ASSA

No content yet

ASSA

#GateSquareCreatorNewYearIncentives

#BTC 🎯 Positive Outlook (利好📈)

#Институции Strengthening demand: Over the past week, Bitcoin (≈95,200 USDT) demonstrates resilience despite fluctuations. Positive flows into ETFs (up to 1.46 billion USD per day) and the interest of major players lay the foundation for a breakout from consolidation. Increased participation of financial institutions in BTC supports the entire market, and related altcoins — primarily ETH and SOL — may gain momentum following the main cryptocurrency.

News Background (利好📈):

Topic: Institutional accumulation of BTC: The backg

View Original#BTC 🎯 Positive Outlook (利好📈)

#Институции Strengthening demand: Over the past week, Bitcoin (≈95,200 USDT) demonstrates resilience despite fluctuations. Positive flows into ETFs (up to 1.46 billion USD per day) and the interest of major players lay the foundation for a breakout from consolidation. Increased participation of financial institutions in BTC supports the entire market, and related altcoins — primarily ETH and SOL — may gain momentum following the main cryptocurrency.

News Background (利好📈):

Topic: Institutional accumulation of BTC: The backg

- Reward

- 3

- 2

- Repost

- Share

Discovery :

:

Thank you for the information and sharing.View More

#Doge #прогноз for a week

Action

Bullish

Buy from support

🎯 Opportunity (Bullish 📈)

Correction completed, a surge upwards possible: DOGE has formed an inverted "head and shoulders" pattern, holding around 0.137 USDT. Breaking through the resistance zone at 0.152 USDT could lead to a rise to 0.19 USDT. Supported by positive momentum in BTC and ETH, as well as a neutral-optimistic market background for altcoins (fear and greed index = 49).

News (Bullish 📈)

Technical reversal: The "head and shoulders" pattern on the daily chart indicates increasing momentum, with analysts noting a weakening of

View OriginalAction

Bullish

Buy from support

🎯 Opportunity (Bullish 📈)

Correction completed, a surge upwards possible: DOGE has formed an inverted "head and shoulders" pattern, holding around 0.137 USDT. Breaking through the resistance zone at 0.152 USDT could lead to a rise to 0.19 USDT. Supported by positive momentum in BTC and ETH, as well as a neutral-optimistic market background for altcoins (fear and greed index = 49).

News (Bullish 📈)

Technical reversal: The "head and shoulders" pattern on the daily chart indicates increasing momentum, with analysts noting a weakening of

- Reward

- 2

- 1

- Repost

- Share

ASSA :

:

Jump in 🚀Brief

News about #Bitcoin is filled with reports of institutional adoption and technological achievements. Here are the latest updates:

U.S. Bitcoin Strategic Reserve (January 17, 2026) – Trump signed an order to create a reserve from confiscated BTC, indicating an unprecedented level of government involvement.

ETF inflows reached $1.42 billion (January 17, 2026) – Spot Bitcoin ETFs recorded the largest weekly inflow since October, signaling renewed institutional investor interest.

BTC closed a CME gap at $94 800 (January 17, 2026) – Technical gap closure is seen as a positive signal toward re

News about #Bitcoin is filled with reports of institutional adoption and technological achievements. Here are the latest updates:

U.S. Bitcoin Strategic Reserve (January 17, 2026) – Trump signed an order to create a reserve from confiscated BTC, indicating an unprecedented level of government involvement.

ETF inflows reached $1.42 billion (January 17, 2026) – Spot Bitcoin ETFs recorded the largest weekly inflow since October, signaling renewed institutional investor interest.

BTC closed a CME gap at $94 800 (January 17, 2026) – Technical gap closure is seen as a positive signal toward re

BTC-2,65%

- Reward

- 2

- 1

- Repost

- Share

ASSA :

:

Follow 🔍 closelyDiscussions #Dogecoin — is a constant struggle between sharp growth and decline. Here's what's trending now:

1. **#Dogecoin Targets** – analysts forecast a breakthrough to $0.21–$0.30 by February

2. **#Оптимистичные Signals** – strong candles and large purchases indicate growth

3. **Pessimistic Warnings** – charts hint at a possible drop to $0.08

Short-term optimistic targets are $0.21

"Price forecast for $DOGE: targets of $0.165–$0.21 by February amid improving technical picture"

**What does this mean:** This is a positive signal for DOGE, as analysts expect consolidation around $

1. **#Dogecoin Targets** – analysts forecast a breakthrough to $0.21–$0.30 by February

2. **#Оптимистичные Signals** – strong candles and large purchases indicate growth

3. **Pessimistic Warnings** – charts hint at a possible drop to $0.08

Short-term optimistic targets are $0.21

"Price forecast for $DOGE: targets of $0.165–$0.21 by February amid improving technical picture"

**What does this mean:** This is a positive signal for DOGE, as analysts expect consolidation around $

DOGE-7,26%

Your opinion on the price trend

DOGE up

5

5

DOGE down

4

4

9 ParticipantsVoting Finished

- Reward

- 11

- 1

- Repost

- Share

ASSA :

:

Dogecoin is on the verge of a significant breakthrough driven by an inverted "head and shoulders" pattern, with the key level to break through being $0.152. 📉 Over the past 24 hours, the price of Dogecoin has changed by -1.9%, to $0.13, and the trading volume has increased by +2.17%, to $1.31b.Brief😟🙁🤒😴🥳🤤😇😂🤠🤗

#Dogecoin overcomes technical levels and expands international partnerships, while major holders (whales) show caution. Here are the latest news:

A bullish pattern is forming (January 15, 2026) – DOGE has broken out of a key descending wedge but faces resistance at the $0.17 level to continue its rise.

Expansion launch in Japan (January 9, 2026) – House of Doge is partnering with Japanese companies on real asset tokenization and payment integrations.

Large holder activity slows down (January 9, 2026) – Major investors did not participate in the January rally, raising

#Dogecoin overcomes technical levels and expands international partnerships, while major holders (whales) show caution. Here are the latest news:

A bullish pattern is forming (January 15, 2026) – DOGE has broken out of a key descending wedge but faces resistance at the $0.17 level to continue its rise.

Expansion launch in Japan (January 9, 2026) – House of Doge is partnering with Japanese companies on real asset tokenization and payment integrations.

Large holder activity slows down (January 9, 2026) – Major investors did not participate in the January rally, raising

DOGE-7,26%

- Reward

- 9

- 8

- Repost

- Share

Plastikkid :

:

Jump in 🚀View More

Brief

Over the past 24 hours, the crypto market decreased by 1.49%, despite a weekly growth of 4.04%. This was due to weak performance of altcoins compared to Bitcoin amid regulatory uncertainty.

Regulatory concerns: Disagreements surrounding the US CLARITY Act increased policy uncertainty, negatively impacting investor sentiment.

Altcoin weakness: Tokens such as UNI and FOGO fell by 5–12% due to issues related to specific projects, affecting the overall market.

Rotation towards Bitcoin: Bitcoin’s dominance increased by 0.10% to 59.07%, indicating a capital shift from altcoins to Bitcoin and p

View OriginalOver the past 24 hours, the crypto market decreased by 1.49%, despite a weekly growth of 4.04%. This was due to weak performance of altcoins compared to Bitcoin amid regulatory uncertainty.

Regulatory concerns: Disagreements surrounding the US CLARITY Act increased policy uncertainty, negatively impacting investor sentiment.

Altcoin weakness: Tokens such as UNI and FOGO fell by 5–12% due to issues related to specific projects, affecting the overall market.

Rotation towards Bitcoin: Bitcoin’s dominance increased by 0.10% to 59.07%, indicating a capital shift from altcoins to Bitcoin and p

- Reward

- 6

- 5

- Repost

- Share

GateUser-40388b14 :

:

Jump in 🚀View More

🐕 #Dogecoin is gaining momentum again — but the next step matters.

After failing to break above $0.152, $DOGE experienced a healthy pullback, a drop below $0.15 and $0.145. Nothing dramatic — the bulls stepped in exactly where it was important.

📉 The price respected the support at $0.142, coinciding with the bullish trend line and key Fibonacci levels.

As long as DOGE remains above $0.142–0.143 and the 100H MA, the structure remains bullish.🔑 Key levels to watch:

- Resistance: $0.145 → $0.150 → $0.151- Break and close above $0.151 → targets open towards $0.155, then $0.176–0.185

- Loss of $

After failing to break above $0.152, $DOGE experienced a healthy pullback, a drop below $0.15 and $0.145. Nothing dramatic — the bulls stepped in exactly where it was important.

📉 The price respected the support at $0.142, coinciding with the bullish trend line and key Fibonacci levels.

As long as DOGE remains above $0.142–0.143 and the 100H MA, the structure remains bullish.🔑 Key levels to watch:

- Resistance: $0.145 → $0.150 → $0.151- Break and close above $0.151 → targets open towards $0.155, then $0.176–0.185

- Loss of $

DOGE-7,26%

- Reward

- 3

- 1

- Repost

- Share

GateUser-d9c25102 :

:

Very interesting information, thank you ♥️#CryptoMarketWatch

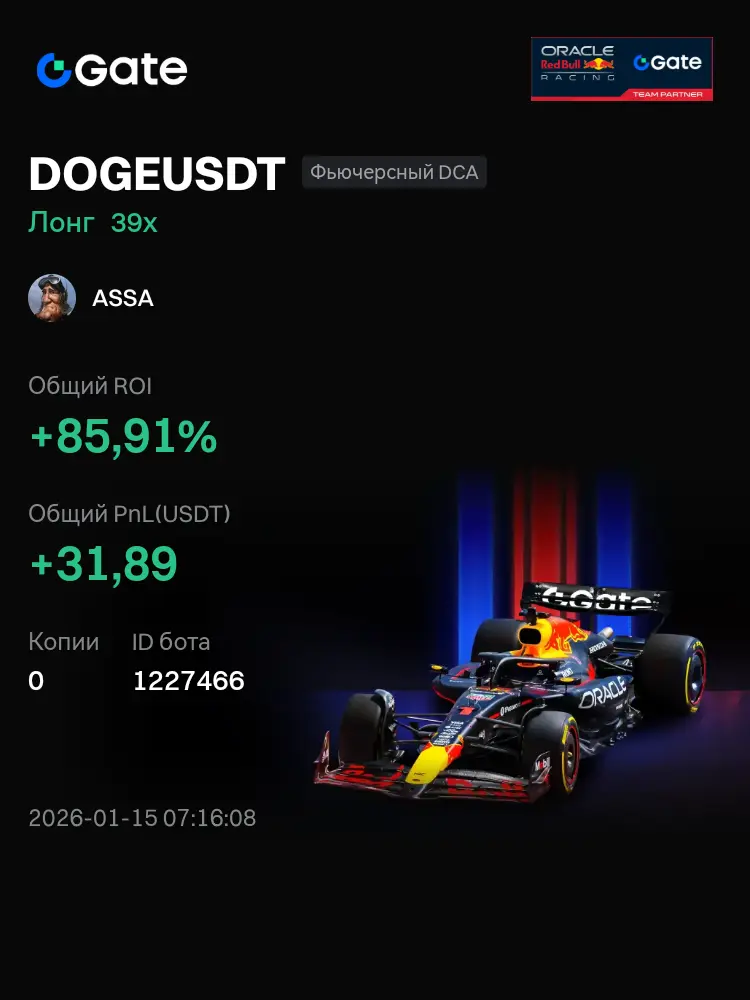

#DOGEUSDT Futures DCA on Gate. ROI since the bot was created has reached +85.91%

View Original#DOGEUSDT Futures DCA on Gate. ROI since the bot was created has reached +85.91%

- Reward

- 7

- Comment

- Repost

- Share

#Dogecoin It is adapting to regulatory changes and expanding its presence in the real world, while traders are closely watching key price levels. Here are the latest updates:

Regulatory vote could free DOGE from SEC oversight (January 15, 2026) – The Senate Committee will decide the legal status of DOGE.

Dogecoin ETFs are ignored in favor of Bitcoin and Solana (January 15, 2026) – Institutional investors prefer more regulated and useful assets.

House of Doge expands in Japan with a focus on real assets (January 9, 2026) – The partnership aims at asset tokenization and stablecoins.

Details

1. R

View OriginalRegulatory vote could free DOGE from SEC oversight (January 15, 2026) – The Senate Committee will decide the legal status of DOGE.

Dogecoin ETFs are ignored in favor of Bitcoin and Solana (January 15, 2026) – Institutional investors prefer more regulated and useful assets.

House of Doge expands in Japan with a focus on real assets (January 9, 2026) – The partnership aims at asset tokenization and stablecoins.

Details

1. R

- Reward

- 6

- 7

- Repost

- Share

Topinvest :

:

Hold tight 💪View More

#MyFavouriteChineseMemecoin

Around #Dogecoin (DOGE), interest is growing due to expansion in Japan, regulatory clarity, and a 9% price increase, with traders targeting the $0.15 mark. Here are the latest updates:

1. **Expansion in Japan (January 9, 2026)** – House of Doge is partnering with Japanese companies to launch projects with real assets (RWA) to use DOGE not just as a meme.

2. **Regulatory support (January 13, 2026)** – The US Senate proposes a bill classifying DOGE as a commodity, reducing risks for institutional investors.

3. **Price increase (January 14, 2026)** – DOGE rose b

View OriginalAround #Dogecoin (DOGE), interest is growing due to expansion in Japan, regulatory clarity, and a 9% price increase, with traders targeting the $0.15 mark. Here are the latest updates:

1. **Expansion in Japan (January 9, 2026)** – House of Doge is partnering with Japanese companies to launch projects with real assets (RWA) to use DOGE not just as a meme.

2. **Regulatory support (January 13, 2026)** – The US Senate proposes a bill classifying DOGE as a commodity, reducing risks for institutional investors.

3. **Price increase (January 14, 2026)** – DOGE rose b

- Reward

- like

- Comment

- Repost

- Share

Brief

The #Kaspa community shows cautious optimism combined with technical interest. Here are the main trends:

Hidden bullish divergence raises hopes for a breakout

Exchange listings support short-term optimism

Low trading volume raises doubts about the sustainability of growth

Decentralized social app K-Social is gaining popularity

Details

1. Hidden bullish divergence detected 🐂

"We see higher lows in price with lower lows in RSI — a classic hidden bullish divergence. A breakout above the annual trend line ($0.048) could trigger an impulse."

What it means: Such a technical pattern indicates

The #Kaspa community shows cautious optimism combined with technical interest. Here are the main trends:

Hidden bullish divergence raises hopes for a breakout

Exchange listings support short-term optimism

Low trading volume raises doubts about the sustainability of growth

Decentralized social app K-Social is gaining popularity

Details

1. Hidden bullish divergence detected 🐂

"We see higher lows in price with lower lows in RSI — a classic hidden bullish divergence. A breakout above the annual trend line ($0.048) could trigger an impulse."

What it means: Such a technical pattern indicates

KAS-3,21%

- Reward

- 3

- 2

- Repost

- Share

ASSA :

:

The team and blockchain have great prospectsView More

#Bitcoin Gaining momentum thanks to institutional adoption and technical momentum: breaking the $95 000 mark sparked new optimism. Here are the latest news:

Bitcoin returns to $95 000 (January 14, 2026) – a rally amid short position liquidations reached a two-month high.

21Shares launches Bitcoin-Gold ETP (January 13, 2026) – a regulated product combining BTC and gold to leverage increasing correlation.

Bank of America recommends allocating 4% of the portfolio to cryptocurrency (January 13, 2026) – the financial giant advises moderate investing, highlighting diversification benefits.

Details

1

Bitcoin returns to $95 000 (January 14, 2026) – a rally amid short position liquidations reached a two-month high.

21Shares launches Bitcoin-Gold ETP (January 13, 2026) – a regulated product combining BTC and gold to leverage increasing correlation.

Bank of America recommends allocating 4% of the portfolio to cryptocurrency (January 13, 2026) – the financial giant advises moderate investing, highlighting diversification benefits.

Details

1

BTC-2,65%

- Reward

- 1

- 1

- Repost

- Share

ASSA :

:

🤑🤑🤑🤑🤑👌👌👌👌👌Over the past 24 hours, #Dogecoin has increased by 9.07%, recovering from the decline over the last 7 days (-0.83%) and continuing to follow the 30-day upward trend (+11.1%). Key growth factors:

Optimism regarding regulation – progress on the CLARITY law has boosted confidence in altcoins.

Inflow of funds into ETFs – spot DOGE ETFs showed a 2290% increase in fund inflows over the month.

Technical breakthrough – bullish patterns and accumulation by large players indicate further growth.

Detailed Analysis

1. Optimism in Regulation (positive factor)

Overview:

The US Senate Banking Committee advan

View OriginalOptimism regarding regulation – progress on the CLARITY law has boosted confidence in altcoins.

Inflow of funds into ETFs – spot DOGE ETFs showed a 2290% increase in fund inflows over the month.

Technical breakthrough – bullish patterns and accumulation by large players indicate further growth.

Detailed Analysis

1. Optimism in Regulation (positive factor)

Overview:

The US Senate Banking Committee advan

- Reward

- 19

- 20

- 3

- Share

GateUser-eb7e3ec6 :

:

Vryvaytes 🚀View More

Dogecoin community is oscillating between hope for growth and caution as technical signals clash with actions from major investors (whales). Here are the main trends:

Most optimism versus model skepticism

Analysts monitor the breakout zone of $0.15–$0.17

Large investor bought DOGE worth $2.3 million at a price of $0.151

Target $0.21 in February gaining popularity

Details

1. @MarketProphit: Mixed Sentiments

"$DOGE Sentiment: CROWD = Bullish 🟩 MP = Bearish 🟥"

– @MarketProphit (70,097 followers · January 3, 2026)

Original post

What it means: Retail traders see growth potential, while quantitati

Most optimism versus model skepticism

Analysts monitor the breakout zone of $0.15–$0.17

Large investor bought DOGE worth $2.3 million at a price of $0.151

Target $0.21 in February gaining popularity

Details

1. @MarketProphit: Mixed Sentiments

"$DOGE Sentiment: CROWD = Bullish 🟩 MP = Bearish 🟥"

– @MarketProphit (70,097 followers · January 3, 2026)

Original post

What it means: Retail traders see growth potential, while quantitati

DOGE-7,26%

- Reward

- 1

- Comment

- Repost

- Share

#Solana Approaches network updates with cautious optimism amid decreasing activity in the ecosystem.

Here are the latest news:

Validator upgrade recommended (January 10, 2026) – Solana releases an important update v3.0.14 to prevent outages during price stabilization.

Kite moves 10.8 million SOL (January 10, 2026) – inactive wallet becomes active again, possibly indicating long-term accumulation plans.

Pump.fun changes fee structure (January 10, 2026) – the meme coin platform shifts focus from token creation to trading incentives.

Details

1. Validator upgrade recommended (January 10, 2

View OriginalHere are the latest news:

Validator upgrade recommended (January 10, 2026) – Solana releases an important update v3.0.14 to prevent outages during price stabilization.

Kite moves 10.8 million SOL (January 10, 2026) – inactive wallet becomes active again, possibly indicating long-term accumulation plans.

Pump.fun changes fee structure (January 10, 2026) – the meme coin platform shifts focus from token creation to trading incentives.

Details

1. Validator upgrade recommended (January 10, 2

- Reward

- 1

- 1

- Repost

- Share

ASSA :

:

Jump in 🚀