# FinanceNews

5.14K

JehanBhai

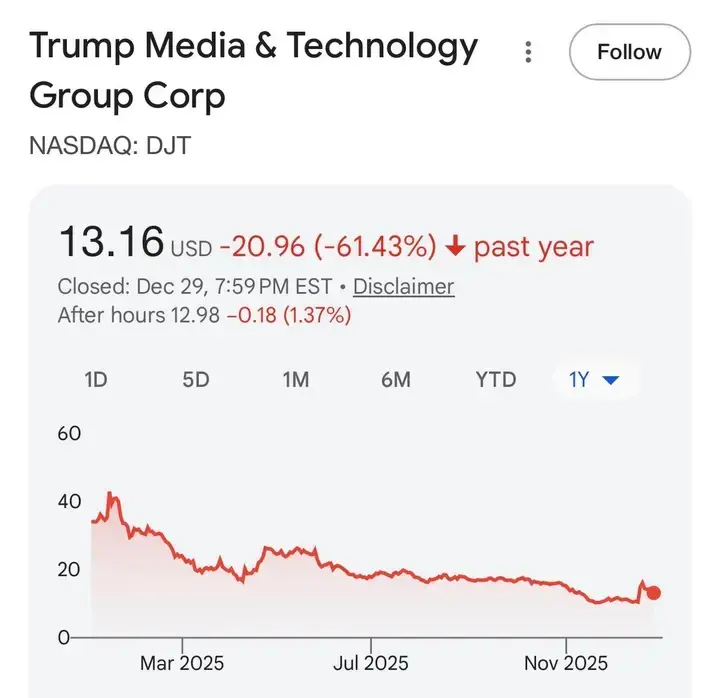

Trump Media stock is down 61% past year

Mostly due to poor financial performance, low revenue, high losses & heavy investments in volatile Bitcoin.

#TechNews #FinanceNews

Mostly due to poor financial performance, low revenue, high losses & heavy investments in volatile Bitcoin.

#TechNews #FinanceNews

BTC-3,14%

- Reward

- like

- Comment

- Repost

- Share

The Fed cut interest rates by 25 basis points, and Powell stated that it is a risk management measure.

According to news from Hashchain, the Fed announced a reduction of the federal funds rate by 25 basis points, lowering it from 4.25%-4.50% to 4.00%-4.25%, in line with market expectations. Following the announcement, the market reacted strongly, with the three major U.S. stock indices rapidly rising before quickly plummeting, and the U.S. dollar index briefly hitting a new low since 2025, before sharply rebounding, turning from a decline to an increase. This market volatility is closely relat

View OriginalAccording to news from Hashchain, the Fed announced a reduction of the federal funds rate by 25 basis points, lowering it from 4.25%-4.50% to 4.00%-4.25%, in line with market expectations. Following the announcement, the market reacted strongly, with the three major U.S. stock indices rapidly rising before quickly plummeting, and the U.S. dollar index briefly hitting a new low since 2025, before sharply rebounding, turning from a decline to an increase. This market volatility is closely relat

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

220.32K Popularity

30.74K Popularity

14.57K Popularity

13.83K Popularity

6.48K Popularity

76.5K Popularity

4.96K Popularity

7.06K Popularity

6.16K Popularity

3.19K Popularity

4.1K Popularity

13.92K Popularity

3.6K Popularity

20.36K Popularity

11.24K Popularity

News

View MoreJapan's Financial Services Agency releases "Draft Guidelines for Strengthening Cybersecurity for Crypto Exchanges" and opens for public comments

1 m

BitMart contracts will launch VZONUSDT, SNOWONUSDT, and 5 perpetual contracts

4 m

USDD becomes the official partner of Stablecoin Odyssey 2026

12 m

Ethereum spot ETF saw a total net inflow of $13,818,400 yesterday, with Grayscale ETH leading at a net inflow of $13,317,300.

13 m

Tom Lee: If Mr. Beast launches an IPO and achieves 100x growth, it will cause the BMNR price to triple from the current level.

18 m

Pin