# CryptoStrategy

20.9K

QueenOfTheDay

#CryptoSurvivalGuide 🛡️ #CryptoSurvivalGuide 🛡️

Crypto isn’t just about quick gains—it’s about surviving the waves and thriving long-term. Here’s your essential checklist:

🔹 Stay Informed: Follow market trends, news, and regulatory updates. Knowledge is your first shield.

🔹 Diversify Smartly: Mix large-cap, mid-cap, and a few promising small-cap assets. Don’t put all eggs in one basket.

🔹 Manage Risk: Use stop-losses, set limits, and avoid emotional trading.

🔹 Think Long-Term: Market dips and surges are normal. Patience pays off more than panic.

🔹 Secure Your Assets: Use hardware wallet

Crypto isn’t just about quick gains—it’s about surviving the waves and thriving long-term. Here’s your essential checklist:

🔹 Stay Informed: Follow market trends, news, and regulatory updates. Knowledge is your first shield.

🔹 Diversify Smartly: Mix large-cap, mid-cap, and a few promising small-cap assets. Don’t put all eggs in one basket.

🔹 Manage Risk: Use stop-losses, set limits, and avoid emotional trading.

🔹 Think Long-Term: Market dips and surges are normal. Patience pays off more than panic.

🔹 Secure Your Assets: Use hardware wallet

- Reward

- 1

- Comment

- Repost

- Share

#WhenisBestTimetoEntertheMarket

⏰📉 #WhenIsBestTimeToEnterTheMarket

The best time to enter the market

is not when everyone feels confident.

It’s when risk is clear

and your plan is ready.

📊 Entry isn’t about timing the exact bottom.

It’s about:

✔️ Entering near strong support — not random price levels

✔️ Buying when sentiment is fearful — not euphoric

✔️ Waiting for confirmation — not chasing green candles

✔️ Having defined risk before defined profit

🧠 Smart Traders Don’t Ask:

“Is this the bottom?”

They ask:

“Is my downside controlled?”

🎯 Real Strategy

• Use DCA in volatile conditions

• In

⏰📉 #WhenIsBestTimeToEnterTheMarket

The best time to enter the market

is not when everyone feels confident.

It’s when risk is clear

and your plan is ready.

📊 Entry isn’t about timing the exact bottom.

It’s about:

✔️ Entering near strong support — not random price levels

✔️ Buying when sentiment is fearful — not euphoric

✔️ Waiting for confirmation — not chasing green candles

✔️ Having defined risk before defined profit

🧠 Smart Traders Don’t Ask:

“Is this the bottom?”

They ask:

“Is my downside controlled?”

🎯 Real Strategy

• Use DCA in volatile conditions

• In

- Reward

- 1

- Comment

- Repost

- Share

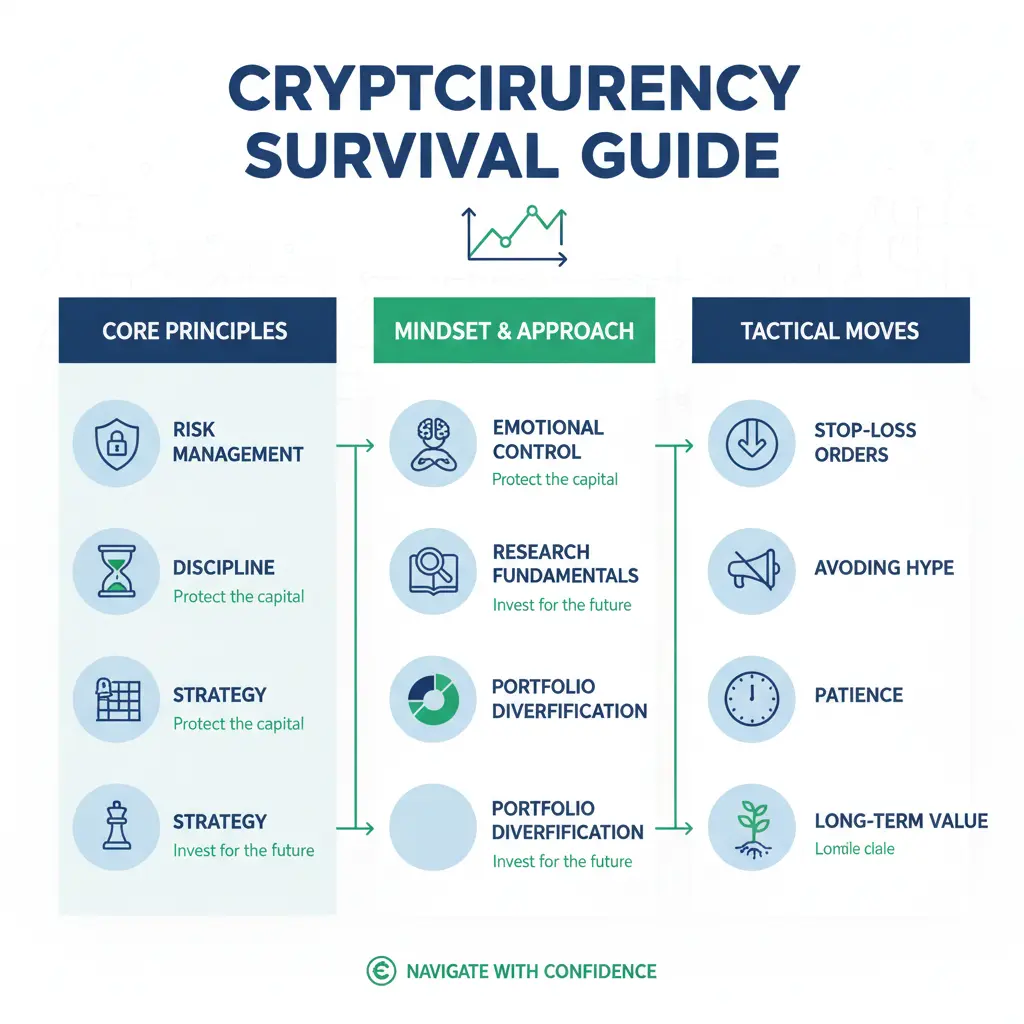

Crypto Survival Guide: Navigating Volatility with Confidence

In the fast-moving world of cryptocurrency, survival isn’t about luck — it’s about discipline, strategy, and emotional control. Markets can swing dramatically within hours, and those who succeed are the ones who stay prepared. A solid crypto survival mindset begins with risk management. Never invest more than you can afford to lose, diversify your portfolio wisely, and always keep a portion of your funds in stable assets to manage sudden downturns.

Research remains your strongest weapon. Before entering any trade or investing in a ne

In the fast-moving world of cryptocurrency, survival isn’t about luck — it’s about discipline, strategy, and emotional control. Markets can swing dramatically within hours, and those who succeed are the ones who stay prepared. A solid crypto survival mindset begins with risk management. Never invest more than you can afford to lose, diversify your portfolio wisely, and always keep a portion of your funds in stable assets to manage sudden downturns.

Research remains your strongest weapon. Before entering any trade or investing in a ne

- Reward

- 5

- 7

- Repost

- Share

CryptoChampion :

:

Ape In 🚀View More

#WhenisBestTimetoEntertheMarket

📈 Entering the market at the right time is key to maximizing potential gains and minimizing risks. Here’s what to consider before taking the step:

1️⃣ Market Trends – Identify if the market is bullish or bearish. Waiting for confirmation in a rising market or looking for “buy the dip” opportunities in a downtrend can make a difference.

2️⃣ Technical Signals – Use support & resistance levels, moving averages, and RSI to find safer entry points.

3️⃣ Fundamentals – Strong fundamentals, growth potential, and positive news can indicate a good long-term entry.

4️⃣ R

📈 Entering the market at the right time is key to maximizing potential gains and minimizing risks. Here’s what to consider before taking the step:

1️⃣ Market Trends – Identify if the market is bullish or bearish. Waiting for confirmation in a rising market or looking for “buy the dip” opportunities in a downtrend can make a difference.

2️⃣ Technical Signals – Use support & resistance levels, moving averages, and RSI to find safer entry points.

3️⃣ Fundamentals – Strong fundamentals, growth potential, and positive news can indicate a good long-term entry.

4️⃣ R

- Reward

- 5

- 10

- Repost

- Share

MrFlower_XingChen :

:

To The Moon 🌕View More

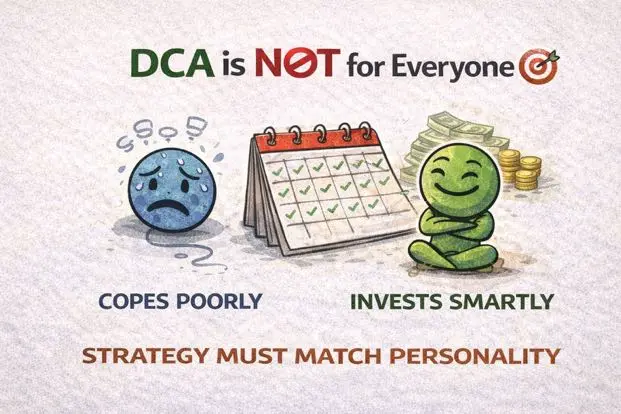

DCA Is NOT for Everyone 🎯

DCA (Dollar Cost Averaging) sounds safe.

Buy regularly. Ignore the noise. Sleep peacefully.

But here’s the truth:

DCA only works if 👇

– You believe in the long-term thesis

– You can handle drawdowns

– You have consistent cash flow

– You’re patient

If you panic every dip…

DCA won’t save you.

If you DCA into weak projects…

Time won’t fix it.

If you need quick profits…

DCA will feel “too slow.”

DCA is a strategy.

Not a magic button.

It rewards discipline.

It punishes impatience.

Before you DCA, ask yourself:

Are you investing… or just coping?

In crypto,

strategy must m

DCA (Dollar Cost Averaging) sounds safe.

Buy regularly. Ignore the noise. Sleep peacefully.

But here’s the truth:

DCA only works if 👇

– You believe in the long-term thesis

– You can handle drawdowns

– You have consistent cash flow

– You’re patient

If you panic every dip…

DCA won’t save you.

If you DCA into weak projects…

Time won’t fix it.

If you need quick profits…

DCA will feel “too slow.”

DCA is a strategy.

Not a magic button.

It rewards discipline.

It punishes impatience.

Before you DCA, ask yourself:

Are you investing… or just coping?

In crypto,

strategy must m

- Reward

- 1

- Comment

- Repost

- Share

Crypto Education: Stop Chasing Every Hype Coin

Most new traders make the same mistake: they jump on every “next big thing” because of hype.

Here’s the reality:

90% of coins fade within months

80% of “hot trends” are overhyped or manipulated

Only projects with real adoption, clear utility, and liquidity survive long-term

Smart traders focus on quality, not quantity.

Owning a few solid projects is far better than spreading thin across dozens.

💡 Rule of thumb:

Utility + adoption + liquidity _ potential staying power

Ask yourself before buying:

1️⃣ Is anyone actually using this project?

2️⃣ Does

Most new traders make the same mistake: they jump on every “next big thing” because of hype.

Here’s the reality:

90% of coins fade within months

80% of “hot trends” are overhyped or manipulated

Only projects with real adoption, clear utility, and liquidity survive long-term

Smart traders focus on quality, not quantity.

Owning a few solid projects is far better than spreading thin across dozens.

💡 Rule of thumb:

Utility + adoption + liquidity _ potential staying power

Ask yourself before buying:

1️⃣ Is anyone actually using this project?

2️⃣ Does

BTC0,58%

- Reward

- like

- Comment

- Repost

- Share

# ETHUnderPressure

The Ethereum Paradox: Price Pressure vs. Fundamental

Strength 🐘⚖️

We are currently seeing a sharp divergence in the

Ethereum ecosystem. While the price of ETH faces downward pressure, the

underlying fundamentals tell a different story. Development activity is

accelerating, and the Layer-2 ecosystem is booming with transactions and

innovation.

This creates a complex scenario for investors. When the

market price detaches from on-chain utility and technical progress, strategy

becomes paramount.

Do you view this pressure as a discount on future

utility, or a reflection o

ETH-1,64%

- Reward

- like

- Comment

- Repost

- Share

# ETHUnderPressure

📉 ETH Under

Pressure: The Great Divergence?

Ethereum is facing some heavy headwinds in the market

right now, with the price coming under scrutiny. Yet, beneath the surface, the

ecosystem is bustling—network upgrades are progressing and Layer-2 activity is

booming. 🛠️⚡

It presents a tricky scenario: Price is

dipping, but fundamentals seem to be climbing.

💬 How do you

navigate this divergence?

• 🛡️ Stay Safe:

Do you wait for price action to stabilize before entering? • 💎

The Believer: Do you see this as a discount accumulation

opportunity despite the chart? • 🔄 Rota

📉 ETH Under

Pressure: The Great Divergence?

Ethereum is facing some heavy headwinds in the market

right now, with the price coming under scrutiny. Yet, beneath the surface, the

ecosystem is bustling—network upgrades are progressing and Layer-2 activity is

booming. 🛠️⚡

It presents a tricky scenario: Price is

dipping, but fundamentals seem to be climbing.

💬 How do you

navigate this divergence?

• 🛡️ Stay Safe:

Do you wait for price action to stabilize before entering? • 💎

The Believer: Do you see this as a discount accumulation

opportunity despite the chart? • 🔄 Rota

ETH-1,64%

- Reward

- 1

- Comment

- Repost

- Share

#MyWeekendTradingPlan #MyWeekendTradingPlan

Weekend Trading Plan: Building Discipline Today for Tomorrow’s Profits

Weekends are not just for rest — they are for preparation. While markets slow down and volatility compresses, smart traders use this time to reset their mindset, refine strategies, and prepare for the next high-probability opportunities.

This weekend, my focus is not on chasing candles. It’s on building structure.

The goal is simple: enter the new week with clarity, confidence, and a data-driven plan.

Market Review & Higher Timeframe Analysis

First, I’m starting with a full top-do

Weekend Trading Plan: Building Discipline Today for Tomorrow’s Profits

Weekends are not just for rest — they are for preparation. While markets slow down and volatility compresses, smart traders use this time to reset their mindset, refine strategies, and prepare for the next high-probability opportunities.

This weekend, my focus is not on chasing candles. It’s on building structure.

The goal is simple: enter the new week with clarity, confidence, and a data-driven plan.

Market Review & Higher Timeframe Analysis

First, I’m starting with a full top-do

- Reward

- 6

- 6

- Repost

- Share

ybaser :

:

2026 Go Go Go 👊View More

📅📊 #MyWeekendTradingPlan | Strategy & Discipline 🚀

As the weekend approaches, having a clear trading plan is essential—especially during periods of lower liquidity and higher volatility. A structured approach helps traders stay focused, manage risk, and respond effectively to market moves. ⚖️📈

🔍 Key Elements of My Weekend Trading Plan:

🎯 Define clear entry and exit levels

🛡️ Set risk limits and stop-loss orders

📉 Focus on high-liquidity pairs and key support/resistance zones

🧠 Stay disciplined and avoid overtrading

💡 Preparation is the edge. Use Gate.io’s advanced charts, indicators,

As the weekend approaches, having a clear trading plan is essential—especially during periods of lower liquidity and higher volatility. A structured approach helps traders stay focused, manage risk, and respond effectively to market moves. ⚖️📈

🔍 Key Elements of My Weekend Trading Plan:

🎯 Define clear entry and exit levels

🛡️ Set risk limits and stop-loss orders

📉 Focus on high-liquidity pairs and key support/resistance zones

🧠 Stay disciplined and avoid overtrading

💡 Preparation is the edge. Use Gate.io’s advanced charts, indicators,

- Reward

- 3

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

246.14K Popularity

871.16K Popularity

10.63M Popularity

98.87K Popularity

517.89K Popularity

299.83K Popularity

62.28K Popularity

40.56K Popularity

28.27K Popularity

25.83K Popularity

26.1K Popularity

22.93K Popularity

25.48K Popularity

52.4K Popularity

News

View MorePolymarket hacked, with vulnerabilities in the off-chain and on-chain transaction result synchronization mechanism

5 m

Balancer suspends reCLAMM-related pools due to security vulnerability reports, ensuring user fund safety

15 m

Spot gold drops about $20 in the short term, latest at $4991.15 per ounce

16 m

Three ETH Short-Position Whales Record Over $8M in Profits Amid Market Stability

20 m

Messari Report: Decibel is building a powerful and highly transparent decentralized exchange platform (DEX)

42 m

Pin