@TomGenzcoin @beeos_arenavs Huge

GateUser-92626ec8

No content yet

GateUser-92626ec8

Big news from the Internet of Real Estate: @integra_layer is now officially part of the ERC3643Org association a major milestone that moves the entire RWA ecosystem forward.

Integra is building the onchain real estate metaverse, and this step reinforces exactly where the future is heading: real assets, globally accessible, natively programmable, and fully compliant.

With @integra_layer, we’re not just talking tokenized property we’re talking true fractional ownership (own as little as 0.0001% of a skyscraper), backed by a built-in compliance engine that finally lets institutions participate wi

Integra is building the onchain real estate metaverse, and this step reinforces exactly where the future is heading: real assets, globally accessible, natively programmable, and fully compliant.

With @integra_layer, we’re not just talking tokenized property we’re talking true fractional ownership (own as little as 0.0001% of a skyscraper), backed by a built-in compliance engine that finally lets institutions participate wi

- Reward

- like

- Comment

- Repost

- Share

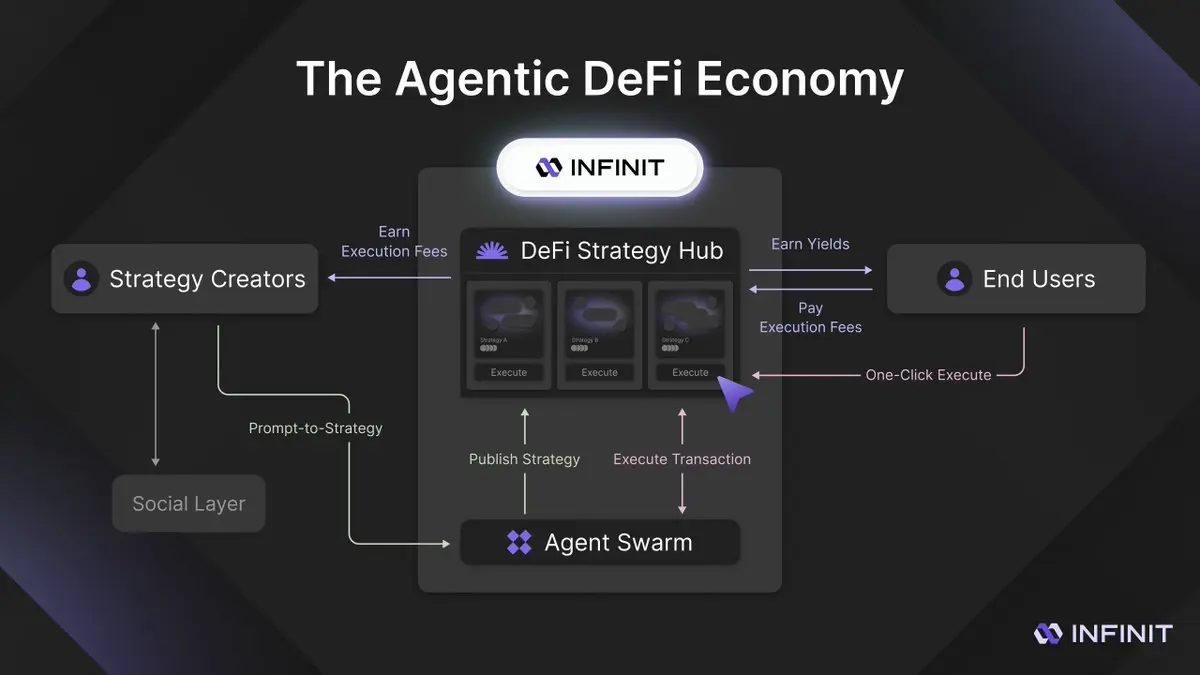

The discourse still paints “AI agents” as an automation narrative.

The real unlock is simpler: coordination without custody.

@Infinit_Labs non-custodial Agent Swarm means the agents never hold size.

They read state, compute routes, and push instructions, but capital stays anchored to the user’s smart-account.

No pooled funds. No shared vault exposure. No rehypothecation risk hidden under an “AI layer.”

From a market-structure POV, that changes everything.

🔸 operations become atomic instead of sequentially exposed

🔸 routes update without waiting for signatures

🔸 execution is deterministic in

The real unlock is simpler: coordination without custody.

@Infinit_Labs non-custodial Agent Swarm means the agents never hold size.

They read state, compute routes, and push instructions, but capital stays anchored to the user’s smart-account.

No pooled funds. No shared vault exposure. No rehypothecation risk hidden under an “AI layer.”

From a market-structure POV, that changes everything.

🔸 operations become atomic instead of sequentially exposed

🔸 routes update without waiting for signatures

🔸 execution is deterministic in

- Reward

- like

- Comment

- Repost

- Share

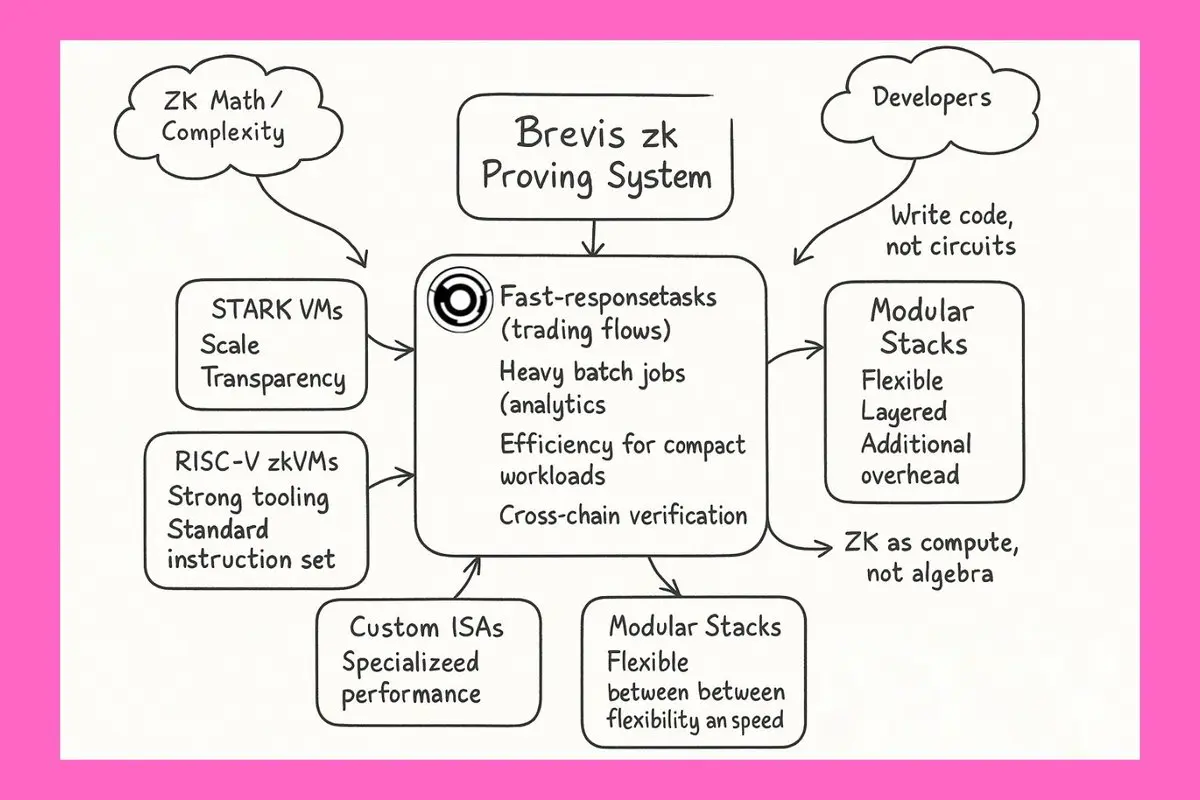

The ZK story always sounds complicated because people fixate on the math.

But the math isn’t the blocker anymore.

The interface is.

Circuits were the reason ZK never broke out.

You had to think in algebra, rebuild control flow from scratch, and treat memory like a puzzle.

That’s not how normal developers build things.

zkVMs change the equation entirely.

You write code.

They turn the execution trace into something the prover can verify.

ZK stops being a cryptography project and becomes a compute environment.

Once you see ZK as compute, the landscape makes more sense:

🔸 STARK VMs: scale, transp

But the math isn’t the blocker anymore.

The interface is.

Circuits were the reason ZK never broke out.

You had to think in algebra, rebuild control flow from scratch, and treat memory like a puzzle.

That’s not how normal developers build things.

zkVMs change the equation entirely.

You write code.

They turn the execution trace into something the prover can verify.

ZK stops being a cryptography project and becomes a compute environment.

Once you see ZK as compute, the landscape makes more sense:

🔸 STARK VMs: scale, transp

- Reward

- like

- Comment

- Repost

- Share

➥ 𝘓𝘢𝘴𝘵 𝘞𝘦𝘦𝘬’𝘴 𝘋𝘢𝘵𝘢, 𝘛𝘩𝘪𝘴 𝘞𝘦𝘦𝘬’𝘴 𝘋𝘪𝘳𝘦𝘤𝘵𝘪𝘰𝘯

Volatility wasn’t the villain it was the signal. Liquidity hunted conviction, weak hands rotated out, and builders stayed locked in.

The next leg isn’t announced. It forms quietly.

𝗛𝗲𝗿𝗲’𝘀 𝘄𝗵𝗮𝘁 𝘀𝗵𝗮𝗽𝗲𝗱 𝘁𝗵𝗲 𝘄𝗲𝗲𝗸:

→ $BTC: Still holding its ground near $106K. Funding reset tightened leverage across major venues, miner revenue stayed elevated, and long-term holders continued absorbing supply. Market wants direction BTC is quietly choosing accumulation.

→ $ETH: Now at $3,187, ETH slid as leverage washed out

Volatility wasn’t the villain it was the signal. Liquidity hunted conviction, weak hands rotated out, and builders stayed locked in.

The next leg isn’t announced. It forms quietly.

𝗛𝗲𝗿𝗲’𝘀 𝘄𝗵𝗮𝘁 𝘀𝗵𝗮𝗽𝗲𝗱 𝘁𝗵𝗲 𝘄𝗲𝗲𝗸:

→ $BTC: Still holding its ground near $106K. Funding reset tightened leverage across major venues, miner revenue stayed elevated, and long-term holders continued absorbing supply. Market wants direction BTC is quietly choosing accumulation.

→ $ETH: Now at $3,187, ETH slid as leverage washed out

- Reward

- like

- Comment

- Repost

- Share

Everyone talks about liquidity. Few know how to find it.

@rainbowdotme doesn’t just show you where the liquidity lives it moves through it.

Every swap, bridge, or send is routed through Rainbow’s engine, scanning chains and DEXs for the best execution path.

No more hopping tabs. No more guessing quotes. Just precision.

Execution becomes the product.

Orderflow becomes value.

And $RNBW turns routing into ownership.

This isn’t just UX polish. It’s infrastructure disguised as a wallet.

✅ Better quotes → higher trust → more users → deeper liquidity → better quotes again.

✅ Each route strengthens th

@rainbowdotme doesn’t just show you where the liquidity lives it moves through it.

Every swap, bridge, or send is routed through Rainbow’s engine, scanning chains and DEXs for the best execution path.

No more hopping tabs. No more guessing quotes. Just precision.

Execution becomes the product.

Orderflow becomes value.

And $RNBW turns routing into ownership.

This isn’t just UX polish. It’s infrastructure disguised as a wallet.

✅ Better quotes → higher trust → more users → deeper liquidity → better quotes again.

✅ Each route strengthens th

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Gold’s been the world’s most traded commodity for centuries. Now it’s going onchain.

@Theo_Network is rolling out thGOLD tokenized gold with deep liquidity, composable yield, and zero physical friction.

🔹 Built on the same model as thBILL, which scaled to $138M+ TVL by turning U.S. Treasuries into yield-bearing DeFi primitives.

🔹 Backed by institutional-grade partners like Standard Chartered, Wellington, and FundBridge.

🔹 thGOLD lets you hold gold exposure while farming yield on platforms like Morpho and Pendle the same asset TradFi funds hedge with daily, now programmable.

This isn’t just

@Theo_Network is rolling out thGOLD tokenized gold with deep liquidity, composable yield, and zero physical friction.

🔹 Built on the same model as thBILL, which scaled to $138M+ TVL by turning U.S. Treasuries into yield-bearing DeFi primitives.

🔹 Backed by institutional-grade partners like Standard Chartered, Wellington, and FundBridge.

🔹 thGOLD lets you hold gold exposure while farming yield on platforms like Morpho and Pendle the same asset TradFi funds hedge with daily, now programmable.

This isn’t just

- Reward

- like

- Comment

- Repost

- Share

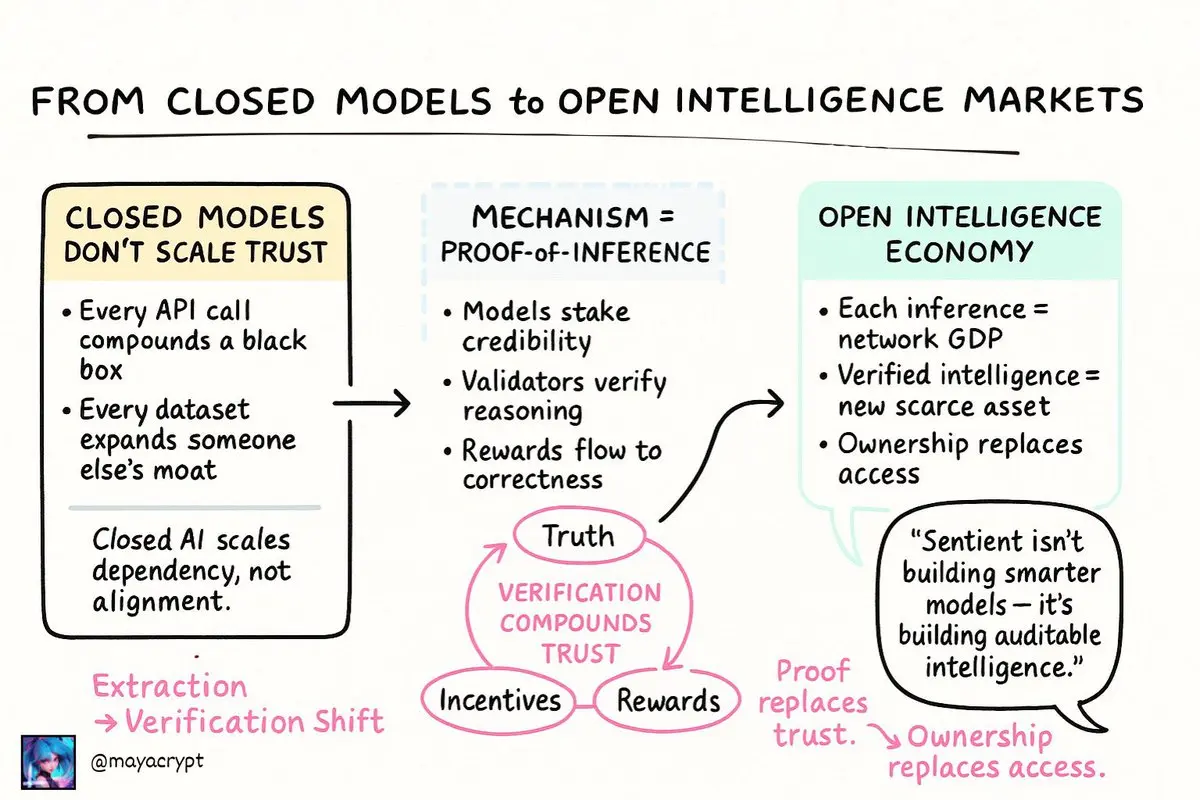

Closed models don’t scale trust.

They scale dependency.

Every call to an API adds value to a black box.

Every dataset compounds someone else’s moat.

That’s not progress.

That’s extraction.

The next cycle of AI won’t be won by scale.

It’ll be won by alignment. and whoever builds the system that proves it.

Closed AI = Centralised Alpha Drain

Today’s model economy is upstream extraction.

You train, they own. You build, they gate.

Inference becomes rent.

But protocols like @SentientAGI are flipping the stack.

Models run independently, submit reasoning proofs, and get verified by other nodes.

Accur

They scale dependency.

Every call to an API adds value to a black box.

Every dataset compounds someone else’s moat.

That’s not progress.

That’s extraction.

The next cycle of AI won’t be won by scale.

It’ll be won by alignment. and whoever builds the system that proves it.

Closed AI = Centralised Alpha Drain

Today’s model economy is upstream extraction.

You train, they own. You build, they gate.

Inference becomes rent.

But protocols like @SentientAGI are flipping the stack.

Models run independently, submit reasoning proofs, and get verified by other nodes.

Accur

BTC6.63%

- Reward

- like

- Comment

- Repost

- Share

Most RWA protocols talk about “bridging TradFi and DeFi.”

@Theo_Network is actually doing it.

→ $20M raised from names like Hack VC, Mirana, and Amber.

→ ex-Optiver & IMC quants building real onchain market structure.

→ $138M+ TVL, with thBILL vaults alone nearing $120M.

Theo isn’t chasing yield it’s reconstructing the plumbing of institutional finance, onchain.

Their thBILL vaults tokenize short-term Treasuries, creating a base layer of real yield.

On top of that, structured vaults, hedging products, and liquidity rails are forming the same tools funds use daily, now accessible to anyone.

Wi

@Theo_Network is actually doing it.

→ $20M raised from names like Hack VC, Mirana, and Amber.

→ ex-Optiver & IMC quants building real onchain market structure.

→ $138M+ TVL, with thBILL vaults alone nearing $120M.

Theo isn’t chasing yield it’s reconstructing the plumbing of institutional finance, onchain.

Their thBILL vaults tokenize short-term Treasuries, creating a base layer of real yield.

On top of that, structured vaults, hedging products, and liquidity rails are forming the same tools funds use daily, now accessible to anyone.

Wi

- Reward

- like

- Comment

- Repost

- Share

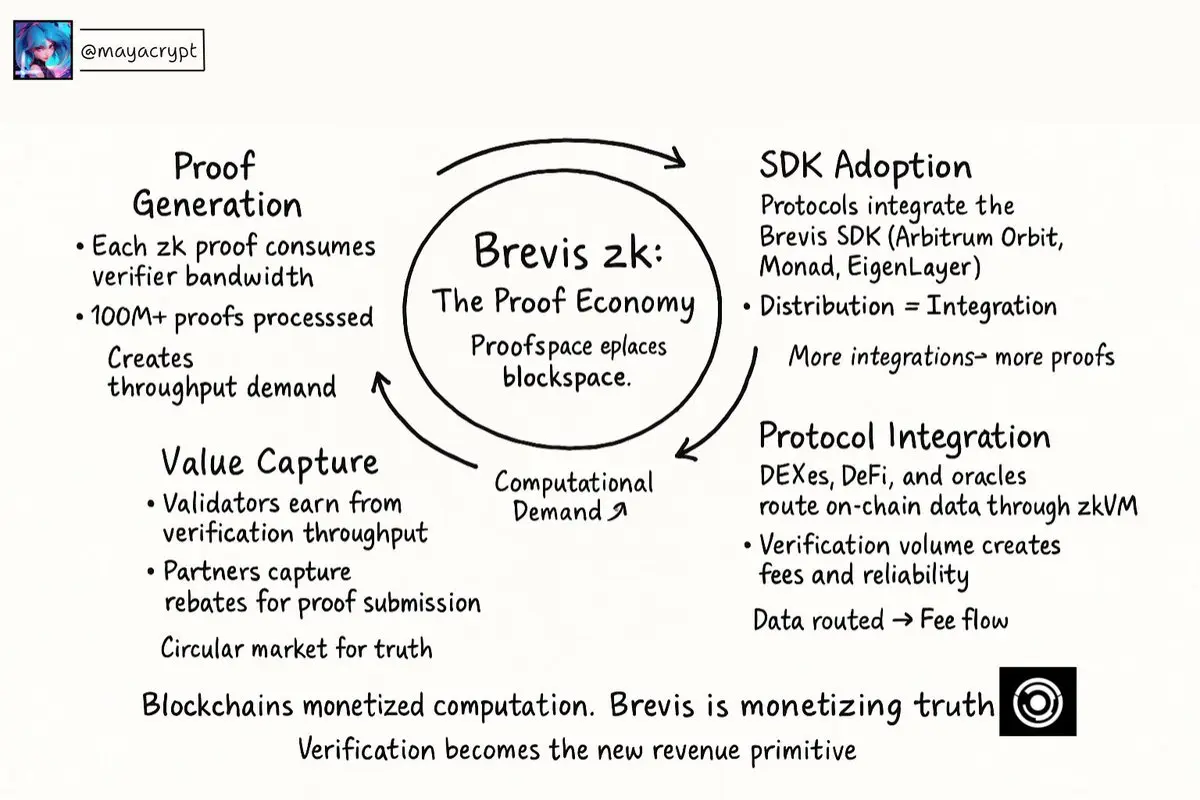

Every layer-one builds blockspace.

@brevis_zk builds proofspace.

Its economic engine is simple, but powerful:

Proof generation → SDK adoption → protocol integration → network effect → value capture.

Here’s how it compounds:

1. Proof Generation: Every zk proof generated through Brevis’ SDK consumes verifier bandwidth and creates demand for computational throughput. As of October 2025, over 100 M proofs have been generated across partner networks.

2. SDK Adoption: Protocols integrating the Brevis SDK will embed Brevis as the default proof verifier; turning infrastructure into a dependency layer.

@brevis_zk builds proofspace.

Its economic engine is simple, but powerful:

Proof generation → SDK adoption → protocol integration → network effect → value capture.

Here’s how it compounds:

1. Proof Generation: Every zk proof generated through Brevis’ SDK consumes verifier bandwidth and creates demand for computational throughput. As of October 2025, over 100 M proofs have been generated across partner networks.

2. SDK Adoption: Protocols integrating the Brevis SDK will embed Brevis as the default proof verifier; turning infrastructure into a dependency layer.

- Reward

- like

- Comment

- Repost

- Share

Real estate is the world’s largest store of wealth a $400 trillion market yet it remains one of the most illiquid, fragmented, and outdated asset classes. While crypto and equities trade in seconds, property still moves at 20th century speed. That’s where @integra_layer comes in.

Integra is a purpose built Layer 1 blockchain designed to digitize real estate from the ground up. It’s not a concept it’s launching with over $12B in verified property assets and $100M+ in annual rent flow, backed by a global consortium of real-world institutions.

What makes @integra_layer different? It’s not just a

Integra is a purpose built Layer 1 blockchain designed to digitize real estate from the ground up. It’s not a concept it’s launching with over $12B in verified property assets and $100M+ in annual rent flow, backed by a global consortium of real-world institutions.

What makes @integra_layer different? It’s not just a

- Reward

- like

- Comment

- Repost

- Share