Post content & earn content mining yield

placeholder

Chillzzz

Live Trading and Learning with Chillzzz

- Reward

- like

- Comment

- Repost

- Share

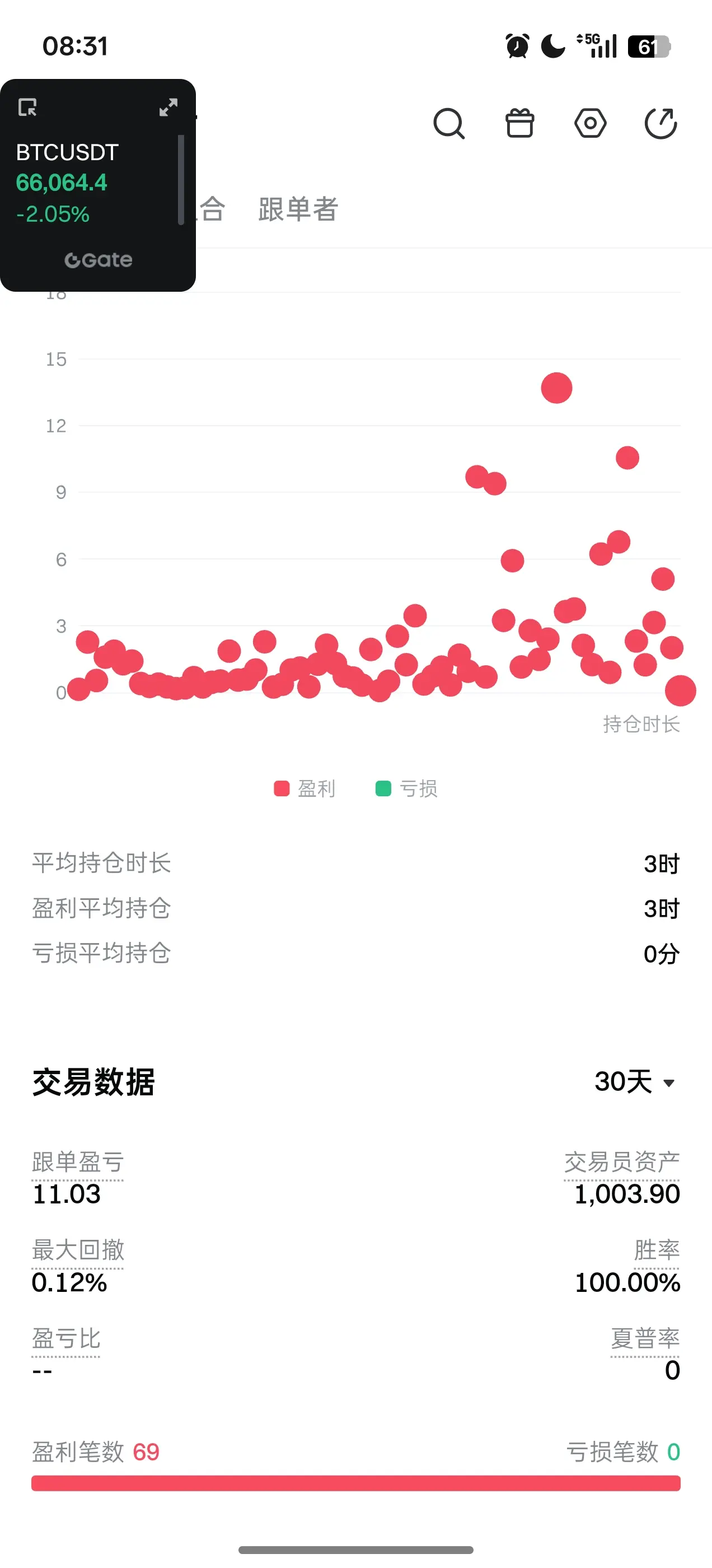

#我在Gate广场过新年 Today, Bitcoin continues its recent weak oscillation, once again falling below the key psychological level of $66,000 in the early trading session. The largest intraday decline approaches 2%, showing a pattern of retreat from high levels with a dominance of bears. External factors such as global risk asset sell-offs, a pullback in the US stock market, and a sideways strengthening of the US dollar index have heightened risk-averse sentiment in the crypto market. Bullish momentum is clearly insufficient, and prices are repeatedly pressured around the $66,000 mark. Short-term downsid

BTC-1,69%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 4

- 7

- Repost

- Share

CoinWay :

:

2026 Go Go Go 👊View More

#GateSpringFestivalHorseRacingEvent GateSpringFestivalHorseRacingEvent 📊 When Celebration Becomes Strategy

The Gate.io Spring Festival Horse Racing Event may appear seasonal on the surface, but strategically it reflects something deeper: structured engagement during traditionally low-liquidity periods. Holiday windows often bring thinner volume, reduced focus, and fragmented attention. By introducing an interactive campaign during this phase, Gate reduces disengagement risk and maintains consistent user touchpoints. This is not short-term marketing — it is retention architecture designed to s

The Gate.io Spring Festival Horse Racing Event may appear seasonal on the surface, but strategically it reflects something deeper: structured engagement during traditionally low-liquidity periods. Holiday windows often bring thinner volume, reduced focus, and fragmented attention. By introducing an interactive campaign during this phase, Gate reduces disengagement risk and maintains consistent user touchpoints. This is not short-term marketing — it is retention architecture designed to s

- Reward

- 2

- 1

- Repost

- Share

Discovery :

:

To The Moon 🌕$QDW

多头币

Created By@LiangNi

Listing Progress

0.00%

MC:

$2.4K

More Tokens

Join the horse racing predictions, complete tasks to earn horse racing tickets, enjoy daily million Gift Coins giveaways, and share a 100,000 USDT prize pool—all at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VQVFB1HZBQ

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VQJHUVBBUW

View Original

- Reward

- like

- Comment

- Repost

- Share

2.13 Friday Morning Market Analysis

Yesterday early morning, Bitcoin's two short positions were perfectly executed, totaling a profit of 7,500 points! The strategy was shared publicly in advance, and those who followed have already taken profits and exited. Opportunities always favor those who are prepared and have strong execution.

From a technical perspective:

- Daily chart: Bearish trend is shrinking in volume, with consecutive down days, gradually forming a downward channel pattern. The overall bearish structure remains unchanged.

- Four-hour chart: Bearish momentum is increasing, with Bol

View OriginalYesterday early morning, Bitcoin's two short positions were perfectly executed, totaling a profit of 7,500 points! The strategy was shared publicly in advance, and those who followed have already taken profits and exited. Opportunities always favor those who are prepared and have strong execution.

From a technical perspective:

- Daily chart: Bearish trend is shrinking in volume, with consecutive down days, gradually forming a downward channel pattern. The overall bearish structure remains unchanged.

- Four-hour chart: Bearish momentum is increasing, with Bol

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VVBCVVHCBQ

View Original

- Reward

- 1

- 1

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

Your sharing has illuminated my ideas.#StrategyToIssueMorePerpetualPreferreds #StrategyToIssueMorePerpetualPreferreds

As capital markets evolve and funding costs fluctuate, many corporations are re-evaluating hybrid financing tools to strengthen their financial structure without overextending traditional debt. One increasingly discussed approach is the strategy to issue more perpetual preferred shares — a move that can reshape balance sheet dynamics while preserving long-term flexibility.

Perpetual preferred shares are equity instruments with no maturity date. Unlike bonds, they do not require repayment of principal at a fixed tim

As capital markets evolve and funding costs fluctuate, many corporations are re-evaluating hybrid financing tools to strengthen their financial structure without overextending traditional debt. One increasingly discussed approach is the strategy to issue more perpetual preferred shares — a move that can reshape balance sheet dynamics while preserving long-term flexibility.

Perpetual preferred shares are equity instruments with no maturity date. Unlike bonds, they do not require repayment of principal at a fixed tim

- Reward

- 3

- 4

- Repost

- Share

Discovery :

:

To The Moon 🌕View More

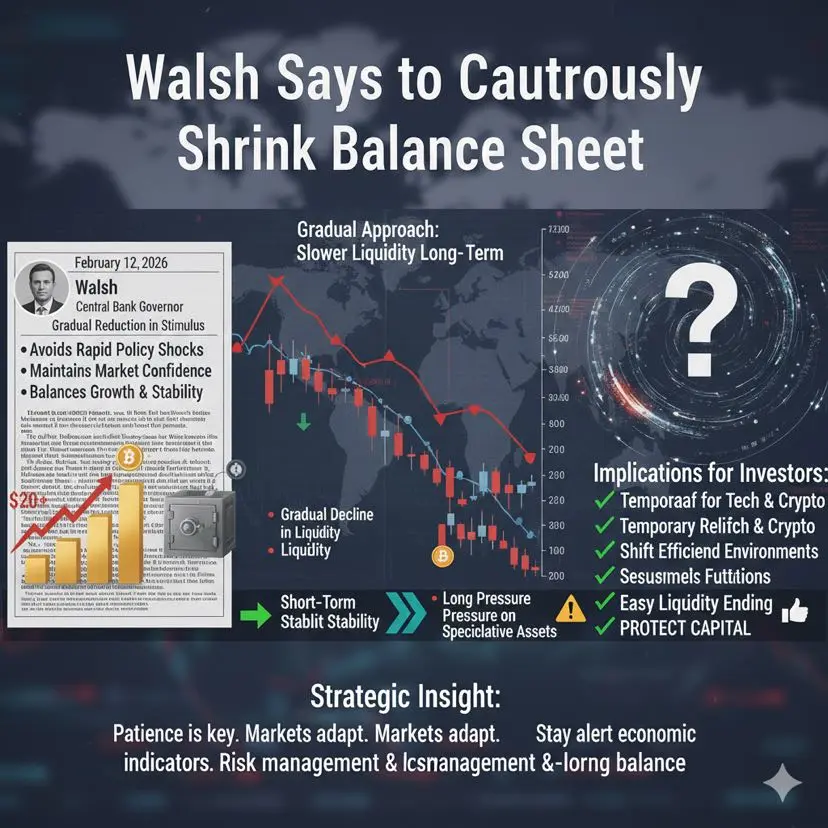

#WalshSaysToCautiouslyShrinkBalanceSheet On February 12, 2026, markets reacted to remarks from Christopher Waller regarding “cautiously shrinking” financial support measures. His message emphasized a gradual, measured reduction in stimulus rather than aggressive tightening — aiming to balance economic growth with long-term monetary stability.

Key Takeaways:

• Gradual approach: Designed to avoid market shocks that can result from rapid balance sheet contraction, preserving confidence and liquidity stability.

• Data-driven policy: Central bank decisions remain tied to inflation data, labor marke

Key Takeaways:

• Gradual approach: Designed to avoid market shocks that can result from rapid balance sheet contraction, preserving confidence and liquidity stability.

• Data-driven policy: Central bank decisions remain tied to inflation data, labor marke

- Reward

- 2

- 2

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

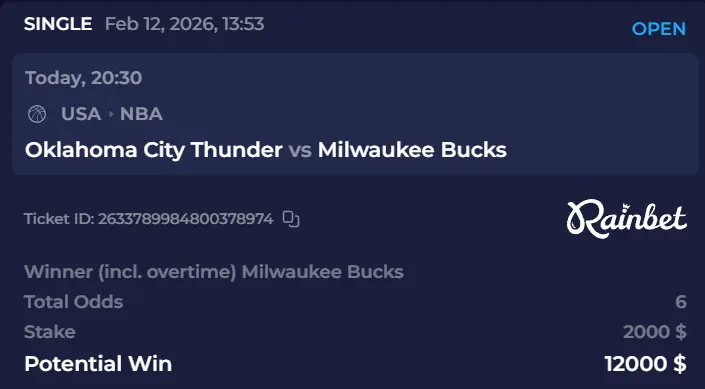

probably gonna lose this. Giannis still out. Maybe Cam Thomas has something to prove as a Buck?

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VLVCVQTAAG

View Original

- Reward

- like

- Comment

- Repost

- Share

Check out Gate and join me in the hottest event! https://www.gate.com/id/campaigns/3959?ref=VQUQVAXXVA&ref_type=132&utm_cmp=Tpgytucw

- Reward

- like

- Comment

- Repost

- Share

BBNation007

BBN

Created By@BBN007

Listing Progress

0.00%

MC:

$2.41K

More Tokens

In just the last three days lighter launched

- Unified margins across spot<>perps

- Korean stocks

- Funding rate discounts

🤯🤯🤯

- Unified margins across spot<>perps

- Korean stocks

- Funding rate discounts

🤯🤯🤯

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=AVDFA11Y

View Original

- Reward

- like

- Comment

- Repost

- Share

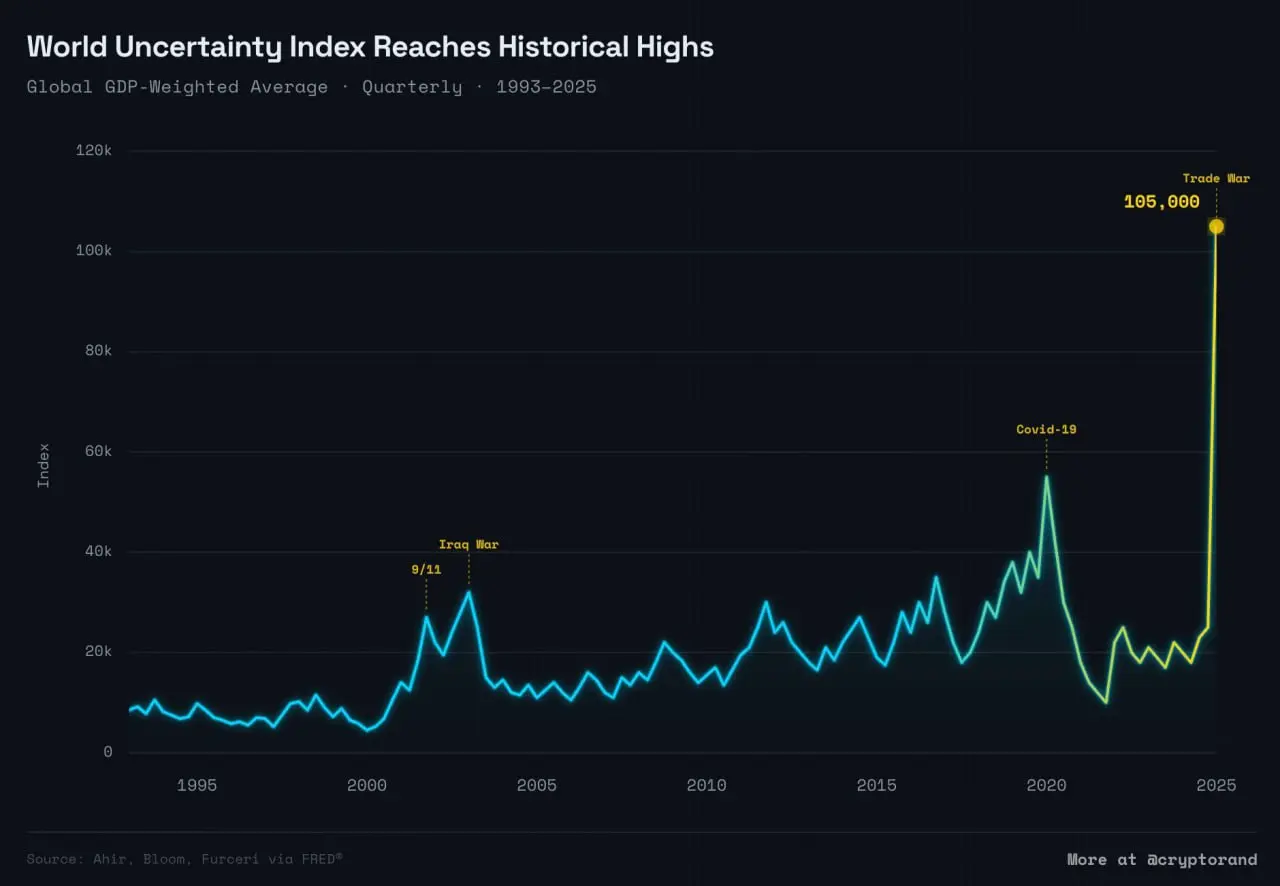

What Is the World Uncertainty Index 👀

The World Uncertainty Index measures how frequently uncertainty-related terms appear in country economic reports. It is calculated by scanning Economist Intelligence Unit reports and counting references to uncertainty, then standardizing the data across countries and time.

🌍 The index is GDP-weighted and published quarterly. That means larger economies influence the reading more than smaller ones. The goal is to capture macro-level policy, economic, and geopolitical uncertainty rather than market volatility alone.

Spikes in the index historically align w

The World Uncertainty Index measures how frequently uncertainty-related terms appear in country economic reports. It is calculated by scanning Economist Intelligence Unit reports and counting references to uncertainty, then standardizing the data across countries and time.

🌍 The index is GDP-weighted and published quarterly. That means larger economies influence the reading more than smaller ones. The goal is to capture macro-level policy, economic, and geopolitical uncertainty rather than market volatility alone.

Spikes in the index historically align w

- Reward

- 1

- 1

- Repost

- Share

HighAmbition :

:

thank you for information about cryptoPost and Interact to Share $50,000 Red Packets on Gate Square https://www.gate.com/id/campaigns/4044?ref=VLJGXQXYAG&ref_type=132

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VgBGVQwL

View Original

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Not just exciting, but reassuring—My "Confession" to ETH

If Bitcoin is the shining moonlight, then ETH is more like a partner you can build a life with. Recently, the reason I keep increasing my position and find it more and more appealing is ETH. My fondness for it lies in "ecosystem stickiness." The value of a token is not just in its price, but also in its use cases and developer consensus. ETH hosts a vast array of DeFi, NFTs, and on-chain applications, like a bustling commercial street that never closes. You can question the market trends, but it's hard to ignore its network effects. Ever

View OriginalIf Bitcoin is the shining moonlight, then ETH is more like a partner you can build a life with. Recently, the reason I keep increasing my position and find it more and more appealing is ETH. My fondness for it lies in "ecosystem stickiness." The value of a token is not just in its price, but also in its use cases and developer consensus. ETH hosts a vast array of DeFi, NFTs, and on-chain applications, like a bustling commercial street that never closes. You can question the market trends, but it's hard to ignore its network effects. Ever

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- 1

- Repost

- Share

CoinWay :

:

2026 Go Go Go 👊- Reward

- 1

- 1

- Repost

- Share

TheOvercomer :

:

How can a loss occur?Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More25.31K Popularity

11.81K Popularity

6.53K Popularity

38.56K Popularity

252.53K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:00.35%

- MC:$2.41KHolders:10.00%

- MC:$2.4KHolders:10.00%

- MC:$2.41KHolders:20.07%

- MC:$2.4KHolders:10.00%

News

View MoreTrove Markets secretly refunded KOLs after the coin price plummeted, and ICO participants suffered heavy losses.

8 m

Market Report: Top 5 Cryptocurrency Gainers on February 13, 2026, led by River

11 m

Artificial intelligence company Anthropic completes $30 billion funding round, led by GIC and others

11 m

BTR (Bitlayer) increased by 52.94% in the past 24 hours, now trading at $0.14

18 m

Ripple and Uniswap executives join CFTC committee, the game of the "CLARITY Act" escalates again

27 m

Pin