Post content & earn content mining yield

placeholder

Crypto_Teacher

Bitwise Files for a UNI Spot ETF — A Signal of DeFi’s Next Phase

Bitwise Asset Management’s renewed filing for a Uniswap (UNI) Spot ETF in early 2026 represents far more than another regulatory application. It marks a broader shift in how Decentralized Finance (DeFi) is being evaluated by regulators, institutions, and market architects.

This filing arrives at a moment when the regulatory environment has evolved from hesitation to structured engagement. Policymakers are increasingly focused on transparency, liquidity standards, custody frameworks, and investor protection—creating conditions whe

Bitwise Asset Management’s renewed filing for a Uniswap (UNI) Spot ETF in early 2026 represents far more than another regulatory application. It marks a broader shift in how Decentralized Finance (DeFi) is being evaluated by regulators, institutions, and market architects.

This filing arrives at a moment when the regulatory environment has evolved from hesitation to structured engagement. Policymakers are increasingly focused on transparency, liquidity standards, custody frameworks, and investor protection—creating conditions whe

- Reward

- like

- Comment

- Repost

- Share

#我最中意的加密货币

💞 My Heartthrob Token: My favorite token is GT (GateToken) because it’s backed by real utility, strong tokenomics, and a growing ecosystem not just hype.

GT reflects long-term value, user benefits, and trust in Gate’s secure and expanding platform, which is why it remains my top choice.

In a market driven by fast-moving narratives and emotional cycles, choosing a true “heartthrob token” requires more than excitement it requires trust, structure, and long-term alignment. For me, that token is GT (GateToken). My conviction in GT is not based on short-term price action, but on its fo

💞 My Heartthrob Token: My favorite token is GT (GateToken) because it’s backed by real utility, strong tokenomics, and a growing ecosystem not just hype.

GT reflects long-term value, user benefits, and trust in Gate’s secure and expanding platform, which is why it remains my top choice.

In a market driven by fast-moving narratives and emotional cycles, choosing a true “heartthrob token” requires more than excitement it requires trust, structure, and long-term alignment. For me, that token is GT (GateToken). My conviction in GT is not based on short-term price action, but on its fo

GT-1,98%

- Reward

- 3

- 3

- Repost

- Share

LittleQueen :

:

2026 GOGOGO 👊View More

I sold everything I had. Every coin I owned is gone. I\'m completely out of the cryptocurrency market, I can\'t take it anymore. Aggressive dumping, manipulation, everything is so intense. crypto is over, I am out, I am very glad to meet you, life has dreams, each is wonderful.Welcome to my new life

- Reward

- like

- Comment

- Repost

- Share

OND

ONOD

Created By@M2SYSA

Subscription Progress

0.00%

MC:

$0

Create My Token

Good morning 🫡Important lesson in this video 👇

- Reward

- like

- Comment

- Repost

- Share

#GlobalTechSell-OffHitsRiskAssets

The recent global tech sell-off has sent shockwaves across financial markets, reinforcing how tightly connected risk assets have become in the current macro environment. As major technology stocks faced sharp declines, the impact quickly spread beyond equities, triggering weakness across crypto, growth stocks, and other high-beta assets. This synchronized move highlights a broader shift in investor behavior, where capital is rotating away from risk amid rising uncertainty.

Technology stocks have long been seen as a barometer for risk appetite, and their recen

The recent global tech sell-off has sent shockwaves across financial markets, reinforcing how tightly connected risk assets have become in the current macro environment. As major technology stocks faced sharp declines, the impact quickly spread beyond equities, triggering weakness across crypto, growth stocks, and other high-beta assets. This synchronized move highlights a broader shift in investor behavior, where capital is rotating away from risk amid rising uncertainty.

Technology stocks have long been seen as a barometer for risk appetite, and their recen

BTC-1,26%

- Reward

- 1

- Comment

- Repost

- Share

Topic of action: Controlled entry at support

Power distribution: the probability of short-term growth is approximately 56%, decline approximately 44%; the market remains bearish, but signs of stabilization are visible in whale behavior and trading volumes. Maintaining the level of $58,000–$60,000 is most likely to lead to a consolidation and recovery. $BTC $BTC

Growth scenario: technical oversold conditions ( RSI 80 1928374656574839201, a large number of liquidated long positions, and balanced buy/sell volumes ) ≈ 1: 1928374656574839201 create a basis for a short squeeze. Additional support c

Power distribution: the probability of short-term growth is approximately 56%, decline approximately 44%; the market remains bearish, but signs of stabilization are visible in whale behavior and trading volumes. Maintaining the level of $58,000–$60,000 is most likely to lead to a consolidation and recovery. $BTC $BTC

Growth scenario: technical oversold conditions ( RSI 80 1928374656574839201, a large number of liquidated long positions, and balanced buy/sell volumes ) ≈ 1: 1928374656574839201 create a basis for a short squeeze. Additional support c

BTC-1,26%

- Reward

- 2

- 1

- Repost

- Share

NextGame :

:

Follow 🔍 closelyYellen releases major news about Bitcoin! $1

U.S. Treasury Secretary Yellen just confirmed. There is no taxpayer bailout for $BTC. The Treasury Department and the Financial Stability Oversight Council have no authority to force banks to hold Bitcoin reserves. The government's Bitcoin holdings are confiscated assets, not taxpayer funds. Your money is safe from crypto foolishness. This is a huge clarification. The market needs this.

This is not financial advice.

#BTC #CryptoNews #Yellen $BTC

U.S. Treasury Secretary Yellen just confirmed. There is no taxpayer bailout for $BTC. The Treasury Department and the Financial Stability Oversight Council have no authority to force banks to hold Bitcoin reserves. The government's Bitcoin holdings are confiscated assets, not taxpayer funds. Your money is safe from crypto foolishness. This is a huge clarification. The market needs this.

This is not financial advice.

#BTC #CryptoNews #Yellen $BTC

BTC-1,26%

- Reward

- like

- Comment

- Repost

- Share

Crypto Technical Concepts Explained Live

- Reward

- like

- Comment

- Repost

- Share

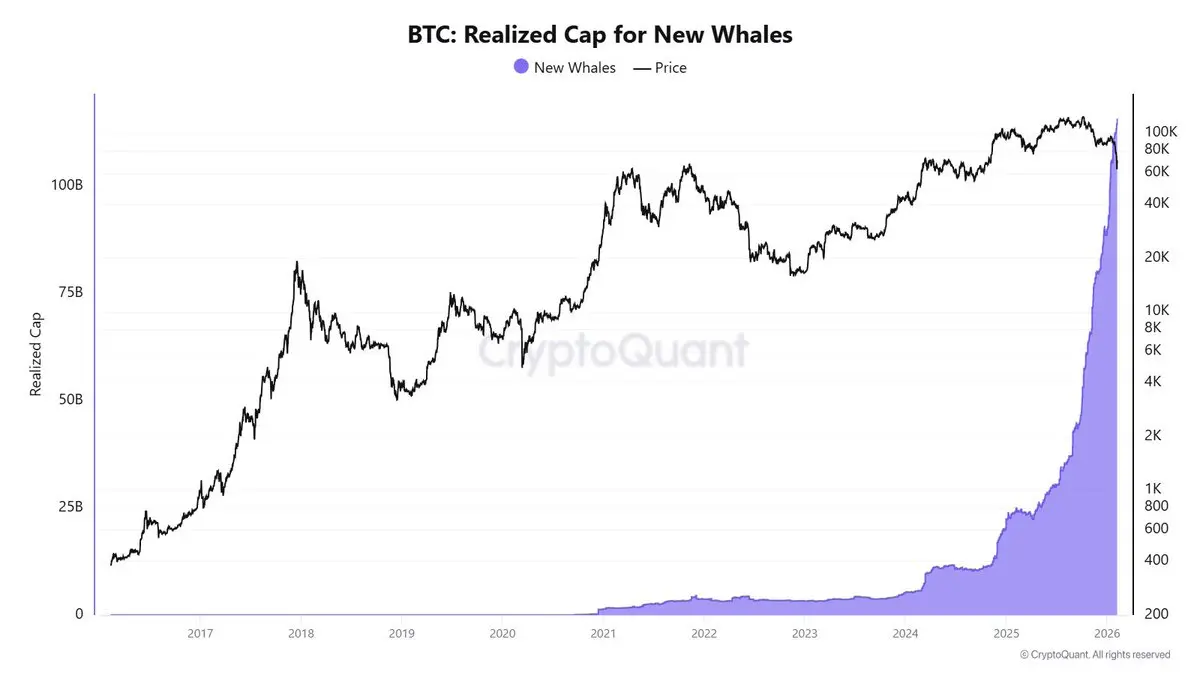

The new whales continue to increase their BTC purchasing efforts. They are actively accumulating Bitcoin, which indicates a growing interest among large investors. This trend suggests that the market may experience upward momentum as these major players continue to buy in. Investors should keep an eye on these developments to understand potential future price movements.

BTC-1,26%

- Reward

- like

- Comment

- Repost

- Share

【$SOL Signal】Short Position + Downtrend Continuation Pattern

$SOL Price decline accompanied by negative funding rates and stable open interest indicates orderly selling under bearish dominance, not panic short squeezes. The 4H rebound high points are gradually decreasing, and buying pressure (Buy/Sell Ratio < 0.5) weakens during the rebound, forming a dense sell wall in the 87.2-87.4 region.

🎯 Direction: Short Position

Price is oscillating above the key support level (previous low 84.4), but the rebound is weak and Taker sell volume persists. Stable open interest suggests short positions ha

View Original$SOL Price decline accompanied by negative funding rates and stable open interest indicates orderly selling under bearish dominance, not panic short squeezes. The 4H rebound high points are gradually decreasing, and buying pressure (Buy/Sell Ratio < 0.5) weakens during the rebound, forming a dense sell wall in the 87.2-87.4 region.

🎯 Direction: Short Position

Price is oscillating above the key support level (previous low 84.4), but the rebound is weak and Taker sell volume persists. Stable open interest suggests short positions ha

- Reward

- like

- Comment

- Repost

- Share

#BuyTheDipOrWaitNow?

This is the question everyone’s asking right now, and honestly, the answer isn’t a simple yes or no. Let’s break it down cleanly 👇

📉 Current Market Context

Bitcoin pullback isn’t random — it’s driven by:

Global tech stock sell-offs

Risk-off sentiment across equities & crypto

Profit-taking after a strong prior rally

This means the dip is macro-driven, not a crypto-only collapse.

🟢 Reasons to Buy the Dip

You may consider buying if:

You’re a long-term investor (months–years)

BTC is holding major support zones (no weekly breakdown)

On-chain data shows accumulation, not pa

This is the question everyone’s asking right now, and honestly, the answer isn’t a simple yes or no. Let’s break it down cleanly 👇

📉 Current Market Context

Bitcoin pullback isn’t random — it’s driven by:

Global tech stock sell-offs

Risk-off sentiment across equities & crypto

Profit-taking after a strong prior rally

This means the dip is macro-driven, not a crypto-only collapse.

🟢 Reasons to Buy the Dip

You may consider buying if:

You’re a long-term investor (months–years)

BTC is holding major support zones (no weekly breakdown)

On-chain data shows accumulation, not pa

BTC-1,26%

- Reward

- 1

- 3

- Repost

- Share

Sakura_3434 :

:

Watching Closely 🔍️View More

#CryptoSurvivalGuide

The crypto market is not simply a place to chase profits it is a long-term survival test where only disciplined participants remain standing. Every market cycle proves the same lesson: traders who focus only on short-term gains often disappear during periods of uncertainty, while those who prioritize strategy, patience, and risk control quietly position themselves for future success. The current market environment has once again highlighted how unforgiving crypto can be for emotionally driven decisions.

Recent price action across Bitcoin and the broader altcoin market re

The crypto market is not simply a place to chase profits it is a long-term survival test where only disciplined participants remain standing. Every market cycle proves the same lesson: traders who focus only on short-term gains often disappear during periods of uncertainty, while those who prioritize strategy, patience, and risk control quietly position themselves for future success. The current market environment has once again highlighted how unforgiving crypto can be for emotionally driven decisions.

Recent price action across Bitcoin and the broader altcoin market re

BTC-1,26%

- Reward

- like

- Comment

- Repost

- Share

王德发

王德发

Created By@MidnightTree

Listing Progress

0.00%

MC:

$2.38K

Create My Token

【$BTC Signal】No Position + High-Level Consolidation Awaiting Direction

$BTC Consolidating at a high level below the 70,000 mark, 4H timeframe shows a contracting pattern, but the bullish and bearish forces are quietly shifting.

🎯Direction: No Position (NoPosition)

Market Logic: Price has fallen back from the 73,000 high and is currently trading sideways around 69,000. Key data points show conflicting signals: the buy ratio on the 4H K-line has been decreasing (0.54→0.48→0.50), indicating waning active buying interest; although Taker is still net buying, open interest (OI) remains stable, comb

View Original$BTC Consolidating at a high level below the 70,000 mark, 4H timeframe shows a contracting pattern, but the bullish and bearish forces are quietly shifting.

🎯Direction: No Position (NoPosition)

Market Logic: Price has fallen back from the 73,000 high and is currently trading sideways around 69,000. Key data points show conflicting signals: the buy ratio on the 4H K-line has been decreasing (0.54→0.48→0.50), indicating waning active buying interest; although Taker is still net buying, open interest (OI) remains stable, comb

- Reward

- like

- Comment

- Repost

- Share

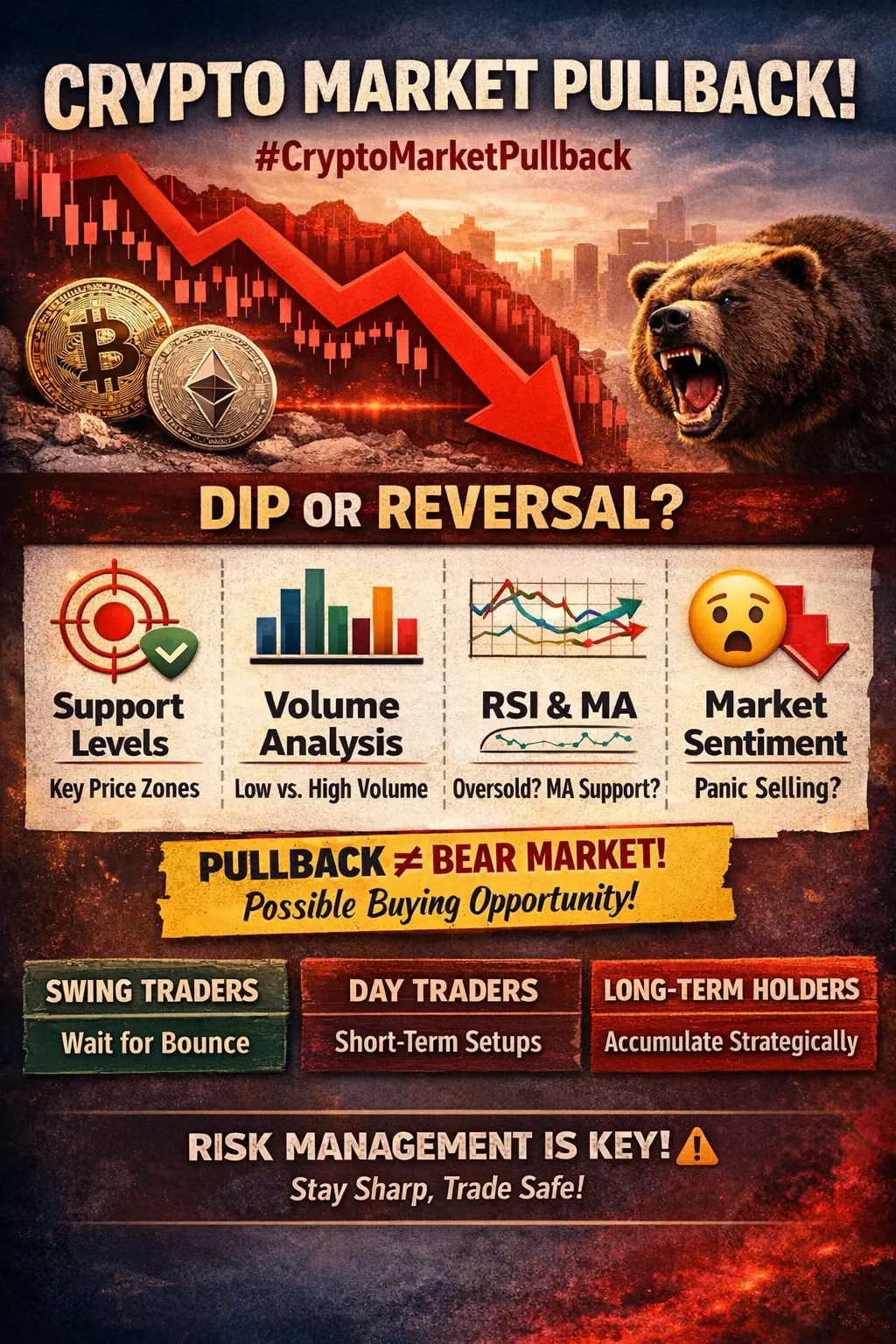

📉 Crypto Market Pullback Alert! #CryptoMarketPullback

The market is showing signs of a pullback, meaning prices are temporarily dropping after recent highs. This is a natural part of market cycles, often giving traders a chance to reassess positions or enter at better prices.

💡 Key Points to Watch:

Support Levels: Look for strong price zones where buyers might step in. These can act as potential bounce points.

Volume Analysis: Pullbacks on low volume often indicate a minor correction, whereas high-volume pullbacks can signal a stronger trend reversal.

Indicators:

RSI nearing oversold levels

The market is showing signs of a pullback, meaning prices are temporarily dropping after recent highs. This is a natural part of market cycles, often giving traders a chance to reassess positions or enter at better prices.

💡 Key Points to Watch:

Support Levels: Look for strong price zones where buyers might step in. These can act as potential bounce points.

Volume Analysis: Pullbacks on low volume often indicate a minor correction, whereas high-volume pullbacks can signal a stronger trend reversal.

Indicators:

RSI nearing oversold levels

- Reward

- 1

- 1

- Repost

- Share

Sanam_Chowdhury :

:

thank you for letting us know that- Reward

- like

- Comment

- Repost

- Share

Gm CT……. Happy Sunday bros ❤️

- Reward

- like

- Comment

- Repost

- Share

Crypto Market Volatility Explained

- Reward

- like

- Comment

- Repost

- Share

ETH 2026.2.8 Weekly K-line is about to close:

📉 2022.06 - 2023.01: Spike bottoming and initial stage bottom confirmation:

In early 2023, we saw several consecutive green tB (Trend Bar) labels appearing, indicating that the market has shaken off bottom hesitation (Doji dense area) and entered the Spike (explosive) phase.

📈 2023.01 - 2024.03: Wide-range upward channel (Broad Bull Channel) this stage is a typical "small steps, quick pace," with the price repeatedly testing the 20 EMA.

Around March 2024, a clear CX (Climax) label appeared. This signals the exhaustion of the first wave of upward

📉 2022.06 - 2023.01: Spike bottoming and initial stage bottom confirmation:

In early 2023, we saw several consecutive green tB (Trend Bar) labels appearing, indicating that the market has shaken off bottom hesitation (Doji dense area) and entered the Spike (explosive) phase.

📈 2023.01 - 2024.03: Wide-range upward channel (Broad Bull Channel) this stage is a typical "small steps, quick pace," with the price repeatedly testing the 20 EMA.

Around March 2024, a clear CX (Climax) label appeared. This signals the exhaustion of the first wave of upward

- Reward

- 1

- Comment

- Repost

- Share

🌍 Global Tech Sell-Off Hits Risk Assets — Crypto in the Crossfire

The recent global tech sell-off is no longer just a Nasdaq story. Its ripple effects are spreading across all risk assets — and crypto is firmly in the impact zone. Understanding these dynamics is essential for navigating volatility and positioning strategically.

📉 What’s Driving the Sell-Off?

Rising interest rate pressure continues to compress valuations as higher bond yields reduce the appeal of growth-heavy assets. At the same time, risk-off sentiment is pushing capital toward safe havens like the USD, bonds, and gold. Add

The recent global tech sell-off is no longer just a Nasdaq story. Its ripple effects are spreading across all risk assets — and crypto is firmly in the impact zone. Understanding these dynamics is essential for navigating volatility and positioning strategically.

📉 What’s Driving the Sell-Off?

Rising interest rate pressure continues to compress valuations as higher bond yields reduce the appeal of growth-heavy assets. At the same time, risk-off sentiment is pushing capital toward safe havens like the USD, bonds, and gold. Add

BTC-1,26%

- Reward

- 5

- 10

- Repost

- Share

Crypto_Teacher :

:

Buy To Earn 💎View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More147.76K Popularity

10.66K Popularity

393.88K Popularity

2.37K Popularity

14.98K Popularity

Hot Gate Fun

View More- MC:$2.37KHolders:10.00%

- MC:$2.37KHolders:10.00%

- MC:$2.39KHolders:10.00%

- MC:$2.39KHolders:10.00%

- MC:$2.36KHolders:00.00%

News

View MoreTrend Research Transfers 651,757 ETH to CEX Worth $1.34B

46 m

Next week's White House crypto meeting will focus on stablecoin yields, with bank representatives attending for the first time.

52 m

Bullish CEO: The crypto industry will undergo large-scale consolidation

1 h

Bitwise CIO: The next bull market will be driven by nine core narratives including AiFi, revenue-generating products, Vitalik's return to Ethereum, and more

1 h

Yi Lihua: Is optimistic about the opportunities in the next industry bull market and will continue to work hard to build and develop the sector, seize new growth points, and contribute to the healthy and sustainable development of the industry.

1 h

Pin