Bit_Bull

No content yet

Bit_Bull

Trump's Tariff War Is Back 🚨

Just now, Trump has imposed 10% tariffs on these countries.

• France

• Finland

• Norway

• Sweden

• Denmark

• Germany

• Netherlands

• United Kingdom

He also said that if a deal to acquire Greenland isn't reached by 1st June, tariffs will increase to 25%.

Just now, Trump has imposed 10% tariffs on these countries.

• France

• Finland

• Norway

• Sweden

• Denmark

• Germany

• Netherlands

• United Kingdom

He also said that if a deal to acquire Greenland isn't reached by 1st June, tariffs will increase to 25%.

- Reward

- like

- Comment

- Repost

- Share

Altcoin MCap giant bullish pennant formation

The breakout and rally will be epic.

The breakout and rally will be epic.

- Reward

- like

- Comment

- Repost

- Share

I’ve seen the impact firsthand.

When protocols integrate @immunefi, the posture changes. Teams ship with more confidence. Users sleep better. Security stops being reactive panic and becomes a system. That feeling of safety is rare in crypto, and it’s powerful.

When protocols integrate @immunefi, the posture changes. Teams ship with more confidence. Users sleep better. Security stops being reactive panic and becomes a system. That feeling of safety is rare in crypto, and it’s powerful.

- Reward

- like

- Comment

- Repost

- Share

I was curious to see how @ TradFi actually feels in real use.

Trading gold and forex straight from a USDT balance makes things simpler than expected.

No moving money to fiat, no extra accounts, no switching between platforms. It all stays inside one flow.

Setup was quick and didn’t need much effort.

Tried Gold (XAU) first.

Orders filled fast, liquidity looked decent, and spreads were reasonable for normal trading.

It’s still early and clearly not a finished product yet, but the idea makes sense.

Crypto and traditional markets sitting in the same place feels like where trading platforms are s

Trading gold and forex straight from a USDT balance makes things simpler than expected.

No moving money to fiat, no extra accounts, no switching between platforms. It all stays inside one flow.

Setup was quick and didn’t need much effort.

Tried Gold (XAU) first.

Orders filled fast, liquidity looked decent, and spreads were reasonable for normal trading.

It’s still early and clearly not a finished product yet, but the idea makes sense.

Crypto and traditional markets sitting in the same place feels like where trading platforms are s

FLOW1,34%

- Reward

- like

- Comment

- Repost

- Share

USDT dominance keeps going down.

The pump isn't over yet.

The pump isn't over yet.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

We are just one breakout away from the generational wealth.

- Reward

- like

- Comment

- Repost

- Share

Big Day For Crypto Holders 🚨

US Supreme court is set to issue a ruling on Trump's tariff at 10am ET today.

The market expects a 75% chance of Supreme court deeming the tariffs illegal.

When Trump issued tariffs back in April, the markets crashed.

Will turning the tariffs illegal pump the markets?

US Supreme court is set to issue a ruling on Trump's tariff at 10am ET today.

The market expects a 75% chance of Supreme court deeming the tariffs illegal.

When Trump issued tariffs back in April, the markets crashed.

Will turning the tariffs illegal pump the markets?

- Reward

- like

- Comment

- Repost

- Share

When most timelines were silent and hype had moved on, #FUNToken was still on my radar.

I didn’t stick around for noise or trends — real conviction is formed when things are quiet, not when everyone is cheering.

Fast forward to today, and FUNToken has been nominated for Best Crypto Token of the Year.

Now the attention is catching up.

Those who’ve been following my journey already know why I stand behind this project.

Cast your vote here 👇

I didn’t stick around for noise or trends — real conviction is formed when things are quiet, not when everyone is cheering.

Fast forward to today, and FUNToken has been nominated for Best Crypto Token of the Year.

Now the attention is catching up.

Those who’ve been following my journey already know why I stand behind this project.

Cast your vote here 👇

FUNTOKEN1,03%

- Reward

- like

- Comment

- Repost

- Share

Crypto MCap is holding above the 2021 ATH.

As long as this holds, the max pain is still to the upside.

As long as this holds, the max pain is still to the upside.

- Reward

- like

- Comment

- Repost

- Share

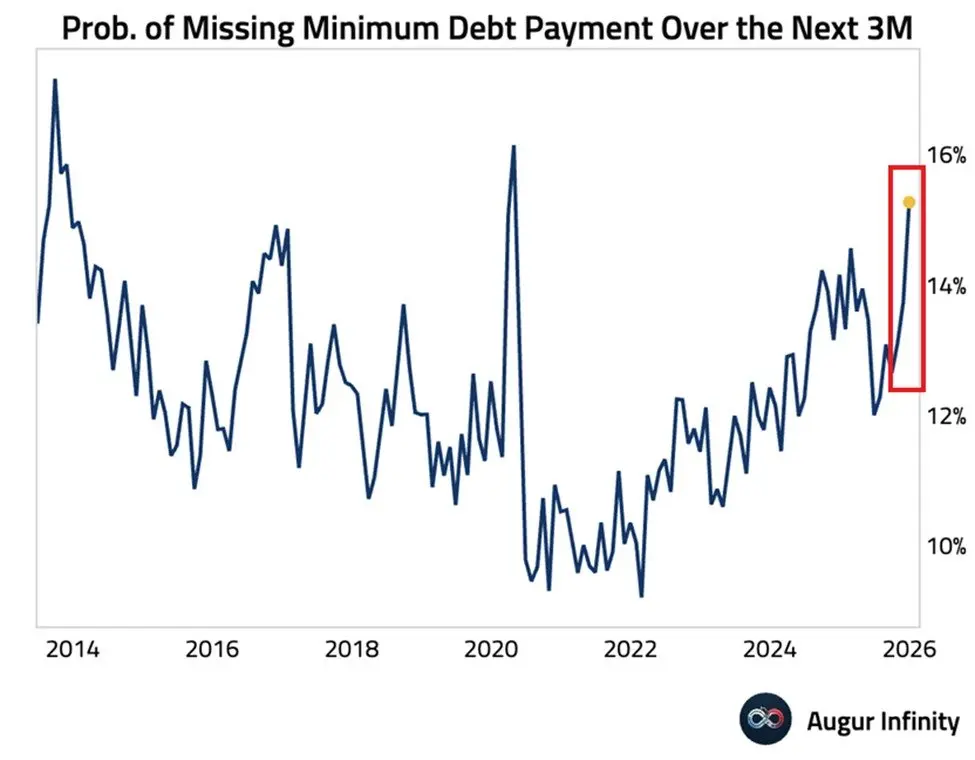

🚨 US consumers are officially under pressure.

The chance of missing a debt payment just hit 15.3%, the highest since April 2020 and the 2nd highest in over a decade.

Low-income households are already at 22.5% risk.

Debt is rising, stress is rising, and spending power is quietly breaking.

This is how economic slowdowns actually start.

The chance of missing a debt payment just hit 15.3%, the highest since April 2020 and the 2nd highest in over a decade.

Low-income households are already at 22.5% risk.

Debt is rising, stress is rising, and spending power is quietly breaking.

This is how economic slowdowns actually start.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

🚨 BREAKING: US Federal Prosecutors have opened a criminal investigation into Fed Chair Jerome Powell.

First, what does this mean?

It means the government is now legally investigating the head of the Federal Reserve. They can demand documents, emails, and testimony.

This is not politics or media noise. This is a real criminal process.

Right now, the official reason being used is the Fed’s headquarters renovation project. But that part is not what markets are reacting to.

The real issue is this:

The Federal Reserve is supposed to be independent.

Interest rates should be decided by inflation, j

First, what does this mean?

It means the government is now legally investigating the head of the Federal Reserve. They can demand documents, emails, and testimony.

This is not politics or media noise. This is a real criminal process.

Right now, the official reason being used is the Fed’s headquarters renovation project. But that part is not what markets are reacting to.

The real issue is this:

The Federal Reserve is supposed to be independent.

Interest rates should be decided by inflation, j

- Reward

- like

- Comment

- Repost

- Share

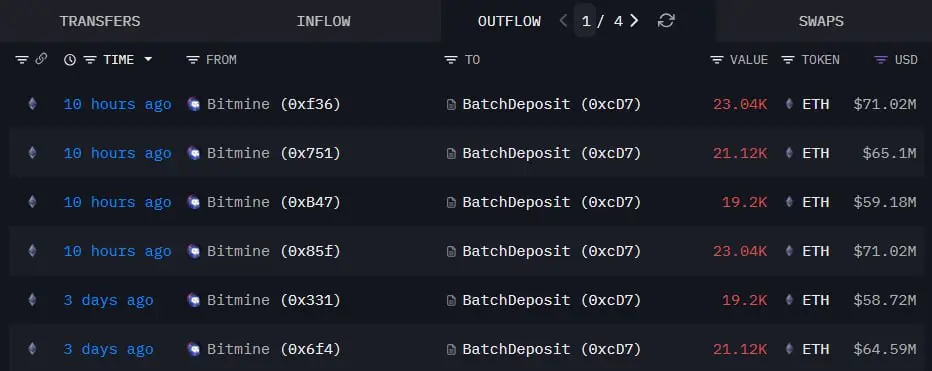

BitMine has staked another 86,400 $ETH worth $266.3 million today.

In total, BitMine has staked nearly $3.3 billion worth of ETH.

With 2.5% annual yield, BitMine will generate $82.5 million in passive income.

And don't forget one thing.

They still hold $7B+ in ETH which could be staked next.

In total, BitMine has staked nearly $3.3 billion worth of ETH.

With 2.5% annual yield, BitMine will generate $82.5 million in passive income.

And don't forget one thing.

They still hold $7B+ in ETH which could be staked next.

ETH0,35%

- Reward

- like

- Comment

- Repost

- Share