Post content & earn content mining yield

placeholder

TabraizShams

Happy Republic Day to my Indian friends ♥️. Best wishes for peace and growth.

- Reward

- like

- Comment

- Repost

- Share

Powell just stated that future foreign exchange reserves will once again expand liquidity, the printing press is about to resume operation.

View Original

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

TAL

Trader All Life

Created By@Kris_Trading

Subscription Progress

0.00%

MC:

$0

Create My Token

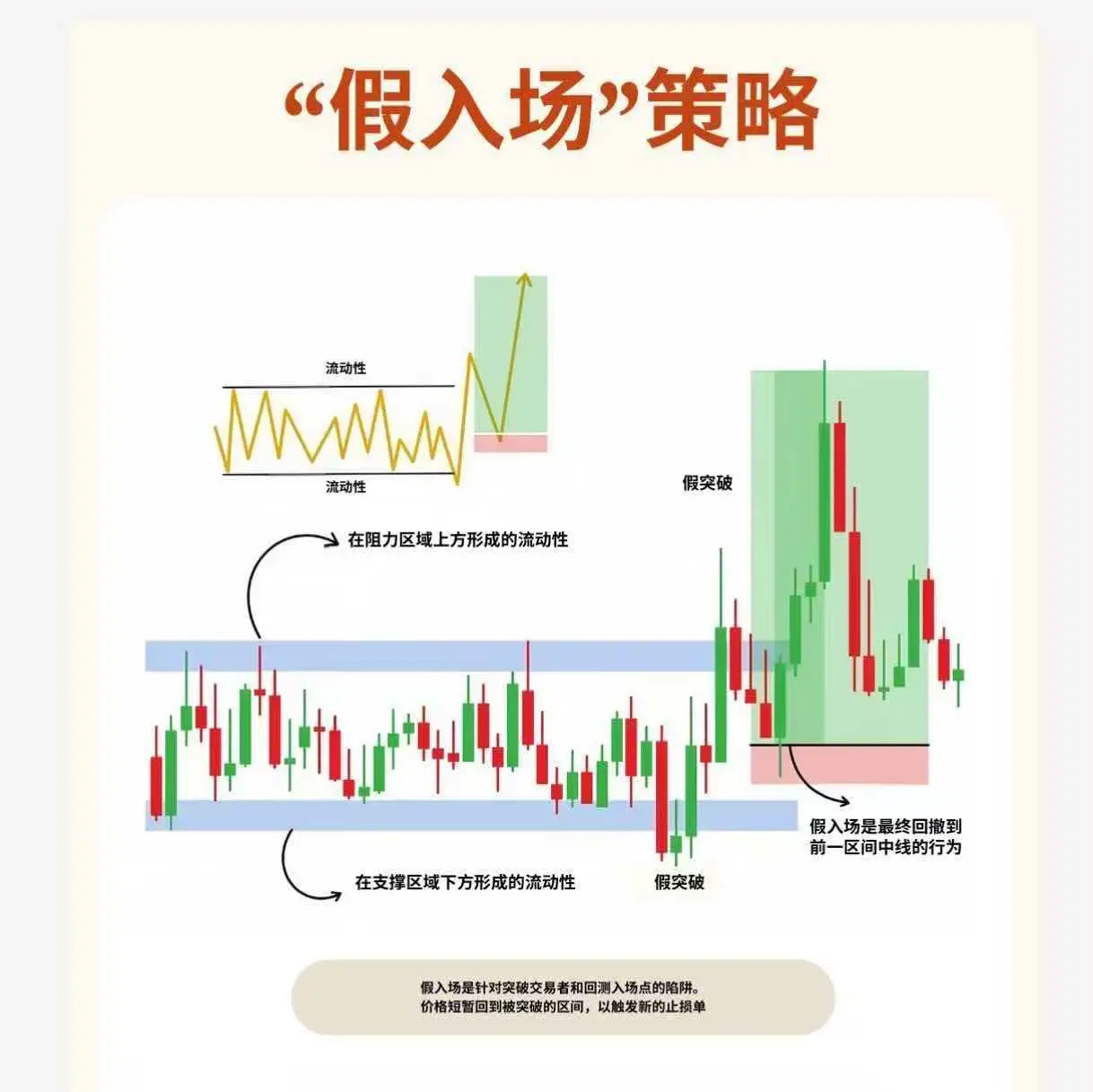

K-line trap, false entry signal trap!

Friends, today let's talk about the "false entry" strategy in investing, which is a key "pitfall avoidance" knowledge!

In the chart, you can see that when the price forms liquidity above resistance areas or below support areas, false breakouts may occur. False entry refers to the behavior where the price ultimately retraces to the midpoint of the previous range, and it is a trap for breakout traders and backtest entry points. Once the price briefly returns to the broken range, it will trigger new stop-loss orders.

For example, in actual trading, seeing the

Friends, today let's talk about the "false entry" strategy in investing, which is a key "pitfall avoidance" knowledge!

In the chart, you can see that when the price forms liquidity above resistance areas or below support areas, false breakouts may occur. False entry refers to the behavior where the price ultimately retraces to the midpoint of the previous range, and it is a trap for breakout traders and backtest entry points. Once the price briefly returns to the broken range, it will trigger new stop-loss orders.

For example, in actual trading, seeing the

BTC-1,02%

- Reward

- like

- Comment

- Repost

- Share

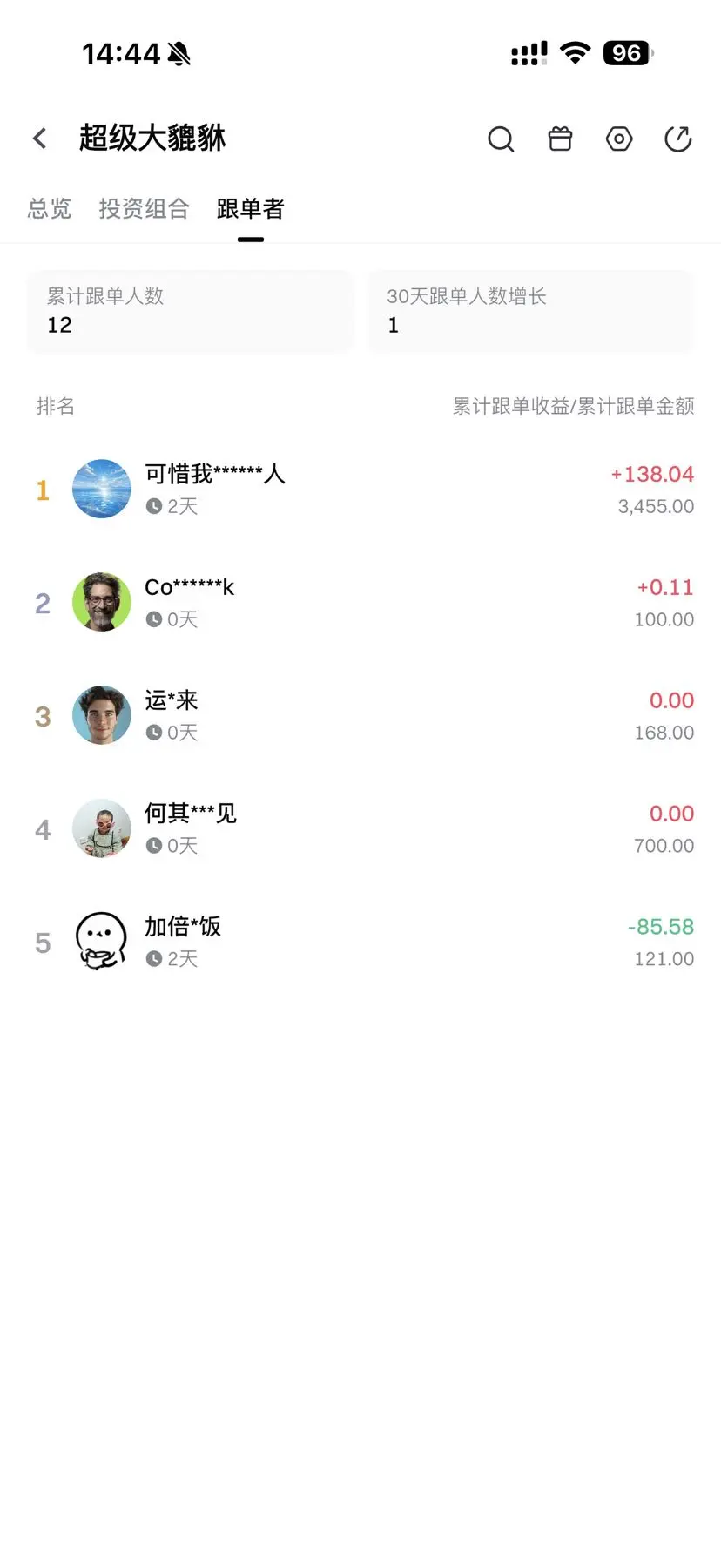

Sixth day of trading, 300U trading, about to flip the account, those who followed, don't move. I'm not afraid of a few hundred U, neither should you be. Stay calm for stable profits!#特朗普取消对欧关税威胁

View Original

- Reward

- like

- Comment

- Repost

- Share

Gate Plaza "Content Mining" Renewal Season Public Beta Officially Launches!🚀

Register Now: https://www.gate.com/questionnaire/7358

Main Highlights:

🔹 Publish qualified content and guide users to complete transactions to unlock up to 60% transaction fee rebate

🔹 10% basic rebate guarantee, with an additional 10% rebate bonus for reaching interaction or posting targets

🔹 Weekly Interaction Leaderboard — the top 100 creators can earn extra rebates

🔹 New or returning creators can enjoy double rebate benefits during the public beta period

To further activate the content ecosystem and truly tur

View OriginalRegister Now: https://www.gate.com/questionnaire/7358

Main Highlights:

🔹 Publish qualified content and guide users to complete transactions to unlock up to 60% transaction fee rebate

🔹 10% basic rebate guarantee, with an additional 10% rebate bonus for reaching interaction or posting targets

🔹 Weekly Interaction Leaderboard — the top 100 creators can earn extra rebates

🔹 New or returning creators can enjoy double rebate benefits during the public beta period

To further activate the content ecosystem and truly tur

- Reward

- 9

- 16

- Repost

- Share

Nasim_210 :

:

nice 👍View More

Crypto Trading Psychology & Risk Control

- Reward

- like

- Comment

- Repost

- Share

TV Quantitative Robot Professional Course: Smart Winning Strategy Robot

[ZYTX GKDD V9] Basic Settings (1)

https://www.gate.com/zh/live/video/d2199ca55c7da0ea884856add84e3140

View Original[ZYTX GKDD V9] Basic Settings (1)

https://www.gate.com/zh/live/video/d2199ca55c7da0ea884856add84e3140

- Reward

- 3

- 1

- Repost

- Share

Ryakpanda :

:

Just go for it💪#RIVERUp50xinOneMonth 🚀

RIVER Delivers a Historic 50x Move in Just 30 Days

RIVER has exploded onto the crypto radar, surging an extraordinary 50x in a single month and printing highs near $74 today. Moves of this magnitude don’t just reflect price action — they signal a powerful mix of momentum, liquidity rotation, and narrative-driven demand.

📊 What’s Driving the Rally

Early accumulation phases quickly transitioned into aggressive breakout waves, with each pullback being bought faster than the last. As volume expanded and visibility increased, RIVER evolved from a low-attention token into a

RIVER Delivers a Historic 50x Move in Just 30 Days

RIVER has exploded onto the crypto radar, surging an extraordinary 50x in a single month and printing highs near $74 today. Moves of this magnitude don’t just reflect price action — they signal a powerful mix of momentum, liquidity rotation, and narrative-driven demand.

📊 What’s Driving the Rally

Early accumulation phases quickly transitioned into aggressive breakout waves, with each pullback being bought faster than the last. As volume expanded and visibility increased, RIVER evolved from a low-attention token into a

- Reward

- 1

- Comment

- Repost

- Share

$Bitcoin is flashing a bullish signal on the hourly as momentum shifts. Eyes on the recovery.🚀

BTC-1,02%

- Reward

- like

- Comment

- Repost

- Share

🎯Zhou Yu experiences a major breakout🎯Launch community alliance🏅🏅🏅

💰💰💰Hurry to seize the bottom chips

💝Buy coins💎Add LP💎Maximize promotional rewards

😍God coin mechanism😍Chips are fully dispersed😍Coin supply is scarce😍Top-tier dividends

♻️♻️♻️Zhou Yu adds LP unilaterally🈵100U real-time aggressive distribution, Xiao Qiao LP👛Xiao Qiao surges

✳️: 832-223-9359

View Original💰💰💰Hurry to seize the bottom chips

💝Buy coins💎Add LP💎Maximize promotional rewards

😍God coin mechanism😍Chips are fully dispersed😍Coin supply is scarce😍Top-tier dividends

♻️♻️♻️Zhou Yu adds LP unilaterally🈵100U real-time aggressive distribution, Xiao Qiao LP👛Xiao Qiao surges

✳️: 832-223-9359

- Reward

- like

- Comment

- Repost

- Share

马上有钱

马上有钱

Created By@GoodLuck168

Listing Progress

0.00%

MC:

$3.33K

Create My Token

Gold Stablecoin XAUT

This morning, the oversold level was 5008

These days, following this strategy for both spot and long positions

Guaranteed profit, just now reached 5110

Of course, this method may not always be effective, a cliff-like drop in gold is currently unlikely, but a pullback should be guarded against

This method requires monitoring the market yourself, without a specific strategy

Gold and silver have already risen to a level that makes everyone doubt life, hesitant to buy, yesterday's high is today's low, and this happens every day

This morning, the oversold level was 5008

These days, following this strategy for both spot and long positions

Guaranteed profit, just now reached 5110

Of course, this method may not always be effective, a cliff-like drop in gold is currently unlikely, but a pullback should be guarded against

This method requires monitoring the market yourself, without a specific strategy

Gold and silver have already risen to a level that makes everyone doubt life, hesitant to buy, yesterday's high is today's low, and this happens every day

XAUT0,86%

- Reward

- like

- Comment

- Repost

- Share

#ContentMiningRevampPublicBeta 🎊Upgrading Gate Web3 to Gate DEX isn't just a name change; it’s a strategic move to solve the "UX debt" that has kept mainstream users away from on-chain trading for years.

Here is a breakdown of the key takeaways from this evolution:

🔑 The Core Evolution

The transition focuses on three main pillars that have historically been "pain points" for DeFi users:

User Experience (UX): Replacing clunky wallet setups with familiar login flows.

Performance: Aiming for CEX-like speed (fast confirmations) on a trustless architecture.

Cost: Minimizing gas fees to make the p

Here is a breakdown of the key takeaways from this evolution:

🔑 The Core Evolution

The transition focuses on three main pillars that have historically been "pain points" for DeFi users:

User Experience (UX): Replacing clunky wallet setups with familiar login flows.

Performance: Aiming for CEX-like speed (fast confirmations) on a trustless architecture.

Cost: Minimizing gas fees to make the p

- Reward

- 1

- 1

- Repost

- Share

楚老魔 :

:

2026 Go Go Go 👊The nights you've endured, the dips you've borne, and the positions you've held will ultimately blossom in the bull market. Trust the trend, believe in yourself, the crypto world never lacks opportunities, only those who persist until the end. After Bitcoin briefly dipped to around 86,034 in the morning and then quickly rebounded, the current price is oscillating around 87,500; Ethereum dipped to a low of 2,784 and then bottomed out and rebounded, now fluctuating around the 2,860 range. Our precise early morning long positions on Shí Pán have all been successfully closed with profits! Profits

View Original

- Reward

- like

- Comment

- Repost

- Share

JUST IN: Gold reaches new all-time high of $5,105#crypto

- Reward

- like

- Comment

- Repost

- Share

Happy 77th Republic Day everyone! 🇮🇳

Bitcoin’s Price History on Republic Day 🇮🇳

2012 - $6

2013 - $17

2014 - $815

2015 - $275

2016 - $392

2017 - $915

2018 - $11,093

2019 - $3,556

2020 - $8,590

2021 - $32,505

2022 - $36,829

2023 - $23,010

2024 - $41,818

2025 - $102,573

2026 - $87,740

Return over the last 10 years: 22,285%

$B2 $AUCTION $TAIKO

Bitcoin’s Price History on Republic Day 🇮🇳

2012 - $6

2013 - $17

2014 - $815

2015 - $275

2016 - $392

2017 - $915

2018 - $11,093

2019 - $3,556

2020 - $8,590

2021 - $32,505

2022 - $36,829

2023 - $23,010

2024 - $41,818

2025 - $102,573

2026 - $87,740

Return over the last 10 years: 22,285%

$B2 $AUCTION $TAIKO

- Reward

- like

- Comment

- Repost

- Share

Bitcoin's recent dip is quite sharp. It nearly broke below $86,000, erasing the year's January-to-date gains, turning the monthly return negative, currently at -0.5%. To put it in perspective, on January 14th, it just broke through $97,000, and from that high, it has already fallen about 10.9%.

Several factors are at play behind this decline. While geopolitical risks still exist, Bitcoin's safe-haven attributes haven't really shown up during this period; market expectations for the Fed's rate cut pace are also adjusting, with concerns about tightening liquidity rising. More directly, instituti

Several factors are at play behind this decline. While geopolitical risks still exist, Bitcoin's safe-haven attributes haven't really shown up during this period; market expectations for the Fed's rate cut pace are also adjusting, with concerns about tightening liquidity rising. More directly, instituti

BTC-1,02%

- Reward

- 1

- Comment

- Repost

- Share

GOLD +$5,100🚀🚀🚀🚀🚀

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More200 Popularity

82.52K Popularity

56.85K Popularity

15.9K Popularity

33.64K Popularity

Hot Gate Fun

View More- MC:$3.33KHolders:10.00%

- MC:$3.35KHolders:10.00%

- MC:$3.35KHolders:10.00%

- MC:$3.35KHolders:10.00%

- MC:$3.4KHolders:20.10%

News

View MoreAperture Finance was attacked, and $17 million was stolen across multiple chains.

4 m

Crypto Rover issues Bitcoin crash warning, BTC key support levels face testing

7 m

On-chain data exposure: PENGUIN profit-taking exits, GHOST welcomes influx of funds

9 m

Pi Network Today’s News: USDT Testnet Launched, Users Experience On-Chain Payments in Advance

12 m

Data: Hyperliquid platform whales currently hold positions worth $5.672 billion, with a long-short position ratio of 0.89.

13 m

Pin