Post content & earn content mining yield

placeholder

RedEnvelope

- Reward

- 2

- 1

- Repost

- Share

RedEnvelope :

:

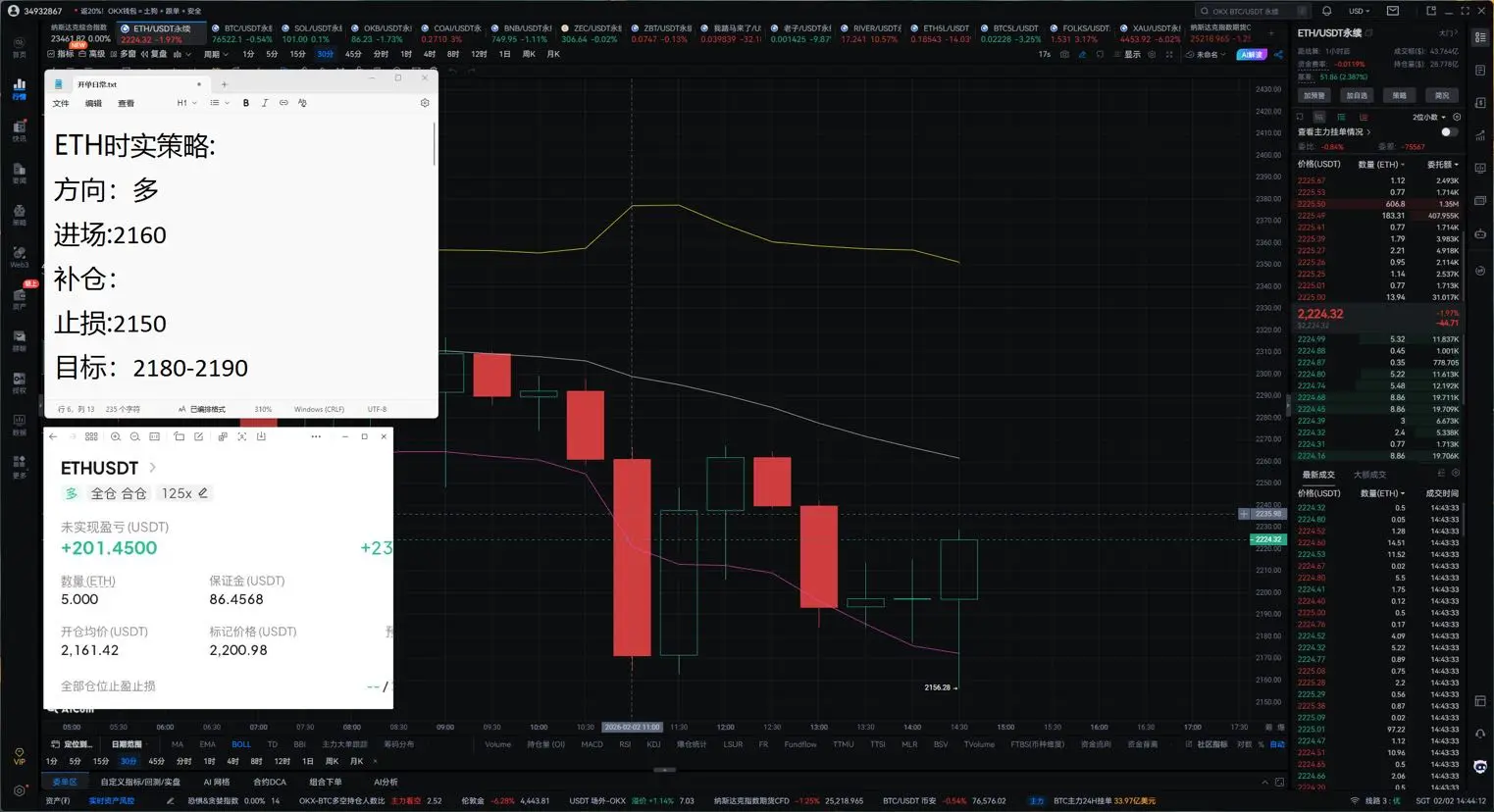

Follow 🔍 closelyTake a look at the market to relieve some of the suppressed emotions.

View Original- Reward

- like

- Comment

- Repost

- Share

this is how people are trying to get rich in 2026

- Reward

- like

- Comment

- Repost

- Share

chn

chojny

Created By@GateUser-3bbb703e

Subscription Progress

0.00%

MC:

$0

Create My Token

Gm my internet frens

- Reward

- like

- Comment

- Repost

- Share

This dive, those chasing after it won't be able to figure it out for at least ten years.

View Original

- Reward

- like

- Comment

- Repost

- Share

Good morning. The market continues to be liquidated.

Movements are sharp, impulsive, and unstructured — liquidity is being absorbed.

I'm only highlighting key zones that currently really matter.

#BTC

🔼Support: 75,300 — 73,600

🔽Resistance: 79,000 – 80,000

As long as below 80k — the market is in a seller’s phase. Bounces are weak....

#ETH

🔼Support: 2,150 – 2,070

🔽Resistance: 2,320 – 2,420

Ethereum has broken structurally. A return above 2.3k is the minimum for stabilization.

#SOL

🔼Support: 96 — 93

🔽Resistance: 105.6 — 110.5

Weaker than the market.

#XRP

🔼Support: 1.50 — 1.48

🔽Resi

View OriginalMovements are sharp, impulsive, and unstructured — liquidity is being absorbed.

I'm only highlighting key zones that currently really matter.

#BTC

🔼Support: 75,300 — 73,600

🔽Resistance: 79,000 – 80,000

As long as below 80k — the market is in a seller’s phase. Bounces are weak....

#ETH

🔼Support: 2,150 – 2,070

🔽Resistance: 2,320 – 2,420

Ethereum has broken structurally. A return above 2.3k is the minimum for stabilization.

#SOL

🔼Support: 96 — 93

🔽Resistance: 105.6 — 110.5

Weaker than the market.

#XRP

🔼Support: 1.50 — 1.48

🔽Resi

- Reward

- like

- Comment

- Repost

- Share

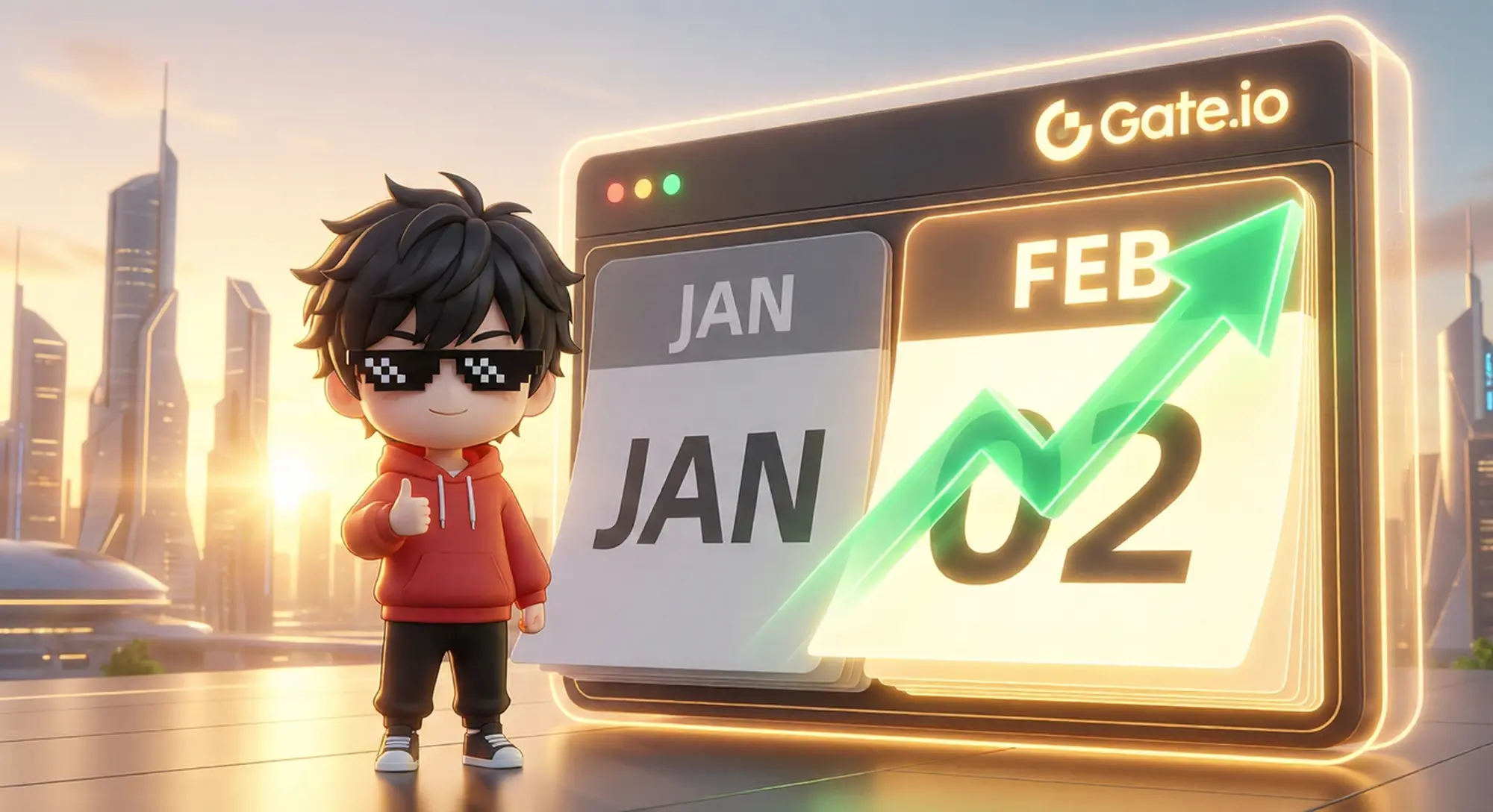

JUST IN: Bitcoin Opens February Trading with Strong Spot Bid Above $94,500.

The new month has started with immediate buy-side aggression. During the Asian session, Bitcoin decisively reclaimed the $94,500 pivot point, effectively erasing the uncertainty of the weekend consolidation. This move is significant because it is driven by genuine spot volume rather than leveraged speculation.

We are seeing a healthy market reset.

Despite the price increase, funding rates across major derivatives platforms remain near neutral. This divergence indicates that the rally is being fueled by institutional ac

The new month has started with immediate buy-side aggression. During the Asian session, Bitcoin decisively reclaimed the $94,500 pivot point, effectively erasing the uncertainty of the weekend consolidation. This move is significant because it is driven by genuine spot volume rather than leveraged speculation.

We are seeing a healthy market reset.

Despite the price increase, funding rates across major derivatives platforms remain near neutral. This divergence indicates that the rally is being fueled by institutional ac

BTC-2,56%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

# FedLeadershipImpact

🏛️ Macro is Back:

The Fed's Influence on Crypto

It feels like we are in a "risk-on/risk-off"

mode dictated by central banks once again. With shifting expectations around

interest rates and leadership moves, every word from the Federal Reserve sends

ripples through the market. 📉📈

But let's be honest—how much does this actually dictate

your personal strategy?

We want to know: Are you adjusting

your bags based on macro data, or are you strictly sticking to technicals and

on-chain fundamentals?

👇 Vote with your

comment: 🔹 Heavy

Influence: I trade the Fed's moves. �

🏛️ Macro is Back:

The Fed's Influence on Crypto

It feels like we are in a "risk-on/risk-off"

mode dictated by central banks once again. With shifting expectations around

interest rates and leadership moves, every word from the Federal Reserve sends

ripples through the market. 📉📈

But let's be honest—how much does this actually dictate

your personal strategy?

We want to know: Are you adjusting

your bags based on macro data, or are you strictly sticking to technicals and

on-chain fundamentals?

👇 Vote with your

comment: 🔹 Heavy

Influence: I trade the Fed's moves. �

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- 1

- Repost

- Share

魏婴Wei :

:

Afternoon small profit Enjoy a small profit in the afternoon by taking advantage of quick opportunities. Whether you're trading, shopping, or making small investments, every little bit counts. Stay alert and make the most of your time to maximize your gains during this period.

Gate Plaza | #MyWeekendTradingPlan

Weekend mode = defensive attack ⚔️🛡️

Volatility is still high, so plan > emotion.

Market Bias (Weekend):

I’m expecting range → rebound attempt, not a straight dump. Liquidity usually thins on weekends; if support holds, a relief bounce is likely. If it breaks, I stay in defense and wait.

Key Levels I’m Watching:

BTC: holding higher-timeframe support → long scalp on confirmation; rejection at resistance → quick short, no overstay.

ETH: strength vs BTC matters; if ETH holds while BTC ranges, alts can breathe.

SOL / AI sector: momentum names only — trade react

Weekend mode = defensive attack ⚔️🛡️

Volatility is still high, so plan > emotion.

Market Bias (Weekend):

I’m expecting range → rebound attempt, not a straight dump. Liquidity usually thins on weekends; if support holds, a relief bounce is likely. If it breaks, I stay in defense and wait.

Key Levels I’m Watching:

BTC: holding higher-timeframe support → long scalp on confirmation; rejection at resistance → quick short, no overstay.

ETH: strength vs BTC matters; if ETH holds while BTC ranges, alts can breathe.

SOL / AI sector: momentum names only — trade react

- Reward

- 1

- Comment

- Repost

- Share

Support vulnerability:Repeated tests weaken demand zones

- Reward

- like

- Comment

- Repost

- Share

SA

StoneAge

Created By@EuropeanFace

Subscription Progress

0.00%

MC:

$0

Create My Token

Its buying time Mf\'s .

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

Viewing the Top Market Coins Spot Chart and comparing them

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

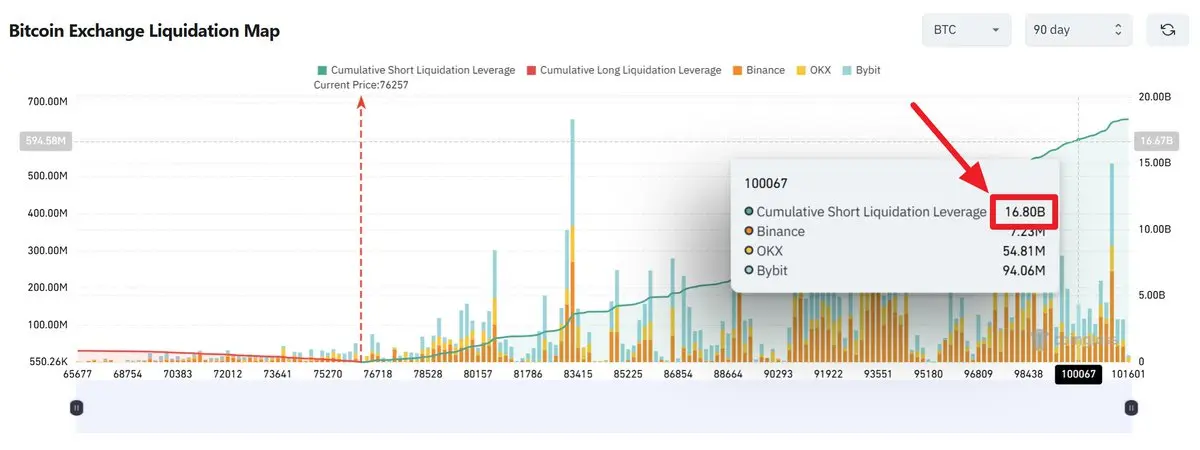

GM. If Bitcoin reclaims the $100,000 level, we could see the biggest short squeeze ever. Almost no one is betting on Bitcoin to rise right now.

BTC-2,56%

- Reward

- 1

- Comment

- Repost

- Share

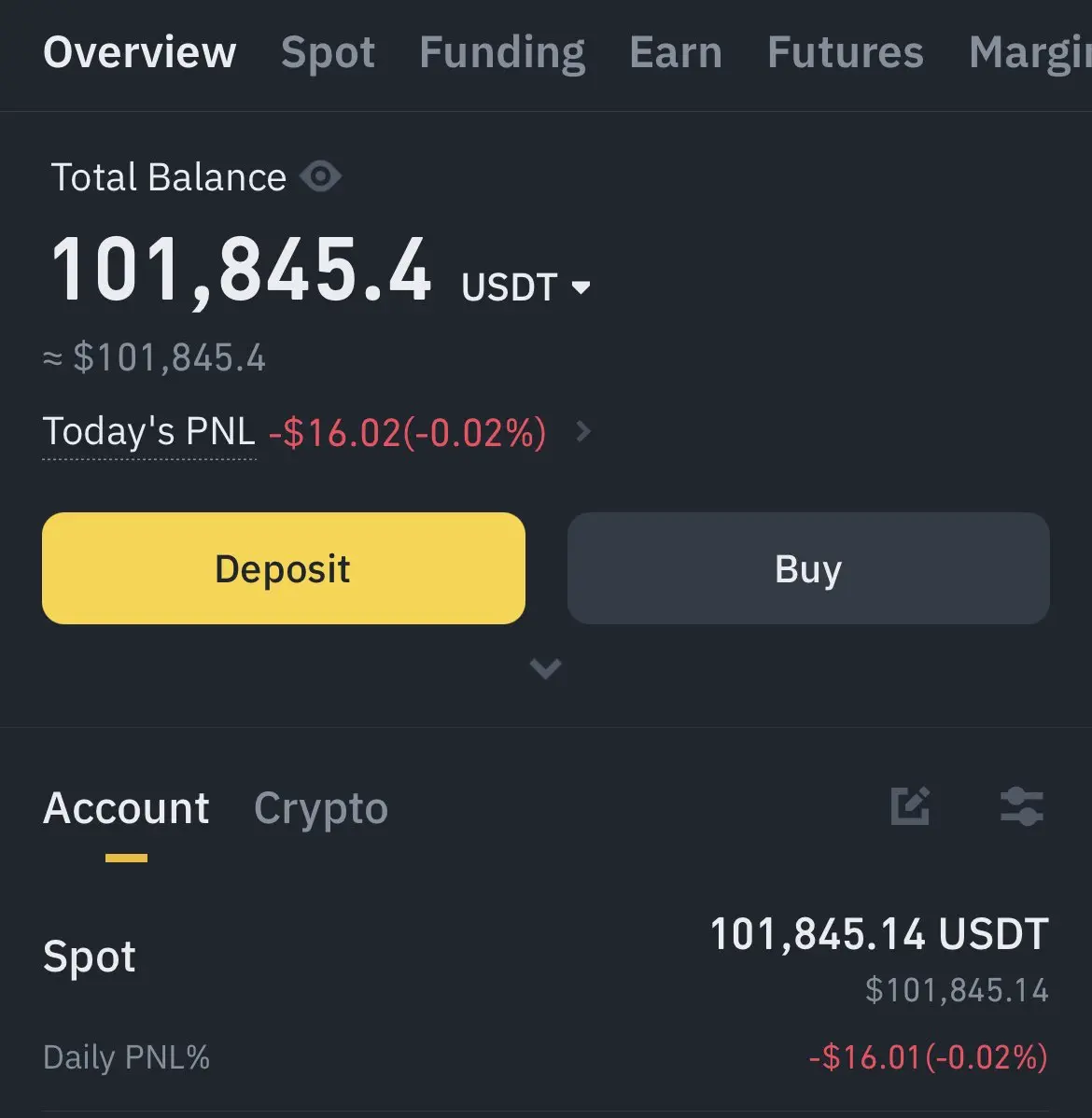

Happy MondayFirst month gone. No rewind button.You either moved closer to your goals, or you just talked about them.

- Reward

- like

- Comment

- Repost

- Share

The only big profit I made last year is still going up. Unfortunately, I didn't do enough. I heard that many studios have already disbanded, but after taking stock of their assets, they still made a damn profit.

View Original

- Reward

- like

- Comment

- Repost

- Share

# Web3FebruaryFocus

🚀 #Web3February: From Hype to High-Utility

Infrastructure

As we step into #Web3February, the industry appears to be shifting away

from speculative momentum toward high-utility

infrastructure. After a volatile January, the market is recalibrating

around three core pillars:

👉 Institutional Integration

👉

AI On-Chain

👉

Global Policy

Here are the sectors and narratives I’m watching

most closely this month:

🏗️ 1. The Infrastructure

Rebirth

With ETHDenver

(Feb 17–21) and Consensus Hong

Kong (Feb 4–5) taking center stage, the spotlight is firmly on modularity and interoperabi

🚀 #Web3February: From Hype to High-Utility

Infrastructure

As we step into #Web3February, the industry appears to be shifting away

from speculative momentum toward high-utility

infrastructure. After a volatile January, the market is recalibrating

around three core pillars:

👉 Institutional Integration

👉

AI On-Chain

👉

Global Policy

Here are the sectors and narratives I’m watching

most closely this month:

🏗️ 1. The Infrastructure

Rebirth

With ETHDenver

(Feb 17–21) and Consensus Hong

Kong (Feb 4–5) taking center stage, the spotlight is firmly on modularity and interoperabi

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More374.94K Popularity

2.55K Popularity

3.16K Popularity

1.94K Popularity

1.06K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:00.00%

- MC:$2.74KHolders:10.00%

- MC:$2.72KHolders:10.00%

- MC:$2.68KHolders:10.00%

- MC:$2.67KHolders:10.00%

News

View MoreThe Smarter Web Company allocates 187,000 common shares in accordance with the subscription agreement.

2 m

易理华:过早看多ETH是错误的 Yi Lihua: It is a mistake to be overly bullish on ETH too early. Investors should be cautious and avoid rushing into conclusions based on short-term trends. Patience and thorough analysis are key to making sound investment decisions in the cryptocurrency market.

2 m

Gate TradFi expands to the Web platform, implementing a unified multi-terminal account system that allows users to manage their financial assets seamlessly across all devices and platforms.

16 m

Base Co-creation: The challenge of tokenization is to provide exposure to early builders without creating negative market incentives

17 m

Bitcoin's sudden plunge reveals the truth: the crypto market is still dominated by BTC, and so-called diversification is just an illusion?

22 m

Pin