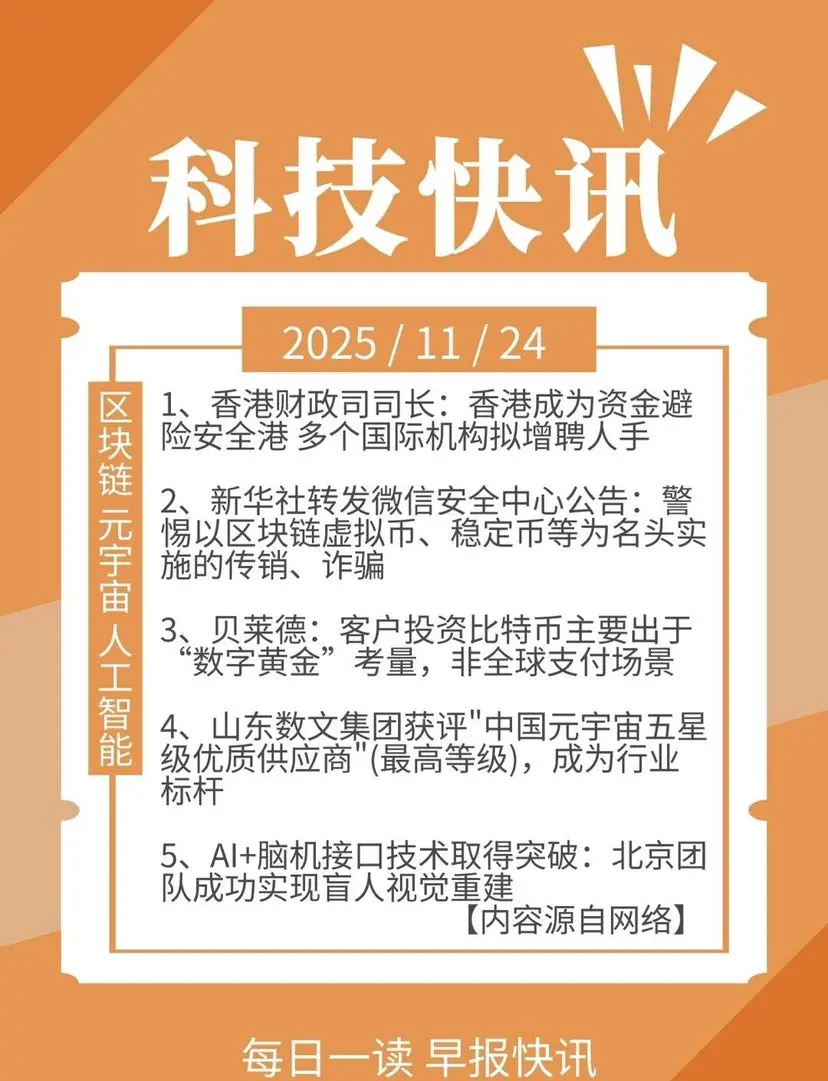

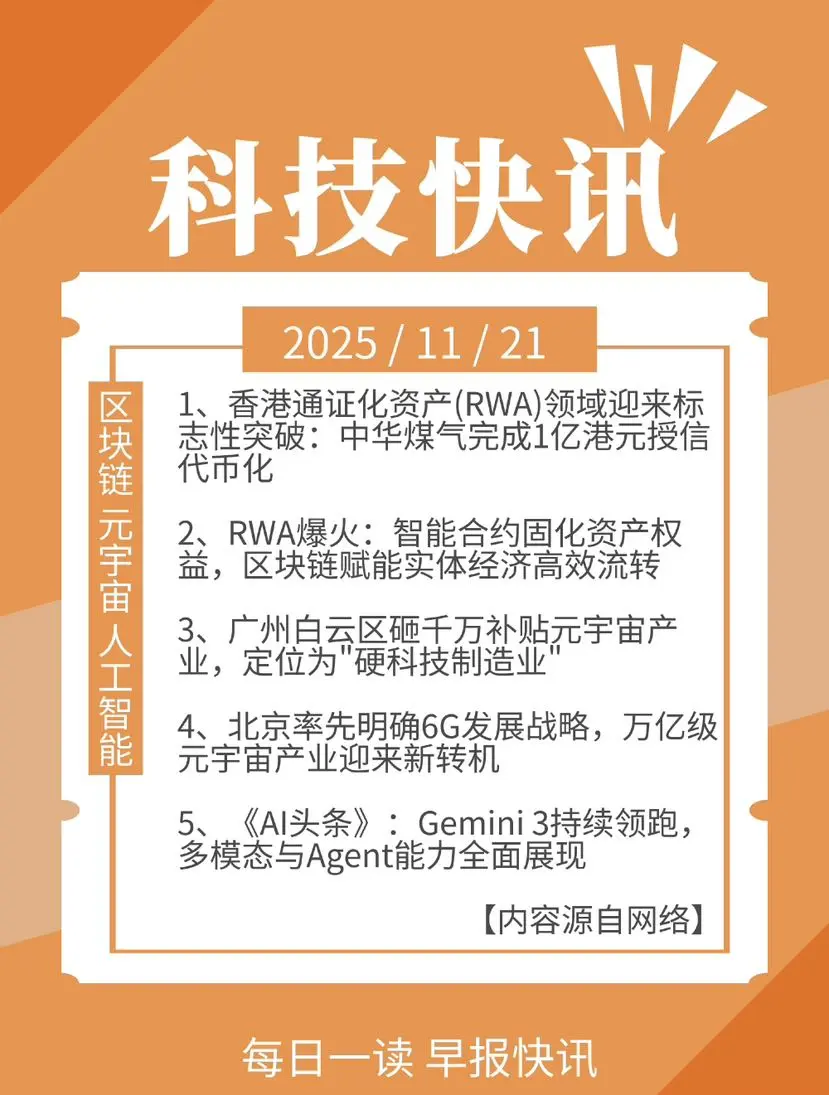

11/26 Fund Morning Report: Equity Market Heat Increases, Institutional Layout Shifts to Positive

1. Market performance: Equity funds lead the way

· Several actively managed equity funds (such as Puyin Ansheng Digital Economy, Tongtai Industry Selection) had a daily increase of over 6% yesterday.

· ETFs surged across the board, with thematic ETFs such as anime games and 5G performing outstandingly.

2. Issuance Dynamics: New Fund "Quality over Quantity"

· The number of newly launched funds has decreased, but the structural changes are significant: equity funds have become the main force in issua

1. Market performance: Equity funds lead the way

· Several actively managed equity funds (such as Puyin Ansheng Digital Economy, Tongtai Industry Selection) had a daily increase of over 6% yesterday.

· ETFs surged across the board, with thematic ETFs such as anime games and 5G performing outstandingly.

2. Issuance Dynamics: New Fund "Quality over Quantity"

· The number of newly launched funds has decreased, but the structural changes are significant: equity funds have become the main force in issua

BTC-0.75%