Berit

No content yet

Future of finance 😭😭😭

- Reward

- like

- Comment

- Repost

- Share

$USDT Supply sees biggest drop since FTX crash

over the last 30 days, USDT supply dropped 1.7%

the volume of the USDT market supply in February decreased by $1.5 billion

in January, the token's capitalization also lost $1.2 billion.

over the last 30 days, USDT supply dropped 1.7%

the volume of the USDT market supply in February decreased by $1.5 billion

in January, the token's capitalization also lost $1.2 billion.

- Reward

- 1

- Comment

- Repost

- Share

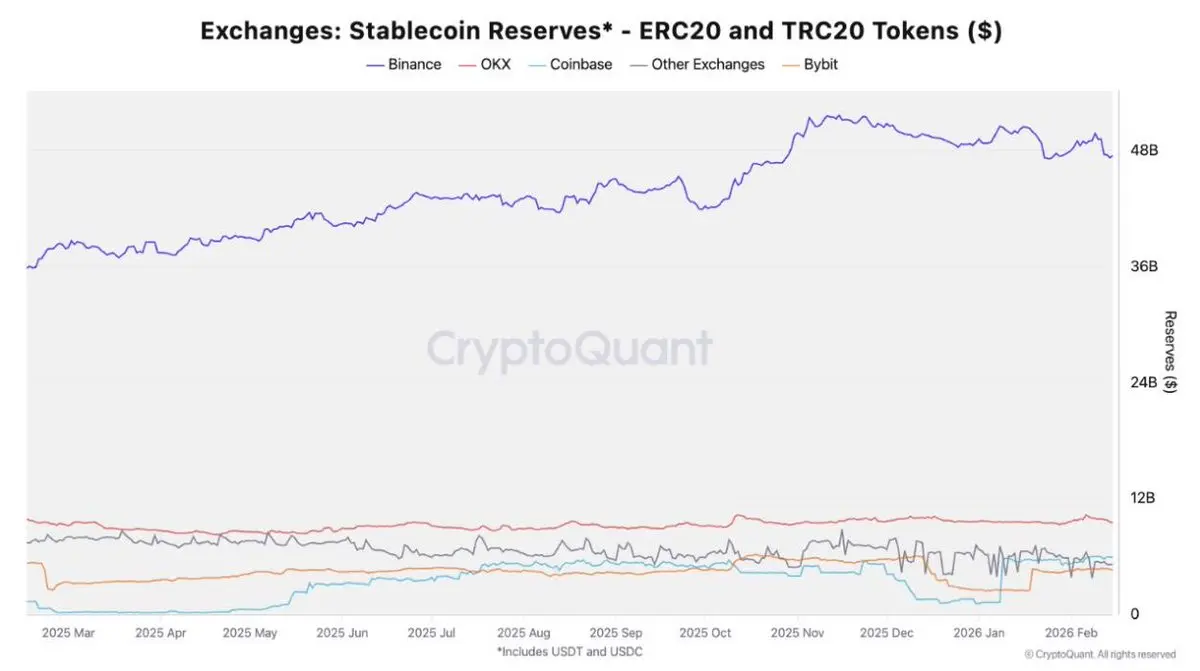

$47.5 billion in stablecoins now sits on

that’s roughly 65% of all exchange stabelcoin liquidity

that’s roughly 65% of all exchange stabelcoin liquidity

- Reward

- 1

- Comment

- Repost

- Share

DeFi Spot Volume is up 3x since the start of 2026

- Reward

- like

- Comment

- Repost

- Share

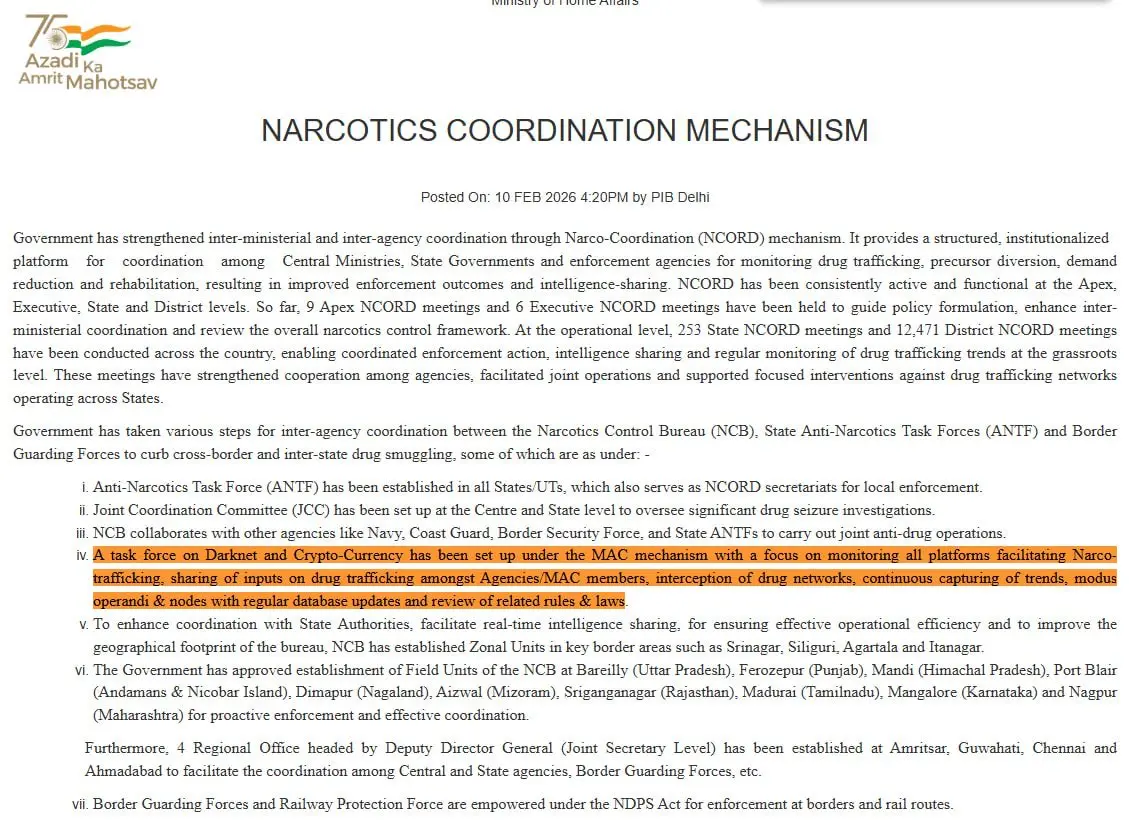

Government of India has formed a Darknet and Crypto task force to track narco-trafficking and monitor illegal drug networks online

- Reward

- like

- Comment

- Repost

- Share

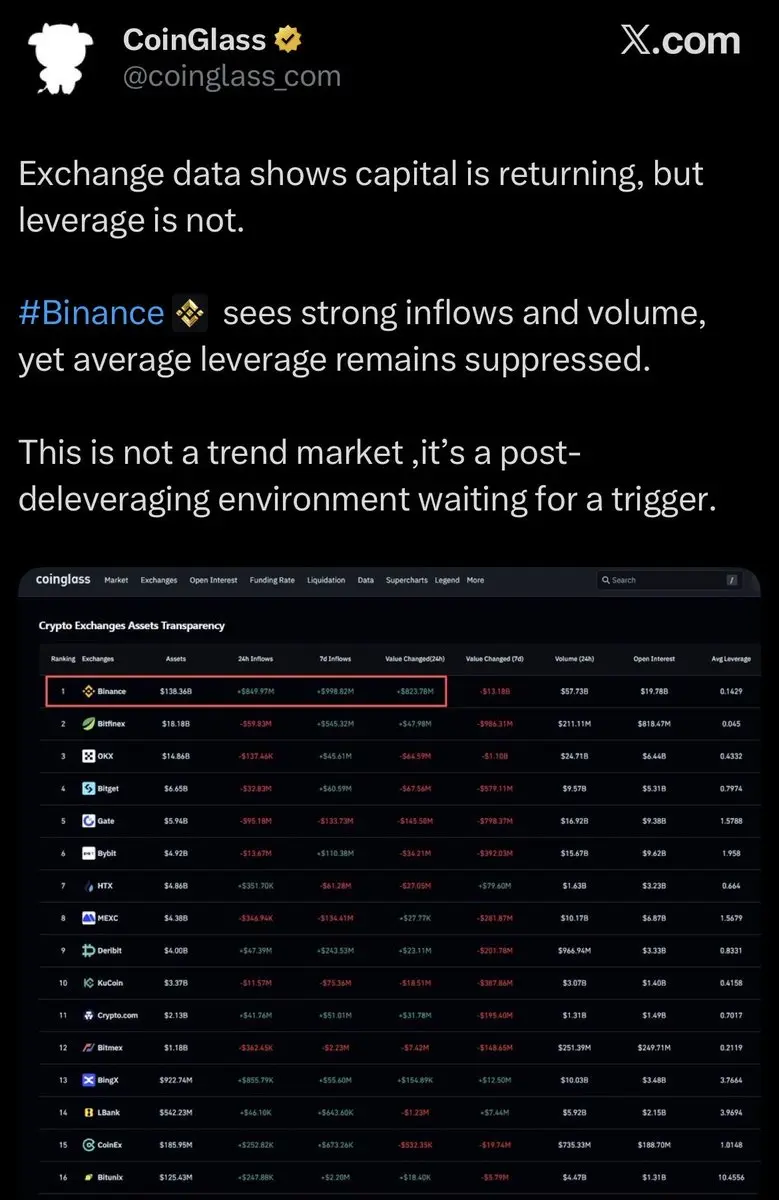

Coinglass: capital flowing back to exchanges

# inflows + volume rising

spot coming in

leverage is quite

# inflows + volume rising

spot coming in

leverage is quite

- Reward

- 1

- Comment

- Repost

- Share

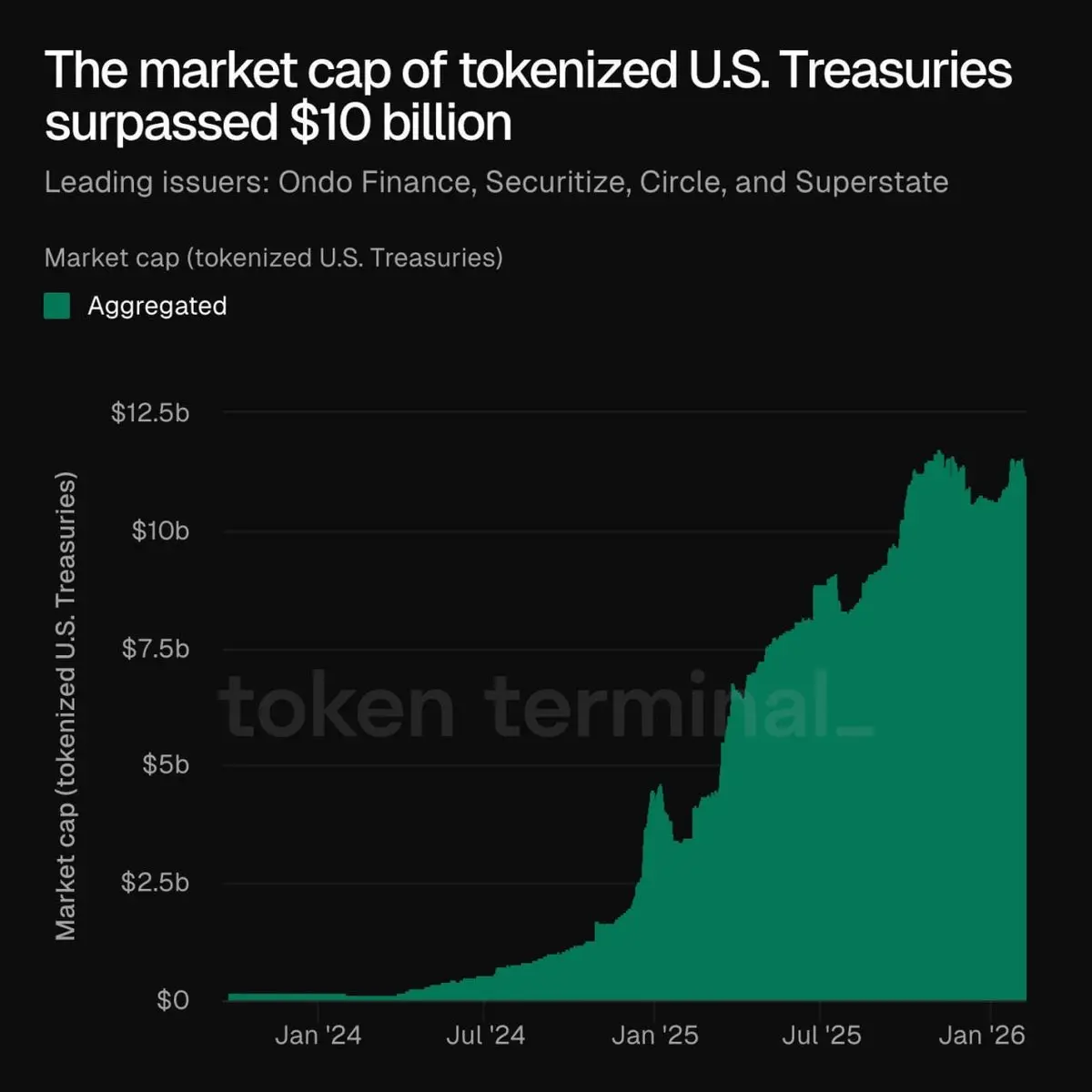

Tokenized US Treasuries market cap surpasses $10 billion, with Ondo Finance, Securitize, Circle, and Superstate as leading issuers.

- Reward

- like

- Comment

- Repost

- Share

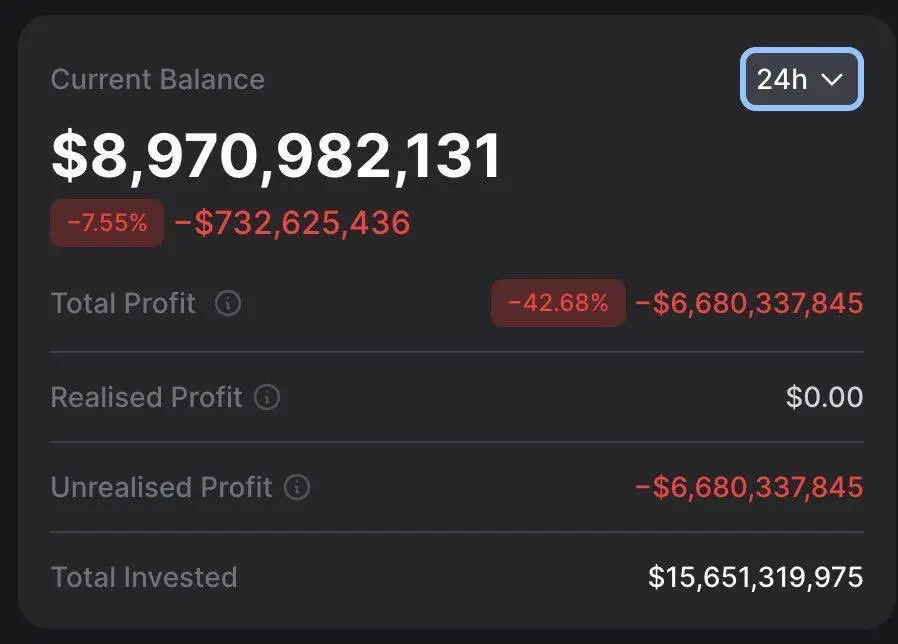

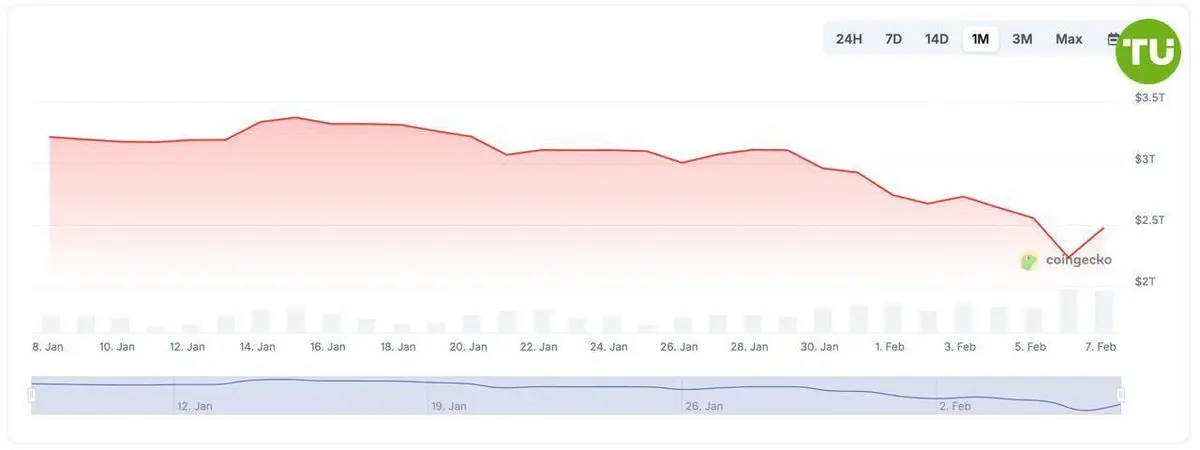

Over the past 30 days, the total cryptocurrency market capitalization has decreased by approximately $750 million.

- Reward

- like

- Comment

- Repost

- Share