Darius128

No content yet

Darius128

💞 Pursuing Passion | Meeting My "Heartthrob Token" MATIC!

Family, who says romance only belongs to roses? My "Must Have" is definitely MATIC (Polygon)! Recently, I’ve been deeply attracted for three reasons:

1️⃣ Ecosystem Explosion: The king of Layer2 tracks, with DeFi, NFT, and blockchain gaming ecosystems blooming everywhere—just like a potential "blue-chip" stock!

2️⃣ Practical Tech: Ethereum’s scaling ace, with low Gas fees + high speed, delivering an excellent user experience—true love-level "reliable commitment"!

3️⃣ Bright Future: zkEVM upgrade + Polygon 2.0 vision, a solid "potential

Family, who says romance only belongs to roses? My "Must Have" is definitely MATIC (Polygon)! Recently, I’ve been deeply attracted for three reasons:

1️⃣ Ecosystem Explosion: The king of Layer2 tracks, with DeFi, NFT, and blockchain gaming ecosystems blooming everywhere—just like a potential "blue-chip" stock!

2️⃣ Practical Tech: Ethereum’s scaling ace, with low Gas fees + high speed, delivering an excellent user experience—true love-level "reliable commitment"!

3️⃣ Bright Future: zkEVM upgrade + Polygon 2.0 vision, a solid "potential

ETH2,27%

- Reward

- 8

- 3

- Repost

- Share

LiMo :

:

2026 Go Go Go 👊View More

$IMU Launchpad Subscription is now officially open!

🔹 Total subscription amount: 212,404,419 $IMU | Unit price: $0.01177

🔹 Tokens will be uniformly distributed after 100% unlock

🔹 The earlier you subscribe = the more you get $IMU

🔹 Participate in new user subscriptions #USD1 YuBiBao can enjoy up to 200% annualized return

Subscription deadline: January 21, 16:00 (UTC+8)

Subscribe now: https://www.gate.com/launchpad/2374

YuBiBao entrance: https://www.gate.com/simple-earn?asset=USD1&product_id=316&product_type_tag=3

More details: https://www.gate.com/article/49255#GateLaunchpadIMU

🔹 Total subscription amount: 212,404,419 $IMU | Unit price: $0.01177

🔹 Tokens will be uniformly distributed after 100% unlock

🔹 The earlier you subscribe = the more you get $IMU

🔹 Participate in new user subscriptions #USD1 YuBiBao can enjoy up to 200% annualized return

Subscription deadline: January 21, 16:00 (UTC+8)

Subscribe now: https://www.gate.com/launchpad/2374

YuBiBao entrance: https://www.gate.com/simple-earn?asset=USD1&product_id=316&product_type_tag=3

More details: https://www.gate.com/article/49255#GateLaunchpadIMU

IMU0,56%

- Reward

- 4

- 2

- Repost

- Share

Discovery :

:

Happy New Year! 🤑View More

Privacy coins collectively surge: DASH +115%, is it regulatory arbitrage or genuine demand?

DASH surged 115% in a week, reaching $80. Meanwhile, Monero increased by 16%, and the entire privacy coin sector is moving.

Why now?

Several possible reasons:

1) Geopolitical tensions, funds seeking anonymous channels;

2) Progress of CBDCs in various countries, indirectly creating privacy demand;

3) Oversold rebound after previous sharp declines.

DASH surged 115% in a week, reaching $80. Meanwhile, Monero increased by 16%, and the entire privacy coin sector is moving.

Why now?

Several possible reasons:

1) Geopolitical tensions, funds seeking anonymous channels;

2) Progress of CBDCs in various countries, indirectly creating privacy demand;

3) Oversold rebound after previous sharp declines.

DASH4,67%

- Reward

- 8

- 7

- Repost

- Share

Discovery :

:

Happy New Year! 🤑View More

Let's talk about the upward logic of gold$XAU and silver$XAG .

The main reason for the rise in gold is the continuous expansion of global central bank debt. In just the first 7 days of 2026, global central banks issued over 200 billion US dollars in debt.

Currently, the US debt ceiling has been raised to $41 trillion, and the US national debt is $38 trillion, leaving significant room for expansion.

However, according to US Treasury Secretary Janet Yellen, the upcoming issuance may mainly be long-term bonds. If the US adjusts its debt issuance structure, the pace of debt expansion will slow do

View OriginalThe main reason for the rise in gold is the continuous expansion of global central bank debt. In just the first 7 days of 2026, global central banks issued over 200 billion US dollars in debt.

Currently, the US debt ceiling has been raised to $41 trillion, and the US national debt is $38 trillion, leaving significant room for expansion.

However, according to US Treasury Secretary Janet Yellen, the upcoming issuance may mainly be long-term bonds. If the US adjusts its debt issuance structure, the pace of debt expansion will slow do

- Reward

- 10

- 5

- Repost

- Share

Cryptoyart929 :

:

New Year Wealth Explosion 🤑View More

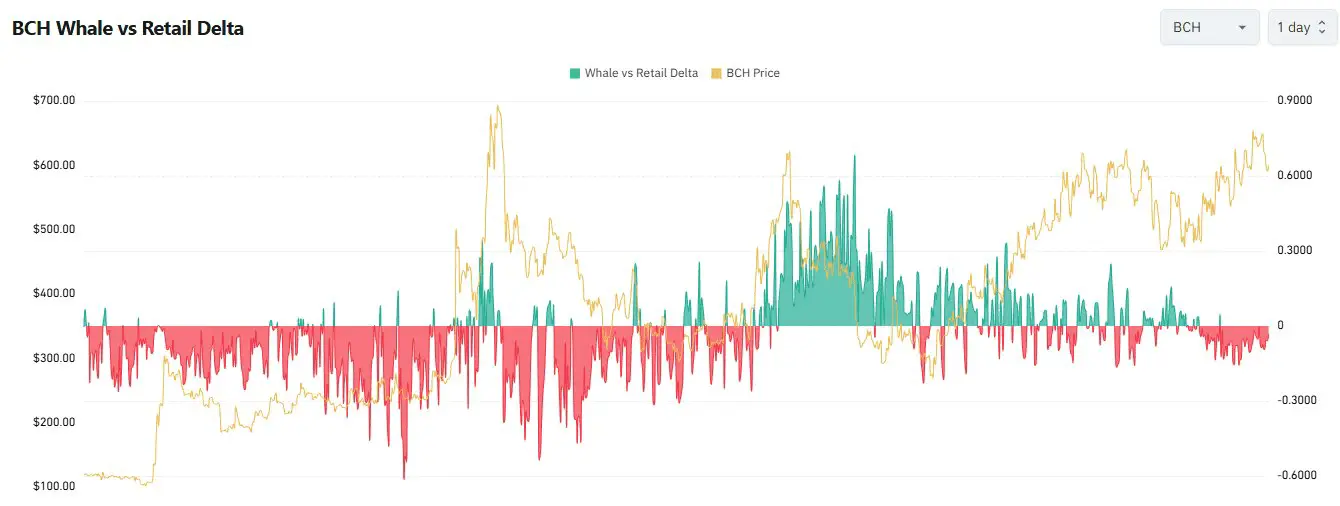

BCH has attracted more retail investor capital inflows during the recent upward trend. Retail investors have driven up the supply and demand in the BCH futures market. Currently, large BCH holders are taking a passive stance, controlling the pace of the rise, while closing out retail investors' high-leverage positions.

Additionally, BCH mining machines have started shipping, so in the short term, consider not going long on BCH.

#我的2026第一条帖

Additionally, BCH mining machines have started shipping, so in the short term, consider not going long on BCH.

#我的2026第一条帖

BCH0,41%

- Reward

- 11

- 10

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

Currently, $BTC has rebounded to around the 98,000 resistance level. Altcoins have basically not followed. For the upcoming altcoin rebound trend, I personally believe that as long as BTC stays above 98,000, oscillating in the 98,000 to 100,000 range at high levels, altcoins will still rebound once more.

Don't miss the opportunity when the market is rising.

My view on $ETH remains unchanged.

Saylor is making efforts again.

A bunch of funds are also buying in at the same time.

Currently, I still don't believe that Ethereum and altcoins will start to rebound.

Now, we must look at t

View OriginalDon't miss the opportunity when the market is rising.

My view on $ETH remains unchanged.

Saylor is making efforts again.

A bunch of funds are also buying in at the same time.

Currently, I still don't believe that Ethereum and altcoins will start to rebound.

Now, we must look at t

- Reward

- 10

- 8

- Repost

- Share

SpeciallyTargetingChildren's :

:

2026 Go Go Go 👊View More

SOL has just broken through the daily resistance level. There are two major upcoming benefits for Solana, so in the short term, it might be worth paying attention to meme coins within the SOL ecosystem. In January this year, the X platform established a deep partnership with Solana. Using SOL as the underlying asset, Twitter with 600 million monthly active users has promoted this, which should significantly enhance the value and empowerment of the SOL ecosystem.

To summarize the SOL ecosystem:

DEX: RAY ORCA

Lending Protocol: JTO

Liquidity Infrastructure: JUP

NFT Trading Platform: TNSR

Oracle:

View OriginalTo summarize the SOL ecosystem:

DEX: RAY ORCA

Lending Protocol: JTO

Liquidity Infrastructure: JUP

NFT Trading Platform: TNSR

Oracle:

- Reward

- 9

- 8

- Repost

- Share

SpeciallyTargetingChildren's :

:

2026 Go Go Go 👊View More

A-shares are rising, U.S. stocks are rising, gold is rising, silver is also rising. Currently, almost all capital markets are on the rise. Although the cryptocurrency market has entered a bear market, a bear market doesn't mean a continuous decline; there will be countless big rebounds in between. So $BTC and $ETH still have room to grow, and long positions should continue to be held. I started bullish trading in the second half of December last year. Not to mention how much I’ve earned following my operations, the overall direction is absolutely correct. In trading, we can only avoid big mi

View Original- Reward

- 8

- 7

- Repost

- Share

Cryptoyart929 :

:

2026 Go Go Go 👊View More

Let's take a look at the actions of the four major market makers in the current altcoin market

First is the market maker GSR

GSR Markets' wallet value increased by $20.01 million last week.

They increased their holdings of ETH, RENDER, SOL, LINK, and PROMPT.

On the other hand, their wallets decreased holdings of POL, SKY, EDGE, SPK, CVC, ZORA, RSR, and AVAX.

Next is the market maker Wintermute

Wintermute's wallet value increased by $18.47 million last week.

They increased their holdings of ETH, SOL, FARTCOIN, W, WLFI, USELESS, and CAKE.

On the other hand, they decreased holdings of BTC, PEPE,

View OriginalFirst is the market maker GSR

GSR Markets' wallet value increased by $20.01 million last week.

They increased their holdings of ETH, RENDER, SOL, LINK, and PROMPT.

On the other hand, their wallets decreased holdings of POL, SKY, EDGE, SPK, CVC, ZORA, RSR, and AVAX.

Next is the market maker Wintermute

Wintermute's wallet value increased by $18.47 million last week.

They increased their holdings of ETH, SOL, FARTCOIN, W, WLFI, USELESS, and CAKE.

On the other hand, they decreased holdings of BTC, PEPE,

- Reward

- 7

- 6

- Repost

- Share

Ryakpanda :

:

Just go for it💪View More

The Federal Reserve does not cut interest rates, is it bad news for the crypto market? The pattern is opening up!

At 3 a.m. on January 9th, the Federal Reserve will announce its interest rate decision. Looking at the current situation, a rate cut is basically unlikely!

As soon as the December non-farm payroll data was released, CME’s “FedWatch” immediately showed that the probability of a 25 basis point rate cut in January dropped to only 5%, with a 95% chance of maintaining the 3.5%-3.75% rate range. Even the expectation of a rate cut in March is only 30%. Once this news came out, the crypto

At 3 a.m. on January 9th, the Federal Reserve will announce its interest rate decision. Looking at the current situation, a rate cut is basically unlikely!

As soon as the December non-farm payroll data was released, CME’s “FedWatch” immediately showed that the probability of a 25 basis point rate cut in January dropped to only 5%, with a 95% chance of maintaining the 3.5%-3.75% rate range. Even the expectation of a rate cut in March is only 30%. Once this news came out, the crypto

BTC1,76%

- Reward

- 9

- 7

- Repost

- Share

SpeciallyTargetingChildren's :

:

2026 Go Go Go 👊View More

The Federal Reserve does not cut interest rates, is it bad news for the crypto market? The pattern is opening up!

At 3 a.m. on January 9th, the Federal Reserve will announce its interest rate decision. Looking at the current situation, a rate cut seems unlikely!

As soon as the December US non-farm payroll data was released, CME’s “FedWatch” tool immediately showed that the probability of a 25 basis point rate cut in January dropped to only 5%, with a 95% chance of maintaining the 3.5%-3.75% rate range. Even the expectation of a rate cut in March is only 30%. Once this news came out, the crypto

At 3 a.m. on January 9th, the Federal Reserve will announce its interest rate decision. Looking at the current situation, a rate cut seems unlikely!

As soon as the December US non-farm payroll data was released, CME’s “FedWatch” tool immediately showed that the probability of a 25 basis point rate cut in January dropped to only 5%, with a 95% chance of maintaining the 3.5%-3.75% rate range. Even the expectation of a rate cut in March is only 30%. Once this news came out, the crypto

BTC1,76%

- Reward

- like

- Comment

- Repost

- Share

The weekend market performance was really worse than a halt, it was just a pointless friction in place.

But overall, this week has been pretty good.

Regarding the market, Bitcoin at 89,300 is considered to have held the first support. A few days ago, Dason also emphasized to everyone to go long at this level, with two consecutive attempts at 89,300 and 89,700 both having nearly 2000 points of upward potential. Additionally, he reminded everyone that the 92,000 resistance level is suitable for shorting, which is quite noteworthy.

The past has become part of the historical trajectory and pattern

View OriginalBut overall, this week has been pretty good.

Regarding the market, Bitcoin at 89,300 is considered to have held the first support. A few days ago, Dason also emphasized to everyone to go long at this level, with two consecutive attempts at 89,300 and 89,700 both having nearly 2000 points of upward potential. Additionally, he reminded everyone that the 92,000 resistance level is suitable for shorting, which is quite noteworthy.

The past has become part of the historical trajectory and pattern

- Reward

- 8

- 6

- Repost

- Share

Cryptoyart929 :

:

New Year Wealth Explosion 🤑View More

#我的2026第一条帖 Bitcoin support at 89,000 below, tested twice without breaking. Similarly, the resistance at 92,500 above is strong. A break of the upper or lower bodies can be followed accordingly. Before a break occurs, maintain a cautious approach with high shorts and low longs, with a small defensive stance!

Next, near the support level, consider a rebound. This is a high-cost performance area for going long. If not going long, it’s also not recommended to short before the support body breaks, as it’s easy to get caught at the bottom. Wait patiently near 92,500 to short!

Buy in batches ar

Next, near the support level, consider a rebound. This is a high-cost performance area for going long. If not going long, it’s also not recommended to short before the support body breaks, as it’s easy to get caught at the bottom. Wait patiently near 92,500 to short!

Buy in batches ar

BTC1,76%

- Reward

- 3

- 2

- Repost

- Share

VisitingTheSettingSun :

:

New Year Wealth Explosion 🤑View More

#GateFun马勒戈币暴涨1251.09%

Malego Coin takes off, starting from Gate Plaza

A single-day surge of 1251.09%. Where do you think Malego Coin will be in 3 days?

Vote + Comment + Post, and 5 users with the closest predictions will share 100U worth of Malego Coin

⏰ Deadline: January 12th, 12:00 (UTC+8)

Want to launch your own coin? Come to Gate Plaza and use Gate Fun to seize the next wealth opportunity

Details: https://www.gate.com/announcements/article/47931

Malego Coin takes off, starting from Gate Plaza

A single-day surge of 1251.09%. Where do you think Malego Coin will be in 3 days?

Vote + Comment + Post, and 5 users with the closest predictions will share 100U worth of Malego Coin

⏰ Deadline: January 12th, 12:00 (UTC+8)

Want to launch your own coin? Come to Gate Plaza and use Gate Fun to seize the next wealth opportunity

Details: https://www.gate.com/announcements/article/47931

FUN8,52%

- Reward

- 4

- 5

- Repost

- Share

VisitingTheSettingSun :

:

New Year Wealth Explosion 🤑View More

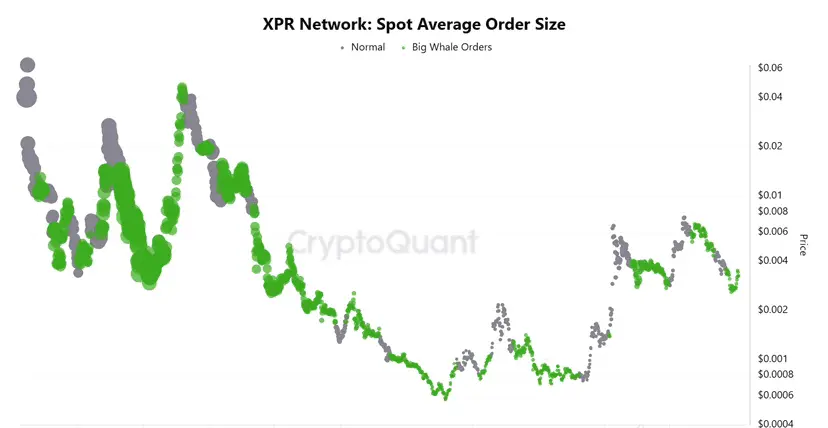

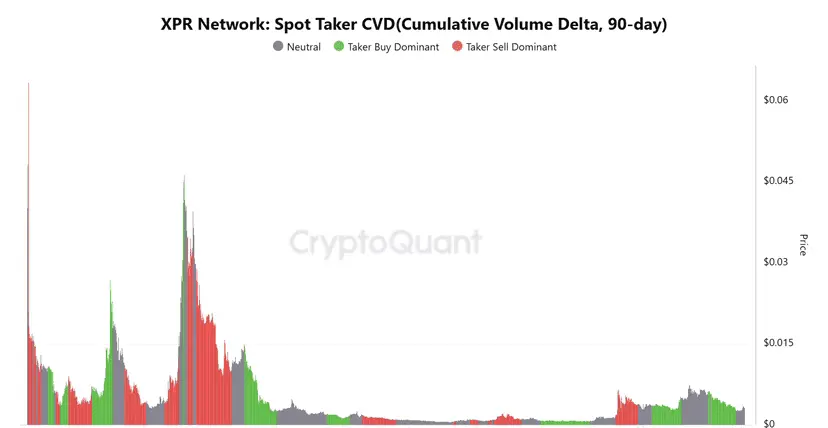

#我的2026第一条帖 XRP trading is dominated by large whales, and retail investors are basically not involved.

During the short-term rebound at the end of last year, the CVD indicator also showed a neutral stance.

Currently, large traders still dominate spot trading of XRP and have been buying on dips.

During the short-term rebound at the end of last year, the CVD indicator also showed a neutral stance.

Currently, large traders still dominate spot trading of XRP and have been buying on dips.

XRP2,19%

- Reward

- 4

- 3

- Repost

- Share

VisitingTheSettingSun :

:

2026 Go Go Go 👊View More

BTC & 1h Market Analysis

The purple area above (near the new high) faces resistance at 95k, forming a strong barrier. The price has attempted multiple breakthroughs in this zone without success, creating a short-term top.

Currently, the price around 90k is also an important recent psychological level. The price is consolidating at this position. If it breaks below 90k without rebounding, the downside space will open.

The current trend is bearish. After breaking key support, the market is likely to seek support at lower levels, with Bitcoin potentially dropping to 89k-86k. Traders should consid

The purple area above (near the new high) faces resistance at 95k, forming a strong barrier. The price has attempted multiple breakthroughs in this zone without success, creating a short-term top.

Currently, the price around 90k is also an important recent psychological level. The price is consolidating at this position. If it breaks below 90k without rebounding, the downside space will open.

The current trend is bearish. After breaking key support, the market is likely to seek support at lower levels, with Bitcoin potentially dropping to 89k-86k. Traders should consid

BTC1,76%

- Reward

- 4

- 3

- Repost

- Share

LiMo :

:

New Year Wealth Explosion 🤑View More

#我的2026第一条帖 Tonight's Non-Farm Payroll Prelude: ADP Data Sparks Market Explosion! The Federal Reserve's rate cut probability plummets, and a rebound is imminent.

Tonight, the financial markets will迎来 this week's first key trigger point—at 21:15 Beijing time, the US December ADP employment data ("Small Non-Farm") will be released with great significance. This core data, viewed as a preview of the Non-Farm report, will directly alter market expectations of the Federal Reserve's policy path and trigger a new wave of market volatility.

The current market landscape has become clear: according to t

Tonight, the financial markets will迎来 this week's first key trigger point—at 21:15 Beijing time, the US December ADP employment data ("Small Non-Farm") will be released with great significance. This core data, viewed as a preview of the Non-Farm report, will directly alter market expectations of the Federal Reserve's policy path and trigger a new wave of market volatility.

The current market landscape has become clear: according to t

BTC1,76%

- Reward

- 7

- 6

- Repost

- Share

LiMo :

:

New Year Wealth Explosion 🤑View More

#我的2026第一条帖 Daily Market Analysis $BTC ➕$ETH

The timing window for this rebound is just before the Federal Reserve's interest rate decision on January 27. The probability of a rate cut is currently only 16%, so it is unlikely that there will be a rate cut in January.

From the market structure perspective, when BTC dropped to just above 80,000, it was strictly a oversold correction. Up to now, it hasn't even touched the 0.618 retracement level.

Therefore, this wave of market movement should be viewed as a rebound. Whether BTC can hold above 94,000 is very critical. The subsequent pullback's l

View OriginalThe timing window for this rebound is just before the Federal Reserve's interest rate decision on January 27. The probability of a rate cut is currently only 16%, so it is unlikely that there will be a rate cut in January.

From the market structure perspective, when BTC dropped to just above 80,000, it was strictly a oversold correction. Up to now, it hasn't even touched the 0.618 retracement level.

Therefore, this wave of market movement should be viewed as a rebound. Whether BTC can hold above 94,000 is very critical. The subsequent pullback's l

- Reward

- 8

- 7

- Repost

- Share

ICameToSeeThePictur :

:

Hold on tight, we're about to take off 🛫View More

#我的2026第一条帖

BlackRock's massive purchase of 30 billion, Bitcoin is swallowing Wall Street!

The turn of the financial giants is more intense than we imagined.

When I saw that BlackRock had withdrawn nearly $600 million worth of on-chain Bitcoin and Ethereum data from Coinbase within three days, I knew that the game rules had been completely changed.

This is no longer a tentative small-scale play, but the horn of the traditional financial giant fleet speeding toward the new crypto continent. The world's largest asset management company has voted with real money, and Bitcoin's asset status as "d

View OriginalBlackRock's massive purchase of 30 billion, Bitcoin is swallowing Wall Street!

The turn of the financial giants is more intense than we imagined.

When I saw that BlackRock had withdrawn nearly $600 million worth of on-chain Bitcoin and Ethereum data from Coinbase within three days, I knew that the game rules had been completely changed.

This is no longer a tentative small-scale play, but the horn of the traditional financial giant fleet speeding toward the new crypto continent. The world's largest asset management company has voted with real money, and Bitcoin's asset status as "d

- Reward

- 1

- Comment

- Repost

- Share

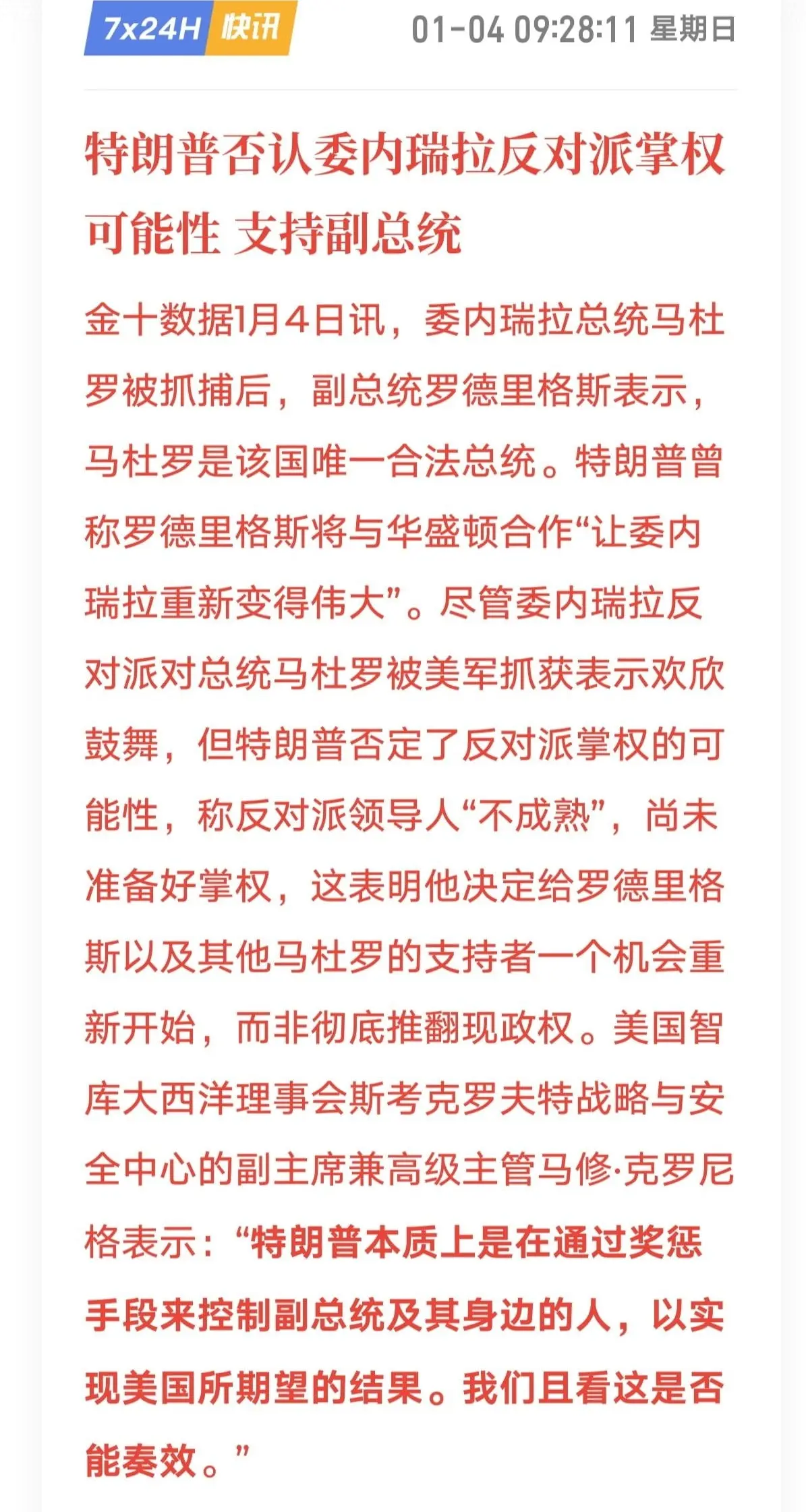

Does the world matter or not, it's all decided by the yellow hair! 26 years just started, and this president has already taken the president away. So arrogant, so hegemonic… They say a cannon shot rings out, and gold is worth ten thousand taels. Oil exports have stopped. On Monday's open, gold might surge again. The yellow hair is so aggressive, not calming down, and the US stocks will also react!

This morning, Bitcoin was already strongly pushed up. The current view remains unchanged: do not chase the rise, continue to hold short positions, set good stop-losses, and beware of the market pulli

This morning, Bitcoin was already strongly pushed up. The current view remains unchanged: do not chase the rise, continue to hold short positions, set good stop-losses, and beware of the market pulli

BTC1,76%

- Reward

- 6

- 5

- Repost

- Share

ICameToSeeThePictur :

:

2026 Go Go Go 👊View More