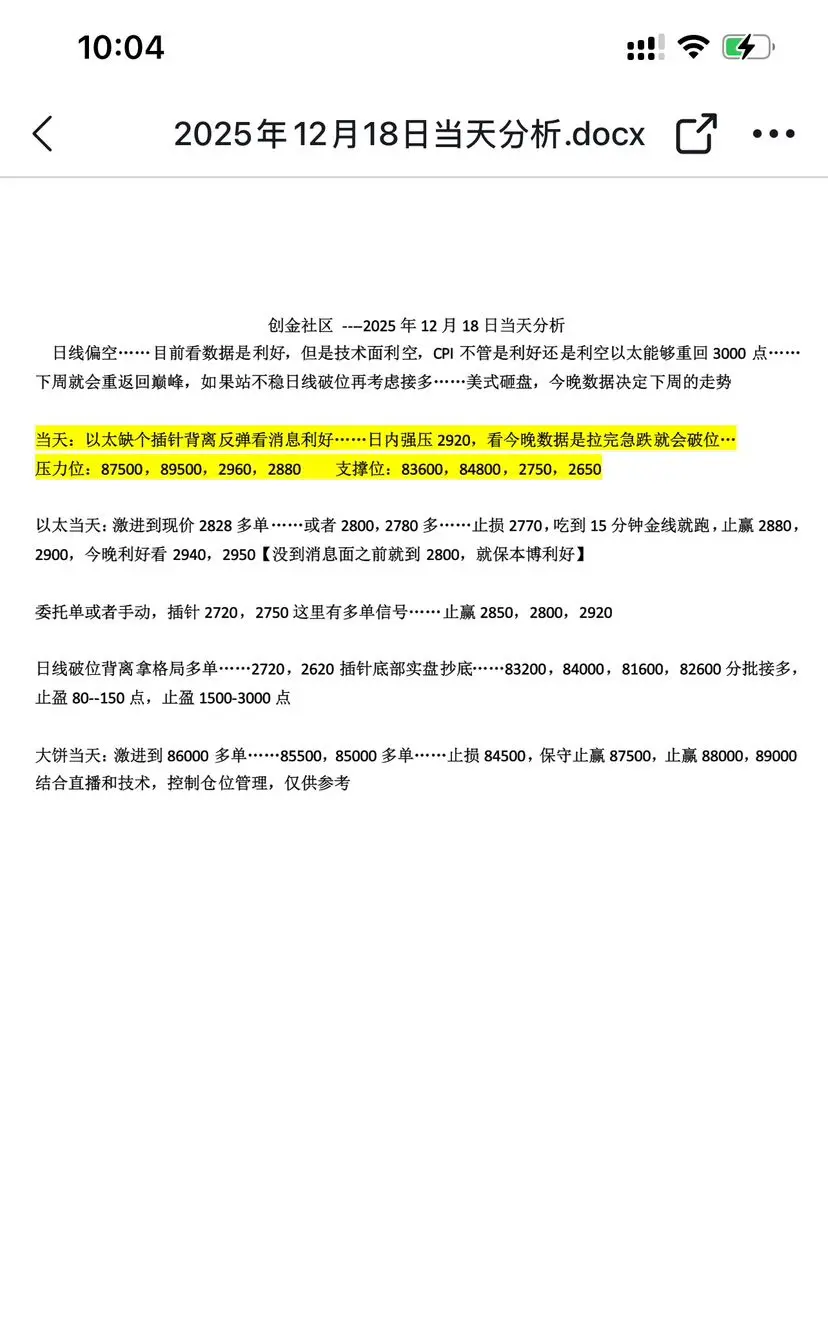

December 17, 2025 Daytime Market Analysis

Large-range 4-hour oscillation... Today’s focus is whether it can hold above 3000 points... Currently showing a daily line bottoming pattern... As long as the decline does not break the level, the market remains optimistic...

Focus on positive news expectations... Spot trading remains mainly swing trading... If CPI meets expectations, look for a surge towards 93,000, above 3,100

During the day: Mainly oscillating, short-term bullish and bearish are not clear, intra-day leaning bullish... Can consider a pullback to add long positions... Short-term long

View OriginalLarge-range 4-hour oscillation... Today’s focus is whether it can hold above 3000 points... Currently showing a daily line bottoming pattern... As long as the decline does not break the level, the market remains optimistic...

Focus on positive news expectations... Spot trading remains mainly swing trading... If CPI meets expectations, look for a surge towards 93,000, above 3,100

During the day: Mainly oscillating, short-term bullish and bearish are not clear, intra-day leaning bullish... Can consider a pullback to add long positions... Short-term long