币莹莹6

No content yet

币莹莹6

- Reward

- like

- 1

- Repost

- Share

JoinTheArmy :

:

Start going long?Currently, the entire market is betting on a rate cut in December. After the US stock market yesterday, Bitcoin surged strongly, and today it is expected to once again rally on the back of the interest rate cut. Once the rate cut is implemented, it will be bullish, so tonight's move is likely to be a rise followed by a fall.

Observers:

You can consider entering with a small position around 9.18, aiming for the 9.3-9.35 range. Those holding long positions should manage their risk carefully. #BTC

Observers:

You can consider entering with a small position around 9.18, aiming for the 9.3-9.35 range. Those holding long positions should manage their risk carefully. #BTC

BTC-1.51%

- Reward

- like

- Comment

- Repost

- Share

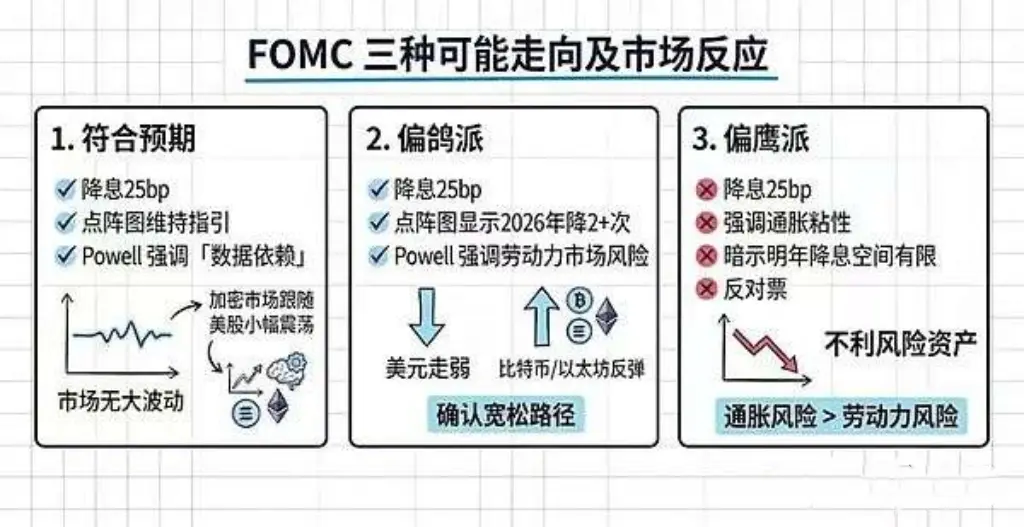

The Federal Reserve's interest rate decision in December and Master Bao's speech are coming, and a wave of big markets is quietly coming, are you ready?

Some are betting on another 25 basis point rate cut, others are betting on no rate cuts, and from the current market expectations, the probability of a rate cut has risen to 89%. In fact, what Sister Ying wants to say is that "whether to cut interest rates" is no longer important, what is important is Master Bao's speech and the follow-up policy signal guidance for 2026.

Interest rate cuts, Bitcoin will definitely rise sharply? Not necessarily

Some are betting on another 25 basis point rate cut, others are betting on no rate cuts, and from the current market expectations, the probability of a rate cut has risen to 89%. In fact, what Sister Ying wants to say is that "whether to cut interest rates" is no longer important, what is important is Master Bao's speech and the follow-up policy signal guidance for 2026.

Interest rate cuts, Bitcoin will definitely rise sharply? Not necessarily

BTC-1.51%

- Reward

- like

- 1

- Repost

- Share

$GlobalVillage$ :

:

Next year, Powell will have already stepped down, don't worry! The people Trump uses will definitely listen, which is good news for the crypto circle.Before the interest rate cut, Bitcoin rose strongly and fell back, and is currently stable above 90,000. The corresponding SOL. also took advantage of the mainstream surge, but the upper part was still under pressure around $145.

This week, in SOL, we shorted from the 138-140 area, and then went long and high from the 130-132 area, and the conversion between long and short was able to be steadily handled every time.

Recently, SOL. has been relatively firm regardless of whether it rises or falls, and since the previous sharp decline, it has been adjusted in a wide range of 120-145 and gradually

View OriginalThis week, in SOL, we shorted from the 138-140 area, and then went long and high from the 130-132 area, and the conversion between long and short was able to be steadily handled every time.

Recently, SOL. has been relatively firm regardless of whether it rises or falls, and since the previous sharp decline, it has been adjusted in a wide range of 120-145 and gradually

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- 1

- 1

- Repost

- Share

TheNightUltimatelyBringsNo :

:

牛逼Today's market is like boiling a frog in warm water—going long is uncomfortable, going short is also uncomfortable, and the spectators are the ones enjoying it the most. Right now, it's all about mindset...

Bitcoin has gone from wide-range fluctuations and shakeouts to narrow-range consolidation. Everything is in preparation for the Federal Reserve's interest rate decision. In this kind of market, you either wait for opportunities or take risks to create them... #BTC

Bitcoin has gone from wide-range fluctuations and shakeouts to narrow-range consolidation. Everything is in preparation for the Federal Reserve's interest rate decision. In this kind of market, you either wait for opportunities or take risks to create them... #BTC

BTC-1.51%

- Reward

- like

- Comment

- Repost

- Share

The recent market movements have left some people stunned, while others have been forcibly shaken out. All I can say is it's a pity and a regret—because you haven't met Sister Ying...

Recently, Bitcoin's posture has mostly been long at the bottom and short at the top, profiting from both long and short positions. Not a single order has been wrong in the past few days; it can truly be called a continuous big win.

Today, we are going directly long. Many people say I’m being aggressive, but I don’t want to explain too much. I’ll just say one thing: “With the Fed’s rate cut approaching,” even if w

Recently, Bitcoin's posture has mostly been long at the bottom and short at the top, profiting from both long and short positions. Not a single order has been wrong in the past few days; it can truly be called a continuous big win.

Today, we are going directly long. Many people say I’m being aggressive, but I don’t want to explain too much. I’ll just say one thing: “With the Fed’s rate cut approaching,” even if w

BTC-1.51%

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

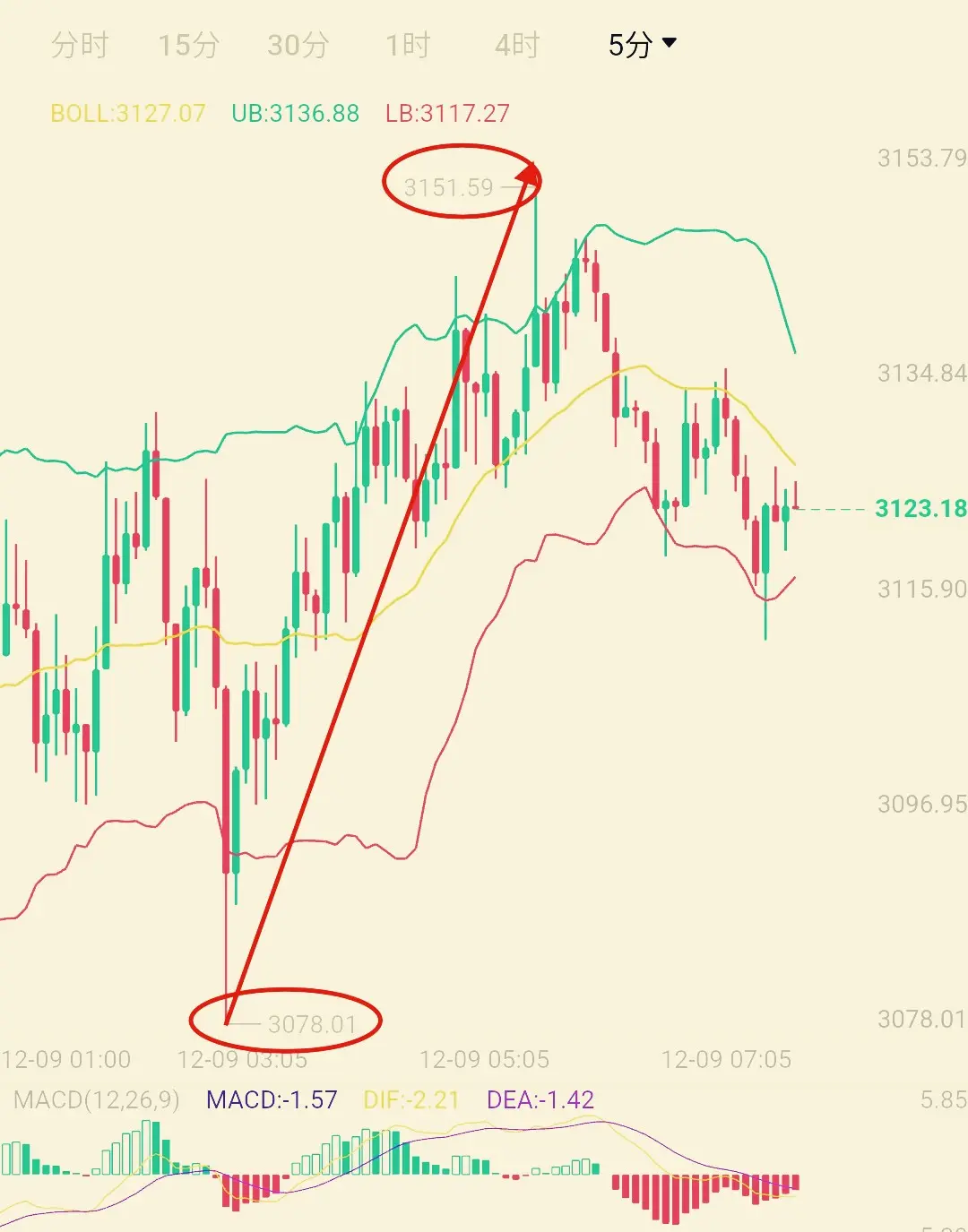

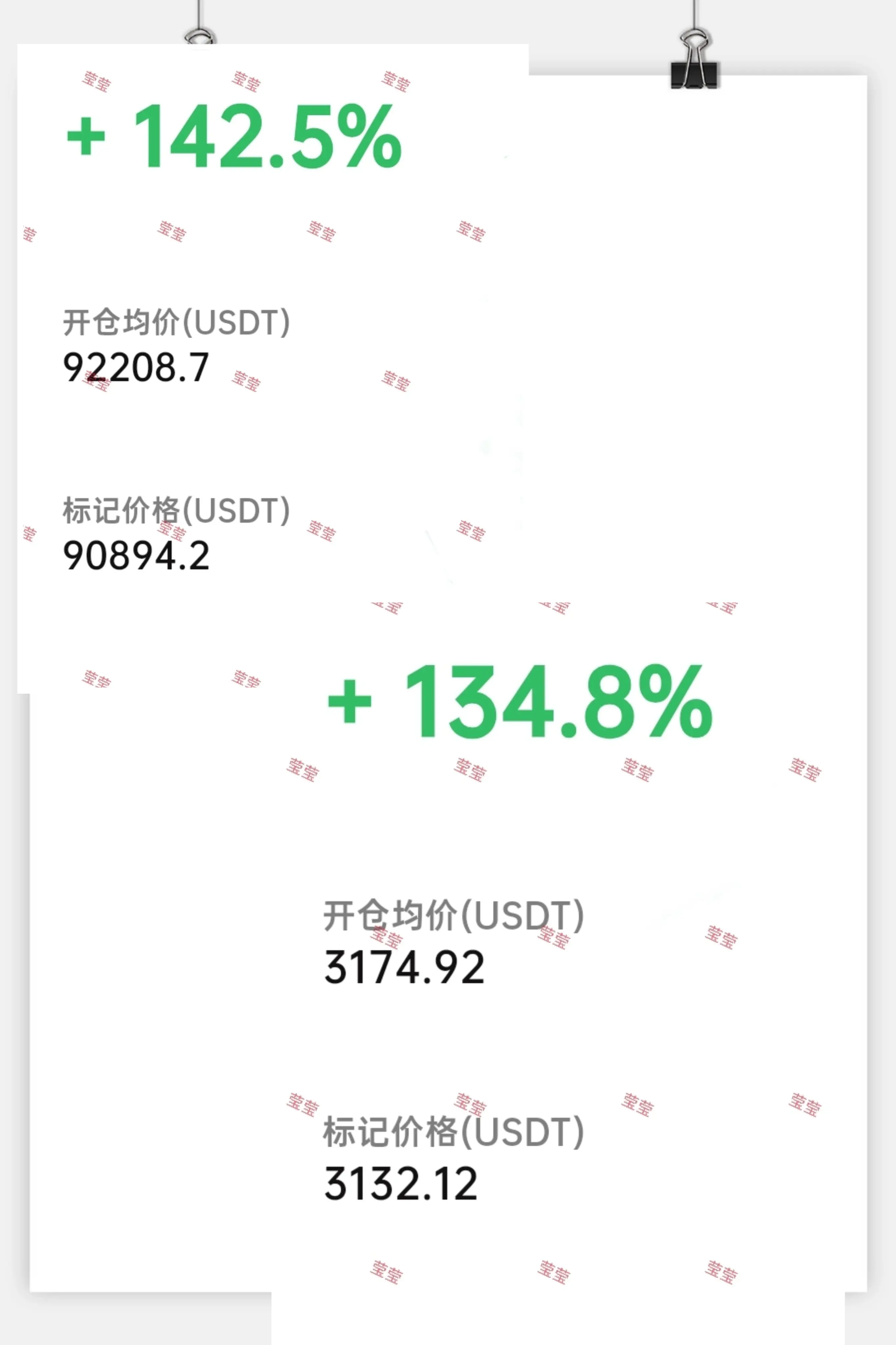

Bitcoin surged and then pulled back, maintaining weak consolidation after falling below the 90,000 level. During the day, a perfect short was executed near 9.22/3175, capturing a space of 2000/70+.

In the evening, a long was initiated based on key support in the 89,500-90,000 area and around 3096, with the highest rise reaching 90,471/3130. Currently, it is in a small profit state; individuals can reduce their positions or exit based on their own situation.

In the short term, the price has not stabilized above the 92,000 level, so continued shorting is recommended. #BTC

In the evening, a long was initiated based on key support in the 89,500-90,000 area and around 3096, with the highest rise reaching 90,471/3130. Currently, it is in a small profit state; individuals can reduce their positions or exit based on their own situation.

In the short term, the price has not stabilized above the 92,000 level, so continued shorting is recommended. #BTC

BTC-1.51%

- Reward

- 1

- 1

- Repost

- Share

LuckAndFortuneComeTo :

:

先赞起来,老师优秀优秀。[强][强][强]Wide-range wicks during the early morning session, and narrow-range consolidation during the European and American sessions up to now. Fortunately, Bitcoin managed to absorb 1300/42 iodine at the top stage.

After 7 consecutive hourly green candles faced resistance and pulled back, there were 4 consecutive red candles, and it happens to be around the BOLL middle band area. However, I still tend to believe the bulls will continue to be pressured. If you want to go long, you can consider key support around 90,000. #BTC

After 7 consecutive hourly green candles faced resistance and pulled back, there were 4 consecutive red candles, and it happens to be around the BOLL middle band area. However, I still tend to believe the bulls will continue to be pressured. If you want to go long, you can consider key support around 90,000. #BTC

BTC-1.51%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

On weekends, you're always in for an unexpected surprise or shock. Fortunately, we always get through the shocks and welcome the surprises.

Sharp drops and surges in the market inevitably cause some panic, especially since it's the weekend. But opportunities are also brewing in these moments. By waiting patiently, buying at the bottom and selling at the stage top, you can profit both ways and secure a space of 4600/200+ points.

After a round of shakeout, Bitcoin has once again stabilized above the 90,000 mark. It's expected to maintain sideways adjustment during the day, with resistance around

Sharp drops and surges in the market inevitably cause some panic, especially since it's the weekend. But opportunities are also brewing in these moments. By waiting patiently, buying at the bottom and selling at the stage top, you can profit both ways and secure a space of 4600/200+ points.

After a round of shakeout, Bitcoin has once again stabilized above the 90,000 mark. It's expected to maintain sideways adjustment during the day, with resistance around

BTC-1.51%

- Reward

- like

- Comment

- Repost

- Share

Getting out of a losing position—how is your long order doing?

Since the big drop in November, Bitcoin has shown a strong bearish trend. Even when it rebounded from around 80,000, it failed to reverse the downward momentum. The short-term rebound was as fleeting as a flash in the pan, especially as it once again fell below the 90,000 mark.

Currently, there is heavy concentration of trapped long positions in the 92,000–98,000 range, and there are plenty above 100,000. Some traders are even still holding long positions above 110,000. If you’re still stubbornly holding on, what can you do to turn

Since the big drop in November, Bitcoin has shown a strong bearish trend. Even when it rebounded from around 80,000, it failed to reverse the downward momentum. The short-term rebound was as fleeting as a flash in the pan, especially as it once again fell below the 90,000 mark.

Currently, there is heavy concentration of trapped long positions in the 92,000–98,000 range, and there are plenty above 100,000. Some traders are even still holding long positions above 110,000. If you’re still stubbornly holding on, what can you do to turn

BTC-1.51%

- Reward

- like

- Comment

- Repost

- Share

We started bottom-fishing at 80,000, then began shorting in stages from 93,000. As I said last weekend, we would start shorting this week, and the results have lived up to my expectations—I’m overall quite satisfied.

On Monday, as expected, there was a sharp drop and we won that trade. On Tuesday, there was an unexpected reversal and surge, resulting in two consecutive losses, but this did not affect our strategy or mindset. On Wednesday and Thursday, the market consolidated sideways, and we continued to maintain a short-biased approach, winning both trades. After the breakdown on Friday, we p

On Monday, as expected, there was a sharp drop and we won that trade. On Tuesday, there was an unexpected reversal and surge, resulting in two consecutive losses, but this did not affect our strategy or mindset. On Wednesday and Thursday, the market consolidated sideways, and we continued to maintain a short-biased approach, winning both trades. After the breakdown on Friday, we p

BTC-1.51%

- Reward

- like

- 3

- Repost

- Share

GateUser-d0f453d4 :

:

Hop on board!🚗View More

Many people always assume that as the "rate cut approaches," there will be a big rally in the market, and with the extension of the four-year cycle, they think Bitcoin will reach new highs again. In the end, they lose because of these assumptions...

Historical experience can be used for reference but shouldn’t be relied on excessively. The current market and trends are completely different from the 2021 phase. Now, most of the market is guided by institutions/whales, the US stock market, and US economic data. Meanwhile, speeches by Powell and Trump can also trigger huge market volatility.

Look

Historical experience can be used for reference but shouldn’t be relied on excessively. The current market and trends are completely different from the 2021 phase. Now, most of the market is guided by institutions/whales, the US stock market, and US economic data. Meanwhile, speeches by Powell and Trump can also trigger huge market volatility.

Look

BTC-1.51%

- Reward

- 1

- Comment

- Repost

- Share