ČyrusTheCreator

No content yet

ČyrusTheCreator

I understand the hardship in the country but being in same bus seat with the biggest streamer in the world and your only request is $10,000 is crazy… you legit have a blank check to request a better life changing opportunity than money but yeah “tewo tewo” culture in Nigeria 💔💔💔

- Reward

- like

- Comment

- Repost

- Share

Really want to meet more people of influence.

Travel round the world.

Know what actual luxury and freedom feels like.

One step, slowly, surely.💜

Travel round the world.

Know what actual luxury and freedom feels like.

One step, slowly, surely.💜

- Reward

- like

- Comment

- Repost

- Share

Reddit and GitHub.

That’s the Tweet.

Have a great week🙂↔️💜

That’s the Tweet.

Have a great week🙂↔️💜

- Reward

- like

- Comment

- Repost

- Share

Are you gonna learn Prompts Engineering now?

Testing Testing BTW.

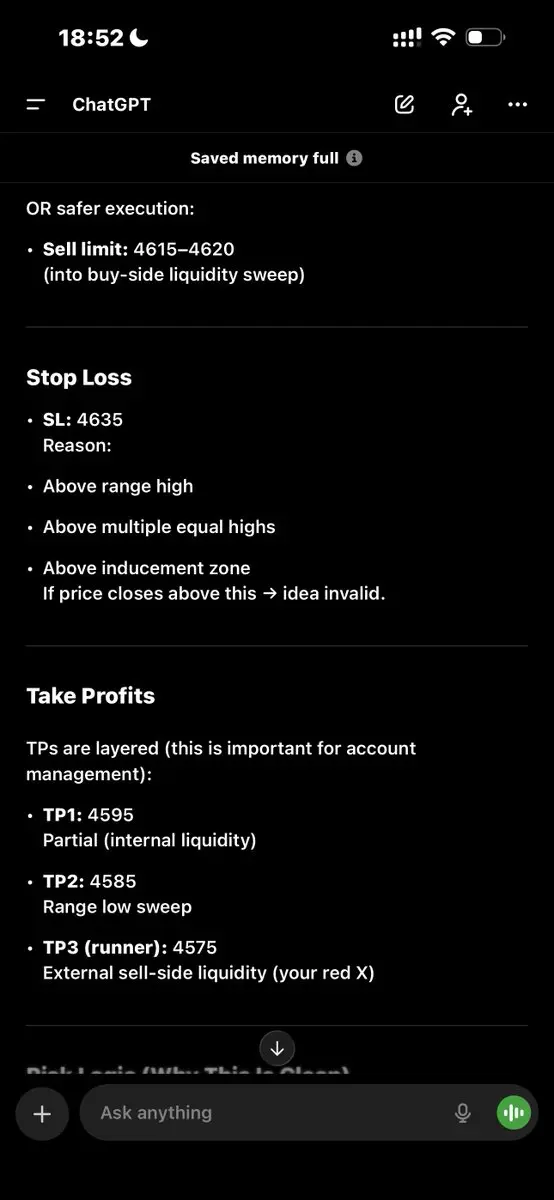

$XAU to wrap the week.👌🏽💜

Testing Testing BTW.

$XAU to wrap the week.👌🏽💜

- Reward

- like

- Comment

- Repost

- Share

Dear God, I’ll also know what 6, 7 figures looks like in my wallet one day.

Until then💜👌🏽

Until then💜👌🏽

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

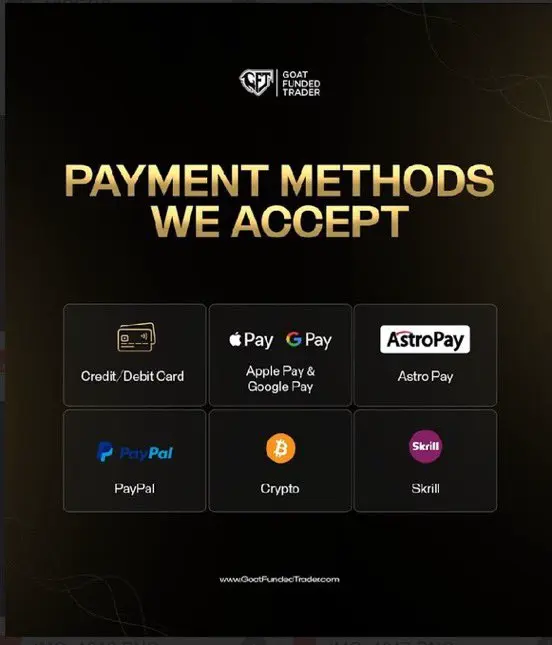

Don’t snooze on the GOATed Firm.

Serious funded trading + real accountability 💪

✔️ Payouts in just 2 days

✔️ $500 compensation for any delay

@GoatFunded 🐐

The firm traders actually trust 👇

Serious funded trading + real accountability 💪

✔️ Payouts in just 2 days

✔️ $500 compensation for any delay

@GoatFunded 🐐

The firm traders actually trust 👇

- Reward

- like

- Comment

- Repost

- Share

What you struggling with in your trading journey!?

Drop in the comments.

Will be answering and sorting any way I can.💜

#30DaysOfChartAndStudyWithCyrus

Drop in the comments.

Will be answering and sorting any way I can.💜

#30DaysOfChartAndStudyWithCyrus

- Reward

- like

- Comment

- Repost

- Share

What you struggling with in your trading journey!?

Drop in the comments.

Will be answering and sorting any way I can.💜

Drop in the comments.

Will be answering and sorting any way I can.💜

- Reward

- like

- Comment

- Repost

- Share

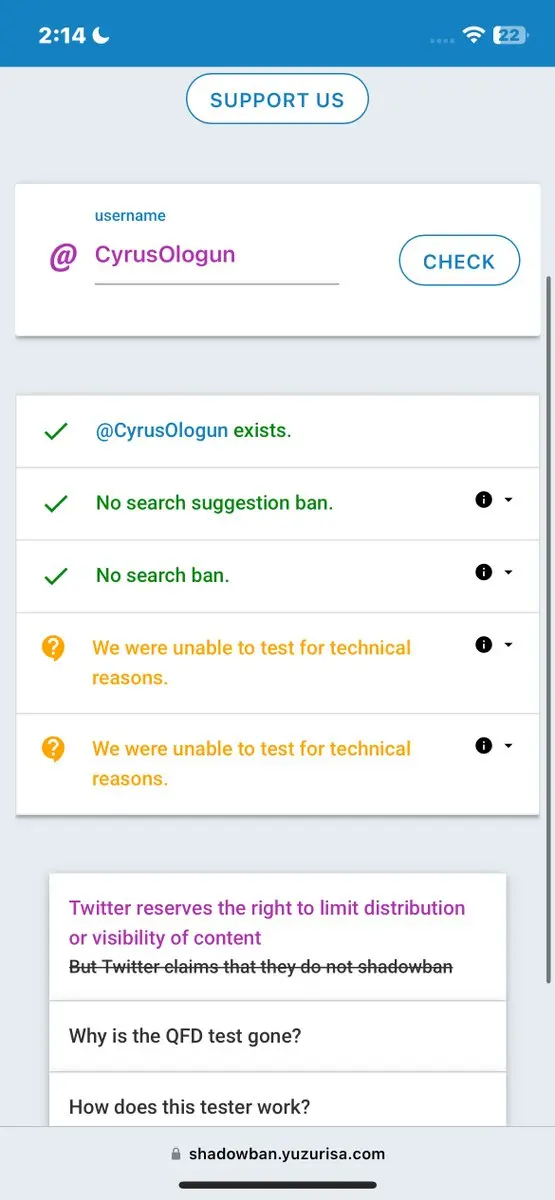

Tryna lift my shadow ban guys to get more reach and give more value.

Kindly quote this with anything when you come across😪🥺🤝💜

Kindly quote this with anything when you come across😪🥺🤝💜

- Reward

- like

- Comment

- Repost

- Share

Bagging another degree in this AI era feels absolutely amazing, I can’t even lie 😭😭💜🔥

You just gather past exam questions from the last 5 years, feed them to your bot, and ask it to generate similar/related questions likely to appear in the next exam… and then you legit see about 65% of what your bot predicted actually show up. Isn’t that a blessing?

You just gather past exam questions from the last 5 years, feed them to your bot, and ask it to generate similar/related questions likely to appear in the next exam… and then you legit see about 65% of what your bot predicted actually show up. Isn’t that a blessing?

- Reward

- like

- Comment

- Repost

- Share

Happy New Year

Still in the New Year Celebrations 💜🔥

NEW YEAR — GOAT OFFER 🐐

💰 $5,000 only $17

🏦 $100,000 only $274

⚡ Instant account access included

🎟️ Code: NY40

⏳ Offer ending soon — don’t miss it

Stay profitable:

Still in the New Year Celebrations 💜🔥

NEW YEAR — GOAT OFFER 🐐

💰 $5,000 only $17

🏦 $100,000 only $274

⚡ Instant account access included

🎟️ Code: NY40

⏳ Offer ending soon — don’t miss it

Stay profitable:

- Reward

- like

- Comment

- Repost

- Share

2026

The year people will ask “How Did You Do It”

The year you’ll laugh so much.

Happy new year family

The year people will ask “How Did You Do It”

The year you’ll laugh so much.

Happy new year family

- Reward

- like

- Comment

- Repost

- Share

365/365 ≈ 2025💜

2026 will be a whole lot better, I believe.💜🌺

2026 will be a whole lot better, I believe.💜🌺

- Reward

- like

- Comment

- Repost

- Share

2026 is not the year to trade more. It’s the year to trade less and execute better.

The easy money phase is gone.

Volatility will still be there, but it will punish impatience harder than ever. The traders who survive and scale in 2026 will not be the loud ones, the over-leveraged ones, or the “everyday is a trade day” crowd.

They’ll be the ones who wait for clean conditions, respect higher-timeframe direction, protect capital aggressively, and treat trading like a business, not entertainment.

In 2026:

If the setup isn’t clear, you do nothing.

If risk isn’t controlled, you don’t enter.

If dis

The easy money phase is gone.

Volatility will still be there, but it will punish impatience harder than ever. The traders who survive and scale in 2026 will not be the loud ones, the over-leveraged ones, or the “everyday is a trade day” crowd.

They’ll be the ones who wait for clean conditions, respect higher-timeframe direction, protect capital aggressively, and treat trading like a business, not entertainment.

In 2026:

If the setup isn’t clear, you do nothing.

If risk isn’t controlled, you don’t enter.

If dis

- Reward

- like

- Comment

- Repost

- Share