ChenJiaguanA

No content yet

ChenJiaguanA

ETH followed the broader market rebound even more strongly,

rising to around 3.4k before pulling back slightly.

For the subsequent pullback, we are watching 3230.

For a conservative approach, you can wait for the gray area to hold

before entering again.

The target is 3.4k-3.5k.

rising to around 3.4k before pulling back slightly.

For the subsequent pullback, we are watching 3230.

For a conservative approach, you can wait for the gray area to hold

before entering again.

The target is 3.4k-3.5k.

ETH6.21%

- Reward

- like

- Comment

- Repost

- Share

BTC broke through the 92k resistance in a single move today.

Currently, the price is fluctuating around 94k.

For the next pullback, we can watch whether 92k turns from resistance to support.

Conservative traders can pay attention to whether the price holds above the gray area.

Subsequent moves may continue to test lower levels.

Our target is to look for 95k-96k.

Currently, the price is fluctuating around 94k.

For the next pullback, we can watch whether 92k turns from resistance to support.

Conservative traders can pay attention to whether the price holds above the gray area.

Subsequent moves may continue to test lower levels.

Our target is to look for 95k-96k.

BTC2.03%

- Reward

- like

- Comment

- Repost

- Share

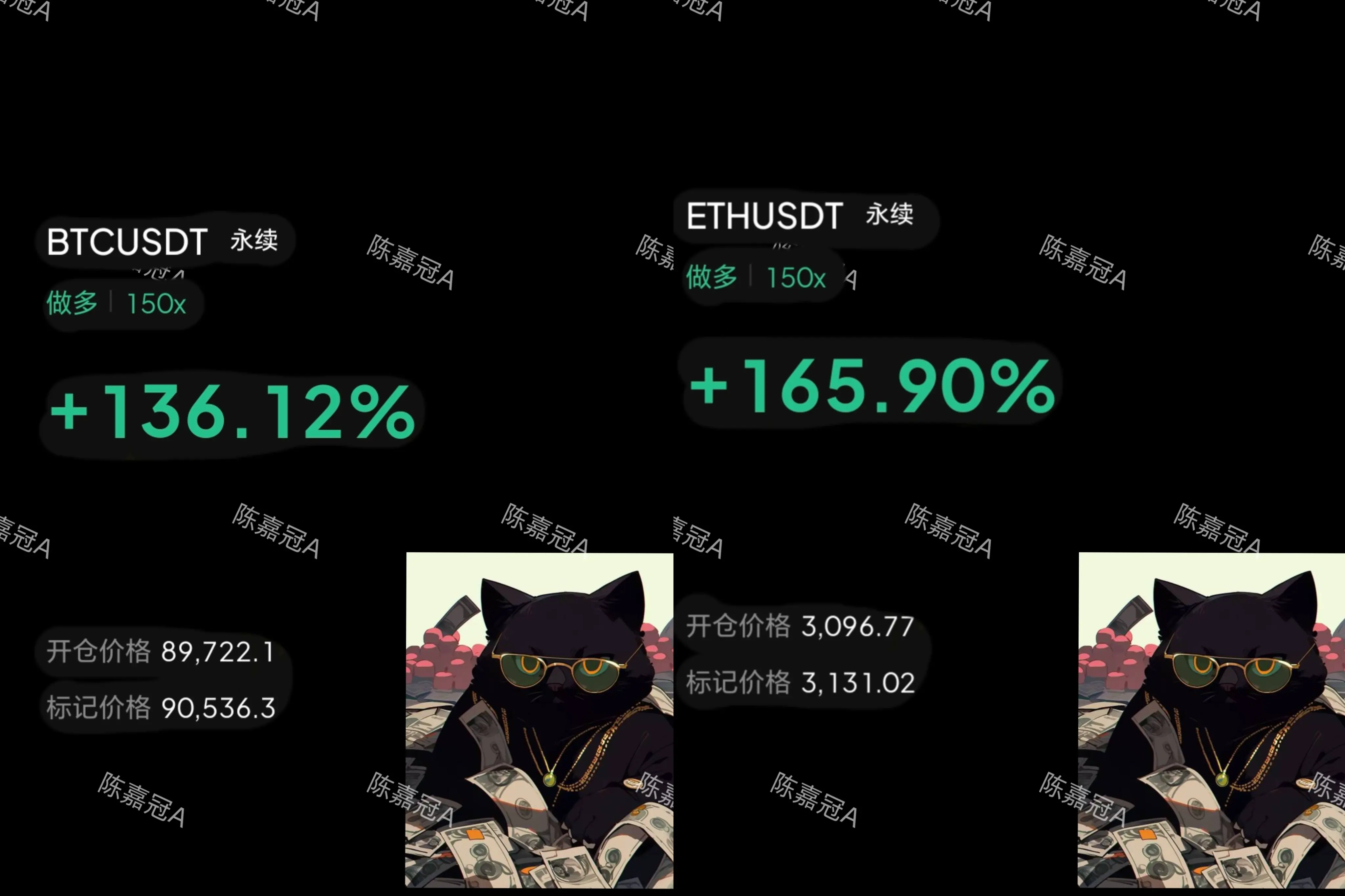

Yesterday ↓ Today ↑

This back and forth

How much space in between

The position is openly given by Jia Guan

If you still haven't received it

Bring over five benches and sit down properly

View OriginalThis back and forth

How much space in between

The position is openly given by Jia Guan

If you still haven't received it

Bring over five benches and sit down properly

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

The intraday rebound is indeed not strong.

The market trend is as calm as water.

But just as we expected in the early morning,

Enter lows in the gray area shown in the chart.

There's no big profit, but small gains are not a problem.

View OriginalThe market trend is as calm as water.

But just as we expected in the early morning,

Enter lows in the gray area shown in the chart.

There's no big profit, but small gains are not a problem.

- Reward

- like

- Comment

- Repost

- Share

The largest liquidity cluster near BTC is located at 93k-94K.

Below $87K is an area to watch,

but liquidity is not as concentrated there.

In any case, the price mainly fluctuates within a range.

Below $87K is an area to watch,

but liquidity is not as concentrated there.

In any case, the price mainly fluctuates within a range.

BTC2.03%

- Reward

- like

- Comment

- Repost

- Share

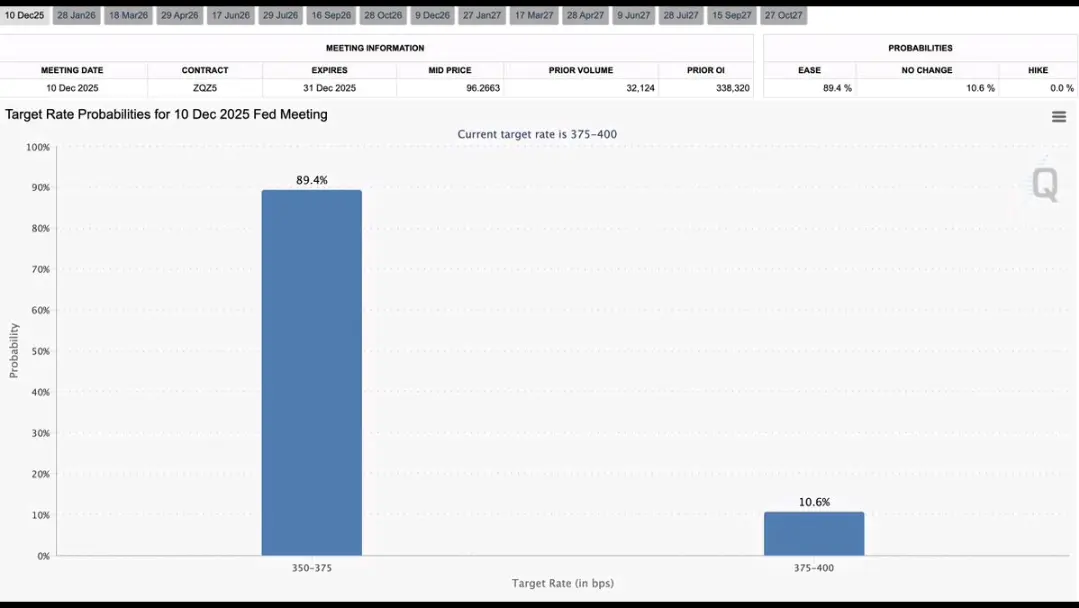

The probability has already reached 89.4%.

It can be said that this is the most important FOMC decision of the year.

It's coming soon.

View OriginalIt can be said that this is the most important FOMC decision of the year.

It's coming soon.

- Reward

- like

- Comment

- Repost

- Share

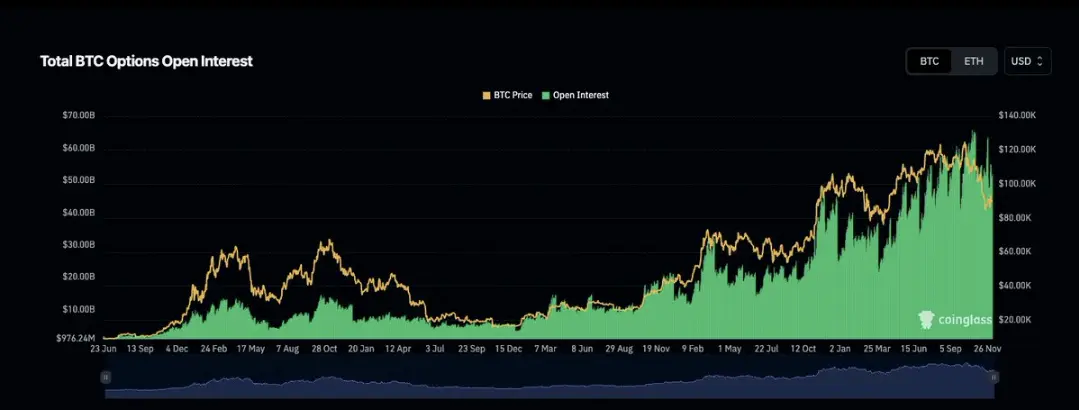

BTC price volatility is low, while open interest in options is near historical highs.

This means:

>A large amount of capital is betting on BTC's future movement

>There is almost no clear direction

>One strong move = someone will be heavily squeezed

The table is already full. We're just waiting for the dealer to reveal the cards.

This means:

>A large amount of capital is betting on BTC's future movement

>There is almost no clear direction

>One strong move = someone will be heavily squeezed

The table is already full. We're just waiting for the dealer to reveal the cards.

BTC2.03%

- Reward

- like

- Comment

- Repost

- Share

At present, this is a consolidation market, and the reason why everyone has been struggling recently is because sharp wicks and V-shaped reversals are everywhere.

From a structural perspective:

The overall trend is still downward. Looking at the move from the 124 high to now, the market has gone through a cycle of decline—sideways—decline—sideways.

Currently, the market is in a sideways phase. You can see that this sideways movement is still forming a bearish flag pattern, which is somewhat similar to the previous sideways structure.

With the interest rate meeting approaching, be aware that if

View OriginalFrom a structural perspective:

The overall trend is still downward. Looking at the move from the 124 high to now, the market has gone through a cycle of decline—sideways—decline—sideways.

Currently, the market is in a sideways phase. You can see that this sideways movement is still forming a bearish flag pattern, which is somewhat similar to the previous sideways structure.

With the interest rate meeting approaching, be aware that if

- Reward

- like

- Comment

- Repost

- Share

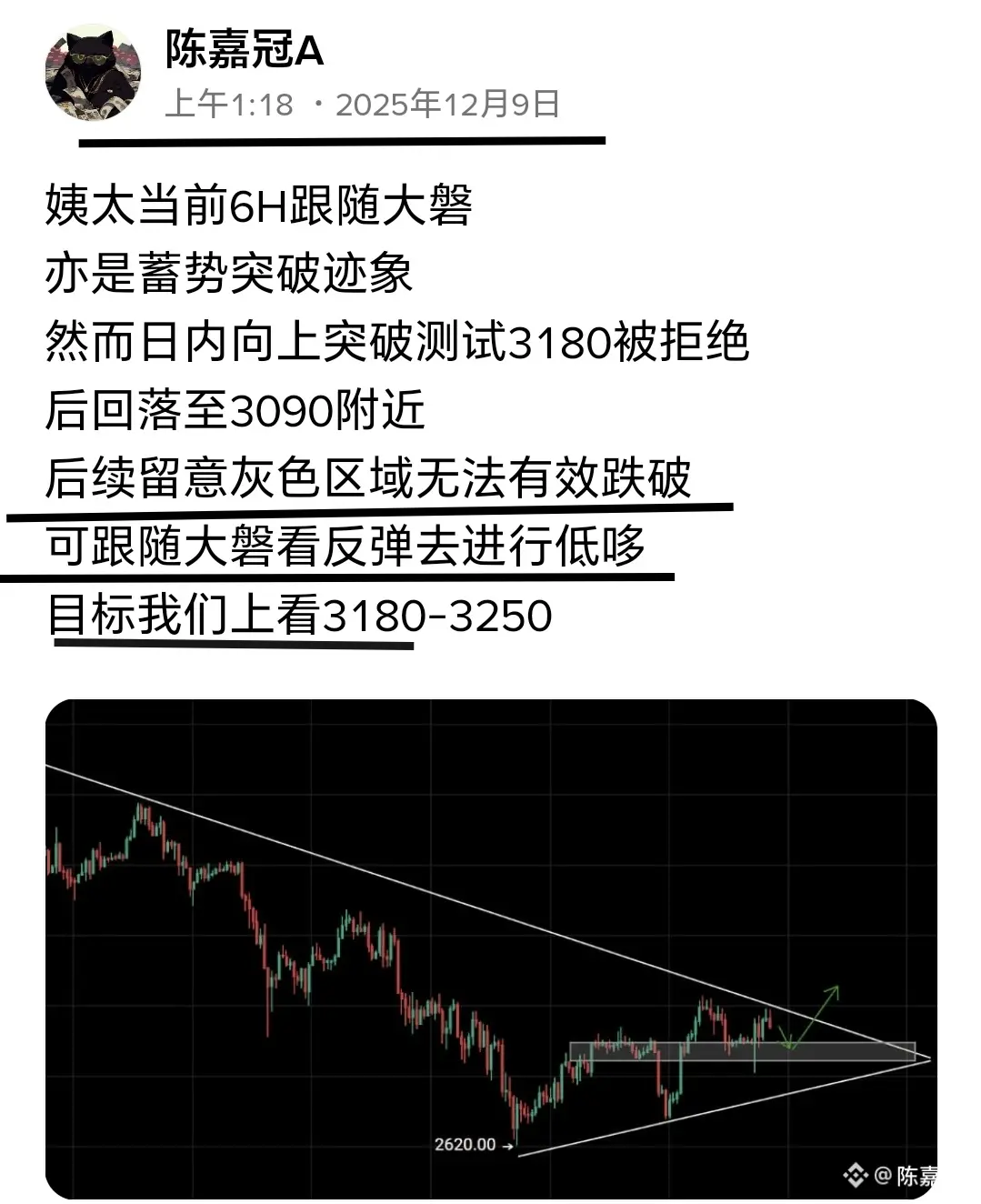

Currently, ETH is following the main market on the 6H chart and also shows signs of building momentum for a breakout. However, an intraday upward breakout attempt to test 3180 was rejected, followed by a pullback to around 3090. Going forward, pay attention to whether the gray area can be effectively broken below. If it cannot, you can follow the main market to look for a rebound and go long at lower positions. Our target is to look up to 3180-3250.

ETH6.21%

- Reward

- like

- Comment

- Repost

- Share

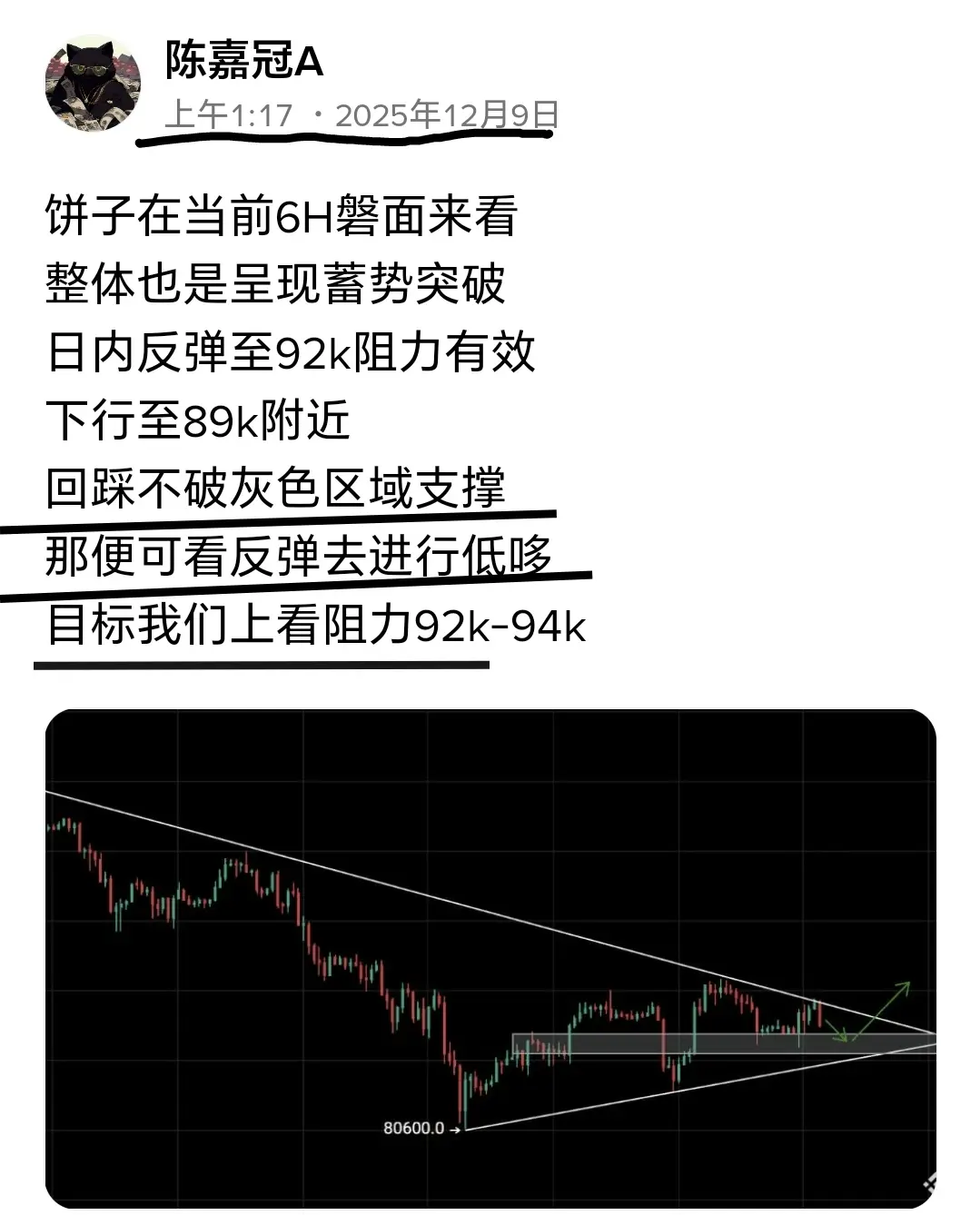

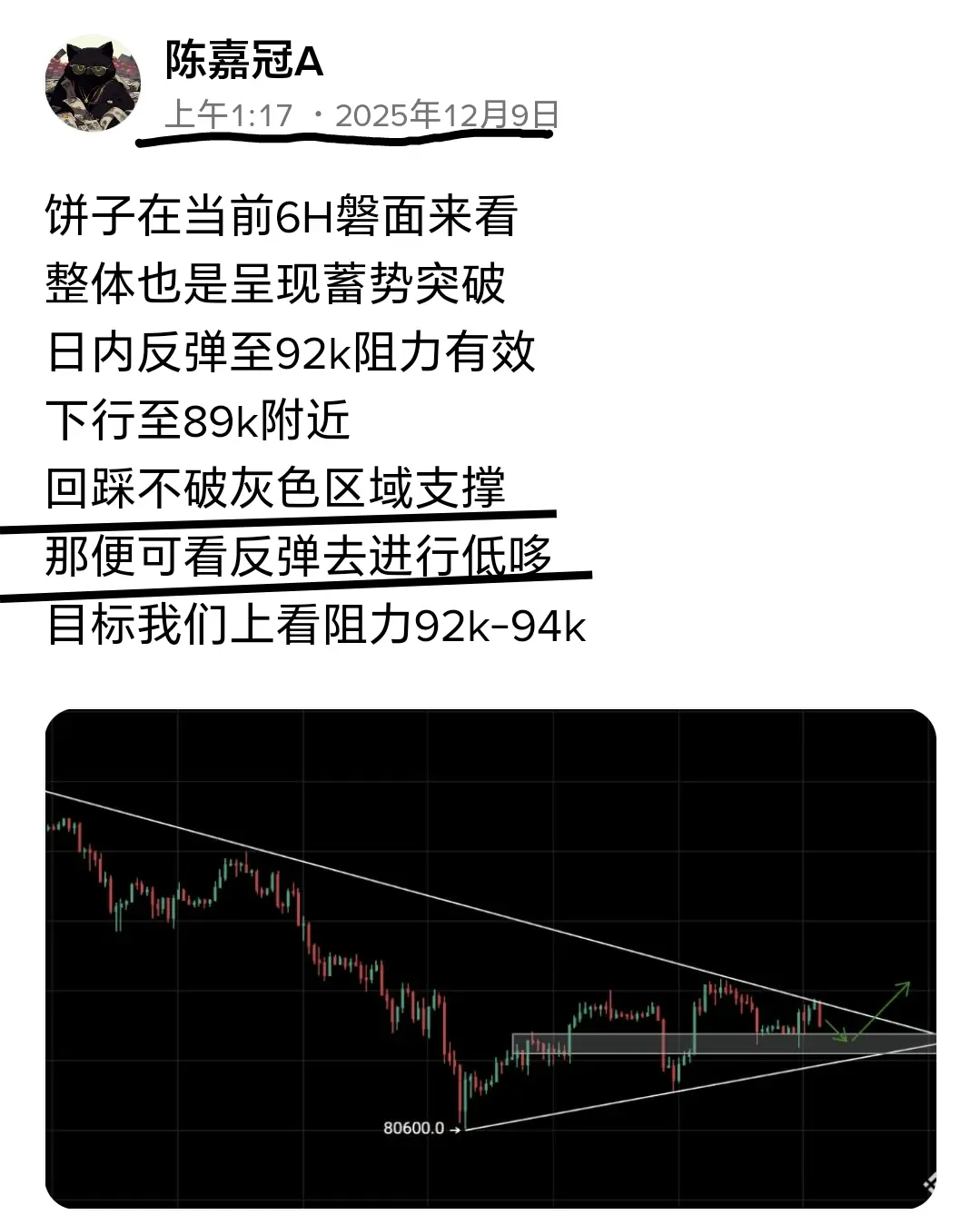

From the current 6H chart for BTC,

overall it is showing signs of consolidation before a breakout.

Intraday rebound up to the 92k resistance is effective,

pulling back down to around 89k.

As long as it doesn’t break below the support in the gray area,

we can look for a rebound and go long on dips.

Our target is to look up to the 92k-94k resistance.

View Originaloverall it is showing signs of consolidation before a breakout.

Intraday rebound up to the 92k resistance is effective,

pulling back down to around 89k.

As long as it doesn’t break below the support in the gray area,

we can look for a rebound and go long on dips.

Our target is to look up to the 92k-94k resistance.

- Reward

- like

- Comment

- Repost

- Share

The top intraday resistance is right here

The 92k resistance was already indicated

Then I also mentioned the weekend CME gap

BTC dropped by 2k as expected

ETH did the same

On the hourly level, two breakout attempts at 3180 were both rejected

Those who are decisive on the right side just picked up profits

View OriginalThe 92k resistance was already indicated

Then I also mentioned the weekend CME gap

BTC dropped by 2k as expected

ETH did the same

On the hourly level, two breakout attempts at 3180 were both rejected

Those who are decisive on the right side just picked up profits

- Reward

- like

- Comment

- Repost

- Share

The above mentioned the 92k resistance level.

It was rejected twice on the hourly timeframe during upward tests.

Also suggested to enter from the right side.

Already ↓1k as a starter.

View OriginalIt was rejected twice on the hourly timeframe during upward tests.

Also suggested to enter from the right side.

Already ↓1k as a starter.

- Reward

- like

- Comment

- Repost

- Share

There is a small CME gap for BTC this weekend.

As always, it's worth keeping an eye on it, but don't get too fixated.

As always, it's worth keeping an eye on it, but don't get too fixated.

BTC2.03%

- Reward

- like

- Comment

- Repost

- Share

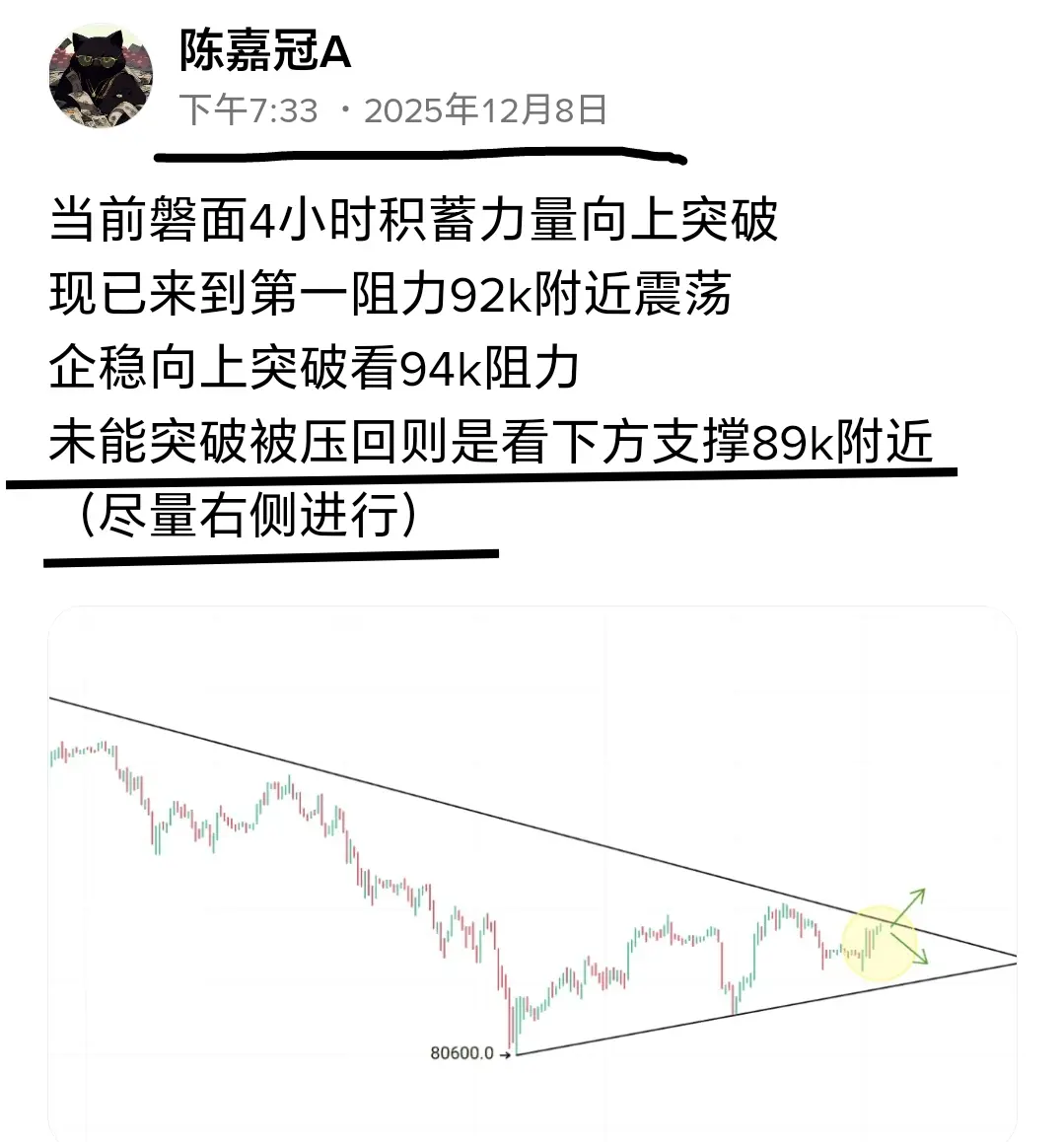

The current 4-hour trend is accumulating strength for an upward breakout.

It is now oscillating near the first resistance at 92k.

If it holds steady and breaks upward, look to the 94k resistance.

If it fails to break through and is pushed back, watch for support near 89k.

(Try to operate on the right side)

View OriginalIt is now oscillating near the first resistance at 92k.

If it holds steady and breaks upward, look to the 94k resistance.

If it fails to break through and is pushed back, watch for support near 89k.

(Try to operate on the right side)

- Reward

- like

- Comment

- Repost

- Share

Don't rush to call it "altcoin season" yet! This chart shows the real picture.

Yellow = BTC price, green = total cryptocurrency market cap, thin lines = market caps of the top 10/50/100 altcoins.

The core of this rally is BTC dominance—the green line basically follows the yellow one, with only brief windows where altcoins have a pulse, after which small-cap coins drop even harder (classic bull market risk-off: funds flow back to BTC + a few strong coins).

A true altcoin season requires 3 signals:

1. BTC cools off and moves sideways

2. Total market cap breaks previous highs + forms higher lows

Yellow = BTC price, green = total cryptocurrency market cap, thin lines = market caps of the top 10/50/100 altcoins.

The core of this rally is BTC dominance—the green line basically follows the yellow one, with only brief windows where altcoins have a pulse, after which small-cap coins drop even harder (classic bull market risk-off: funds flow back to BTC + a few strong coins).

A true altcoin season requires 3 signals:

1. BTC cools off and moves sideways

2. Total market cap breaks previous highs + forms higher lows

BTC2.03%

- Reward

- like

- Comment

- Repost

- Share

Currently, on the 1H level, the market is fluctuating up and down.

The market style is still in a consolidation phase.

It is now approaching the stage resistance zone of 91.2-91.7 (, which is a potential entry point for bears ).

If it fails to break through, it will still come down to 89K.

View OriginalThe market style is still in a consolidation phase.

It is now approaching the stage resistance zone of 91.2-91.7 (, which is a potential entry point for bears ).

If it fails to break through, it will still come down to 89K.

- Reward

- like

- Comment

- Repost

- Share

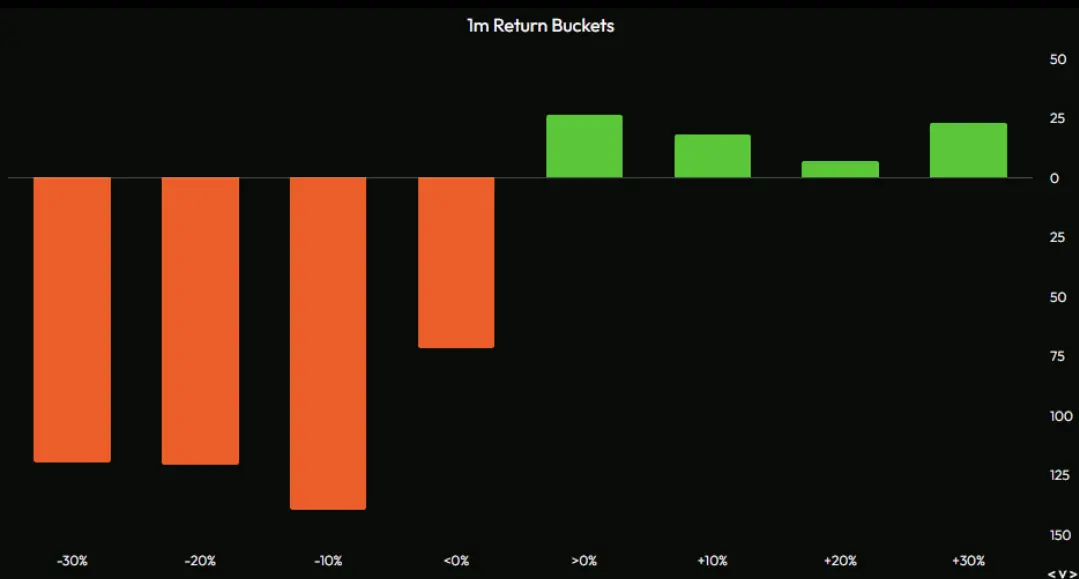

The market is still the same as before.

In the past month, dozens of coins have risen by +20-30%.

Meanwhile, most coins continue to fall endlessly, plagued by investor and team unlocks, deeply trapped holders, as well as generally weak momentum and sentiment.

This trend runs through the entire cycle, and I feel it will never stop.

Most coins will eventually go to zero.

Some coins will perform well for a while, then also go to zero.

Only a few coins will survive and continue to perform well in the next cycle.

This is the law of the market, and it will continue to develop this way.

If you are no

In the past month, dozens of coins have risen by +20-30%.

Meanwhile, most coins continue to fall endlessly, plagued by investor and team unlocks, deeply trapped holders, as well as generally weak momentum and sentiment.

This trend runs through the entire cycle, and I feel it will never stop.

Most coins will eventually go to zero.

Some coins will perform well for a while, then also go to zero.

Only a few coins will survive and continue to perform well in the next cycle.

This is the law of the market, and it will continue to develop this way.

If you are no

BTC2.03%

- Reward

- like

- Comment

- Repost

- Share

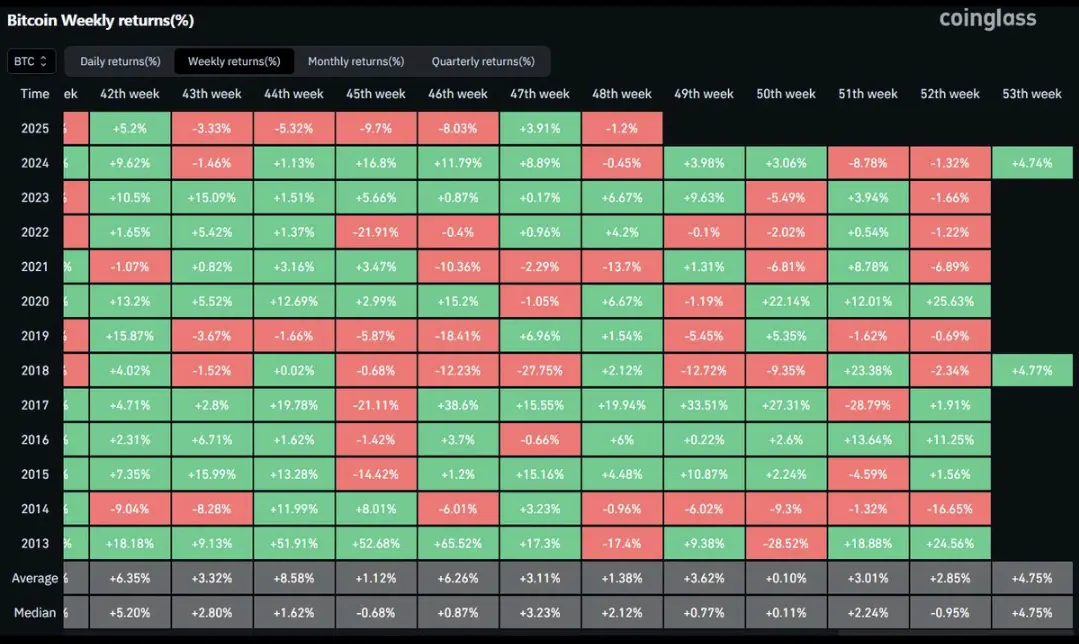

The last few weeks of the year for BTC usually don’t see much interesting price movement.

Except for 2013, 2017, and 2020, things have generally been pretty flat.

Interestingly, the extra day in a leap year usually brings decent returns—something I hadn’t noticed before.

Overall, I don’t expect any major volatility until the new year begins.

Typically, the market is quite choppy at the end and beginning of the year.

Especially during Christmas, both liquidity and trading volumes are very low.

Except for 2013, 2017, and 2020, things have generally been pretty flat.

Interestingly, the extra day in a leap year usually brings decent returns—something I hadn’t noticed before.

Overall, I don’t expect any major volatility until the new year begins.

Typically, the market is quite choppy at the end and beginning of the year.

Especially during Christmas, both liquidity and trading volumes are very low.

BTC2.03%

- Reward

- like

- Comment

- Repost

- Share