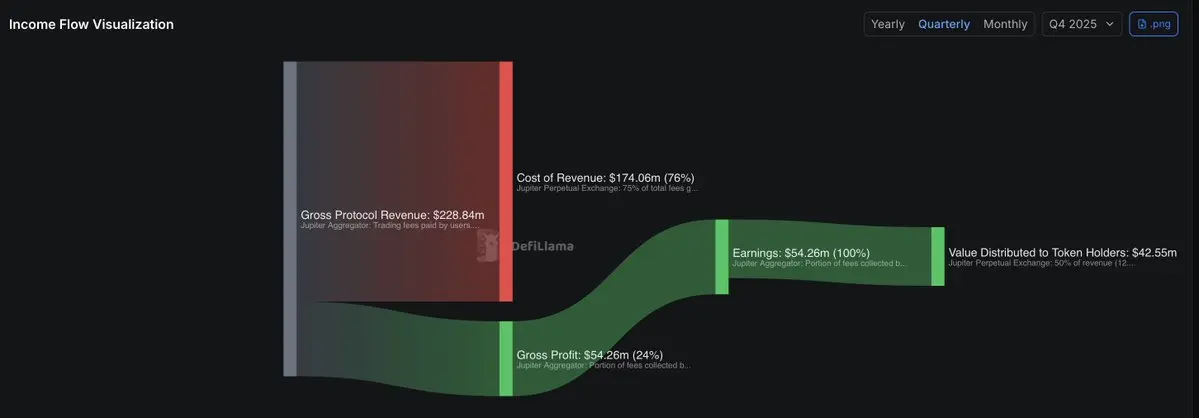

Visualization of @JupiterExchange's revenue flow here.

I think that in 2026, directing value back to token holders is a must.

2025 has shown us what happens when tokens lack utility and connection to product success.

No need for a new 2025 in this context, pls.

I think that in 2026, directing value back to token holders is a must.

2025 has shown us what happens when tokens lack utility and connection to product success.

No need for a new 2025 in this context, pls.

TOKEN-3,77%

- Reward

- like

- Comment

- Repost

- Share

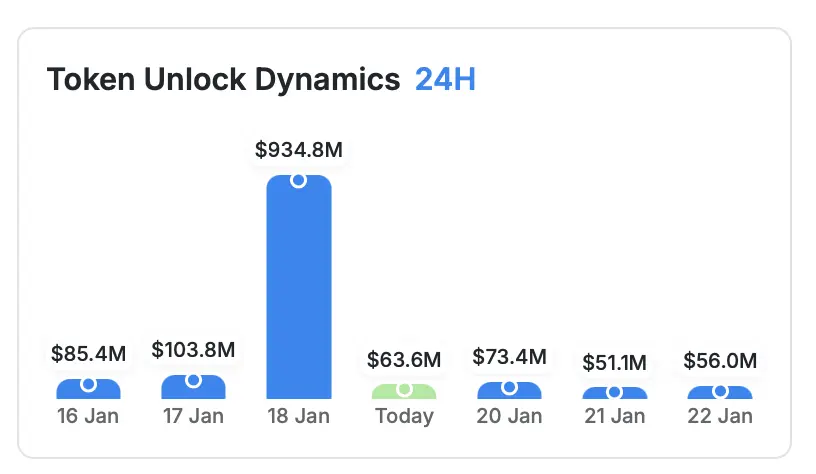

No one noticed but we had almost $1B in new token unlocks yesterday.

There's really no fundamental reason why alts should not bleed.

There's really no fundamental reason why alts should not bleed.

- Reward

- like

- Comment

- Repost

- Share

Wtf do people say that perps are easier than memecoins?

><

><

- Reward

- like

- Comment

- Repost

- Share

Lmao, this is amazing

We're hiring at @GREEND0TS now and sometimes my colleagues send me candidate sumbissions that are too good to be real.

This one is a hidden HR meme.

In short:

Many people are now reverse-engineering their CVs from the JD – which is already cringe and easy to spot.

This guy:

• Reverse-engineered

• Forgot to remove the note from AI

• Sent his Polymarket-ready CV to Green Dots

• Asks $5K per month

Are we cooked or wat?

We're hiring at @GREEND0TS now and sometimes my colleagues send me candidate sumbissions that are too good to be real.

This one is a hidden HR meme.

In short:

Many people are now reverse-engineering their CVs from the JD – which is already cringe and easy to spot.

This guy:

• Reverse-engineered

• Forgot to remove the note from AI

• Sent his Polymarket-ready CV to Green Dots

• Asks $5K per month

Are we cooked or wat?

- Reward

- like

- Comment

- Repost

- Share