December 26 Daily Market Analysis

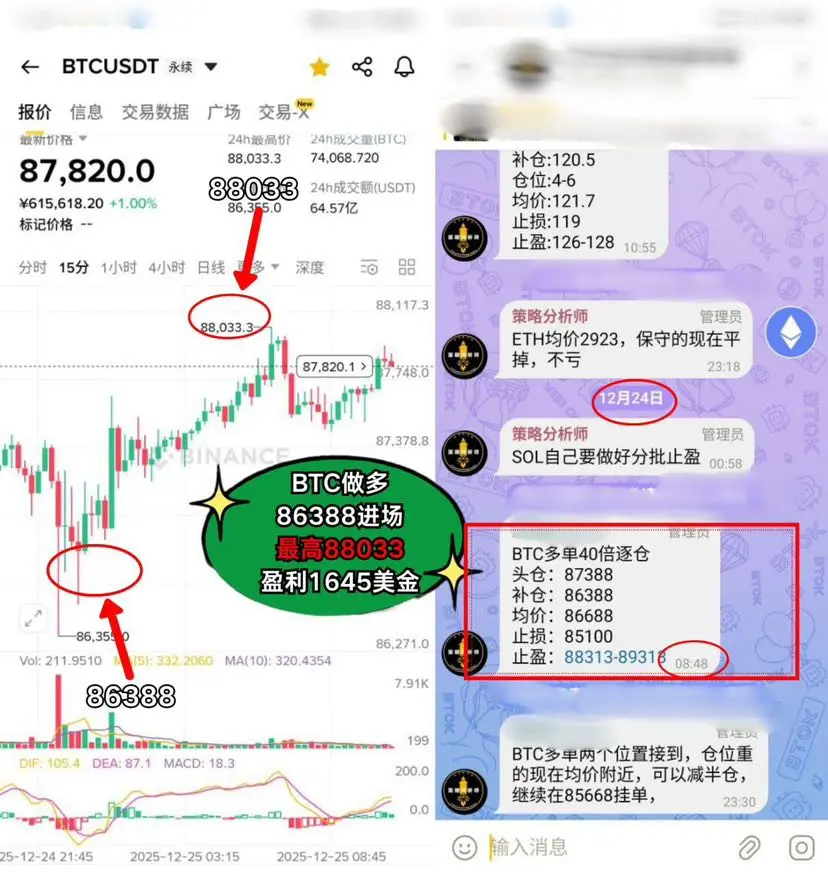

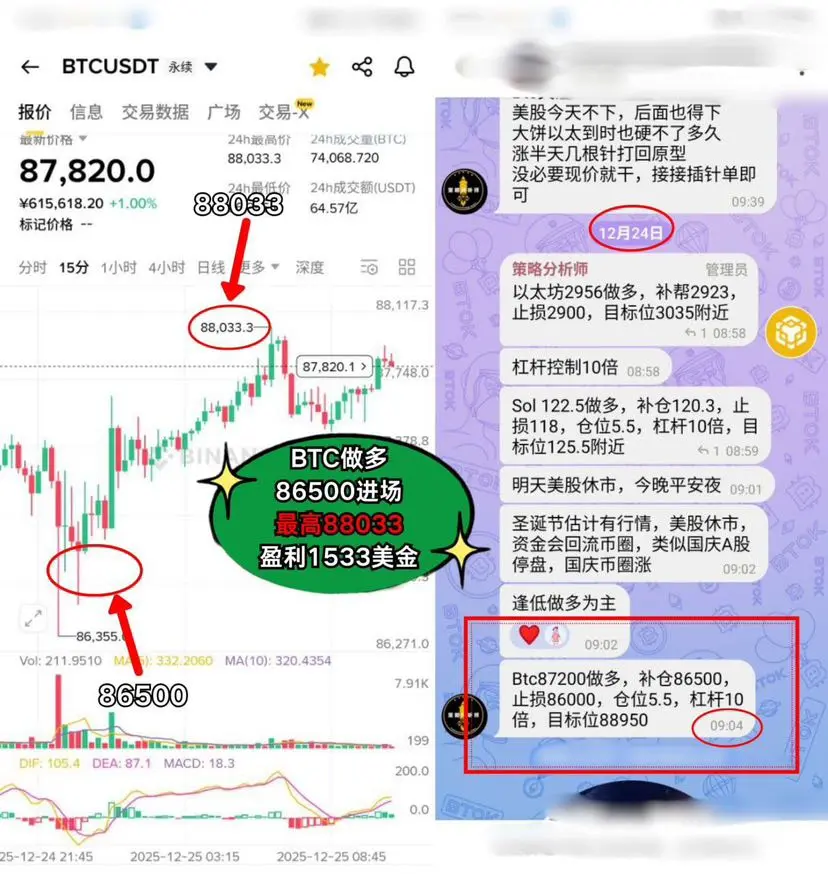

Last night at 11 PM and this morning at 10 AM, the volume and long-term trend K-lines already indicated significant market fluctuations today, making trading more difficult.

Although yesterday's breakout with increased volume looked impressive, it did not break the 883 range. After testing the upper boundary of the range, it immediately retreated to 870. The breakout only formed this morning, indicating that yesterday's intraday strategy was effective.

Despite the large trend volume and movement amplitude during the breakout, subsequent momentum did not follow

Last night at 11 PM and this morning at 10 AM, the volume and long-term trend K-lines already indicated significant market fluctuations today, making trading more difficult.

Although yesterday's breakout with increased volume looked impressive, it did not break the 883 range. After testing the upper boundary of the range, it immediately retreated to 870. The breakout only formed this morning, indicating that yesterday's intraday strategy was effective.

Despite the large trend volume and movement amplitude during the breakout, subsequent momentum did not follow

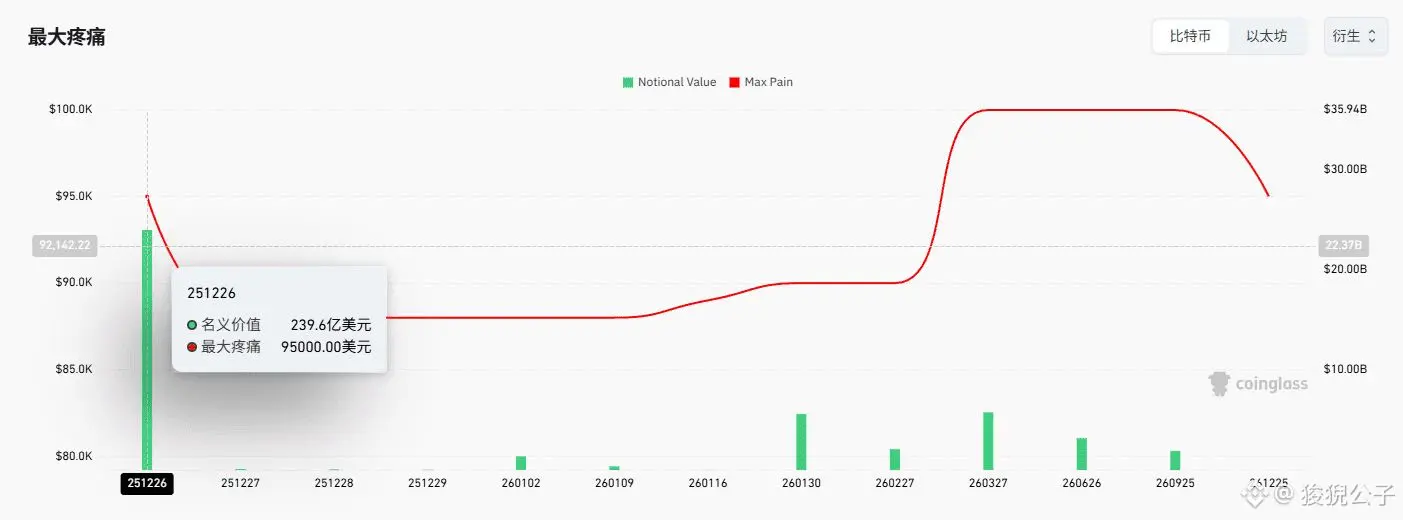

BTC-1,79%