#GateTradFiExperience Bitcoin and Ethereum remain at the center of market attention as traders evaluate whether the recent correction is a temporary pause or the start of a deeper trend change. BTC continues to trade beneath the psychological $100,000 barrier, a level that has repeatedly acted as heavy resistance. ETH, meanwhile, is holding above the important $3,100–$3,200 demand zone. The overall structure shows consolidation rather than panic selling, suggesting that many long-term holders are still confident about the broader cycle.

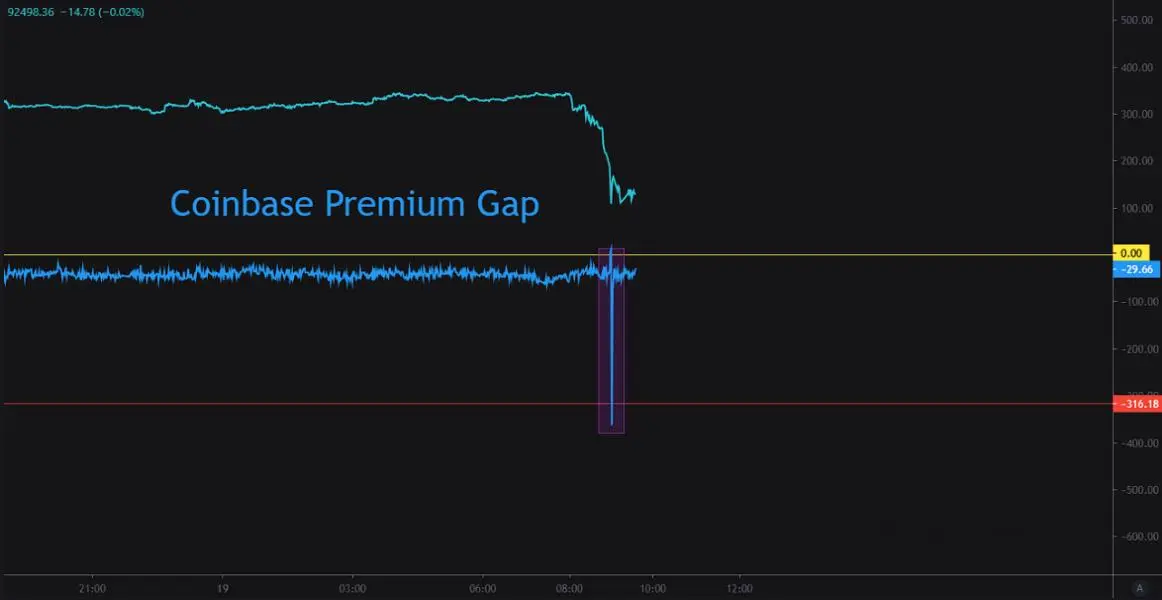

From a technical perspective, Bitcoin is moving inside a wide range formed over the past several weeks. Buyers have defended the lower boundary near the $91,000–$92,000 region, while sellers dominate close to $98,000 and above. Momentum indicators such as RSI and moving averages show neutral readings, confirming indecision. For a fresh bullish wave, BTC must reclaim the mid-range resistance with strong volume; otherwise, another retest of support is likely.

Ethereum displays a slightly different picture. ETH has been relatively stronger compared with Bitcoin, and the ETH/BTC ratio has stabilized after months of decline. The zone between $3,360 and $3,420 acts as immediate resistance, while $3,050 remains a critical floor. If Ethereum manages to break higher, it could trigger renewed interest across the altcoin sector, as ETH often leads risk appetite outside Bitcoin.

Macro factors continue to influence both assets. Global risk sentiment has been fragile due to concerns over interest-rate policy and geopolitical uncertainty. These elements have reduced speculative flows into crypto markets, keeping volumes below last year’s averages. However, institutional interest has not disappeared, and exchange data shows steady accumulation on dips rather than aggressive distribution.

Derivatives markets provide additional insight. Funding rates for Bitcoin are close to neutral, indicating balanced positioning, while Ethereum futures have seen a gradual rise in open interest. This suggests that professional traders may be preparing for volatility in ETH ahead of a decisive move. Spot market liquidity is also improving, which could support a breakout once confidence returns.

In the short term, traders should watch key triggers: for BTC, acceptance above $100,000 would open the path toward new highs, whereas losing $90,000 could invite a deeper correction. For ETH, holding above $3,100 keeps the bullish structure intact, with $3,500 as the next major objective. Overall, the market is in an accumulation phase where patience is essential, and the next directional expansion is likely to be powerful once these ranges finally resolve.$BTC $ETH

From a technical perspective, Bitcoin is moving inside a wide range formed over the past several weeks. Buyers have defended the lower boundary near the $91,000–$92,000 region, while sellers dominate close to $98,000 and above. Momentum indicators such as RSI and moving averages show neutral readings, confirming indecision. For a fresh bullish wave, BTC must reclaim the mid-range resistance with strong volume; otherwise, another retest of support is likely.

Ethereum displays a slightly different picture. ETH has been relatively stronger compared with Bitcoin, and the ETH/BTC ratio has stabilized after months of decline. The zone between $3,360 and $3,420 acts as immediate resistance, while $3,050 remains a critical floor. If Ethereum manages to break higher, it could trigger renewed interest across the altcoin sector, as ETH often leads risk appetite outside Bitcoin.

Macro factors continue to influence both assets. Global risk sentiment has been fragile due to concerns over interest-rate policy and geopolitical uncertainty. These elements have reduced speculative flows into crypto markets, keeping volumes below last year’s averages. However, institutional interest has not disappeared, and exchange data shows steady accumulation on dips rather than aggressive distribution.

Derivatives markets provide additional insight. Funding rates for Bitcoin are close to neutral, indicating balanced positioning, while Ethereum futures have seen a gradual rise in open interest. This suggests that professional traders may be preparing for volatility in ETH ahead of a decisive move. Spot market liquidity is also improving, which could support a breakout once confidence returns.

In the short term, traders should watch key triggers: for BTC, acceptance above $100,000 would open the path toward new highs, whereas losing $90,000 could invite a deeper correction. For ETH, holding above $3,100 keeps the bullish structure intact, with $3,500 as the next major objective. Overall, the market is in an accumulation phase where patience is essential, and the next directional expansion is likely to be powerful once these ranges finally resolve.$BTC $ETH