PaiCrypto

No content yet

PaiCrypto

Come on! Are you going to wipe out the bears (shorts) or the bulls (longs)? Who will ultimately dominate the market?

View Original- Reward

- like

- Comment

- Repost

- Share

It's time to execute a wave of mid-term short positions.

View Original- Reward

- like

- Comment

- Repost

- Share

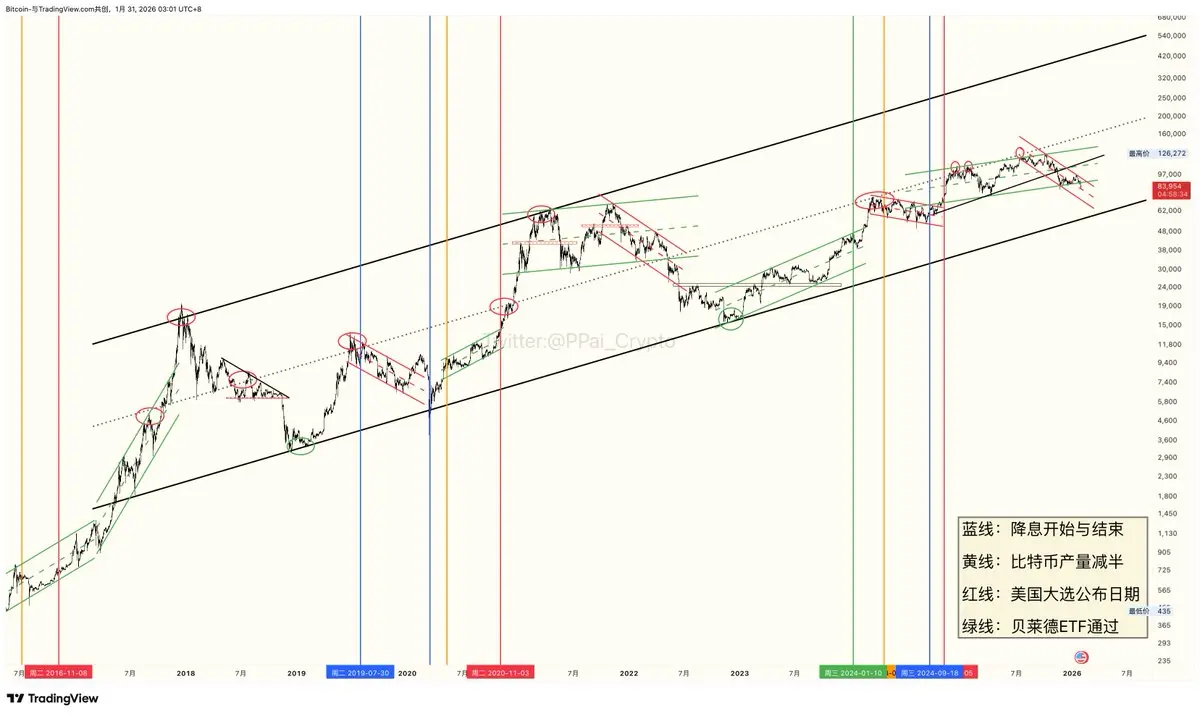

#BTC I am willing to call this chart 🚢 the "Bitcoin Navigation Map," which has been my "Golden Bible" for many years. The price fluctuation pattern essentially represents a journey of "channel switching": the channel is the trend: each upward or downward channel is a specific current breakthrough, crossing over: we transition from one price channel to a higher one through guidance from "lighthouses" such as interest rate cut cycles and halving nodes. Waves are fluctuations: no matter how turbulent the middle, the ship will ultimately follow the pattern, sailing from low-latitude waters (the b

BTC-1,93%

- Reward

- 1

- Comment

- Repost

- Share

Gemini in Chrome Now it's good, real-time AI assistance during Chrome browsing, very efficient to use.

View Original- Reward

- like

- Comment

- Repost

- Share

Almost a week without opening X, I just browsed through some X posts. Clearly, the market discussion has significantly declined. Since last year, the enthusiasm in the crypto circle has been rapidly declining. Due to various factors, most traders have started shifting to traditional financial markets. Of course, there are still some people who cannot distinguish the current situation and insist on the arrival of a full-blown altcoin season, repeatedly being knocked down. I have emphasized countless times since last year to abandon this idea. It is foolish. As a trader, the core is not to play

BTC-1,93%

- Reward

- like

- Comment

- Repost

- Share

This morning's decline was not unexpected.

Whether in the member group or the teaching group, it was clearly reminded yesterday not to go long.

At the same time, sharing how to implement the strategy, with grid short as the core.

View OriginalWhether in the member group or the teaching group, it was clearly reminded yesterday not to go long.

At the same time, sharing how to implement the strategy, with grid short as the core.

- Reward

- like

- Comment

- Repost

- Share

Swearing in this kind of market situation is basic respect

View Original- Reward

- like

- Comment

- Repost

- Share

Just a question, what do you think is the biggest difference between trading in the crypto world and trading in the traditional finance world?

View Original- Reward

- like

- Comment

- Repost

- Share

This lamb noodle soup's chili 🌶️ is super fragrant

View Original

- Reward

- like

- Comment

- Repost

- Share

Now even the volatility of cancer stocks is stronger than that of the crypto world. What else can I say?

It can be said that the current "largest" group of players in the crypto world is undoubtedly the "gamblers" group.

Since they are gamblers, there is no need for a value narrative targeting this group; as long as there is a reason to gamble, it's enough. Therefore, memecoin can create topics for gamblers to participate in.

After the New Year, U.S. stocks will also be incorporated into my investment system. Before the next cycle, there will definitely be some CEXs collapsing.

It can be said that the current "largest" group of players in the crypto world is undoubtedly the "gamblers" group.

Since they are gamblers, there is no need for a value narrative targeting this group; as long as there is a reason to gamble, it's enough. Therefore, memecoin can create topics for gamblers to participate in.

After the New Year, U.S. stocks will also be incorporated into my investment system. Before the next cycle, there will definitely be some CEXs collapsing.

MEME-9,62%

- Reward

- like

- Comment

- Repost

- Share

#BTC Long or short tonight?

View Original- Reward

- like

- Comment

- Repost

- Share

We notice CME: BTC1!

Forming consecutive gap openings at 88K and 90.5K respectively.

View OriginalForming consecutive gap openings at 88K and 90.5K respectively.

- Reward

- like

- Comment

- Repost

- Share

I see everyone's nervous relaxation about the market rebound

So I think it's unlikely to reach the expected rebound target level

Have a great weekend~

View OriginalSo I think it's unlikely to reach the expected rebound target level

Have a great weekend~

- Reward

- like

- Comment

- Repost

- Share

Many people overlook exchange fee rebates

They think this small benefit is not worth mentioning

First, check the transaction fees for each of your trades. Convert them into RMB and calculate how much money you lost over the years without fee rebates—you'll realize how much money rightfully belonged to you.

View OriginalThey think this small benefit is not worth mentioning

First, check the transaction fees for each of your trades. Convert them into RMB and calculate how much money you lost over the years without fee rebates—you'll realize how much money rightfully belonged to you.

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More7.63K Popularity

50.2K Popularity

362.46K Popularity

38.44K Popularity

57.62K Popularity

Pin