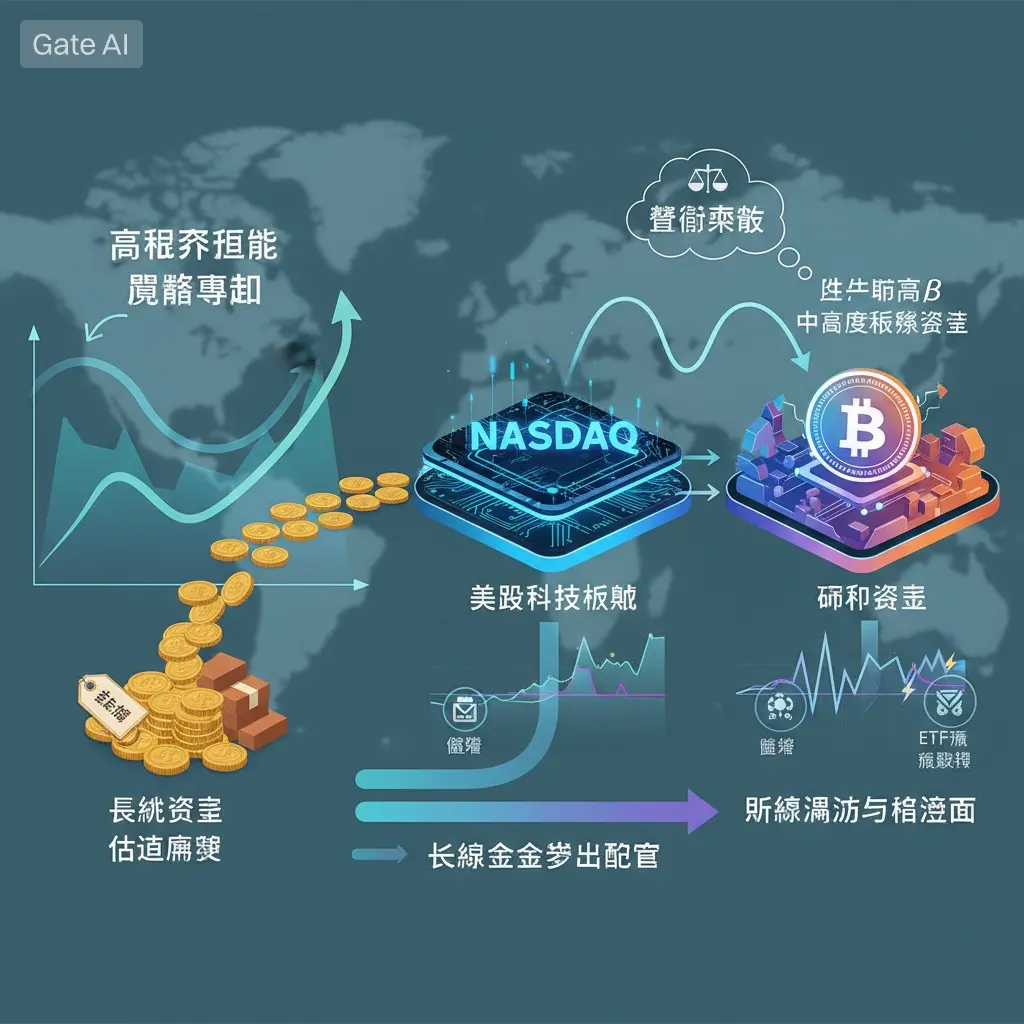

The world is still in a "high interest rate + low growth" combination, with traditional asset risk appetite being generally low; funds are more inclined towards high liquidity and top assets (BTC/ETH) rather than small market capitalization tokens.

Cryptographic assets are more often viewed as "high volatility risk assets" in institutional allocation, with respect to macro liquidity and Federal Reserve interest rate expectations.

The market is highly sensitive; once "interest rate cut expectations" or "easing signals" appear, it often first reacts on BTC before spreading to altcoins.

Market se

View OriginalCryptographic assets are more often viewed as "high volatility risk assets" in institutional allocation, with respect to macro liquidity and Federal Reserve interest rate expectations.

The market is highly sensitive; once "interest rate cut expectations" or "easing signals" appear, it often first reacts on BTC before spreading to altcoins.

Market se