A成杰日记A

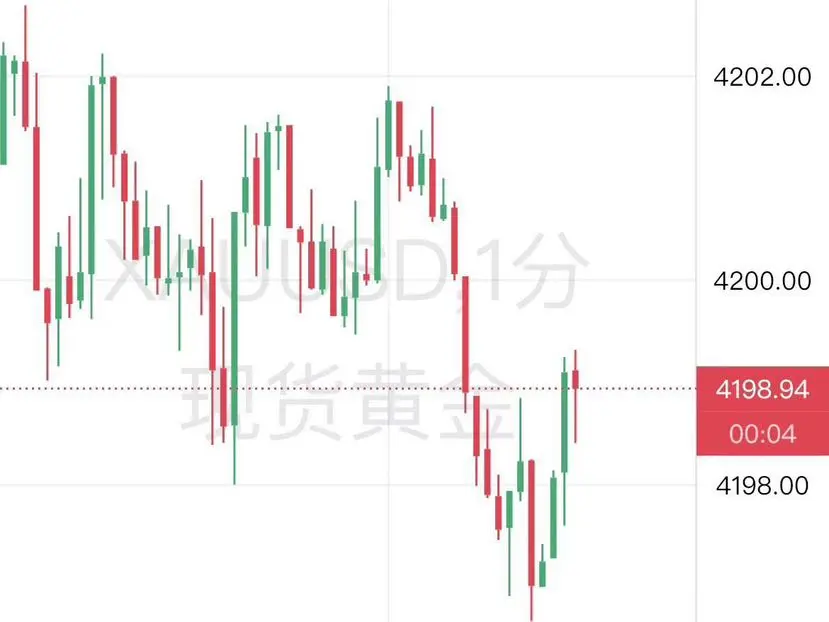

This Week's Gold Trading Summary | 4200 Becomes Key Watershed, Next Week’s Strategy Clear

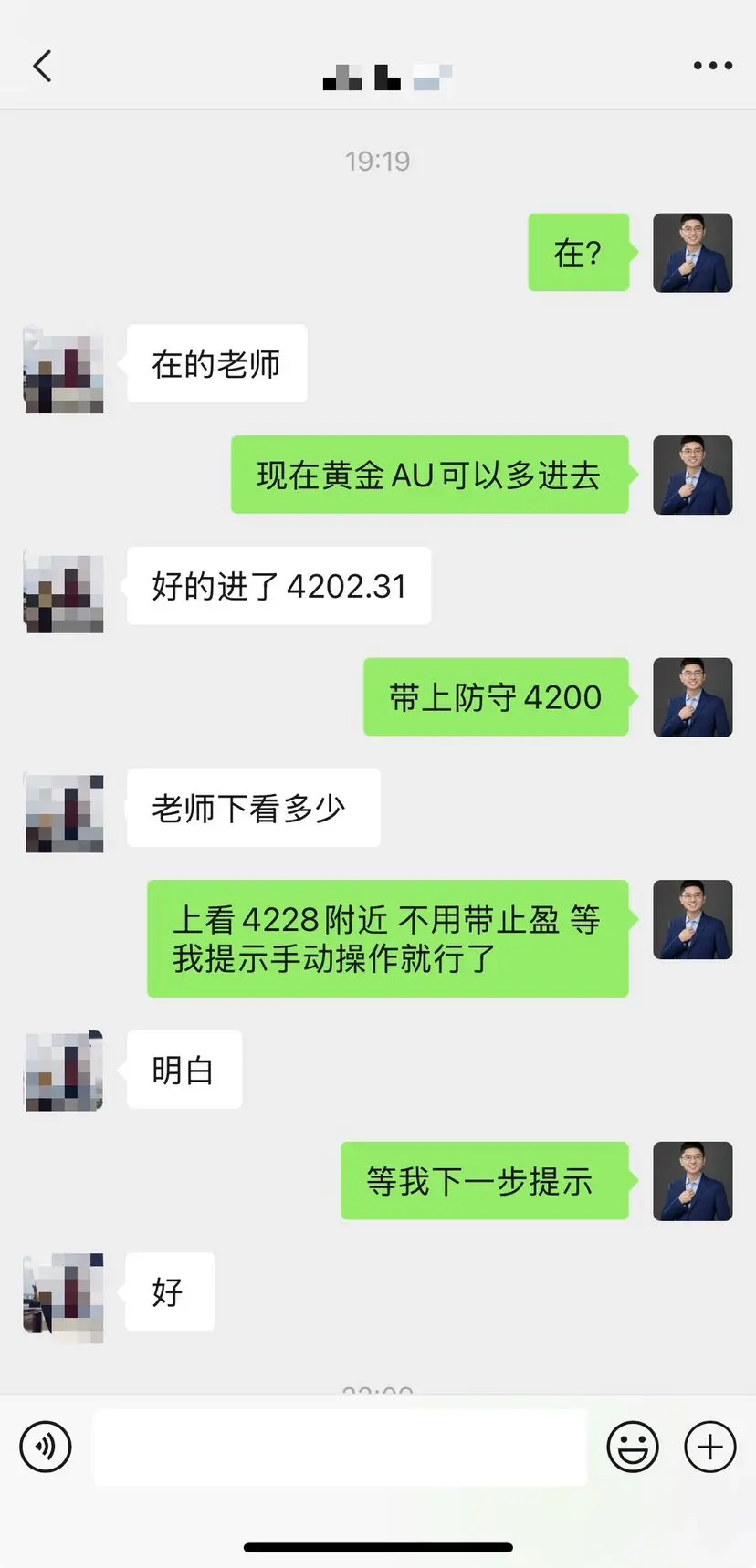

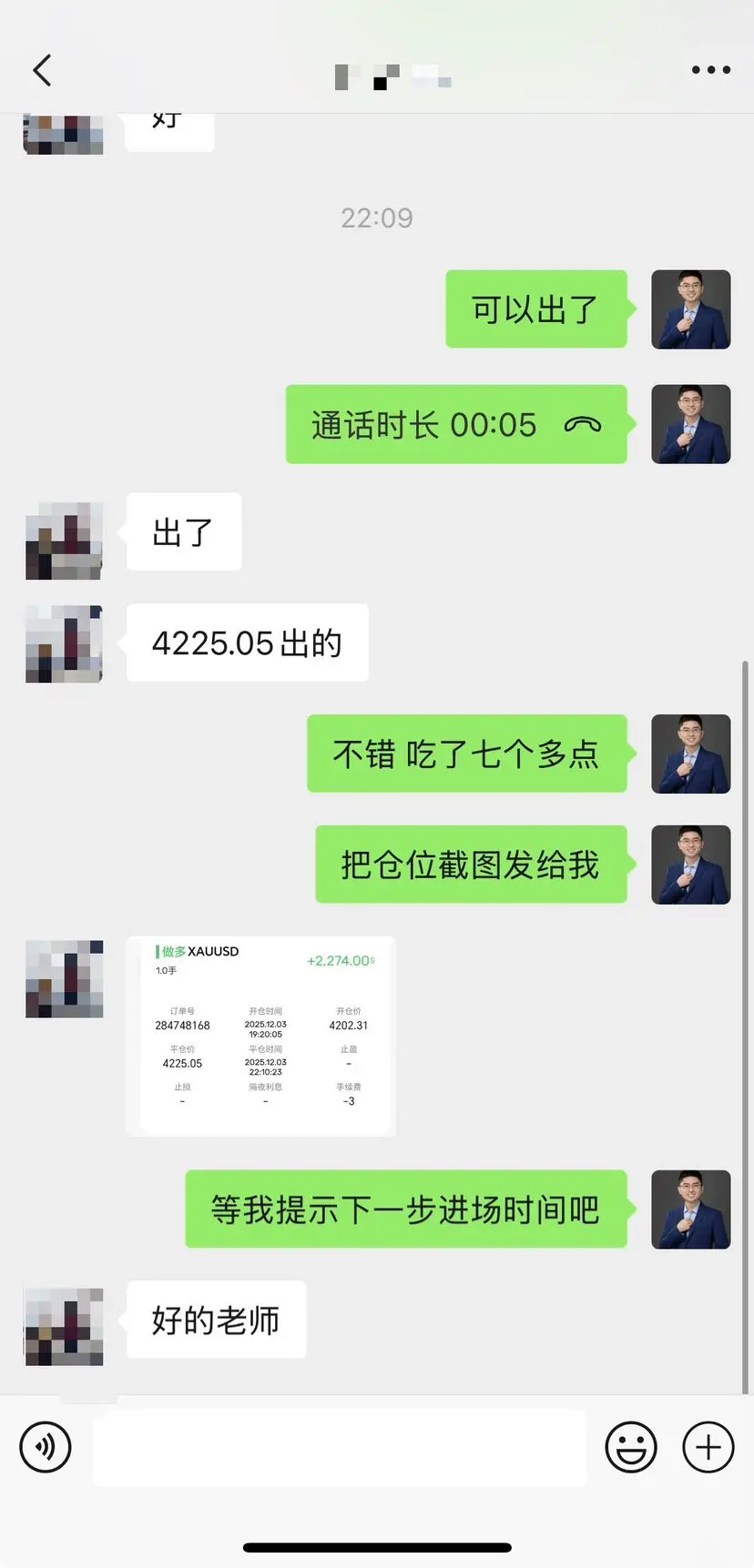

Brothers! For this week’s gold trading, 4200 was the best entry point! Break above 4200, decisively go long, maxed out at 4250, perfectly hitting this week’s 50-point profit forecast—everyone who followed made a profit!

Core Conclusions for This Week

1. 4200 remains the short-term watershed. The wide range oscillation continues, and the effectiveness of this level has been repeatedly verified this week. It will continue to serve as a core reference going forward.

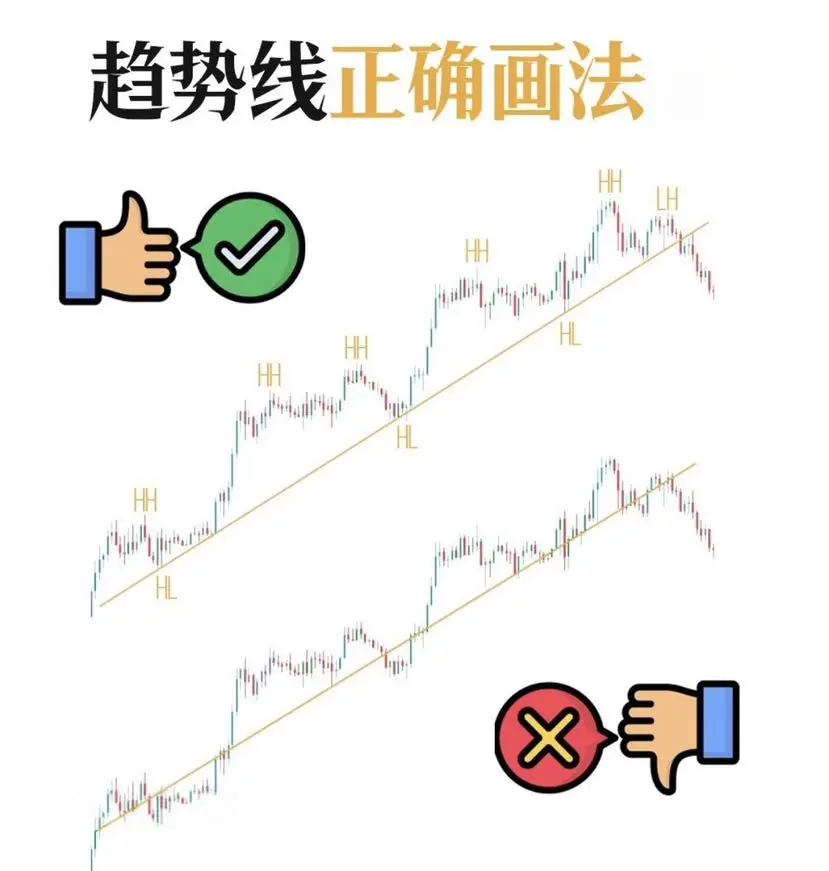

2. The essence of trading is “waiting”: Bu

View OriginalBrothers! For this week’s gold trading, 4200 was the best entry point! Break above 4200, decisively go long, maxed out at 4250, perfectly hitting this week’s 50-point profit forecast—everyone who followed made a profit!

Core Conclusions for This Week

1. 4200 remains the short-term watershed. The wide range oscillation continues, and the effectiveness of this level has been repeatedly verified this week. It will continue to serve as a core reference going forward.

2. The essence of trading is “waiting”: Bu