LittleAssistant

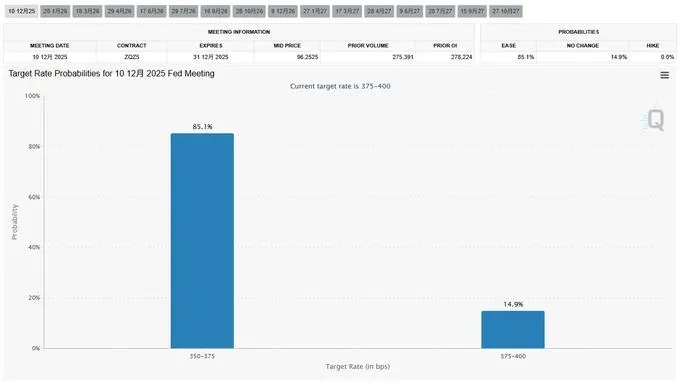

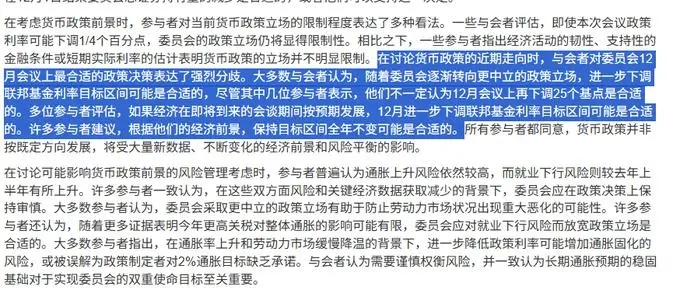

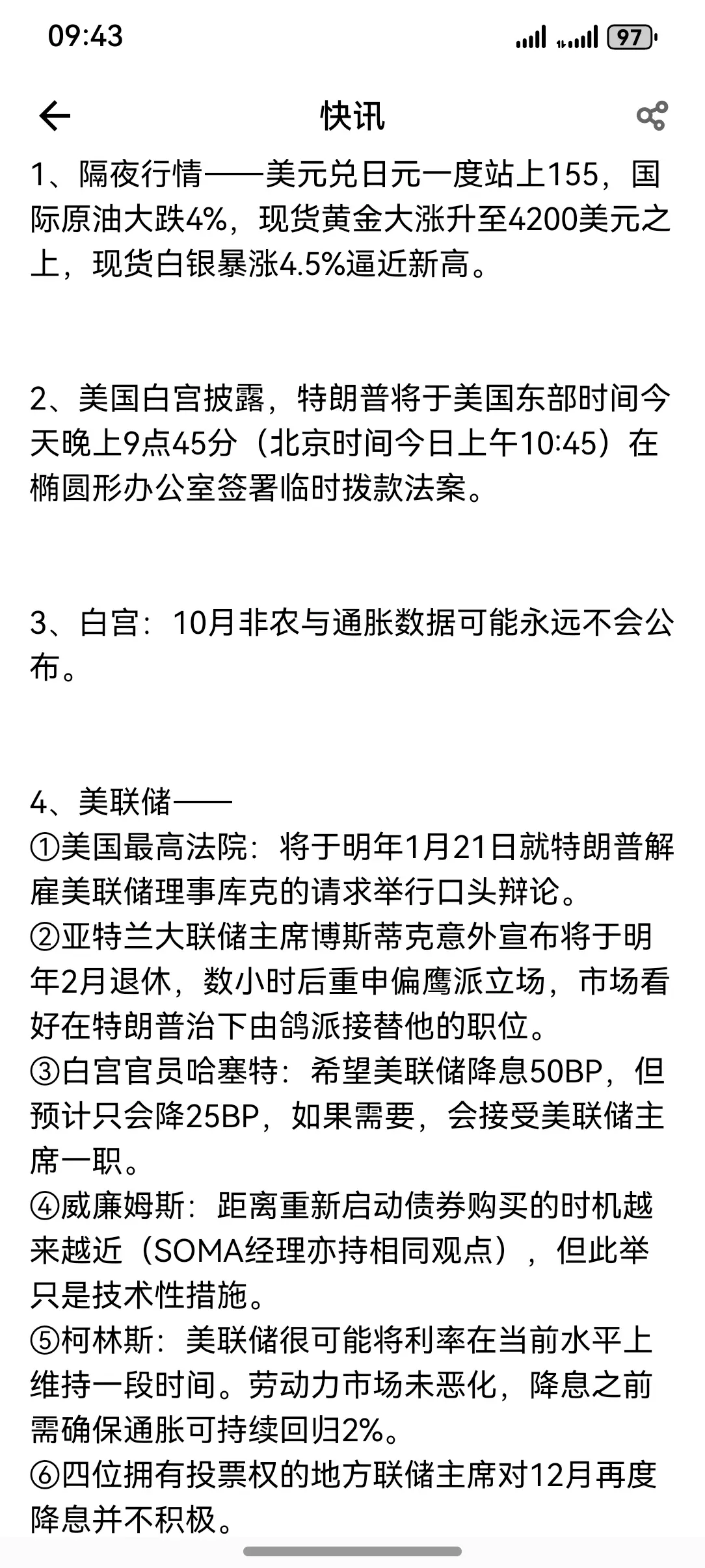

Recently, the verbal sparring between China and Japan has forced the yen to depreciate significantly, causing Japan's inflation in November to rise above expectations, thereby putting interest rate hikes in Japan on the agenda. At the same time, the Fed's rate cut in December will be the last rate cut of the year, and the period from December to February next year will be a gap where the Fed pauses rate cuts, with a strong bearish outlook during this cycle. Japan's interest rate hike will be the biggest black swan accelerating the decline of the global financial market from Decembe

View Original