BigCakeHouse

No content yet

BigCakeHouse

The situation has changed, the situation has changed. I just had tea with Te Bu Pu and intercepted top-secret information. The 89,700 level needs to be protected promptly, and the 89,300 below may not be able to support it. You can enter small positions, beware of pinning, and look to recover around 88,400. The second pancake is also a hypothetical break below, with support expected around 3023. #比特币: Bloodbath for the bulls with a deep correction, but don't be afraid when given the opportunity. Boldly go ahead and establish long positions.

BTC-2,68%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- 2

- Repost

- Share

BigCakeHouse :

:

In summary, overall, go around 88,400 to catch its surge or pullback.View More

My trading idea today is probably to see if Bitcoin can surge to around 93,200, then pull back to around 89,300 for a bottom-fishing opportunity. Additionally, around 87,600 is also a defensive zone for me. If it breaks below, I will consider positioning long positions here to recover losses. I'm not very keen on trading Ethereum, but if it pulls back to around 3,080, I will consider setting up medium to long-term long positions. #比特币六连涨 #以太坊

View Original

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 2

- 5

- Repost

- Share

RedEnvelope :

:

Bull run 🐂View More

Congratulations to the fans for another gain. Those who entered long positions around 90700 should exit gradually in batches. For conservative traders, consider including capital preservation. There is resistance around 91800. Additionally, the most ideal bottom-fishing position is around 89300, which can be bought in batches. Leave some room for yourself. If the level breaks, watch for strong support at 87600 below #比特币六连涨 .

BTC-2,68%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 9

- 5

- Repost

- Share

CircumferenceZhang :

:

The first native DEX in the Pi ecosystem is here! PIJSwap independent public chain open-source countdown, lock in with us, unlock new opportunities for decentralized trading! (For investment research only, not investment advice. Please exercise caution!)

View More

Whether it's the main Bitcoin or altcoins, the upward trend has already been confirmed. Since the uptrend is established, we should firmly believe that in the medium to long term, it will reach the extreme tops of 102,000 and 107,000. Currently, from the market perspective, it is in an overbought state, and there is a possibility of a short-term pullback. For now, I am still focusing on buying the dip around 89,300, and considering adding some positions around 90,700. As for altcoins, I think the overbought condition is more serious. If a pullback occurs, I am also worried about a sharp drop a

BTC-2,68%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 3

- 10

- Repost

- Share

RedEnvelope :

:

Hi. Can you tell me what kind of indicator you have for buying and selling? What is it called?View More

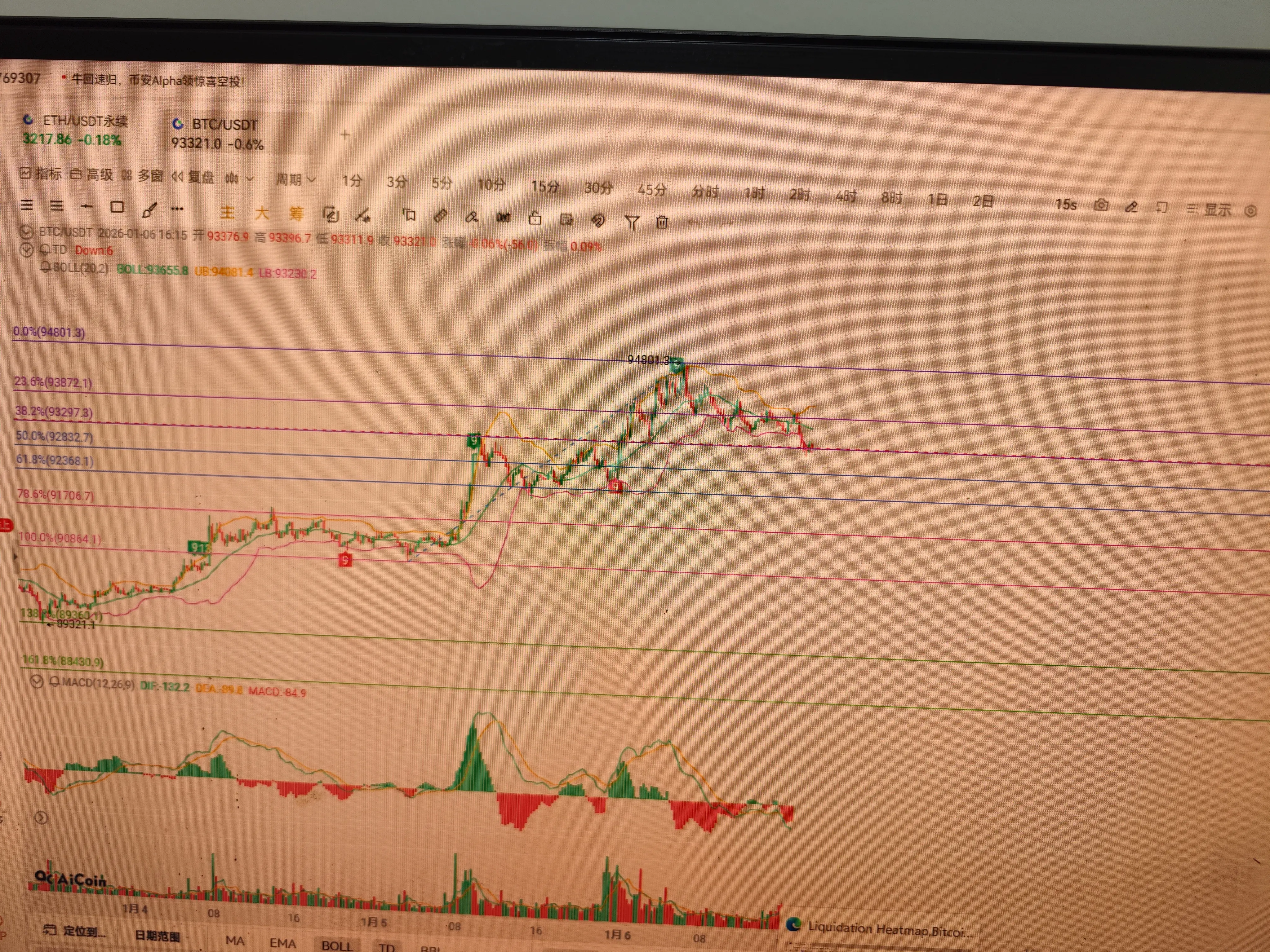

Congratulations to the fans, after two consecutive bites, MACD is a pretty good indicator. It is still recommended that everyone learn about it, combined with Fibonacci, and you can basically enter and close positions at the top and bottom of the wave,

It's the same old story, breaking through 94,000 clearly indicates an upward trend. During a pullback, consider establishing long positions. The long position established around 91,700 can be considered for partial profit-taking at the resistance level, and wait for a rally and pullback around 93,200 to add to the position. The current target of

It's the same old story, breaking through 94,000 clearly indicates an upward trend. During a pullback, consider establishing long positions. The long position established around 91,700 can be considered for partial profit-taking at the resistance level, and wait for a rally and pullback around 93,200 to add to the position. The current target of

BTC-2,68%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- 3

- Repost

- Share

Yunan :

:

New Year Wealth Explosion 🤑View More

Breaking through 94,000 clearly indicates an upward trend. As always, chasing after gains is not advisable. Bitcoin has now retraced to the support level of 93,200. Aggressive traders can consider establishing long positions. To continue its upward trend, the targets are around 95,000, 97,300, 102,100, and the extreme top at 107,300. For conservative traders, the best entry point is around 91,700, which is the Fibonacci 78.6% level.

BTC-2,68%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 6

- 5

- Repost

- Share

FallingWildGooseBright :

:

2026 Go Go Go 👊View More

The current trend is clearly upward. The top of this round is around 102100. This week, you can consider testing the top. The advantage of trading against the trend is that the stop loss is very small, almost negligible. Each time, you can either take a small profit or ride out a correction. Currently, the resistance levels above Bitcoin are around 95090 and 97300. Both of these levels can be considered for short positions. During a correction, protect your capital, and you can close some positions at the lower Bollinger Band. Do not chase long positions; if a correction occurs, around 91700 i

BTC-2,68%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 3

- 5

- Repost

- Share

Yunan :

:

Thank you, big brother, for helping me make money.View More

Brothers who have been following my diary and holding heavy positions these days, please take timely profit and exit in batches.

View Original

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- 2

- Repost

- Share

ImpactIt. :

:

You also have no food, huhView More

Bitcoin MACD hourly level correction is approaching. In the short term, consider establishing long positions around 91,550, aiming for a continuation of the bullish trend to 95,000-98,000. Those holding short positions may consider taking profits around 91,700#比特币2026价格预测 .

View Original

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 2

- 2

- Repost

- Share

Yunan :

:

OkayView More

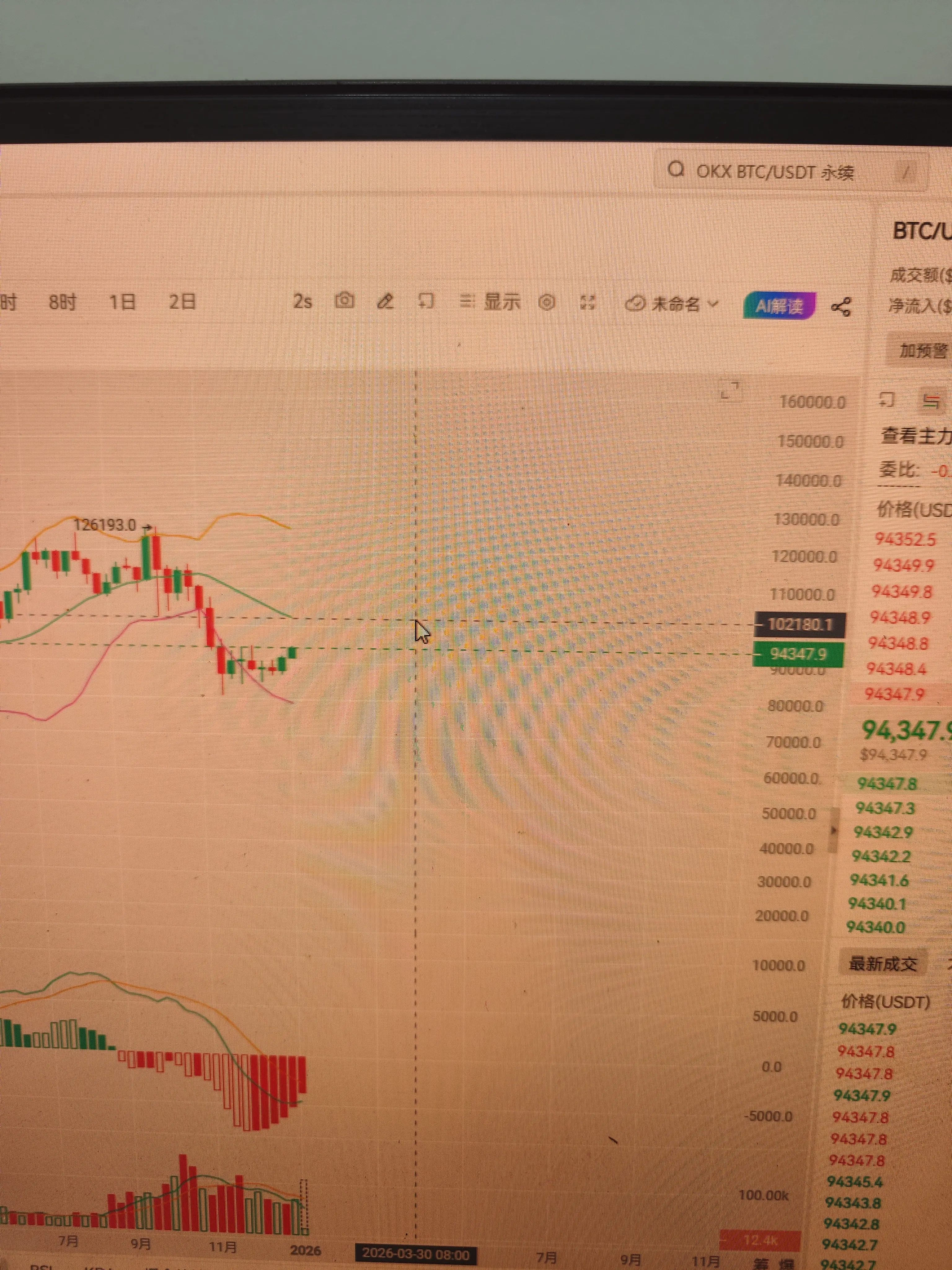

The two-day Bollinger Bands for Bitcoin are now widely open. The short position around 92,000 can only be a quick nibble. Focus on the heavy resistance zone around 93,700. As mentioned yesterday, you might consider shorting, possibly trying to catch a pullback for confirmation or even a trend wave. As for the second pancake, there aren't many opportunities, and I don't really want to touch it. The movement isn't very ideal. #我的2026第一条帖 #加密市场开年反弹

BTC-2,68%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 3

- 1

- Repost

- Share

BigCakeHouse :

:

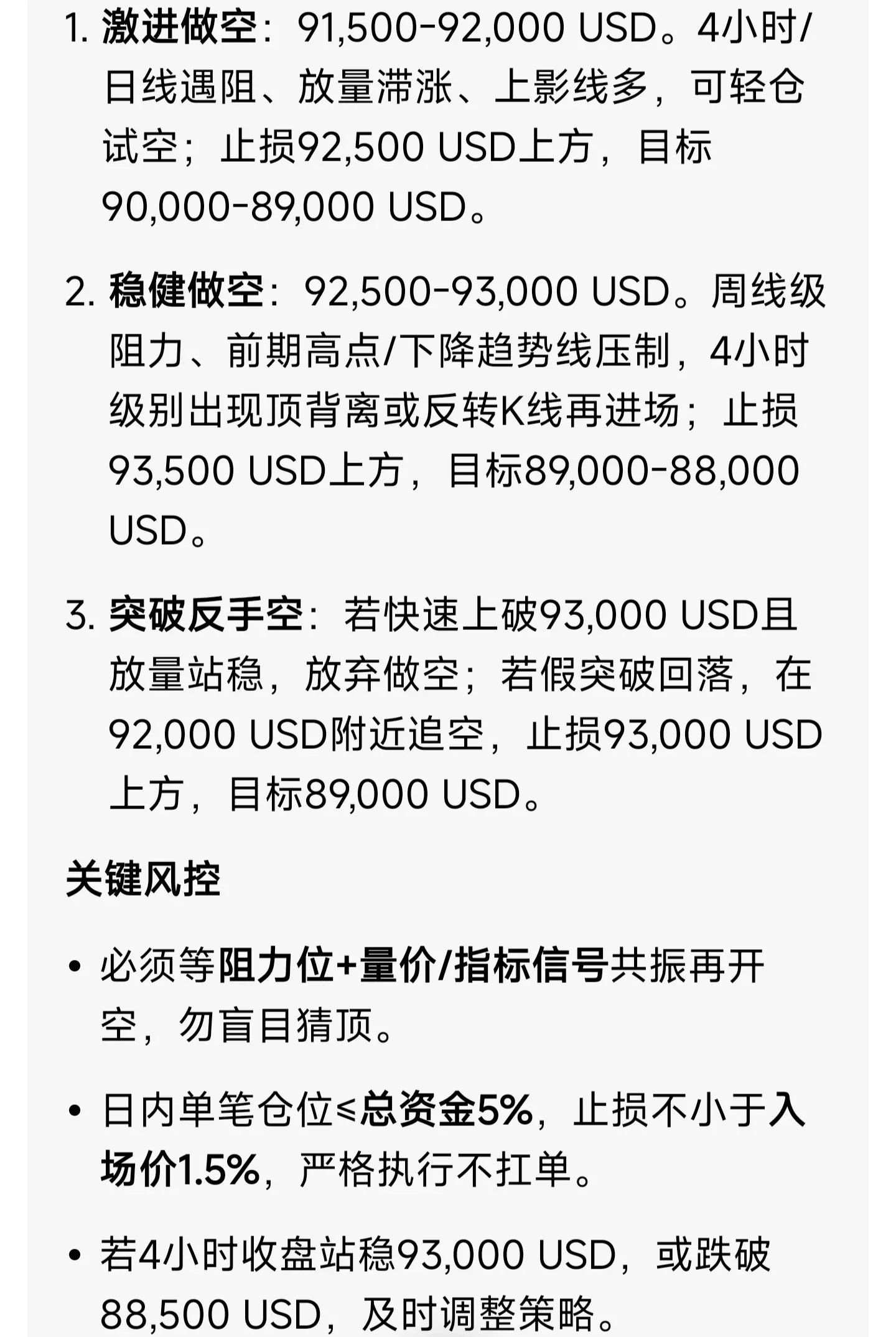

New Year Wealth Explosion 🤑The two-day resistance zone for Bitcoin is a good point to short. Conservative traders can consider short positions, with heavy positions entering around 93700 and 94060 for a quick profit, light traders considering entering a main position around 92200, adding on dips near 93600, with a stop loss at 94060. The target is to catch its retest confirmation #比特币2026价格预测

BTC-2,68%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 4

- 5

- Repost

- Share

FallingWildGooseBright :

:

Is it going to retest?View More

Bitcoin has strong momentum, breaking out strongly on the daily chart. The pullback to a long position is around 88190, with a stop loss near 87500. I personally prefer contrarian trading and have already positioned for short positions in the 92200-92800 range, with a stop loss at 93100. The target is to wait for a pullback confirmation. The second Bitcoin spike is intense and I prefer not to touch it. However, if the pullback to 3033 occurs, it is a very good long entry, with a stop loss at 3028.

BTC-2,68%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 4

- Comment

- Repost

- Share

Bitcoin is currently focused on 85700 with recent daily support levels. Swing trading opportunities are around 85300, 84300, and 82690, all of which can be considered for long positions. The second coin around 2824 is also suitable for swing trading. The main focus remains on Bitcoin, and any stabilization at key levels can be considered for a position.

BTC-2,68%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- Comment

- Repost

- Share

Bitcoin just touched the daily moving average, encountering resistance around 89,370. Short-term volatility is leaning bullish. Watch for short positions around 92,190 with a stop loss of 400 points. For long positions, consider entering near 87,160 with a stop loss at 86,600. It's not ideal to set up positions during the second Bitcoin spike. Try short positions around 3,156. For longs, focus on 2,887-2,824#加密行情预测 .

BTC-2,68%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

Bitcoin and Ethereum both failed to reach new highs, quickly pulling back after a surge. Support levels are around 85,600 and 83,600. Stabilizing above these levels suggests a bullish stance, consistent with MACD daily signals, with death crosses and golden crosses appearing. The next target could be around 107,000. Conditions are favorable, and preparations for bottom-fishing can be made at two higher levels.

View Original

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 3

- 2

- Repost

- Share

FallingWildGooseBright :

:

Merry Christmas, let's get bullish! 🐂View More

Bitcoin is strongly advancing with a slow pullback, clearly indicating that large investors are secretly selling off behind the scenes. Pay attention to the areas around 85070 and 85390, where the MACD golden cross and death cross signal an excellent bottoming opportunity.

BTC-2,68%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- Comment

- Repost

- Share