The Fed has now entered garbage time, or a transition period of the game.

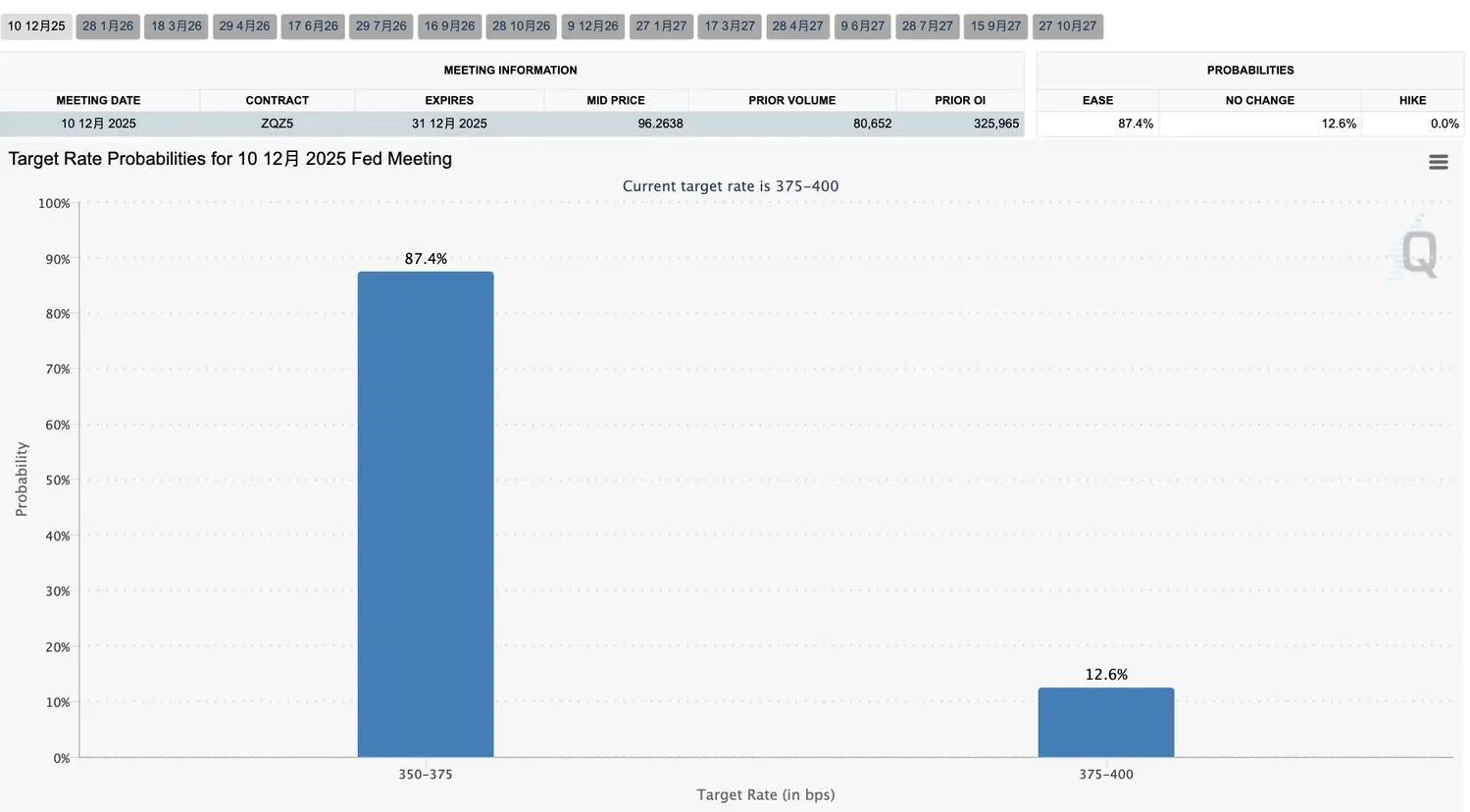

With Hassett surfacing the surface, Powell is now in a state of caretaking, in this context, he does not dare to be too aggressive, such as cutting interest rates by 50bp, and will not stop cutting interest rates directly, and a 25bp cut is the best

The current situation is very interesting, the nominees from both parties in the council are evenly matched.

It is precisely because he is at such an awkward political juncture that Powell can only hold the shield of data, but it leads to a big problem, the shelf life of this

View Original