Bitimmortal

No content yet

if this plays out again, patience wins

- Reward

- like

- Comment

- Repost

- Share

tap to see the truth

- Reward

- like

- Comment

- Repost

- Share

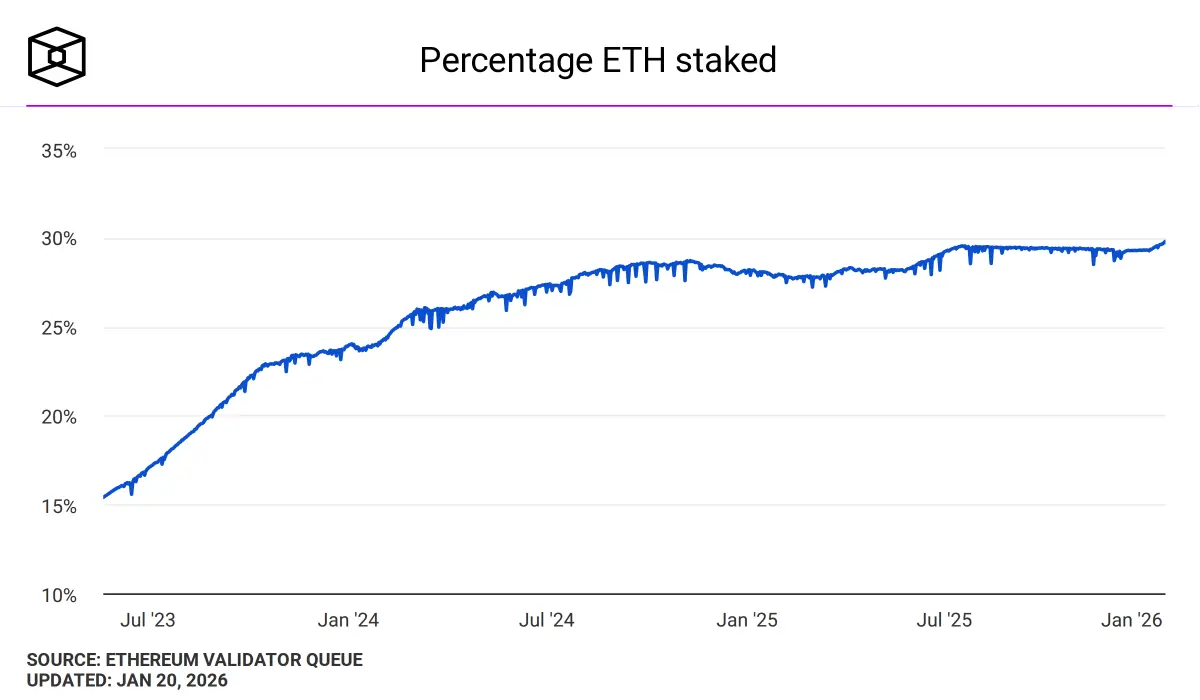

Something big is happening on Ethereum

- active addresses all time high

- staked ETH all time high

- new addresses all time high

- daily transactions all time high

- active addresses all time high

- staked ETH all time high

- new addresses all time high

- daily transactions all time high

ETH3,35%

- Reward

- like

- Comment

- Repost

- Share

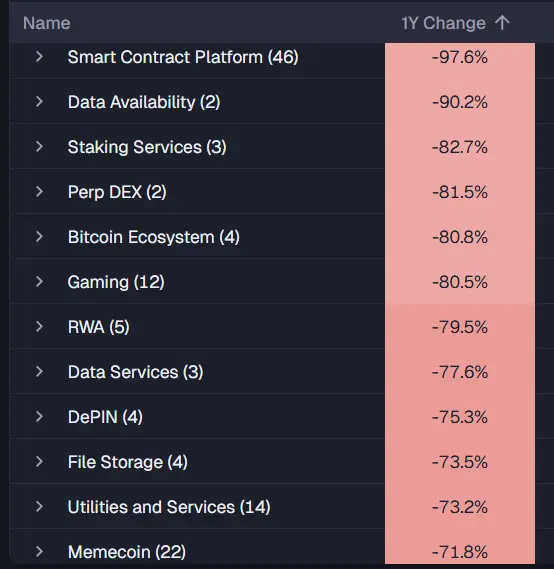

a full reset actually looks like this

- Reward

- like

- Comment

- Repost

- Share

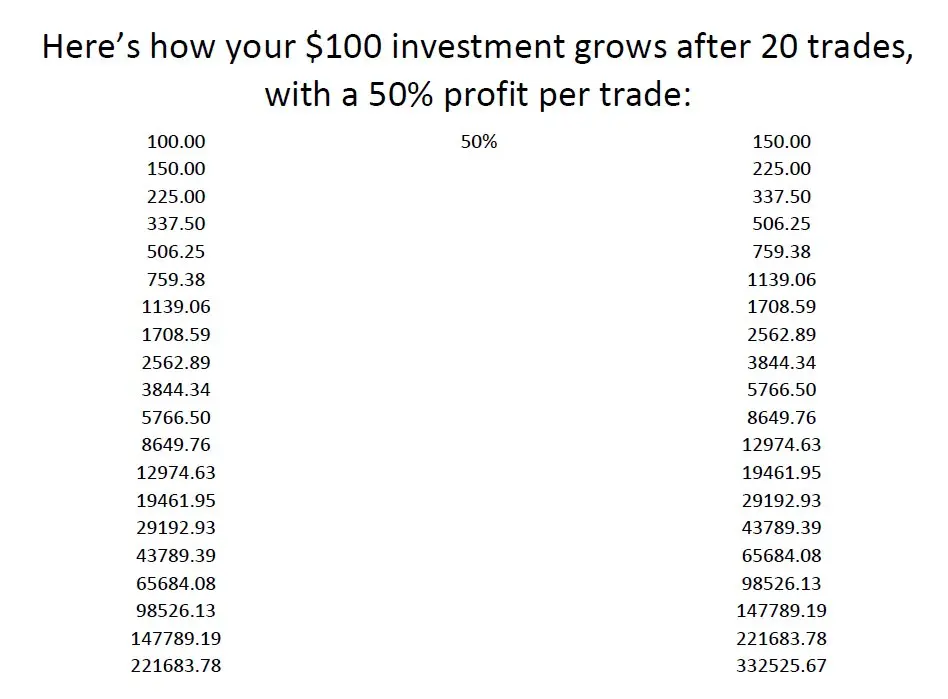

Compounding is boring…?

- Reward

- like

- Comment

- Repost

- Share

Gm still discovering new lows

- Reward

- like

- Comment

- Repost

- Share

One year ago:

$BTC $101K

$ETH $3.2K

Today?

BTC looks fine

ETH looks fine

Alts got absolutely nuked.

Top 100 alts: then vs now

$SOL 250 → 140

$LINK 24 → 13

$SUI 4.5 → 1.8

$AVAX 35 → 14

$TON 4.8 → 1.7

$DOT 6.2 → 2.2

$UNI 13 → 5.3

$NEAR 5 → 1.7

$APT 8.5 → 1.8

$ENA 0.85 → 0.21

$ARB 0.70 → 0.21

$ATOM 5.8 → 2.5

$TIA 4.6 → 0.56

$OP 1.7 → 0.33

$S 0.56 → 0.08

$STRK 0.39 → 0.083

$BTC $101K

$ETH $3.2K

Today?

BTC looks fine

ETH looks fine

Alts got absolutely nuked.

Top 100 alts: then vs now

$SOL 250 → 140

$LINK 24 → 13

$SUI 4.5 → 1.8

$AVAX 35 → 14

$TON 4.8 → 1.7

$DOT 6.2 → 2.2

$UNI 13 → 5.3

$NEAR 5 → 1.7

$APT 8.5 → 1.8

$ENA 0.85 → 0.21

$ARB 0.70 → 0.21

$ATOM 5.8 → 2.5

$TIA 4.6 → 0.56

$OP 1.7 → 0.33

$S 0.56 → 0.08

$STRK 0.39 → 0.083

- Reward

- like

- Comment

- Repost

- Share

Altcoins will always be a bubble, be a profit-booking bot.

- Reward

- like

- Comment

- Repost

- Share

A trader swapped $220K USDC and got $5K USDT back.

MEV said “thank you for your contribution”

MEV said “thank you for your contribution”

USDC0,02%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

Babylon Protocol’s valuation doesn’t match its fundamentals at all.

> $5.93B TVL

> $196M FDV

> total raised: $103M

> TVL-to-FDV ratio: 30x

> DeFi TVL holding strong

> recently raised $15M from a16z

$BABY is the only BTC DeFi protocol still holding multi-billion TVL without a major drop.

> $5.93B TVL

> $196M FDV

> total raised: $103M

> TVL-to-FDV ratio: 30x

> DeFi TVL holding strong

> recently raised $15M from a16z

$BABY is the only BTC DeFi protocol still holding multi-billion TVL without a major drop.

- Reward

- like

- 1

- Repost

- Share

IncomeOf1MillionDollarsIn2026 :

:

Awesome👍🏻look what changed in just 2 years:

- gold out of hand

- silver out of hand

- bitcoin $100K

- stocks all time high

- real estate up

- energy up

the only thing that didn’t move?

altcoins 🥲

- gold out of hand

- silver out of hand

- bitcoin $100K

- stocks all time high

- real estate up

- energy up

the only thing that didn’t move?

altcoins 🥲

BTC1,39%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

You don’t need 10 tools. To find a gem, you just need @DefiLlama

- Reward

- like

- 1

- Repost

- Share

IncomeOf1MillionDollarsIn2026 :

:

What is this?