BTC_POWER_LA

No content yet

BTC_POWER_LA

Scientific Bitcoin Institute Director look.

- Reward

- like

- Comment

- Repost

- Share

People have the wrong interpretation of the power law. They think in bands around the power law. These are relatively large (we shown in the past that they are not if one focuses on where Bitcoin spends most of its time).

But really the concepts of bands is not what matters in terms of understanding the true Bitcoin behavior. One has to use the language of normalized returns or daily slopes to truly understand the significance of the power law.

1. The core problem: raw returns are misleading

If you look at Bitcoin’s raw daily returns or raw price changes, you immediately face two problems:

N

But really the concepts of bands is not what matters in terms of understanding the true Bitcoin behavior. One has to use the language of normalized returns or daily slopes to truly understand the significance of the power law.

1. The core problem: raw returns are misleading

If you look at Bitcoin’s raw daily returns or raw price changes, you immediately face two problems:

N

BTC0,58%

- Reward

- like

- Comment

- Repost

- Share

My grandson is growing as a fine Italian.

- Reward

- like

- Comment

- Repost

- Share

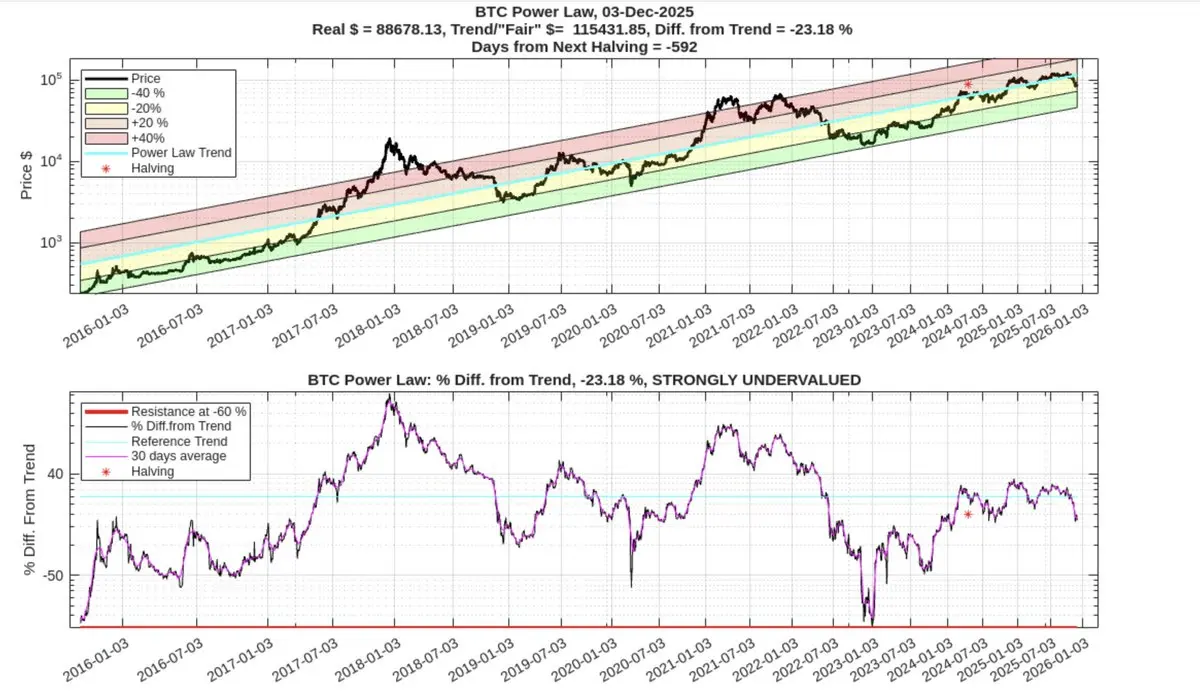

The blue line in the lower panel represents the average power-law slope, computed over a two-week window. It is now crossing the long-term value of 5.9, which is the same exponent obtained from the full regression.

This indicates that the power-law trend itself is reverting to its mean. Even though the price has not yet converged back to the regression line, the directionality of the growth regime is being restored.

In other words, whenever price is temporarily pushed away from the power-law growth path, that deviation has historically been transient. The system consistently re-aligns with the

This indicates that the power-law trend itself is reverting to its mean. Even though the price has not yet converged back to the regression line, the directionality of the growth regime is being restored.

In other words, whenever price is temporarily pushed away from the power-law growth path, that deviation has historically been transient. The system consistently re-aligns with the

- Reward

- like

- Comment

- Repost

- Share

Going back to the origins in Lugano.

- Reward

- like

- Comment

- Repost

- Share

Today I orange pilled another taxi driver but even the crazier I discussed Bitcoin with a railway policewoman while she was patrolling with her team (she was already a Bitcoiner).

We ended up orange pilling together the rest of the squad.

We ended up orange pilling together the rest of the squad.

BTC0,58%

- Reward

- like

- Comment

- Repost

- Share

Viareggio.

View Original

- Reward

- like

- Comment

- Repost

- Share

At this point I have presented the fundamentals of the Power Law framework in person to several technically knowledgeable financial professionals, university professors and engineers.

Everybody that got exposed to my hundreds of slides with dozens of ways to validate the theory and discussions of the implications and relevance of these findings leaves with a renewed appreciation of the beauty of Bitcoin and enthusiasm for the main worldview expressed by the theory.

I'm very glad for this shared experience and feel very motivated to carry on the mission to demonstrate to the world Bitcoin is

Everybody that got exposed to my hundreds of slides with dozens of ways to validate the theory and discussions of the implications and relevance of these findings leaves with a renewed appreciation of the beauty of Bitcoin and enthusiasm for the main worldview expressed by the theory.

I'm very glad for this shared experience and feel very motivated to carry on the mission to demonstrate to the world Bitcoin is

- Reward

- like

- Comment

- Repost

- Share

Great things are coming. In Lugano again to meet professors from the Italian Swiss University and other ones to discuss academic initiatives around Bitcoin.

A lot of great ideas and overall vision to support the concept Bitcoin is a phenomenon worth serious scientific studies.

Stay tuned.

A lot of great ideas and overall vision to support the concept Bitcoin is a phenomenon worth serious scientific studies.

Stay tuned.

BTC0,58%

- Reward

- like

- Comment

- Repost

- Share

Join us now for live lecture at Turin Polytechnic on the power law. Link below

- Reward

- like

- Comment

- Repost

- Share

With 93 K we are at about 19 % from the power law.

Given the Bitcoin volatility, this is pretty remarkable. Even without a bull market, we are still growing as the power law predicts over the long run.

Given the Bitcoin volatility, this is pretty remarkable. Even without a bull market, we are still growing as the power law predicts over the long run.

BTC0,58%

- Reward

- like

- Comment

- Repost

- Share

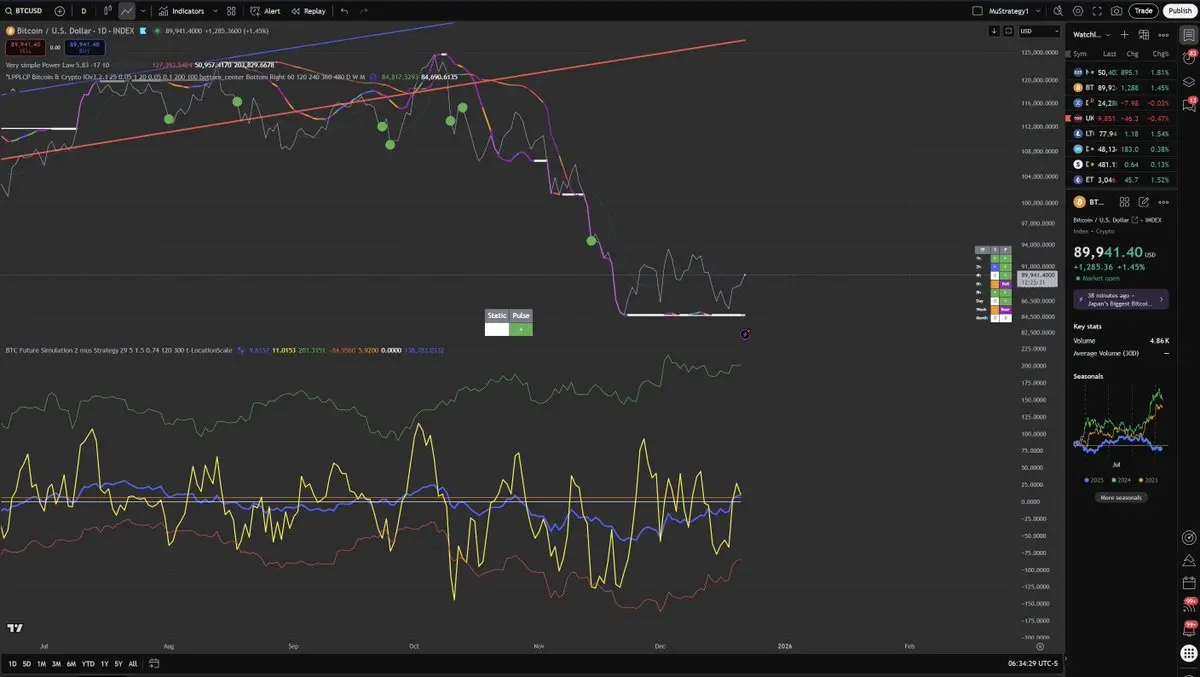

I'm actually impressed by the ability of Bitcoin to spring back from these surgical liquidity sweeps.

The power law daily slopes (lower panel) are going back to their average, which we followed for 16 years.

The critical pulse signal (upper panel) shows a white line that means a change of state is happening, but we will need the two main signals to separate to confirm a full change of state.

The power law daily slopes (lower panel) are going back to their average, which we followed for 16 years.

The critical pulse signal (upper panel) shows a white line that means a change of state is happening, but we will need the two main signals to separate to confirm a full change of state.

BTC0,58%

- Reward

- like

- Comment

- Repost

- Share

The show can be watched here too:

- Reward

- like

- Comment

- Repost

- Share

Bitcoin Critical Pulse, #10 12/2/2025

BTC0,58%

- Reward

- like

- Comment

- Repost

- Share

At 2:00 PM Central European Time or 8 AM EST, we will have another "Bitcoin Complexity Pulse" with Chris and GIovanni.

We will discuss the current market situation using tools from complexity science.

The show will be here on X, YouTube, and Twitch.

We will discuss the current market situation using tools from complexity science.

The show will be here on X, YouTube, and Twitch.

BTC0,58%

- Reward

- like

- Comment

- Repost

- Share

The power law is our best hope.

People will beg in a few years that Bitcoin continues to follow the power law.

People will beg in a few years that Bitcoin continues to follow the power law.

BTC0,58%

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More38.07K Popularity

21.36K Popularity

8.46K Popularity

54.97K Popularity

343.63K Popularity

Pin