Jace

No content yet

Jace

Gate CrossEx Account Now Live

Experience unified multi-exchange trading with spot, cross margin, and USDT perpetuals.

Up to 20× leverage, advanced risk control, and API-only trading for professionals.

VIP+3 Fee Benefit: Jan 19 – Feb 19, 2026

Open Now:

Experience unified multi-exchange trading with spot, cross margin, and USDT perpetuals.

Up to 20× leverage, advanced risk control, and API-only trading for professionals.

VIP+3 Fee Benefit: Jan 19 – Feb 19, 2026

Open Now:

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- 1

- Repost

- Share

Onenight :

:

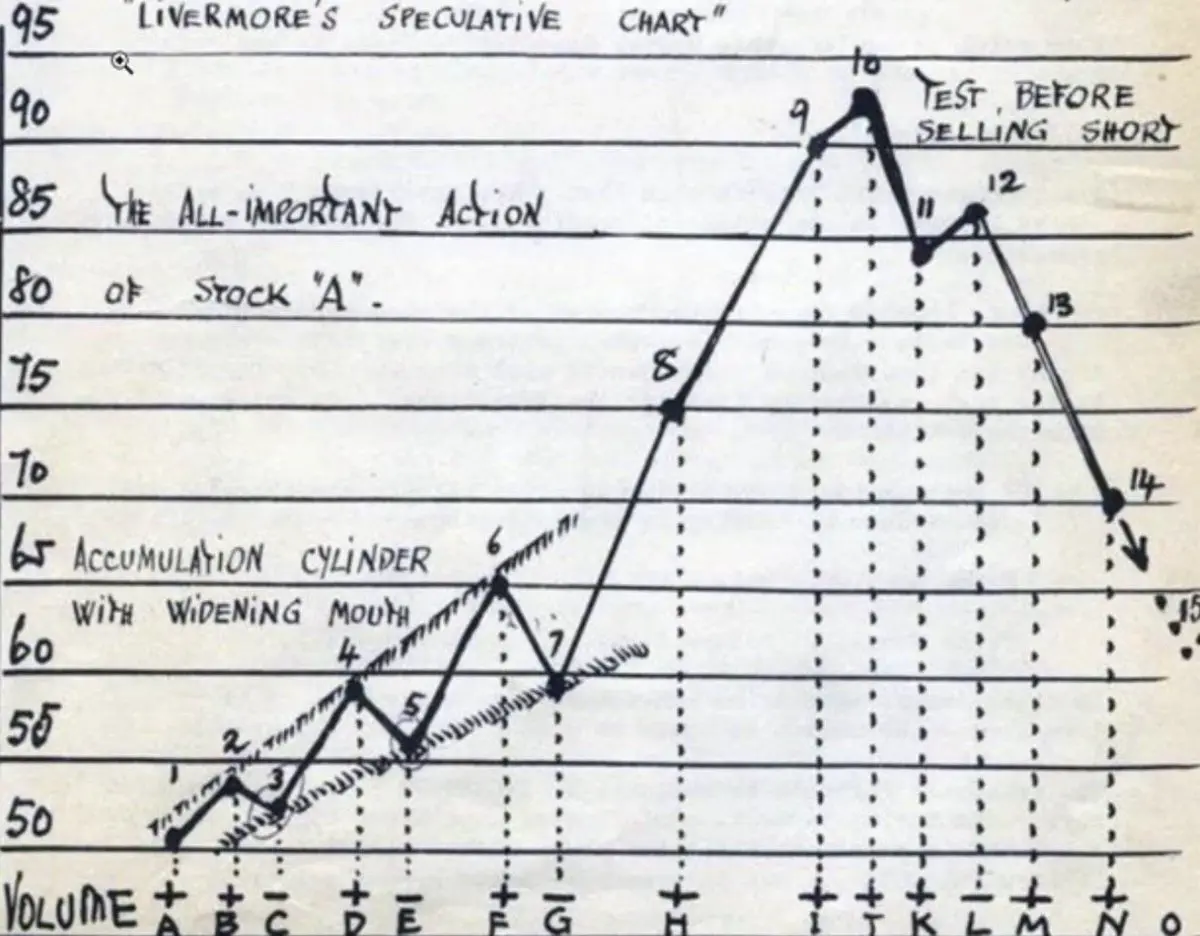

People still believe in this nonsense. It proves that long-term returns are insufficient.FTX just unlocked $28M worth of $SOL… and the market barely blinked.

That’s the real signal.

Despite fresh supply, Solana’s liquidity absorbed it smoothly, TVL is rising, volume is steady, and structure remains bullish.

Strong markets don’t react to noise

Via @creators

That’s the real signal.

Despite fresh supply, Solana’s liquidity absorbed it smoothly, TVL is rising, volume is steady, and structure remains bullish.

Strong markets don’t react to noise

Via @creators

SOL-3,37%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Wall Street is waking up to $COIN.

Bank of America sees 40% upside to $340, calling Coinbase deeply undervalued after the crypto drawdown.

Tokenization, new products, Base monetization, the “everything exchange” thesis is starting to click.

Shared Via @creators

Bank of America sees 40% upside to $340, calling Coinbase deeply undervalued after the crypto drawdown.

Tokenization, new products, Base monetization, the “everything exchange” thesis is starting to click.

Shared Via @creators

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- 1

- Repost

- Share

DrinkingAloneUnderTheMoon666 :

:

New Year Wealth Explosion 🤑- Reward

- like

- 1

- Repost

- Share

StarStepping :

:

Hold on tight, we're about to take off 🛫$HYPE is coiling tight between $23–$27, and $27 remains the real battlefield.

On-chain metrics show strength, momentum indicators are turning bullish, but whale sell walls keep capping price.

Break $27 with volume, and the next leg opens.

Until then, patience wins.

Shared Via Coinex Creator Program @creators

On-chain metrics show strength, momentum indicators are turning bullish, but whale sell walls keep capping price.

Break $27 with volume, and the next leg opens.

Until then, patience wins.

Shared Via Coinex Creator Program @creators

- Reward

- like

- Comment

- Repost

- Share

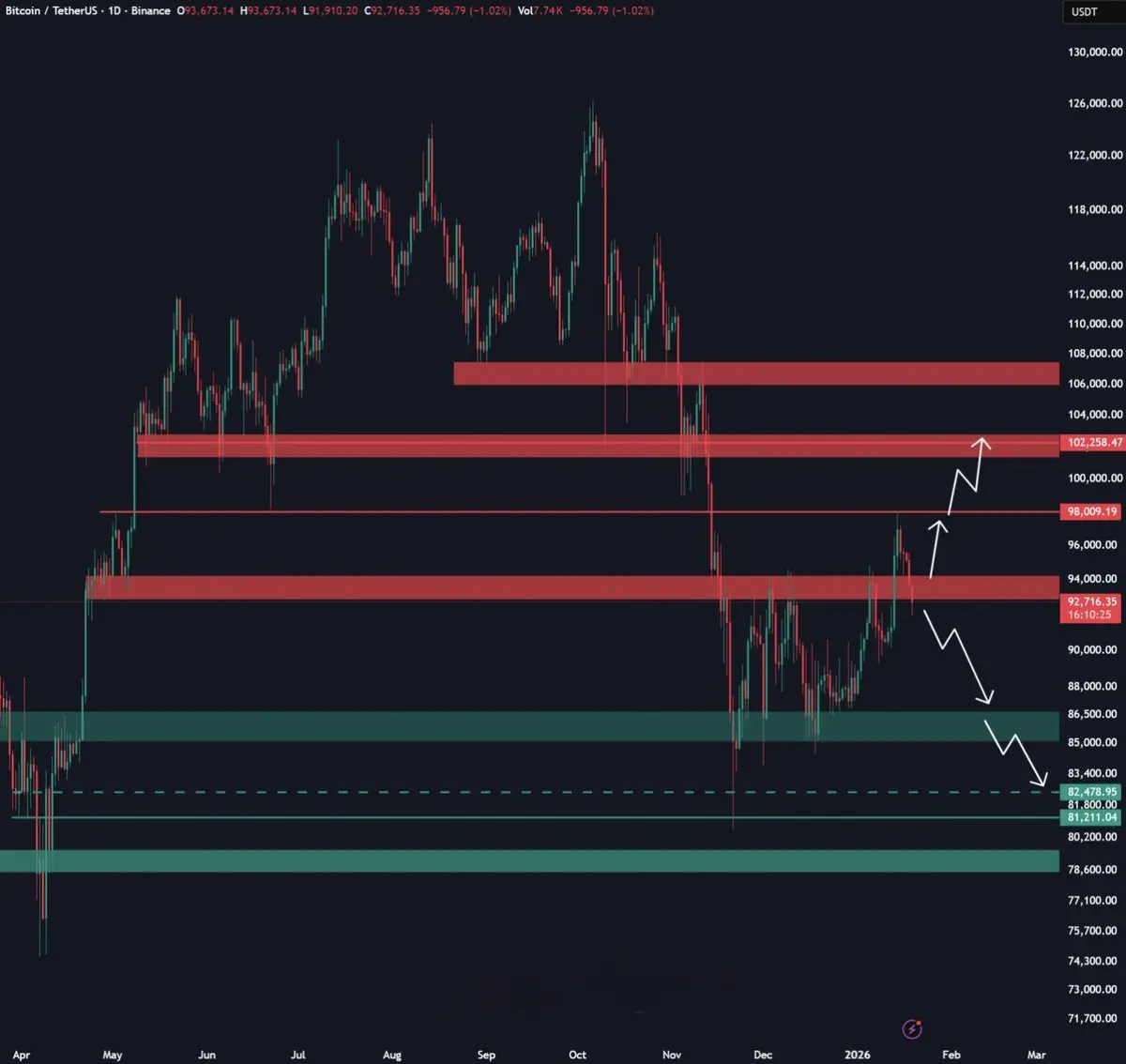

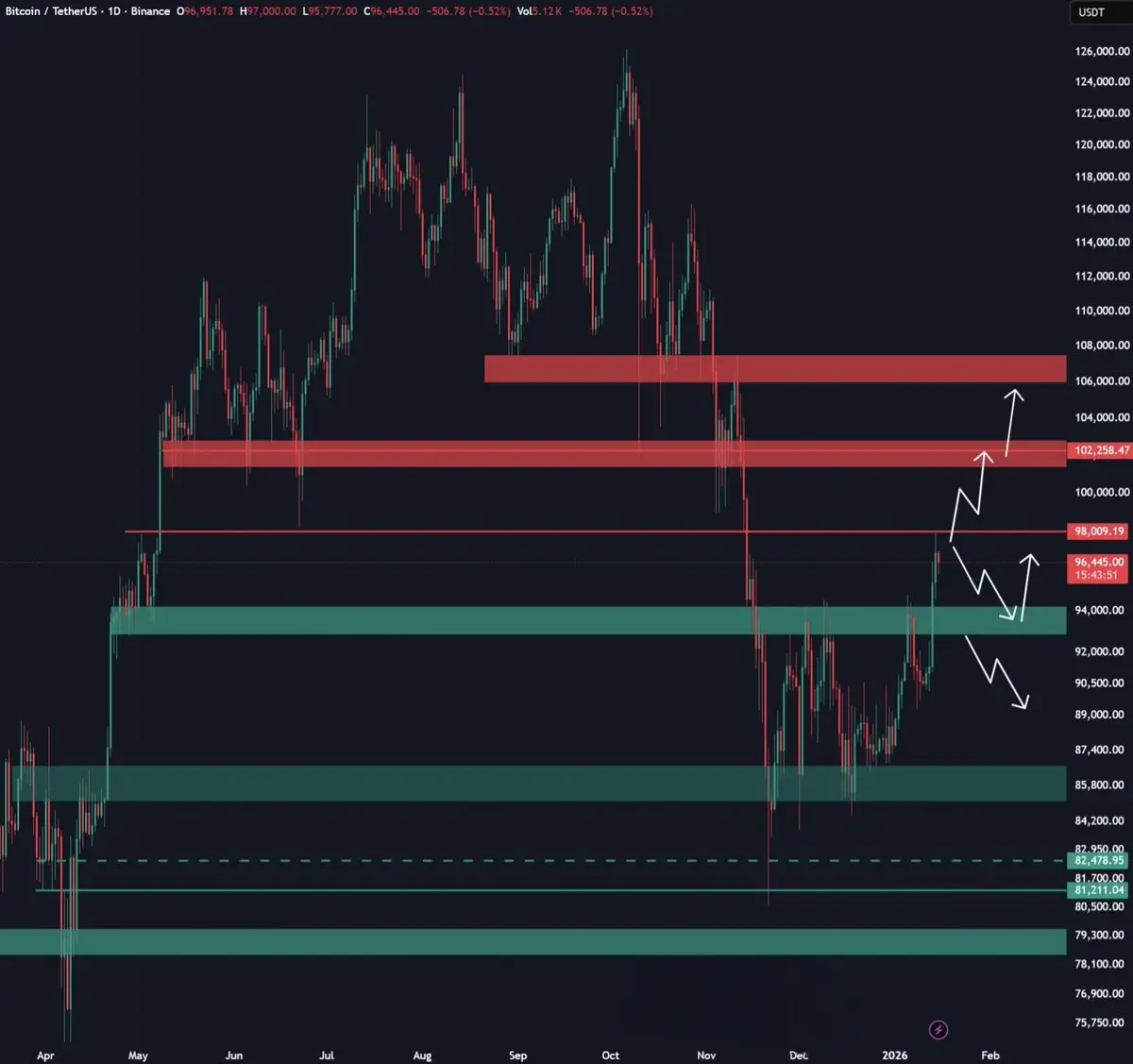

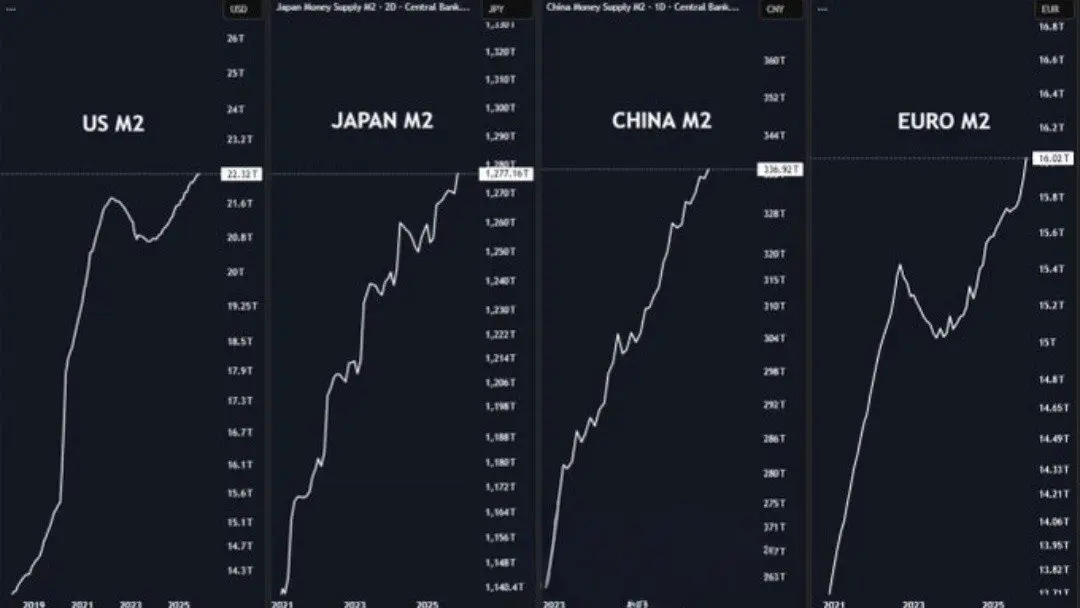

Global liquidity is at record highs.

• US M2: ATH

• Japan M2: ATH

• China M2: ATH

• Eurozone M2: ATH

Equities and precious metals are also trading at all-time highs.

In contrast, the crypto market remains well below its previous peak.

In my view, this valuation gap is hard for institutions to ignore and could drive fresh capital allocation into Bitcoin and select altcoins in Q1 2026.

• US M2: ATH

• Japan M2: ATH

• China M2: ATH

• Eurozone M2: ATH

Equities and precious metals are also trading at all-time highs.

In contrast, the crypto market remains well below its previous peak.

In my view, this valuation gap is hard for institutions to ignore and could drive fresh capital allocation into Bitcoin and select altcoins in Q1 2026.

BTC-1,94%

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More1.46K Popularity

32.34K Popularity

48.32K Popularity

10.24K Popularity

8.38K Popularity

Pin